[ad_1]

Gold and Silver costs ended barely decrease on Friday (15/12). Friday’s strengthening US Greenback weighed on steel costs. As well as, hawkish feedback from New York Fed President Williams weakened Gold costs, as he rejected hypothesis a couple of Fed fee minimize in March.

Trying on the knowledge, the variety of preliminary jobless claims within the US final week was 202,000, in comparison with the estimate of 220,000. The earlier determine was revised as much as 221,000 from 220,000. The variety of persevering with jobless claims within the week of two December was 1.876 million, in comparison with expectations of 1.887 million, and former claims had been revised to 1.856 million from 1.861 million. US retail gross sales rose 0.3% m/m in November, in comparison with an anticipated decline of 0.1%, and the earlier knowledge was revised from a decline of 0.1% to a decline of 0.2%. Core retail gross sales rose 0.2% m/m, in comparison with an estimated decline of 0.1%, and the earlier determine was revised to flat from an increase of 0.1%.

On Friday (15 December), spot gold fell barely and is at the moment buying and selling round $2019. Buying and selling on expectations of a fee minimize the day earlier than, was let down by the info launched. US retail gross sales and preliminary jobless claims knowledge had been stronger than anticipated, suggesting that the job market and client spending stay resilient.

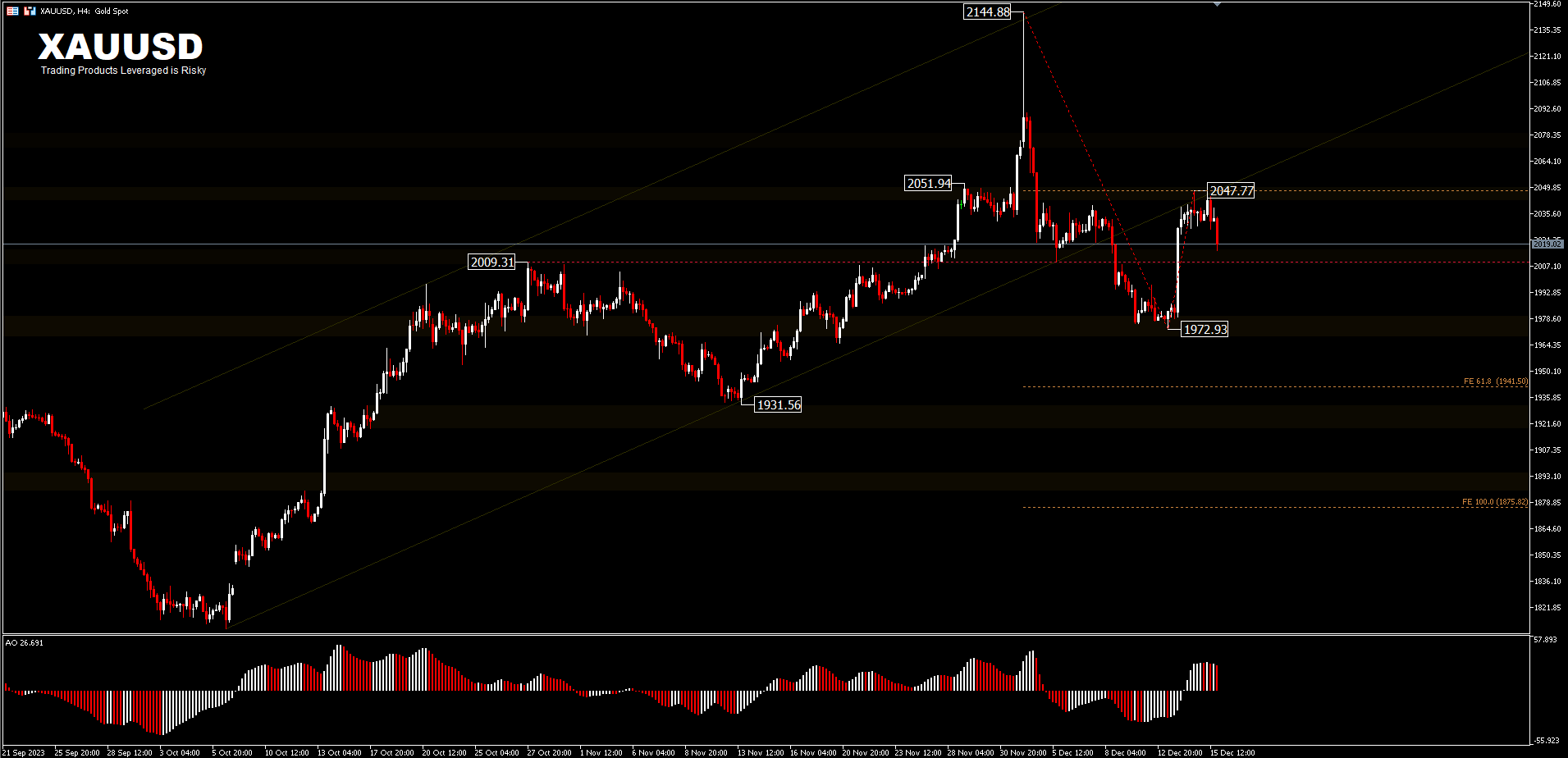

Expectations of a significant Fed fee minimize subsequent 12 months eased barely, regardless of indicators from Powell’s earlier statements. In consequence, gold costs stopped shifting larger and fluctuated extensively yesterday. Early final week, gold rose on bullish information, however the news-driven pattern was short-lived and intermittent. At the moment, the power of bulls and bears within the 2019 – 2047 vary is comparatively balanced. Within the brief time period, fee minimize expectations are corrected. However within the medium and long run, merchants will give attention to when and by how a lot rates of interest might be minimize. As soon as world central banks, situation clear indicators to chop rates of interest, gold can have a clearer course.

Final week, XAUUSD costs surged to 2047, then fluctuated downwards, falling to a low close to 2015. The failure to surpass the 2051 resistance, signifies that the bullish sentiment will not be robust sufficient. Gold costs are more likely to transfer inside the vary of 2009 – 2047 subsequent. Nevertheless, a drop under the 2009 resistance degree will deliver a decline to check the latest low of 1972 and additional to the FE61.8% projection of 1941 from 2144 – 1972 and 2047 drawdown.

In the meantime, silver costs got here below strain, because of industrial steel demand issues after US manufacturing manufacturing in November, US December S&P manufacturing PMI and Japan’s Jibun Financial institution December manufacturing PMI stories had been all weaker than anticipated. A supporting issue for valuable metals on Friday was low world bond yields.

XAGUSD value recorded a 7-month excessive of 25.89 final week, however since then it has fallen -13% to report a low of 22.48 earlier than a brief rebound to chop losses. In the interim, the worth seems to be fairly impartial.On the upside, a transfer above 24.27 may check the 61.8percentFR degree round 24.66. Whereas on the draw back, a continued transfer opens up the potential for testing the latest low.

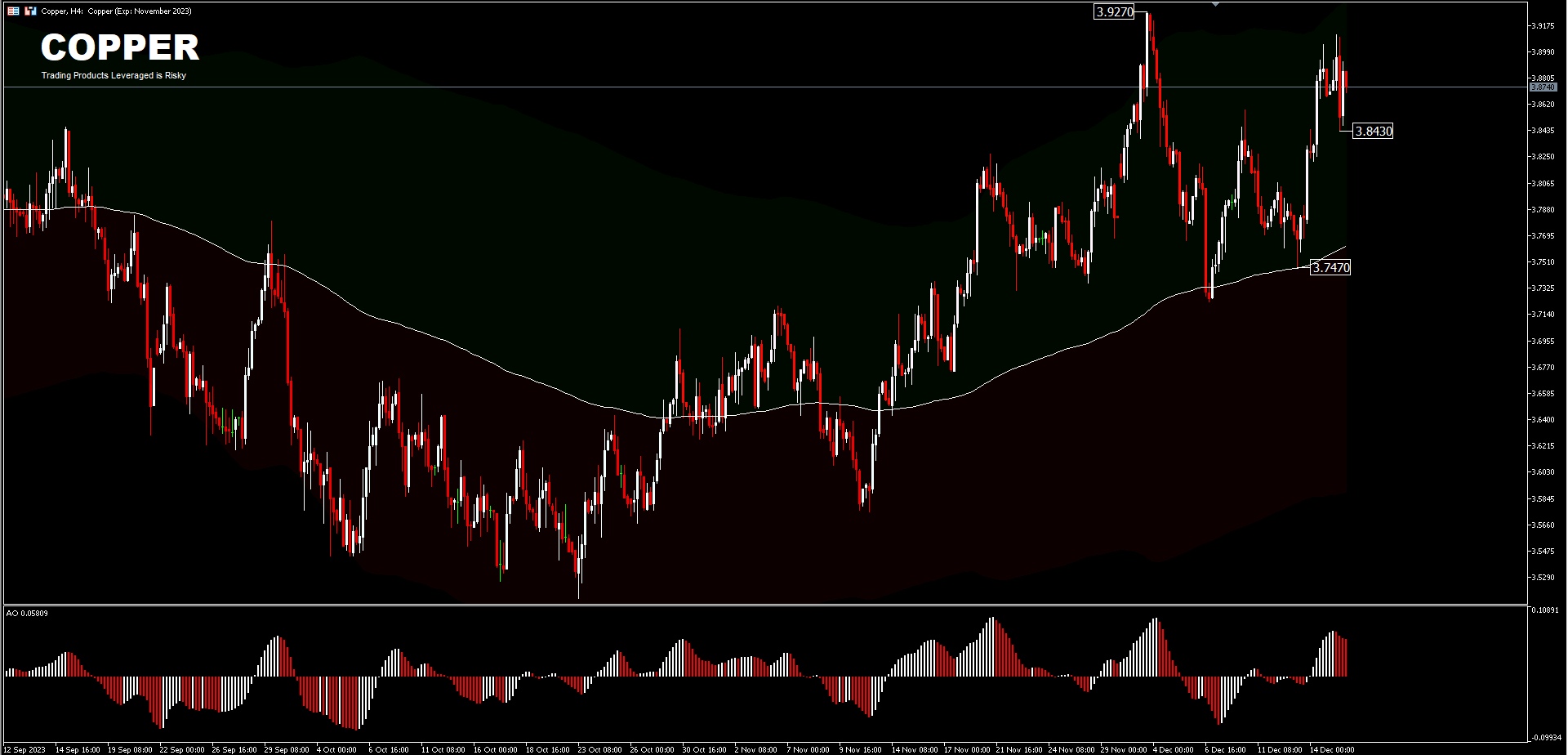

Copper futures rose in the direction of $3.8 per pound, near a four-month excessive of $3.92 hit on December 1, monitoring different base metals’ positive aspects as dovish projections from the Fed pressured the greenback and supported the outlook for industrial exercise. Central financial institution members elevated the variety of rate of interest cuts projected for subsequent 12 months whereas revising down its measure of inflation, elevating hopes that decrease borrowing prices may help manufacturing exercise. As well as, the weaker US Greenback elevated overseas demand for base metals priced in USD, thereby additionally driving up their costs.

Provide issues additionally supported this pattern, as Panama plans to shut its First Quantum Cobre mine, thus halting manufacturing from a significant supply of world provide. Nevertheless, restricted demand expectations from China capped the upside, triggered by the lack of stimulus bulletins, after a collection of coverage conferences this week.

Copper remains to be on a short-term upward path above the 200-period EMA, and for now it tends to be impartial. A transfer to the upside may check 3.92 resistance whereas a transfer under 3.84 may check 3.74 help.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is supplied as a common advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or needs to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link