[ad_1]

The Financial institution of Japan is the one central financial institution that has not raised rates of interest, though inflation has exceeded the two% goal for the previous yr and a half, Japan has not been declared deflation-free.

The Japanese financial system skilled a larger-than-expected contraction in Q3, elevating questions in regards to the energy of the Japanese financial system at a time when the BOJ is contemplating ending adverse rates of interest.

Japan’s financial system shrank 0.7% q/q in Q3 of 2023, the primary GDP contraction because the third quarter of 2022, amid rising price pressures and growing world headwinds. The patron worth index rose to three.3% y/y in October and the Tokyo CPI determine due on Friday is more likely to gradual in November as nicely. The principle reason for this weak spot is slowing household spending. Over the previous two quarters, consumption declined drastically as rising prices put stress on family funds. Then again, the Japanese authorities just lately introduced a big stimulus bundle aimed toward easing the burden on households from excessive inflation, so a turnaround in shopper spending is probably going within the coming months.

The unsure financial situations are a headwind for policymakers, however ultra-loose insurance policies will finally cease as wages rise. Nevertheless, the result of the yield curve management (YCC) coverage is a little more difficult. Though elevating the higher restrict of the 10-year yield goal to 1.0% in October gave the BoJ appreciable leverage over the yield curve, it’s unlikely that the BoJ will utterly surrender on the YCC coverage to keep up its capacity to forestall sudden swings in yields. The latest decline in world bond yields has additionally eliminated the stress for policymakers to additional modify their YCC technique.

A price change from the BOJ is predicted in Q2 2024, probably on the June assembly. By then, the BOJ will have the ability to guarantee strong wage will increase primarily based on the Shunto outcomes. Development inflation is predicted to ease firstly of subsequent yr, however core inflation is predicted to stay above 2%. Even when the BoJ does hike charges, the Financial institution’s JGB buy operations will possible proceed to keep away from a pointy rise in long-term yields.

Nevertheless, Ueda’s narrative suggests a bias in direction of coverage normalisation. Given the BoJ’s historical past of unusual markets, the chance of a shock resolution in early 2024 to boost charges or finish the YCC, or each can’t be discounted. In the meantime, the chance is so low for the December assembly that a lot of the market response will rely upon the change in Ueda’s assertion. Any trace {that a} price hike will occur as early as 2024 may set off a US Greenback sell-off in opposition to the Japanese forex.

Then again, the possibility of a Fed price lower as introduced by Jerome Powell on the final assembly, has benefited the Yen forex by recording a big achieve for the second time, after the primary, when Ueda’s assembly with the Prime Minister the earlier week, triggered a reasonably fast shift in market sentiment. It seems just like the BOJ is paving the way in which in direction of gradual normalisation and signalling to markets, that the time is close to.

Within the FX market, USDJPY on Friday’s buying and selling was up +0.16% (15/12). The yen gave up earlier good points and turned decrease because the Fed’s hawkish feedback pushed the Greenback greater. The Yen on Friday initially moved greater on falling T-note yields and Japanese Finance Minister Suzuki’s feedback that triggered Yen short-covering, as he stated the federal government will proceed to observe forex actions “carefully.” Japanese financial information on Friday was blended for the Yen. The BOJ Jibun Manufacturing PMI for December fell -0.6 to 47.7, the weakest stage in 10 months. Nevertheless, the December Jibun Financial institution companies PMI rose +1.2 to 52.0.

Technical Evaluation

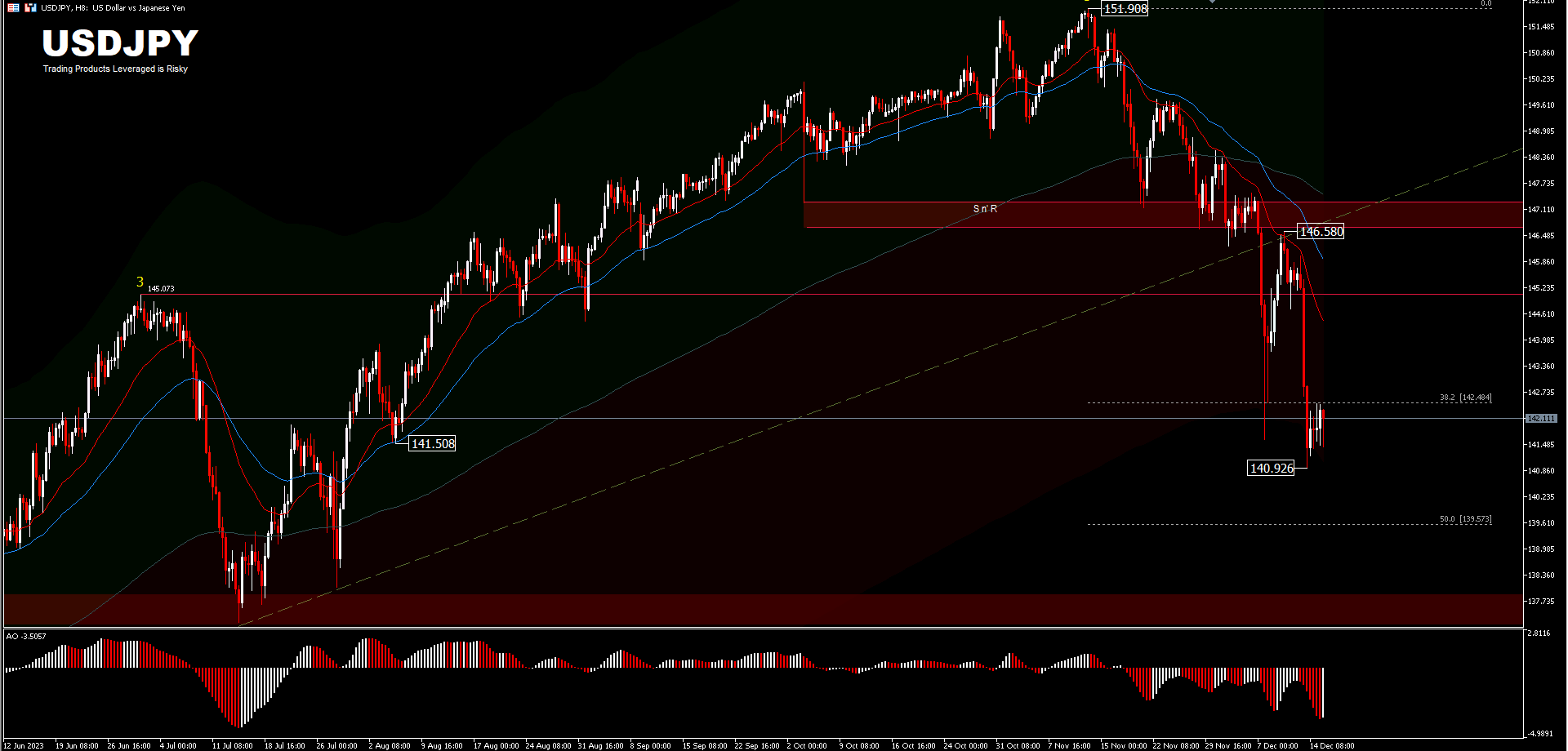

USDJPY’s decline from 151.90 is seen because the third a part of a corrective sample from the 2022 peak of 151.93. A deeper drop may take a look at the 50percentFR or 61.8percentFR stage, from 127.20 to 151.90 pullback. A sustained break there’ll open the way in which to 127.20 assist. The extent will now stay the main target of consideration so long as 146.58 resistance holds.

USDJPY (H8) decline from 151.90 remains to be ongoing. However as a brief low was shaped at 140.92, the bias early this week is impartial first for consolidation. The upside must be restricted by 146.58 resistance to deliver the decline again. A break of 140.92 will goal the subsequent Fibonacci stage at 139.57 and the resistance which is now assist at 137.90.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Academic Workplace – Indonesia

Disclaimer: This materials is supplied as a normal advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or must be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link