[ad_1]

Intel Corp. joined the competitors of AI chip manufacturing amongst its friends (Nvidia and AMD), by introducing final week its brand-new Gaudi 3, a chip for generative AI software program which will likely be launched in 2024. The truth is, the corporate has been engaged on creating Gaudi chips after buying chip developer Habana Labs in 2019. In line with the officers, Gaudi 3 works two occasions sooner networking efficiency, 1.5x increased bandwidth in comparison with Gaudi 2, and 4 occasions increased than BF16 (a brand new floating-point format that may speed up machine studying algorithms) efficiency.

With a maintain of robust perception that the AI PC would be the star of the present for the upcoming yr, Intel CEO Pat Gelsinger additionally launched Core Extremely chips designed for Home windows laptops and PCs, in addition to the fifth era Xeon server chips – each embrace neural processing unit (NPU), a specialised half for working AI packages at sooner charge.

The introduction of Core Extremely Chips signaled the corporate’s largest architectural shift in 40 years, with innovation on all fronts: CPU compute, energy, battery life, graphics, and profound new AI options. Furthermore, Intel’s partnership with over 100 software program distributors in bringing a number of hundred AI-boosted purposes to the PC market (which creates a greater consumer expertise) has inevitably a aggressive benefit for the corporate available in the market.

Alternatively, the brand new Xeon processor is claimed to be delivering as much as 42% increased inference and fantastic tuning on fashions as giant as 20 billion parameters. In contrast with its predecessors, the 5th era Xeon hit 21% common efficiency achieve for basic compute efficiency and 36% common efficiency per watt throughout a spread of buyer workloads, finally decreasing whole value of possession as much as 77%.

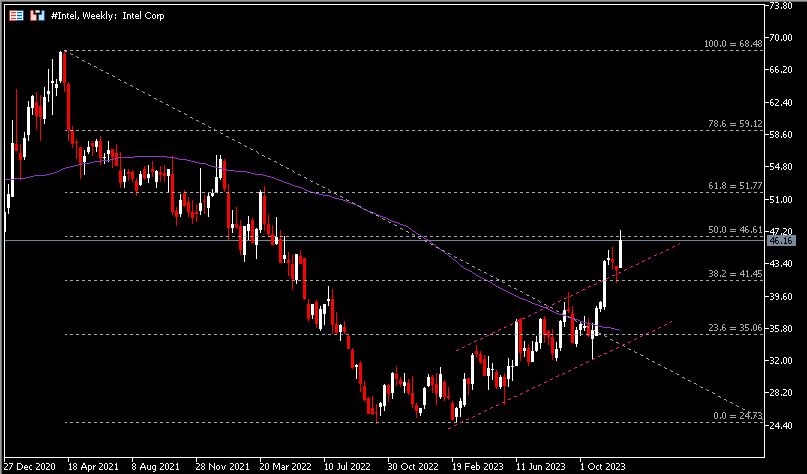

Technical Evaluation:

#Intel, Weekly: The corporate share value has been traded in an ascending channel till it broke the highest line in November. As of its shut final week, the asset is testing $46.60, a FR 50.0% prolonged from the excessive in April 2021 to the low in October 2022. A profitable break above this stage might also point out a shift in pattern course, with subsequent resistance to focus at $51.80 and $59. Quite the opposite, a false break is validated if value retraces again to the channel, with $41.50 (FR 38.2%) serves as the closest assist, adopted by $35 (FR 23.6%).

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is offered as a basic advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link