[ad_1]

- Earnings season is about to wrap up and has fared a bit higher than anticipated

- However some firms have overwhelmed market forecasts by huge margins

- Let’s check out the highest 4 shares to take action this season

Q2 earnings season ended up yielding better-than-anticipated outcomes, albeit not by a hefty margin. On common, firms posted a modest +7% development in earnings per share and a +2% in income quarter-on-quarter.

Nonetheless, the variety of firms surpassing market projections has exceeded the 10-year common.

However regardless of the comparatively optimistic image, a year-over-year decline of over -8% stays, marking the third consecutive quarter of decline compared to the earlier 12 months. Nonetheless, a glimmer of hope shines by means of within the forecasts, suggesting a possible uptick within the subsequent quarter.

In opposition to this backdrop, what really captures our consideration is a particular group of shares that share a typical attribute: they’ve overwhelmed market forecasts by over 125%.

With out additional delay, let’s delve deep and analyze whether or not these shares are a purchase proper now.

1. Paramount World

Paramount World (NASDAQ:), previously often called ViacomCBS, is a New York-based media conglomerate.

On October 2, it can distribute a dividend of $0.050 per share, requiring shareholders to own shares by September 14 to qualify for the dividend.

The exceptional from August 7 underscore its efficiency. It achieved an EPS of 10 cents per share, a exceptional +671% enchancment in comparison with market expectations.

This stands out as probably the most vital earnings beat amongst all shares listed within the .

Wanting forward, Paramount World is scheduled to disclose its upcoming outcomes on November 2. The market’s outlook is much less optimistic, anticipating a -68% lower in earnings per share.

The help is $14.03.

2. Intel

Intel (NASDAQ:), the corporate famend for creating the x86 sequence of laptop processors, was based on July 18, 1968.

Curiously, throughout its inception, they initially thought-about the title ‘Moore Noyce,’ nevertheless it was dismissed as a result of it appeared like “Extra Noise.”

After briefly utilizing NM Electronics, they finally settled on Built-in Electronics, abbreviated as Intel.

Within the newest unveiled on July 27, Intel reported earnings per share of $0.13, surpassing market forecasts by a powerful +546%. Moreover, its revenues outperformed expectations by +6.7%.

Mark your calendar for Intel’s upcoming outcomes announcement on October 26. Though a decline in earnings per share is anticipated for 2023, there is a optimistic outlook with projected will increase from 2024 onward, together with a noteworthy +184% surge in 2024.

At present, the resistance at $36.87 is proving troublesome to beat.

3. Constellation Power

Constellation Power (NASDAQ:), headquartered in Baltimore, Maryland, is a outstanding vitality firm specializing in offering electrical vitality and pure fuel companies.

Within the not too long ago disclosed outcomes on August 3, Constellation Power achieved an EPS of $3.67 per share, surpassing market expectations by a putting +370%. The optimistic streak continued, with revenues exceeding projections by +19.8%.

Wanting forward, mark November 7 in your calendar for Constellation Power’s subsequent outcomes unveiling. The corporate is anticipated to take care of its development trajectory, with expectations of continued earnings per share (EPS) development not solely in 2023 but additionally within the forthcoming years.

The inventory’s present pattern is clearly bullish, particularly after breaking by means of resistance firstly of August.

4. Qorvo

Qorvo (NASDAQ:), headquartered in North Carolina, is an organization specializing in wi-fi and vitality market merchandise.

The corporate’s institution emerged from the merger of TriQuint Semiconductor and RF Micro Gadgets, a union that was introduced in 2014 and finalized on January 1, 2015.

Throughout the presentation on August 2, Qorvo demonstrated distinctive efficiency, revealing earnings per share of $0.34, exceeding market projections by a powerful +125.7%. Moreover, the corporate outperformed income forecasts by almost +2%.

Keep tuned for November 1, when Qorvo will unveil its subsequent outcomes. The corporate’s development trajectory seems promising, with expectations of steady income enlargement all through 2023 and the following years.

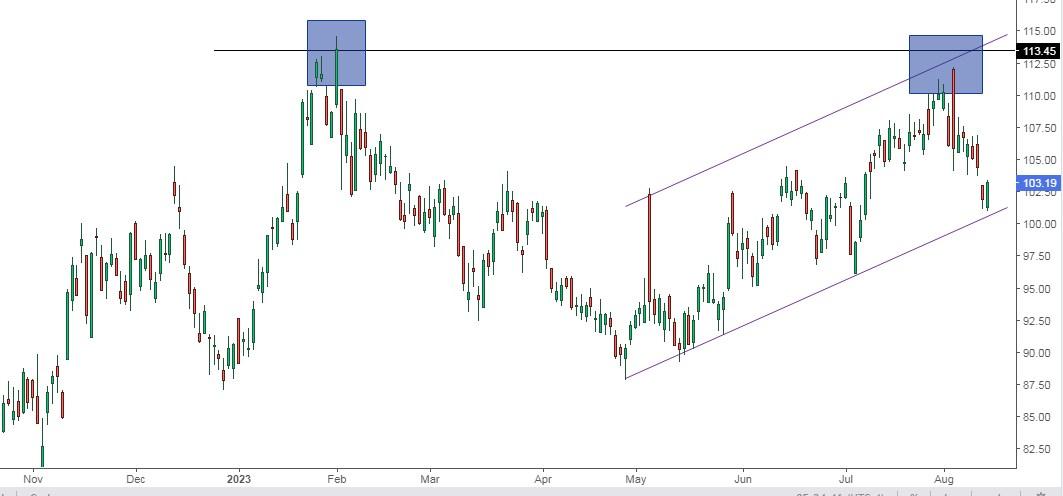

It couldn’t break by means of its resistance at $113.53 when it tried on August 3.

***

Discover All of the Information you Want on InvestingPro!

Disclaimer: This text is written for informational functions solely; it’s not meant to encourage the acquisition of property in any means, nor does it represent a solicitation, provide, suggestion, recommendation, counseling, or suggestion to take a position. We remind you that every one property are thought-about from totally different views and are extraordinarily dangerous, so the funding determination and the related threat are the investor’s personal.

[ad_2]

Source link