[ad_1]

HANG SENG, CSI 300 Index- Outlook:

- The Hold Seng Index has reversed course after failing to interrupt above key resistance.

- The CSI 300 index is testing an important help.

- What’s the outlook and what are the important thing ranges to look at?

Really useful by Manish Jaradi

The Fundamentals of Vary Buying and selling

China/Hong Kong equities are testing essential help areas that might outline the development for the subsequent few weeks, presumably months.

In latest weeks, China/Hong Kong equities have proven tentative indicators of base constructing, however have lacked the much-needed follow-through upward momentum. For extra dialogue on this, see “HK/China Equities Try to Construct Base on Stimulus Hopes; Hold Seng, CSI 300 Value Setups,” printed August 1.

Because of this, the Hold Seng Index and the CSI 300 index are actually testing the decrease finish of the latest vary amid a faltering financial system and a chronic slowdown within the property market. Tight liquidity situations have weighed on the true property sector, dragging down the broader index.

Chinese language authorities have pledged to help the delicate post-Covid financial system restoration, specializing in boosting home demand, confidence and stopping dangers. Authorities have additionally responded with a collection of stimulus measures, however these measures haven’t boosted confidence but.

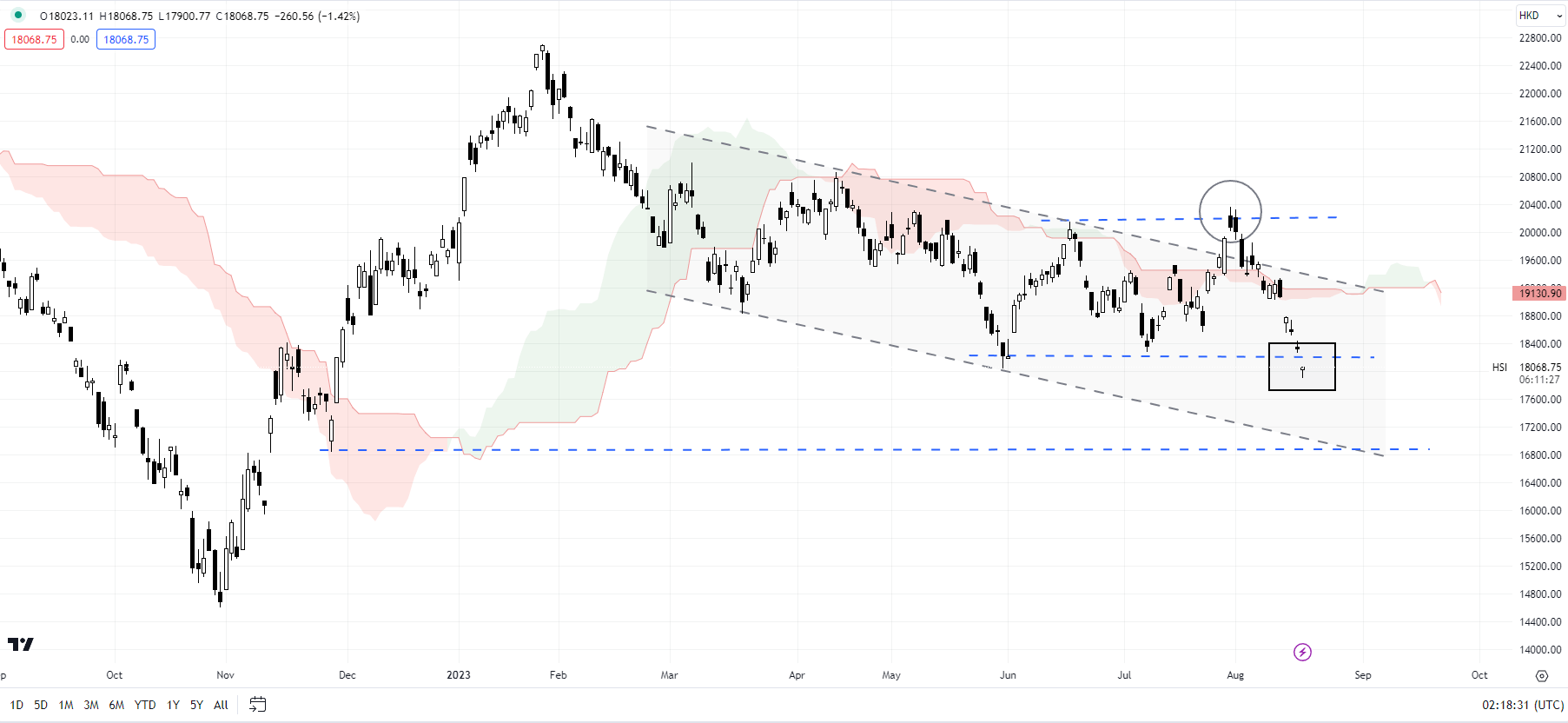

Hold Seng Index Month-to-month Chart

Chart Created Utilizing TradingView

As highlighted within the earlier replace, enticing valuations in contrast with a few of its friends, usually oversold situations, and better threat premia (in keeping with some estimates, pessimism towards China is at excessive ranges) argue for a turnaround in Hong Kong/China equities. The catalysts, nonetheless, seem like missing.

Hold Seng Index Each day Chart

Chart Created Utilizing TradingView

Hold Seng: Now or by no means second

A failed try to rise previous a key ceiling on the mid-June excessive of 20155 has put the Hold Seng Index (HSI) again inside its well-established vary since June. As highlighted within the earlier replace, a break above 20155 is essential for the base-building view to carry. The index is now testing the decrease fringe of the vary at about 18000. The subsequent help is across the November 2022 low of 16830.

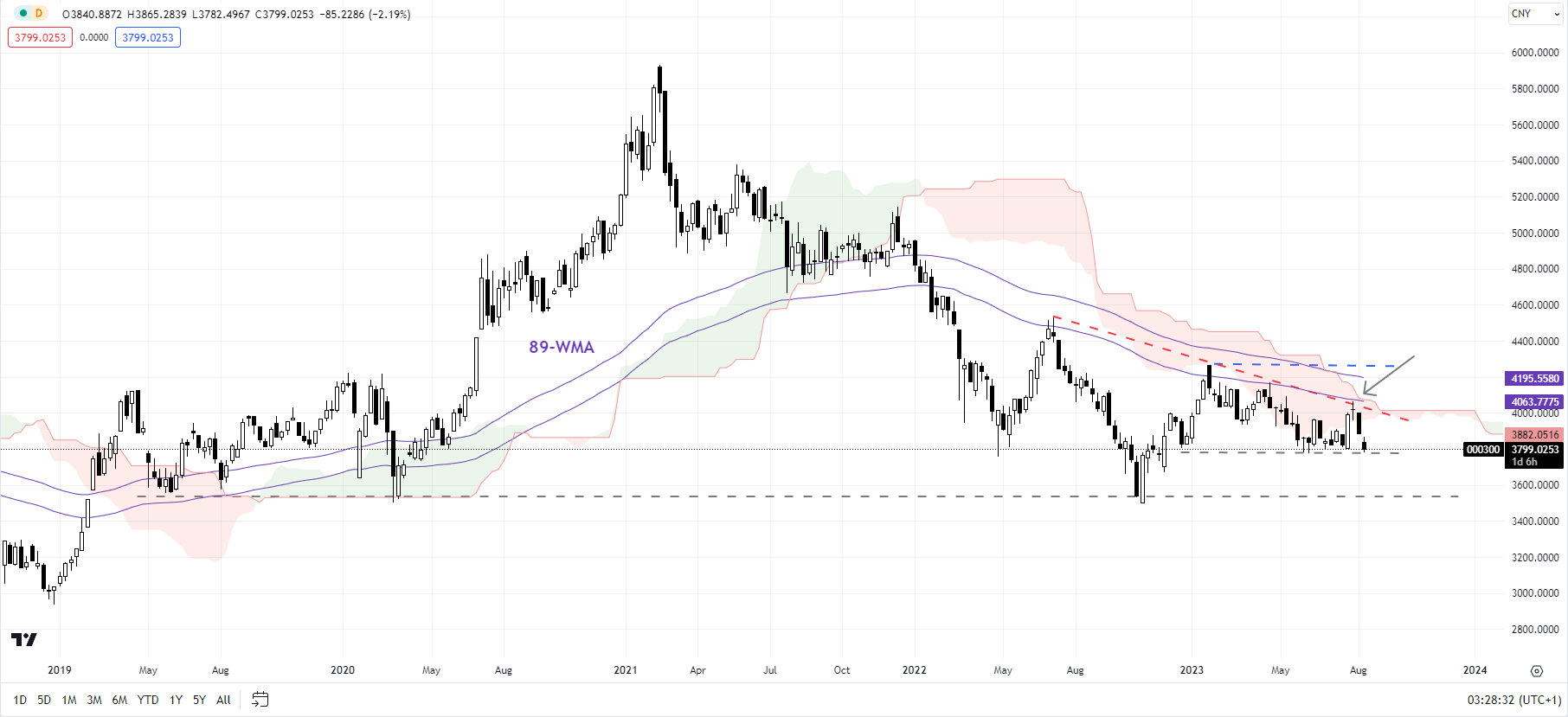

CSI 300 Index Weekly Chart

Chart Created Utilizing TradingView

Whereas it might be untimely to imagine a decrease break, a decisive fall beneath the help would increase the percentages that the November 2022-January 2023 rebound is over, shifting the stability of dangers towards the draw back. On the upside, a crack above 20155 is required for the speedy bearish dangers to fade.

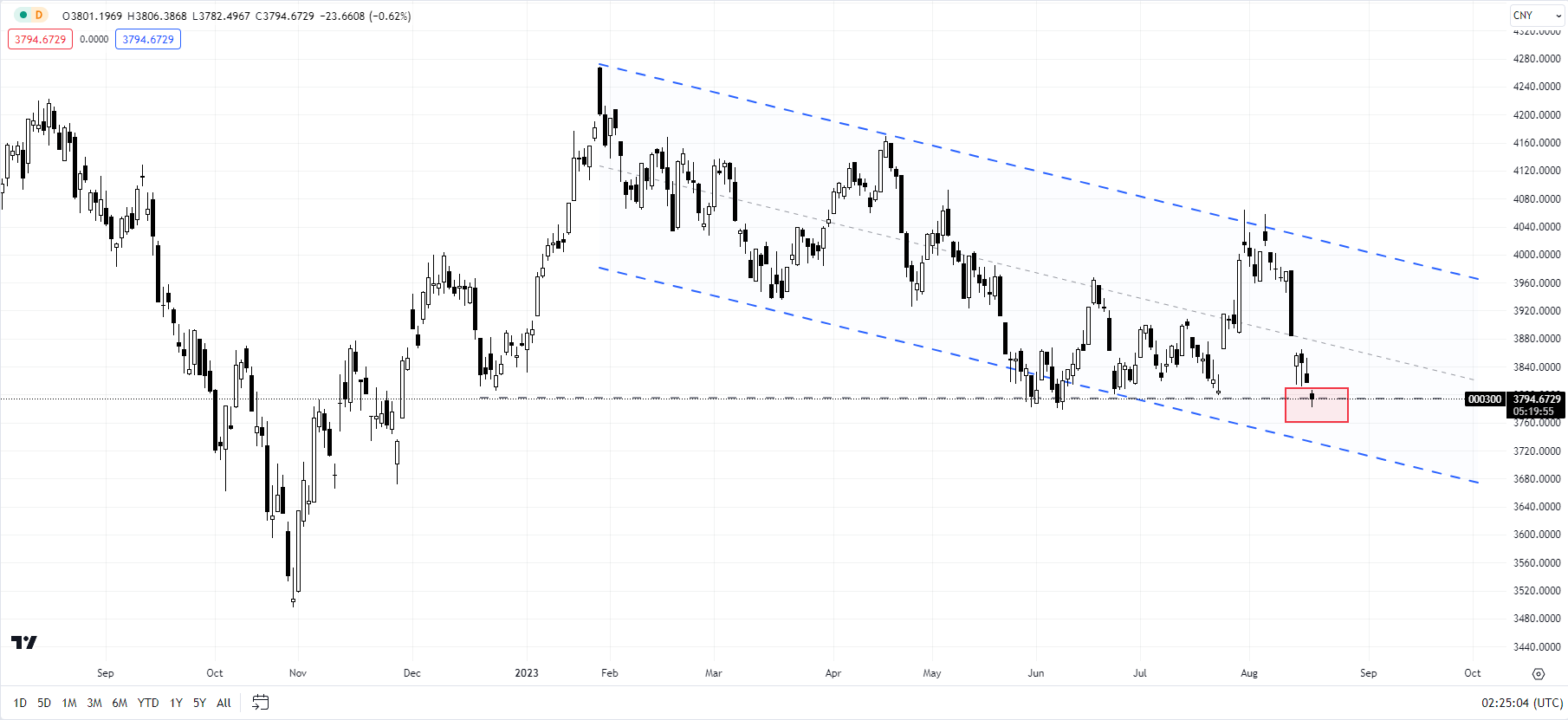

CSI 300 Index Each day Chart

Chart Created Utilizing TradingView

CSI 300: At an important help

The CSI 300 index has surrendered all of its good points after a failed try to decisively rise above the stiff hurdle on the June excessive of 3968. As highlighted within the earlier replace, until the index surpasses the speedy ceiling on the February excessive of 4268, the trail of least resistance stays sideways to down.

It’s now testing essential help on the June low of 3780. Any break beneath may pave the best way towards 3675 initially, presumably the October low of 3495.

Really useful by Manish Jaradi

Traits of Profitable Merchants

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and comply with Jaradi on Twitter: @JaradiManish

[ad_2]

Source link