[ad_1]

Nothing new within the FOMC minutes – “important upside dangers to inflation which could require additional tightening” pushed latest dip patrons to the sidelines, permitting yields to float increased into the day’s finish. – Immediately, implied Fed funds futures proceed to point out the federal funds price regular at 88% its subsequent assembly in September.

Wall Road completed on the lows of the session due to added pressures from issues over weakening development in China. Asian shares declined on issues over a sustained interval of elevated rates of interest within the US and weaker than anticipated outcomes at Tencent. Tencent missed estimates, it mentioned, on account of weakened client confidence and gaming gross sales that fell wanting projections. In Japan, exports declined in July for the primary time since February 2021, dragged down by waning demand in China for pc chips and cars. China’s actual property hunch stays in focus as markets weigh the impression of the fallout. One in every of China’s greatest shadow banks is reportedly planning to restructure its debt and Evergrande Group mentioned the securities regulator has constructed a case towards it. China’s central financial institution has been making an attempt to prop up the system with money injections, however to date official motion has failed to revive confidence.

- FX – USDIndex discovered legs on the hawkish lean from the FOMC minutes. The USDIndex closed at 103.31, whereas as we speak’s highs are at 103.47. EURUSD drifted to 1.0860, Cable jumped to 1.2738 from 1.2685. USDJPY has climbed to a excessive of 146.56, as a few of the haven demand for the Yen fades. Bloomberg famous the 145.90 mark was the catalyst for intervention final September.

- Shares – The US100 misplaced -1.15% with the US500 down -0.76% whereas the US30 was off -0.52%. There was a drop in Intel after it agreed with Tower Semiconductor to desert merger plans after Chinese language regulators didn’t rule on the motion earlier than the agreed to deadline.

- Commodities – USOil dropped to $78.63.

- Gold – held under $1,900, at $1,889.

Immediately: Walmart earnings and US unemployment claims and Philly index.

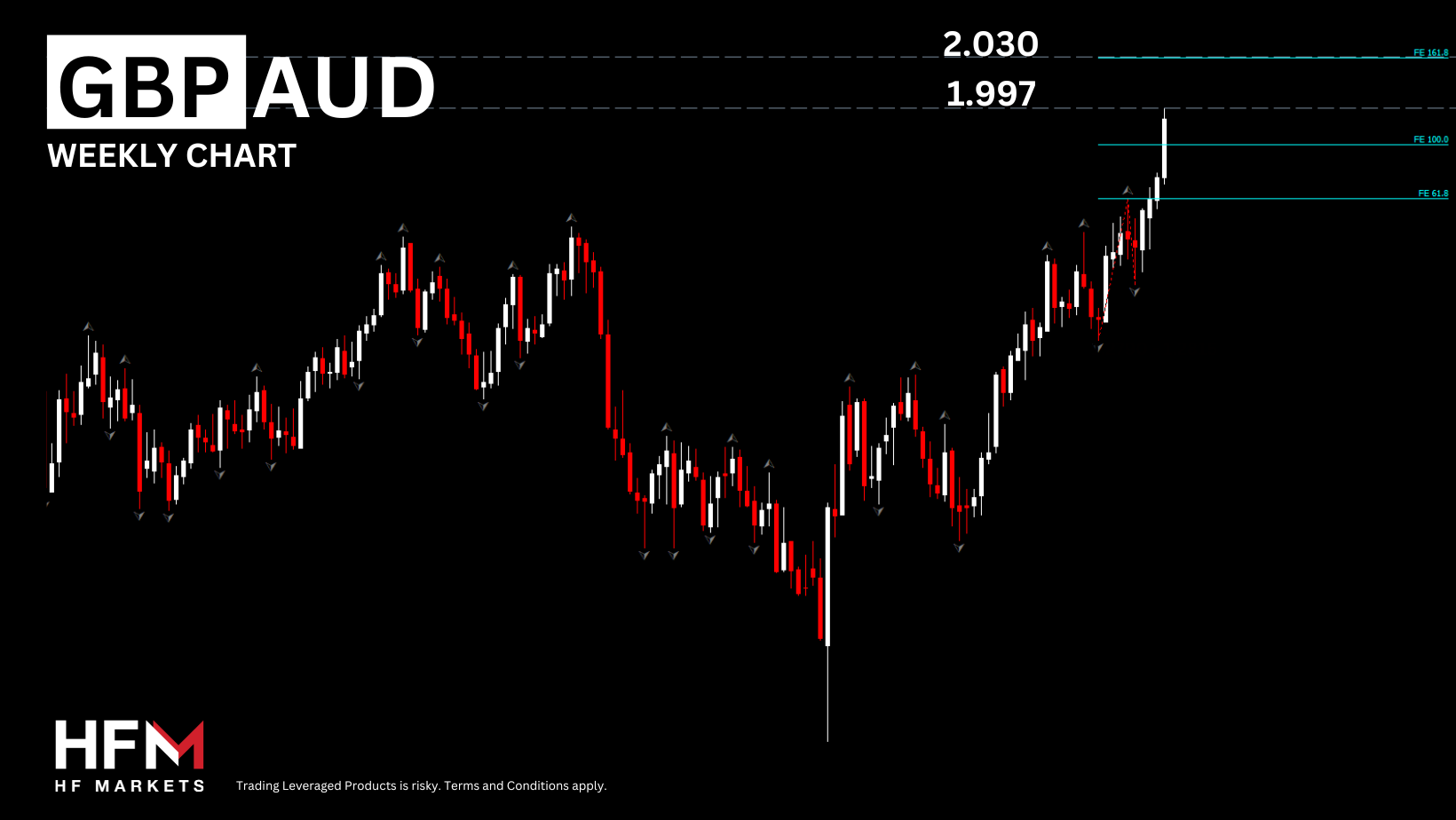

Largest FX Mover: GBPAUD (+0.45%) spiked to 1.9970, whereas in August the asset appreciated by greater than 4.6%.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is supplied as a common advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link