- America and Europe hit Russia with suffocating financial sanctions

- Russian central financial institution raises rates of interest however can not defend foreign money

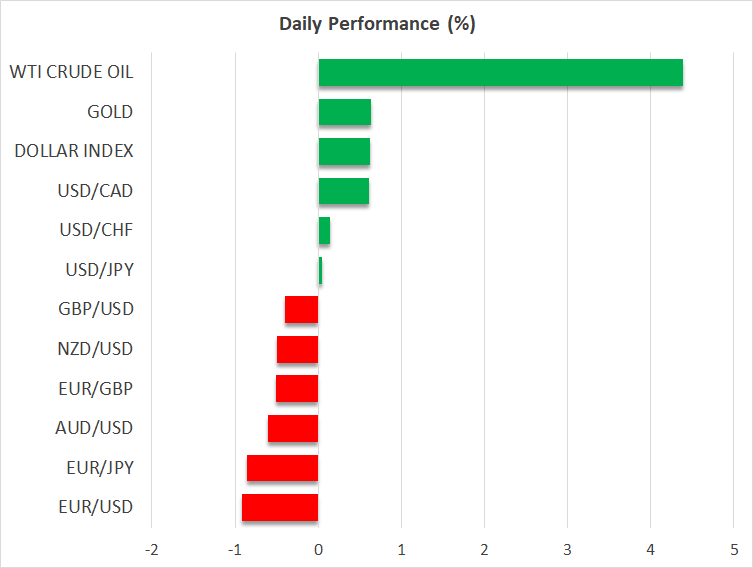

- Shares retreat, US greenback and oil advance as merchants scale back threat

Capital flees Russia

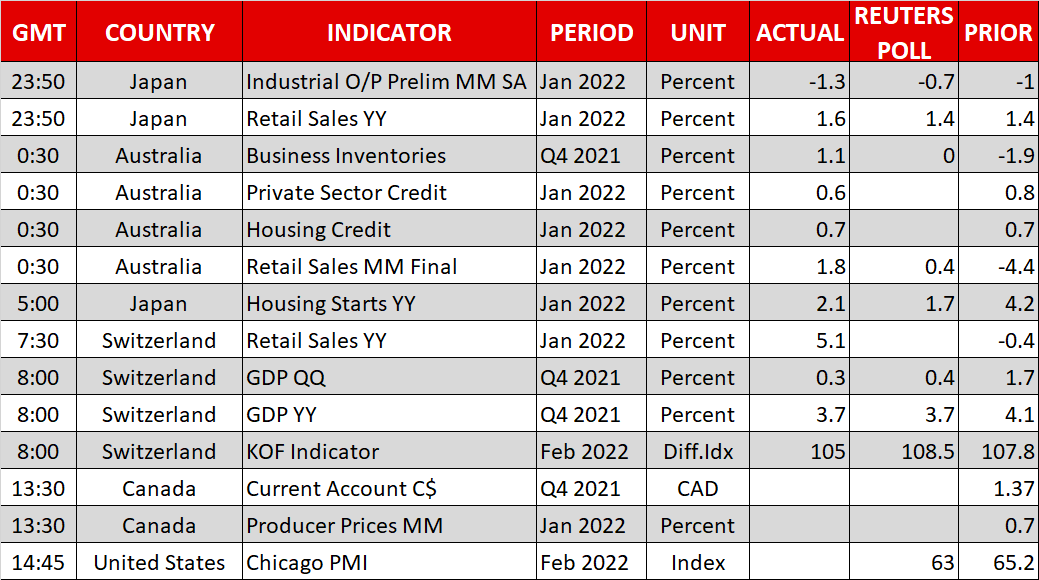

The invasion of Ukraine has despatched markets right into a tailspin. Europe and America lastly took off the gloves and introduced a brand new spherical of crippling financial sanctions in opposition to Russia. These embrace the expulsion of a number of Russian banks from the SWIFT worldwide funds system and freezing many of the FX reserves held by the central financial institution.

That is basically a one-two punch from the West. It’ll deal a heavy blow to Russia’s monetary establishments and maybe spark a recession, whereas additionally leaving the central financial institution powerless to defend its foreign money by stopping entry to its personal struggle chest. The Russian central financial institution raised rates of interest to twenty% at the moment in a last-ditch try to combat foreign money depreciation, however the rouble nonetheless collapsed to a brand new document low.

Capital is fleeing the nation and Russian belongings are on hearth sale. Many massive gamers have introduced they may divest their Russian holdings, individuals are queuing up for money machines, and gentle capital controls have already been launched by ‘prohibiting’ foreigners from promoting securities on the Moscow Alternate.

Markets react

Pricing geopolitical threat into monetary markets is notoriously tough. There isn’t any actual system for the way to shield a portfolio in opposition to probably catastrophic occasions, so oftentimes buyers are inclined to overreact by dramatically slashing their threat publicity and deleveraging.

has been one of the best barometer of market issues round this battle. The prospect of sanctions constraining Russian provide has turbocharged vitality costs, though Western powers have been cautious to not goal the sector explicitly, petrified of the collateral harm on the European financial system from hovering gas costs.

That is additionally why the euro is beneath stress. The sanctions may come again to chew Europe by squeezing shoppers and restraining the banking sector in international locations with excessive publicity to Russian cash, so foreign money merchants are taking cowl within the security of the US greenback.

What now?

Inventory markets have been hit by a strong wave of promoting as properly. European markets are down nearly 2% whereas futures level to an analogous loss when Wall Avenue opens at the moment. ‘Cut threat first, ask questions later’ appears to be the technique amongst cash managers.

The one piece that doesn’t match the puzzle is gold. Bullion opened increased for the week however has already surrendered these beneficial properties, which is unusual contemplating that Treasury yields are additionally sinking. It could possibly be that the Russian central financial institution is dumping gold on the open market to shore up its devastated foreign money, since most of its FX reserves have been frozen.

Wanting forward, markets will stay hostage to incoming headlines. Russian forces have encircled Ukraine’s capital, Vladimir Putin has put his nuclear arsenal on excessive alert, and the European Union has pledged to ship arms to Ukraine, together with fighter jets. Therefore, the state of affairs could be very unpredictable.

One ray of hope comes from the peace talks that will probably be held between Ukrainian and Russian officers at the moment. Whereas the negotiations may not cease the struggle, they is likely to be sufficient to elevate threat sentiment. A whole lot of the negativity has already been priced in and everyone seems to be hedged at this level, so any piece of fine information may have an amazing influence by way of calming the markets.