[ad_1]

Printed on November twenty fifth, 2022 by Quinn Mohammed

Berkshire Hathaway (BRK.B) has an fairness funding portfolio value practically $300 billion as of the top of the 2022 third quarter.

Berkshire Hathaway’s portfolio is crammed with high quality shares. You possibly can comply with Warren Buffett shares to seek out picks for your portfolio. Buffett (and different institutional buyers) should periodically present their holdings in a 13F Submitting.

You possibly can see all Warren Buffett shares (together with related monetary metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink under:

Observe: 13F submitting efficiency is totally different than fund efficiency. See how we calculate 13F submitting efficiency right here.

As of September 30th, 2022, Buffett’s Berkshire Hathaway owned practically 6.0 million shares of Louisiana-Pacific (LPX) for a market worth of about $297 million. Louisiana-Pacific represents about 0.1% of Berkshire Hathaway’s funding portfolio.

This text will analyze the forest merchandise firm in higher element.

Enterprise Overview

Louisiana-Pacific Company (LPX) is a frontrunner in high-performance constructing options. The corporate manufactures engineered wooden constructing merchandise for builders, remodelers, and householders throughout the globe.

The corporate was based in 1972 and operates 22 crops within the U.S., Canada, Chile, and Brazil. LPX trades with a market capitalization of $4.5 billion.

Supply: Investor Presentation

On November 1st, 2022, Louisiana-Pacific reported third-quarter 2022 outcomes. The corporate generated $852 million in web gross sales, which was a 16% year-over-year lower. The siding options noticed web gross sales rise 27% year-over-year to $393 million, whereas OSB web gross sales declined 35% to $388 million.

Adjusted diluted earnings per share have been $1.72, a big lower from $3.52 per share within the third quarter of 2021.

Louisiana-Pacific repurchased 5.6 million shares within the third quarter for $325 million. On September thirtieth, 2022, the corporate had 71.7 million frequent shares excellent.

We estimate that Louisiana-Pacific can generate $11.98 in earnings-per-share for the fiscal 12 months 2022.

Progress Prospects

Progress has been lumpy up to now decade, with outsized earnings in 2021 greater than thrice that of 2020. In 2019, 2020, and 2021, LP generated adjusted earnings per share of $0.37, $4.31, and $13.97, respectively. The corporate’s inventory value has mirrored this huge leap in earnings, rising by 121% within the trailing three years.

Louisiana-Pacific’s Siding phase is experiencing sturdy progress and achieved report gross sales within the third quarter. Each quantity and costs are rising impressively, at 9% and 16% in the latest quarter, respectively.

The corporate is investing within the Siding phase by increasing amenities and enhancing capability within the Houlton, Maine, and Washington amenities.

The addressable wood-like siding and trim market stand at about $10 billion, of which Louisiana-Pacific made up 12% in 2021. Consequently, a big market share stays that LP can pry from opponents or generate new enterprise.

Moreover, the corporate has repurchased a big variety of shares in recent times because it executes its capital plan. Since 2019, LP has repurchased greater than $2.7 billion of its personal shares, which is exceptional contemplating the corporate solely has a market capitalization of $4.5 billion. It will act as a tailwind to earnings on a per-share foundation.

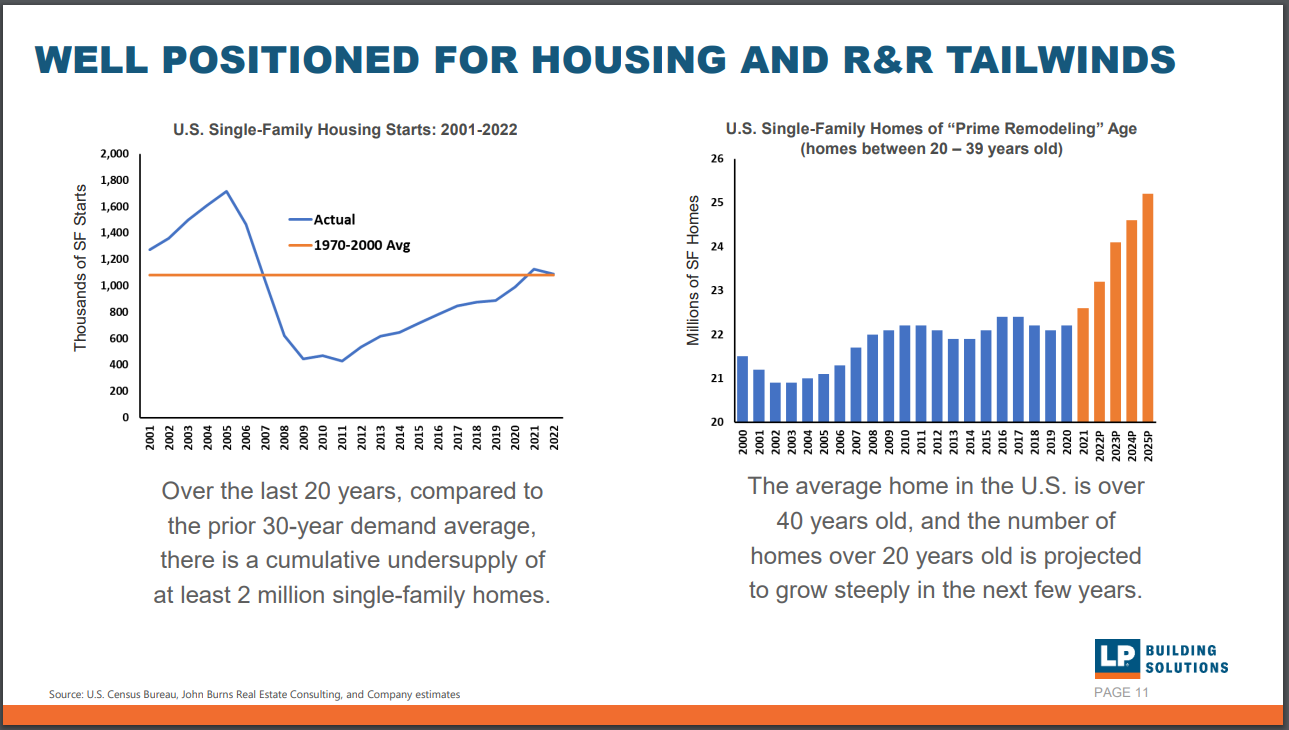

Supply: Investor Presentation

A progress catalyst for the corporate can be the leap within the variety of properties coming to their “Prime Reworking” age, which is between 20 and 39 years previous. Moreover, the demand for properties outstrips the provision, that means many new properties that might use LP’s merchandise have to be constructed.

Given the lumpiness within the firm’s historic earnings, we estimate a 4.0% decline in earnings per share from now into 2027 because of the excessive comparability base shaped this 12 months.

Aggressive Benefits & Recession Efficiency

Louisiana-Pacific operates in a closely aggressive setting. The corporate’s product innovation could possibly be thought of a aggressive benefit over friends.

Supply: Investor Presentation

The corporate’s outcomes are tightly linked to the housing and transforming market. Consequently, the corporate’s enterprise is more likely to gradual within the face of a recession or rising rates of interest.

Within the Nice Monetary Disaster, LP carried out very poorly. The corporate posted losses all through that interval and in 2009, utterly lower the dividend. This dividend was not reinstated till 2018, nevertheless it has grown yearly since then.

Nevertheless, within the current recession, which resulted from the pandemic, the corporate managed to develop its gross sales and earnings due to strong housing, building, and transforming progress.

Louisiana-Pacific has raised its dividend for 4 consecutive years up to now. And the present dividend is well-covered by earnings. Primarily based on anticipated fiscal 2022 earnings, LPX has a payout ratio of simply 7%. We anticipate the corporate will be capable to develop its dividend, albeit at an affordable tempo, in order that the dividend stays sustainable, in contrast to throughout the nice recession.

Valuation & Anticipated Returns

Shares of Louisiana-Pacific Company have traded for a median price-to-earnings a number of of 17.8 over the past 5 years. Shares are actually buying and selling far under this common, which signifies that shares could possibly be extremely undervalued on the present 5.4 instances earnings.

Our honest worth estimate for Louisiana-Pacific inventory is 10.0 instances earnings. If this proves right, the inventory will profit from a 13.3% annualized return acquire by means of 2027.

Shares of Louisiana-Pacific at present yield 1.4%, which is according to its common yield of 1.5%. On a dividend yield foundation, Louisiana-Pacific shares appear to be buying and selling at about honest worth.

Placing all of it collectively, the mix of valuation modifications, EPS progress, and dividends produces whole anticipated returns of 9.7% per 12 months over the subsequent 5 years. This makes Louisiana-Pacific Company a maintain.

Ultimate Ideas

Louisiana-Pacific Company is a frontrunner in high-performance constructing options. The corporate manufactures an important part for brand spanking new and previous buildings.

The inventory has risen by 121% within the final three years, and 2021 earnings seem to mark a cyclical high for an organization that has posted risky outcomes over the past decade.

Different Dividend Lists

Worth investing is a precious course of to mix with dividend investing. The next lists include many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link