[ad_1]

USD/JPY Evaluation and Chart

- USD/JPY clawed again some floor however stays pressured

- Markets are not sure how a lot additional US rates of interest will rise as knowledge softens

- Financial institution of Japan’s ultra-loose financial coverage can be in focus

Uncover what sort of foreign exchange dealer you might be

The Japanese Yen slipped a bit towards United States Greenback on Friday however nonetheless seems set for its strongest week this 12 months as Japanese yields rise and the buck is weighed down by a broad rethink about how a lot greater US rates of interest may go.

Official knowledge this week confirmed inflation coming to heel Stateside, with the labor market softening. Seeing this, traders on look ahead to chunky, half-percentage-point price rises instantly dialed again their expectations. For positive the final view is that the Federal Reserve will improve borrowing prices once more this month. However now solely a quarter-point improve is predicted. There’s additionally much more uncertainty about whether or not there’ll be any extra such motion this 12 months.

Naturally, this new actuality has undermined the US Greenback, particularly towards currencies just like the Euro and Sterling whose central banks have to date been a lot much less profitable than the Fed in bringing costs beneath management.

The Yen is in a financial class of its personal, in fact. The Financial institution of Japan has been making an attempt with restricted success to stoke home inflation for years and nonetheless views the present bout as a product of worldwide elements reasonably than one which wants a shift in its ultra-loose financial coverage.

Nonetheless, basic weak spot within the US Greenback has been amply mirrored in USD/JPY. Furthermore, some analysts really feel that US yields now have a lot much less room to rise in comparison with these in Japan, ought to the BoJ ‘tweak’ its repressive coverage of Yield Curve Management. Certainly, ten-year Japanese bond yields hit their highest level for almost 5 months on Friday.

The BoJ will give its subsequent coverage resolution on July 28, two days after the Fed. It should additionally unveil financial projections. The market is more and more ready to guess that the tweak is coming.

USD/JPY Technical Evaluation

Chart Compiled Utilizing TradingView

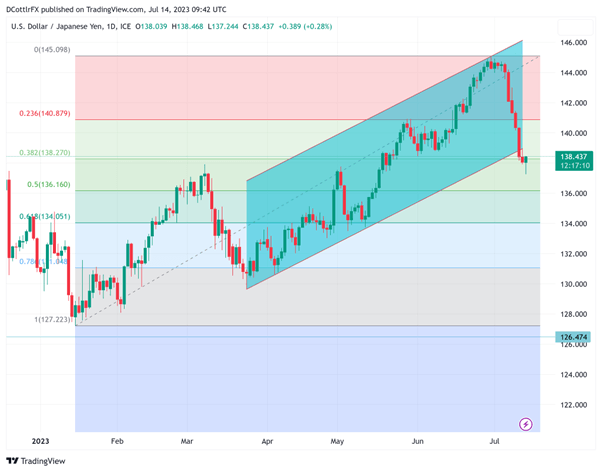

USD/JPY’s collapse since July 5 has been sharp, taking the pair down by means of each the primary and second Fibonacci retracements of its rise from the lows of January to the peaks of this month.

The second retracement at 138.270 has been retaken as of Friday’s European morning however hardly comfortably and it stays beneath menace.

The pair has additionally fallen under the uptrend channel dominant since March 24 and to date struggled to regain it. It now gives near-term resistance at 139.087 and it is going to be fascinating to see whether or not the bulls handle to shut this week out again above that time.

Unsurprisingly the Greenback is beginning to look greater than a bit oversold through its Relative Energy Index at this level and a few short-term moderation in promoting strain can most likely be anticipated with Greenback bulls probably out to defend the psychological 137.00 assist area.

| Change in | Longs | Shorts | OI |

| Each day | -7% | -13% | -11% |

| Weekly | 30% | -24% | -5% |

IG’s personal sentiment index finds merchants fairly balanced on the pair’s prospects from right here, with 53% nonetheless bearish, not an enormous margin. It’s additionally potential that markets are barely overdoing their basic justification to purchase the Yen. The BoJ is prone to take a really measured and gradual strategy to unwinding any of its financial easing, assuming it does so in any respect.

–By David Cottle for DailyFX

[ad_2]

Source link