[ad_1]

This week’s information on shopper helps the case for anticipating that the Federal Reserve’s rate of interest hikes are approaching the tip recreation. The essential calculus is which can be disinflation persists, the chances rise that the central financial institution will pause its coverage of tightening financial coverage.

US shopper costs rose in June on the slowest tempo since March 2021, offering extra help for anticipating that the Fed will put fee hikes on ice. Core inflation’s descent remains to be comparatively sticky, which leaves extra room for warning in contrast with reviewing headline comparisons, that are decrease primarily resulting from softer meals and vitality costs.

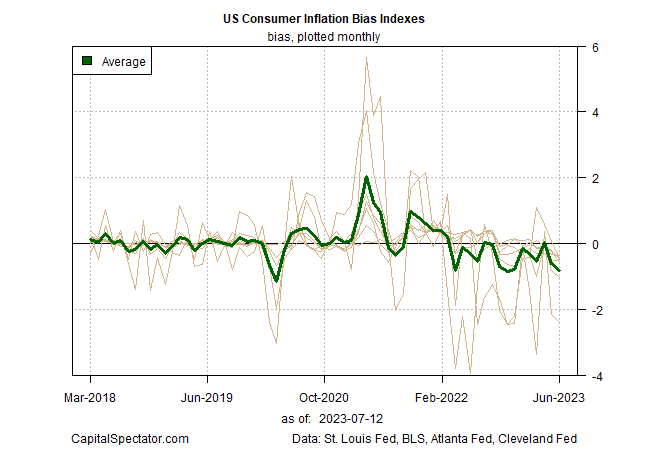

However a broad set of inflation metrics signifies that disinflation is powerful. (For an inventory of the inflation indexes within the chart under, see p. 3 in CapitalSpectator.com’s The US Inflation Pattern Chartbook, which is distributed each month to subscribers of The US Enterprise Cycle Danger Report.)

US Client Inflation Indexes

The bias (month-to-month-change within the 1-year development) has deepened recently for the common 1-year change within the chart above. That’s a clue for anticipating that the current run of disinflation will keep sturdy for the close to time period.

US Client Inflation Bias Indexes

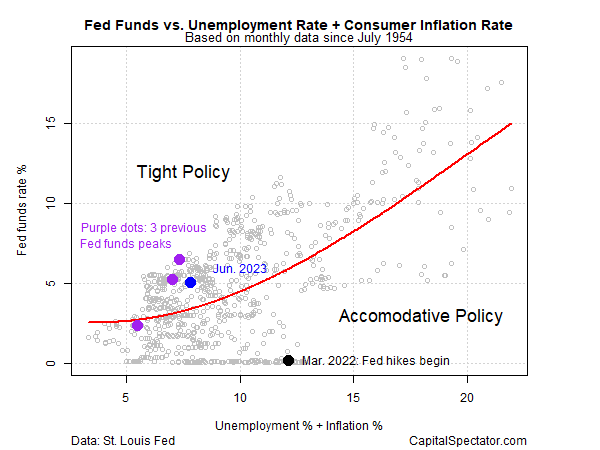

In the meantime, Fed financial coverage stays reasonably tight, based mostly on a easy mannequin that compares the Fed funds goal fee to unemployment and inflation. With inflation easing at a strong tempo, the central financial institution could also be satisfied that it could actually put fee hikes on pause and permit the present reasonably tight coverage stance to place downward strain on costs.

Fed Funds vs Unemployment Fee

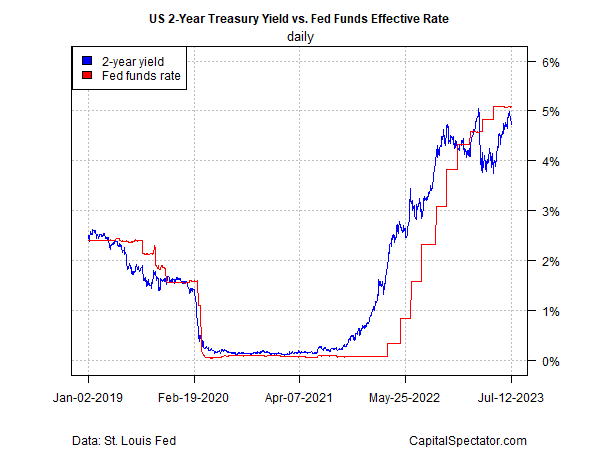

The policy-sensitive Treasury yield, which is buying and selling under the Fed funds goal fee, continues to cost in expectations that the Fed funds goal fee is near a peak if it hasn’t peaked already.

US 2-Yr Treasury Yield vs Fed Funds Efficient Fee

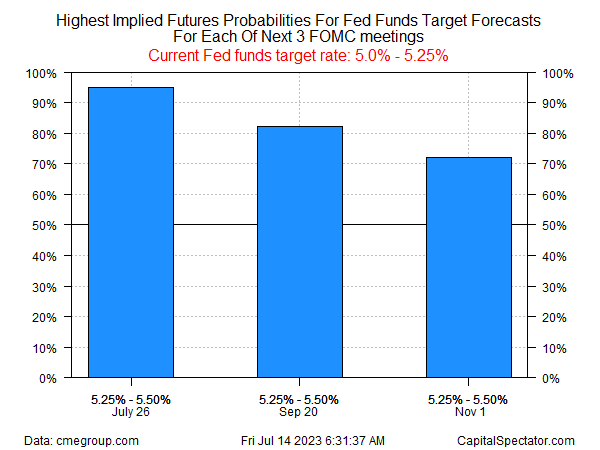

Fed funds futures are pricing in excessive odds for an additional fee hike on the July 26 coverage assembly, adopted by reasonably excessive odds for pausing on the two subsequent FOMC conferences.

Chances For Fed Fed Funds Goal Forecasts

Though the case is strengthening for anticipating a pause in fee hikes, one Fed official yesterday cautioned that it’s untimely to declare victory over inflation and assume that fee hikes are over. San Francisco Fed President Mary Daly advises that whereas “there isn’t a doubt that the excellent news on inflation is sweet information certainly, it’s actually too early to declare victory on inflation.”

This a lot is obvious: the most recent inflation numbers elevate the chances that the Fed’s rate-hiking cycle is near peaking. Upside surprises to incoming inflation numbers may derail the optimism, however for the second, the group is studying the tea leaves and turning into extra assured that the tip recreation is in sight.

Commenting on the June inflation report, economists at Goldman Sachs wrote on Wednesday: “In the present day’s report is in step with our view that Fed tightening is in its closing innings.”

[ad_2]

Source link