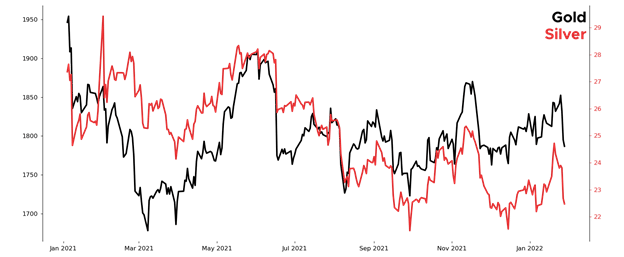

The descent in metals following final week’s FOMC might current an fascinating alternative for these trying so as to add lengthy gold and silver publicity to their portfolio or no less than strive their hand at buying and selling this distinctive asset class diversified from equities on a historic excessive.

GC & SI Gold and Silver Futures

Futures have lengthy been a low-cost, direct path to gaining valuable metallic funding with out having to both bodily personal the commodity or pay a excessive capital requirement (50-100% of funding) for an exchange-traded fund or notice. The comparatively new Small Metals (SPRE®) futures allow you to entry gold, silver, and platinum in a single order that prices lower than conventional and Micro Gold and Silver futures.

SPRE Small Metals

Shopping for a Market with Lengthy Calls

The lengthy name choice can provide you near 1-for-1 publicity within the underlying market if that market’s worth is increased than your strike’s, and your loss potential is solely the quantity you paid for the decision. Nevertheless, you commerce likelihood of success for an outlined quantity of danger on this technique in what is known as the premium on the choice.

SPRE Small Metals Lengthy Name

Shopping for a Market with Brief Places

The brief put choice can provide you near 1-for-1 publicity within the underlying market if that market’s worth is decrease than your strike’s, and you are taking near-full possession so long as the market exists beneath your put strike. Since you’re on the brief aspect of choices, nonetheless, your likelihood of success is boosted north of fifty% given you’re the vendor of choice premium. That stated, you stand to lose publicity, the premium, and extra because the underlying market rises.

SPRE Small Metals Brief Put

Derivatives provide other ways to revenue from the identical outdated markets you hear about day by day, and every by-product – futures, calls, places – comes with its personal tradeoffs. Acquire publicity to gold, silver, and extra in the best way that most closely fits your portfolio.

—

To study extra about how the Small Trade is merging the effectivity of futures with the readability of shares, be certain to subscribe to their YouTube channel and comply with them on Twitter so that you by no means miss an replace.

© 2022 Small Trade, Inc. All rights reserved. Small Trade, Inc. is a Designated Contract Market registered with the U.S. Commodity Futures Buying and selling Fee. The knowledge on this commercial is present as of the date famous, is for informational functions solely, and doesn’t contend to handle the monetary goals, state of affairs, or particular wants of any particular person investor. Buying and selling futures entails the danger of loss, together with the potential of loss better than your preliminary funding.