[ad_1]

Armed with some knowledge from our mates at CrunchBase, I broke down the biggest NYC Startup funding rounds in New York for September 2023. I’ve included some further data reminiscent of business, description, spherical sort, and complete fairness funding raised to additional the evaluation of the state of enterprise capital in NYC.

Now you is perhaps considering: “what the heck are you speaking about?” However preserve studying, as a result of this funding platform’s customers are already smiling all the best way to the financial institution. Because of Masterworks, the award-winning platform for investing in blue-chip artwork.

Each single certainly one of Masterworks’ 15 gross sales has returned a revenue to buyers, for a 100% constructive internet return observe report. With 3 latest gross sales, Masterworks buyers realized internet annualized returns of 17.6%, 21.5% and 35%.

How does it work? Easy, Masterworks does the entire heavy lifting like discovering the portray, shopping for it, storing it, and finally promoting it. It information every providing with the SEC so that almost anybody can spend money on extremely coveted artworks for only a fraction of the worth of the whole piece.

Shares of each providing are restricted, however AlleyWatch readers can skip the waitlist to hitch with this unique hyperlink.

See essential disclosures at masterworks.com/cd

14. level.me $10.0M

Spherical: Sequence A

Description: level.me is a real-time metasearch engine for locating and reserving flights utilizing loyalty reward factors on 150+ airways. Based by Adam Morvitz and Tiffany Funk in 2021, level.me has now raised a complete of $12.0M in complete fairness funding and is backed by Gaingels, Plug and Play Ventures, WndrCo, RiverPark Ventures, and 4 Cities Capital.

Buyers within the spherical: Carl de Marcken, Dave Baggett, 4 Cities Capital, Gaingels, MoreThan Capital, PAR Capital Administration, Plug and Play Ventures, RiverPark Ventures, Thayer Ventures

Trade: Consulting, Info Providers, Loyalty Packages, Subscription Service, Journey, Vertical Search

Founders: Adam Morvitz, Tiffany Funk

Founding yr: 2021

Complete fairness funding raised: $12.0M

AlleyWatch’s unique protection of this spherical: Level.me Raises $10M for its Search Engine That Helps Vacationers Maximize The Worth of Their Factors

14. LastMile AI $10.0M

Spherical: Seed

Description: LastMile AI gives an AI developer platform for engineering and product groups. Based by Andrew Hoh, Sarmad Qadri, and Suyog Sonwalkar in 2023, LastMile AI has now raised a complete of $10.0M in complete fairness funding and is backed by Gradient Ventures, Guillermo Rauch, AME Cloud Ventures, 10x Founders, and Distinctive Capital.

Buyers within the spherical: 10x Founders, AME Cloud Ventures, Distinctive Capital, Gradient Ventures, Guillermo Rauch

Trade: Synthetic Intelligence, Developer Platform, Software program

Founders: Andrew Hoh, Sarmad Qadri, Suyog Sonwalkar

Founding yr: 2023

Complete fairness funding raised: $10.0M

13. Stepful $11.8M

Spherical: Seed

Description: Stepful helps these with out faculty levels practice for and discover entry-level healthcare jobs. Based by Carl Madi, Edoardo Serra, and Tressia Hobeika in 2021, Stepful has now raised a complete of $24.3M in complete fairness funding and is backed by Attain Capital, Y Combinator, Unpopular Ventures, Firm Ventures, and Nitesh Banta.

Trade: Well being Care, Skilled Providers, Coaching

Founders: Carl Madi, Edoardo Serra, Tressia Hobeika

Founding yr: 2021

Complete fairness funding raised: $24.3M

13. Momofuku Items $11.5M

Spherical: Enterprise

Description: Momofuku Items is a restaurant chain that gives modern Asian-American delicacies. Based by David Chang in 2004, Momofuku Items has now raised a complete of $29.0M in complete fairness funding and is backed by Alliance Client Development, RSE Ventures, and Siddhi Capital.

Buyers within the spherical: Alliance Client Development, Siddhi Capital

Trade: Meals and Beverage, Resort, Eating places

Founders: David Chang

Founding yr: 2004

Complete fairness funding raised: $29.0M

Now you is perhaps considering: “what the heck are you speaking about?” However preserve studying, as a result of this funding platform’s customers are already smiling all the best way to the financial institution. Because of Masterworks, the award-winning platform for investing in blue-chip artwork.

Each single certainly one of Masterworks’ 15 gross sales has returned a revenue to buyers, for a 100% constructive internet return observe report. With 3 latest gross sales, Masterworks buyers realized internet annualized returns of 17.6%, 21.5% and 35%.

How does it work? Easy, Masterworks does the entire heavy lifting like discovering the portray, shopping for it, storing it, and finally promoting it. It information every providing with the SEC so that almost anybody can spend money on extremely coveted artworks for only a fraction of the worth of the whole piece.

Shares of each providing are restricted, however AlleyWatch readers can skip the waitlist to hitch with this unique hyperlink.

See essential disclosures at masterworks.com/cd

12. Mundi $15.0M

Spherical: Sequence A

Description: Mundi gives monetary, commerce growth, technique, freight and reinventing worldwide commerce providers. Based by Juan Carlos Christensen, Martin Pustilnick, Paulina Aguilar Vela, and Sebastian Kontarovsky in 2020, Mundi has now raised a complete of $38.8M in complete fairness funding and is backed by Gaingels, Silicon Valley Financial institution, Union Sq. Ventures, FJ Labs, and Uneven Capital Companions.

Buyers within the spherical: Uneven Capital Companions, Base10 Companions, Colibri Ventures, Gaingels, GMO VenturePartners, Haymaker Ventures, Mana Ventures, SquareOne Capital, Union Sq. Ventures, Upper90

Trade: Monetary Providers, Info Know-how

Founders: Juan Carlos Christensen, Martin Pustilnick, Paulina Aguilar Vela, Sebastian Kontarovsky

Founding yr: 2020

Complete fairness funding raised: $38.8M

12. Canvs AI $15.0M

Spherical: Enterprise

Description: Canvs AI is the quickest, best method to remodel open-ended textual content into enterprise insights. Based by Jared Feldman in 2015, Canvs AI has now raised a complete of $22.1M in complete fairness funding and is backed by Cox Enterprises, Delta Air Strains, Ludlow Ventures, Gambit Ventures, and Social Begins.

Buyers within the spherical: Coca-Cola Enterprises, Cox Enterprises, Delta Air Strains, Interact, Fulcrum Fairness Companions, Encourage Manufacturers, The Residence Depot

Trade: Promoting, Analytics, Machine Studying, Market Analysis, Media and Leisure, Social Media, Textual content Analytics

Founders: Jared Feldman

Founding yr: 2015

Complete fairness funding raised: $22.1M

11. Tassat Group $15.1M

Spherical: Enterprise

Description: TassatPay is a developer of a digital blockchain platform for digital funds and trade markets. Based by Sunil Hirani in 2017, Tassat Group has now raised a complete of $60.5M in complete fairness funding and is backed by ConsenSys Mesh.

Trade: Blockchain, Monetary Exchanges, Monetary Providers, FinTech, Funds

Founders: Sunil Hirani

Founding yr: 2017

Complete fairness funding raised: $60.5M

10. IYK $16.8M

Spherical: Seed

Description: IYK is a platform for manufacturers, musicians, and creators to deploy fully-customizable, digi-physical experiences at scale. Based by Ryan Ouyang in 2021, IYK has now raised a complete of $16.8M in complete fairness funding and is backed by Palm Tree Crew, Artwork Blocks, Collab+Foreign money, a16z crypto, and Wave Digital Belongings.

Buyers within the spherical: 1kx, Collab+Foreign money, a16z crypto, Synergis Capital, Lattice Fund, G cash, Coop Information, Justin Aversano, Artwork Blocks, Palm Tree Crew

Trade: Blockchain, Model Advertising and marketing, Style

Founders: Ryan Ouyang

Founding yr: 2021

Complete fairness funding raised: $16.8M

9. Second $17.0M

Spherical: Sequence A

Description: Second is an operator of a fixed-income infrastructure for contemporary companies. Based by Dean Hathout and Dylan Parker in 2022, Second has now raised a complete of $20.0M in complete fairness funding and is backed by Andreessen Horowitz, Opposite, Neo, Venrock, and Henry Kravis.

Buyers within the spherical: Andreessen Horowitz, Opposite, Henry Kravis, Neo, Venrock

Trade: Analytics, Monetary Providers, FinTech, Danger Administration

Founders: Dean Hathout, Dylan Parker

Founding yr: 2022

Complete fairness funding raised: $20.0M

Now you is perhaps considering: “what the heck are you speaking about?” However preserve studying, as a result of this funding platform’s customers are already smiling all the best way to the financial institution. Because of Masterworks, the award-winning platform for investing in blue-chip artwork.

Each single certainly one of Masterworks’ 15 gross sales has returned a revenue to buyers, for a 100% constructive internet return observe report. With 3 latest gross sales, Masterworks buyers realized internet annualized returns of 17.6%, 21.5% and 35%.

How does it work? Easy, Masterworks does the entire heavy lifting like discovering the portray, shopping for it, storing it, and finally promoting it. It information every providing with the SEC so that almost anybody can spend money on extremely coveted artworks for only a fraction of the worth of the whole piece.

Shares of each providing are restricted, however AlleyWatch readers can skip the waitlist to hitch with this unique hyperlink.

See essential disclosures at masterworks.com/cd

8. Summus International $19.5M

Spherical: Enterprise

Description: Summus International is a digital specialist platform that brings personalised recommendation to each medical resolution. Based by Jennifer Kherani and Julian Flannery in 2015, Summus International has now raised a complete of $56.8M in complete fairness funding and is backed by Sator Grove Holdings, Teamworthy Ventures, Outsiders Fund, and Savoy Capital.

Buyers within the spherical: Mitchell Rales, Sator Grove Holdings

Trade: Well being Care, Hospital, Medical, Software program

Founders: Jennifer Kherani, Julian Flannery

Founding yr: 2015

Complete fairness funding raised: $56.8M

AlleyWatch’s unique protection of this spherical: Summus Raises One other $19.5M for its Digital Well being Care Platform That Gives Entry to Specialists

7. Harmonya $20.0M

Spherical: Sequence A

Description: Harmonya presents an API-based knowledge enrichment and augmentation product that assists in class administration, innovation, and product search. Based by Cem Kent in 2021, Harmonya has now raised a complete of $20.0M in complete fairness funding and is backed by Team8, LiveRamp, Allen & Firm, J Ventures, and Vivid Pixel.

Buyers within the spherical: Allen & Firm, arc buyers, Vivid Pixel, J Ventures, LiveRamp, Silicon Street Ventures, Susa Ventures, Team8

Trade: Synthetic Intelligence, Product Analysis, Retail Know-how

Founders: Cem Kent

Founding yr: 2021

Complete fairness funding raised: $20.0M

6. Medallion $21.5M

Spherical: Seed

Description: Medallion develops a blockchain-based platform to attach artists and their followers. Based by Naman Gupta, Kavitha Gnanasambandan,Nima Roohi Sefidmazgi in 2020, Medallion has now raised a complete of $30.5M in complete fairness funding and is backed by Betaworks, Polygon, Shima Capital, Coil, and POAP.

Buyers within the spherical:

Trade: Blockchain, Media and Leisure, Music

Founders: Naman Gupta, Kavitha Gnanasambandan,Nima Roohi Sefidmazgi

Founding yr: 2020

Complete fairness funding raised: $30.5M

5. Arduino $22.0M

Spherical: Sequence B

Description: Arduino is an open-source digital prototyping platform permitting customers to create interactive digital objects. Based by David Cuartielles, David Mellis, Gianluca Martino, Massimo Banzi, and Tom Igoe in 2005, Arduino has now raised a complete of $54.0M in complete fairness funding and is backed by Arm Holdings, CDP Enterprise Capital, Anzu Companions, Bosch Ventures, and Renesas Electronics Company.

Buyers within the spherical: Anzu Companions, CDP Enterprise Capital

Trade: {Hardware}, Human Pc Interplay, Product Design, Software program

Founders: David Cuartielles, David Mellis, Gianluca Martino, Massimo Banzi, Tom Igoe

Founding yr: 2005

Complete fairness funding raised: $54.0M

Now you is perhaps considering: “what the heck are you speaking about?” However preserve studying, as a result of this funding platform’s customers are already smiling all the best way to the financial institution. Because of Masterworks, the award-winning platform for investing in blue-chip artwork.

Each single certainly one of Masterworks’ 15 gross sales has returned a revenue to buyers, for a 100% constructive internet return observe report. With 3 latest gross sales, Masterworks buyers realized internet annualized returns of 17.6%, 21.5% and 35%.

How does it work? Easy, Masterworks does the entire heavy lifting like discovering the portray, shopping for it, storing it, and finally promoting it. It information every providing with the SEC so that almost anybody can spend money on extremely coveted artworks for only a fraction of the worth of the whole piece.

Shares of each providing are restricted, however AlleyWatch readers can skip the waitlist to hitch with this unique hyperlink.

See essential disclosures at masterworks.com/cd

4. Gem $23.0M

Spherical: Sequence A

Description: Gem mission is to assist safety operations evolve into the cloud period, and cease cloud threats earlier than they turn out to be incidents. Based by Ofir Brukner, Ron Konigsberg, and Arie Zilberstein in 2019, Gem has now raised a complete of $34.0M in complete fairness funding and is backed by Team8, GGV Capital, IBM Ventures, and Silicon Valley CISO Investments.

Buyers within the spherical: GGV Capital, IBM Ventures, Silicon Valley CISO Investments, Team8

Trade: Community Safety

Founders: Ofir Brukner, Ron Konigsberg, Arie Zilberstein

Founding yr: 2019

Complete fairness funding raised: $34.0M

3. Farther Finance $31.0M

Spherical: Sequence B

Description: Farther Finance is a developer of an funding advisory platform used to offer fashionable know-how with trusted recommendation. Based by Brad Genser and Taylor Matthews in 2019, Farther Finance has now raised a complete of $46.0M in complete fairness funding and is backed by MassChallenge, Khosla Ventures, MassMutual Ventures, Lightspeed Enterprise Companions, and Cota Capital.

Buyers within the spherical: Bessemer Enterprise Companions, Cota Capital, Khosla Ventures, Lightspeed Enterprise Companions, MassMutual Ventures, Moneta VC

Trade: Finance, Monetary Providers, FinTech, Influence Investing, Wealth Administration

Founders: Brad Genser, Taylor Matthews

Founding yr: 2019

Complete fairness funding raised: $46.0M

2. Transfr $40.0M

Spherical: Sequence C

Description: Transfr based on the idea that studying is about enhancing the human expertise. Based by Bharani Rajakumar in 2017, Transfr has now raised a complete of $87.0M in complete fairness funding and is backed by Creativeness Capital, JPMorgan Chase & Co., Social Begins, Akkadian Ventures, and Album VC.

Buyers within the spherical: ABS Capital Companions, Akkadian Ventures, Album VC, Firework Ventures, JPMorgan Chase & Co., Lumos Capital Group, Spring Tide Capital

Trade: Training, Simulation, Coaching, Digital Actuality

Founders: Bharani Rajakumar

Founding yr: 2017

Complete fairness funding raised: $87.0M

2. OneChronos $40.0M

Spherical: Sequence B

Description: OneChronos is a Good Market, which is a technical identify for marketplaces that use mathematical optimization to match counterparties. Based by Kelly Littlepage and Stephen Johnson in 2015, OneChronos has now raised a complete of $49.3M in complete fairness funding and is backed by Y Combinator, BoxGroup, DCVC, Addition, and Amino Capital.

Buyers within the spherical: Addition

Trade: Finance, Monetary Providers, FinTech

Founders: Kelly Littlepage, Stephen Johnson

Founding yr: 2015

Complete fairness funding raised: $49.3M

Now you is perhaps considering: “what the heck are you speaking about?” However preserve studying, as a result of this funding platform’s customers are already smiling all the best way to the financial institution. Because of Masterworks, the award-winning platform for investing in blue-chip artwork.

Each single certainly one of Masterworks’ 15 gross sales has returned a revenue to buyers, for a 100% constructive internet return observe report. With 3 latest gross sales, Masterworks buyers realized internet annualized returns of 17.6%, 21.5% and 35%.

How does it work? Easy, Masterworks does the entire heavy lifting like discovering the portray, shopping for it, storing it, and finally promoting it. It information every providing with the SEC so that almost anybody can spend money on extremely coveted artworks for only a fraction of the worth of the whole piece.

Shares of each providing are restricted, however AlleyWatch readers can skip the waitlist to hitch with this unique hyperlink.

See essential disclosures at masterworks.com/cd

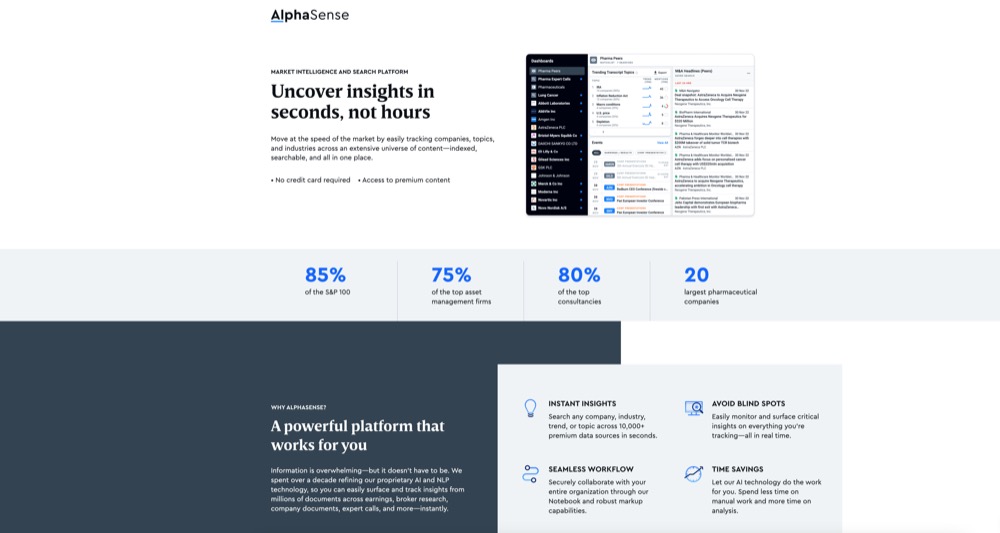

1. AlphaSense $150.0M

Spherical: Sequence E

Description: AlphaSense is a intelligence platform that makes use of synthetic intelligence permitting professionals to make vital selections. Based by Jack Kokko in 2008, AlphaSense has now raised a complete of $740.0M in complete fairness funding and is backed by Citi, BlackRock, Morgan Stanley, Financial institution of America, and Goldman Sachs Asset Administration.

Buyers within the spherical: Bond, CapitalG, Goldman Sachs Asset Administration, Viking International Buyers

Trade: Analytics, Synthetic Intelligence, Machine Studying, SaaS, Search Engine

Founders: Jack Kokko

Founding yr: 2008

Complete fairness funding raised: $740.0M

Now you is perhaps considering: “what the heck are you speaking about?” However preserve studying, as a result of this funding platform’s customers are already smiling all the best way to the financial institution. Because of Masterworks, the award-winning platform for investing in blue-chip artwork.

Each single certainly one of Masterworks’ 15 gross sales has returned a revenue to buyers, for a 100% constructive internet return observe report. With 3 latest gross sales, Masterworks buyers realized internet annualized returns of 17.6%, 21.5% and 35%.

How does it work? Easy, Masterworks does the entire heavy lifting like discovering the portray, shopping for it, storing it, and finally promoting it. It information every providing with the SEC so that almost anybody can spend money on extremely coveted artworks for only a fraction of the worth of the whole piece.

Shares of each providing are restricted, however AlleyWatch readers can skip the waitlist to hitch with this unique hyperlink.

See essential disclosures at masterworks.com/cd

[ad_2]

Source link