[ad_1]

- Nike inventory surged larger after the Oregon-based big beat earnings expectation subsequent week

- But, regardless of the optimistic figures, the US retail trade is more likely to face important headwinds over the ultimate quarter of the 12 months

- Let’s take a deep dive into the behemoth’s fundamentals with InvestingPro to evaluate whether or not this can be a good second to purchase the inventory

Nike (NYSE:) shares surged roughly 7% to $95.62 final week after the corporate better-than-expected earnings per share (EPS) and enhancing gross margins in its earnings report. Though the inventory retreated within the final market session to $94.56, it stays up by 6% because the report.

The sporting-apparel big posted a EPS of $0.94, beating InvestingPro expectations by 24%. Nevertheless, the corporate’s income was barely under expectations at $12.93 billion. Nonetheless, the market usually priced Nike’s final quarter report positively.

Furthermore, regardless that the corporate’s income got here in under expectations, there is a rise in income on an annual foundation in comparison with the leads to the identical interval final 12 months. As seen within the chart, the corporate’s income continues to take care of its upward pattern.

Supply: InvestingPro

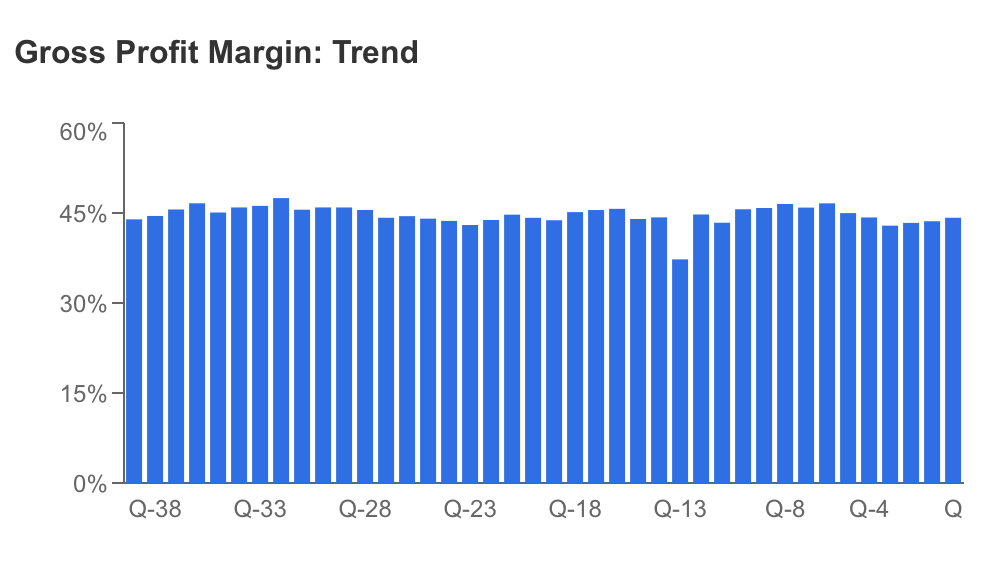

By retaining the price of items bought on this area at $7 billion, the corporate managed to partially enhance its gross revenue, resulting in a restoration of the gross revenue margin to 44%, as noticed in the identical interval final 12 months.

Supply: InvestingPro

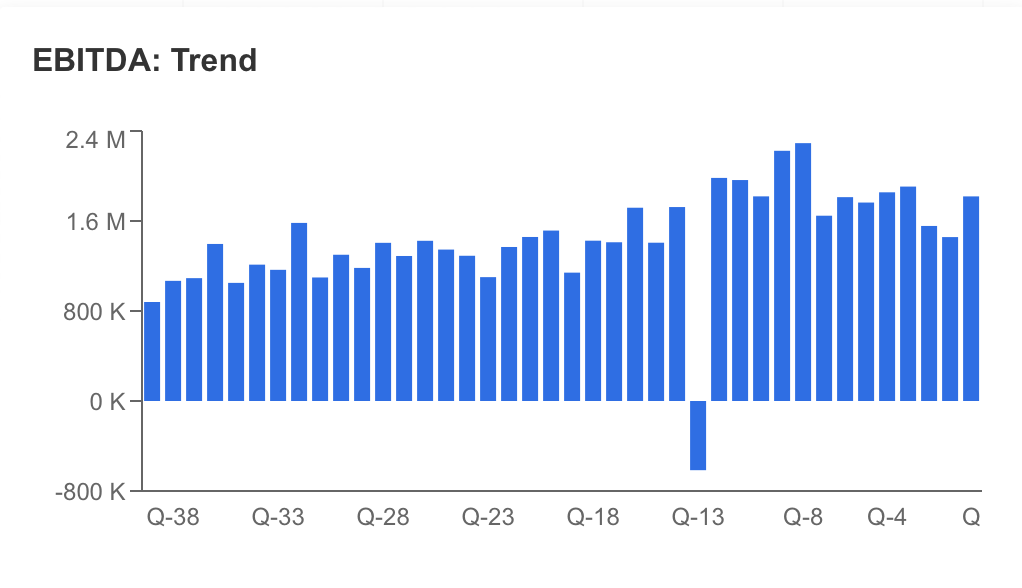

Based on the Q3 outcomes, the sportswear behemoth’s EBITDA improved in comparison with the final two quarters, however remained under the EBITDA of $1.9 billion in the identical interval of final 12 months with 1.8 billion {dollars}. Nonetheless, the bounce in EBITDA, coupled with the corporate’s optimistic outlook for the longer term, creates an expectation that the development in revenue margin will proceed.

Supply: InvestingPro

Macro Headwinds

Regardless of the optimistic operational figures, the macroeconomic image does not look as shiny for the Oregon-based firm.

Nike, which operates within the retail sector, is seen as one of many corporations that could be uncovered to the considerations of slowdown in consumption throughout the framework of the tightening coverage within the US financial system. Nevertheless, firm officers’ optimistic outlook for the longer term and quarterly outcomes don’t but mirror a unfavourable affect. Furthermore, the US information displays that financial vitality is being maintained, additional suspending recession considerations. Once more, the sportswear firm faces two challenges, certainly one of which is international.

Based on the most recent information, Nike’s US gross sales fell by 2% and its general gross sales figures fell under forecasts for the primary time in two years. Executives, nevertheless, do not see this as an issue and anticipate gross sales to select up throughout the vacation season as customers stay resilient. Nike has the benefit of being a number one international model that’s amongst customers’ first decisions.

The resumption of scholar mortgage funds within the US this month is one other essential issue that will curtail consumption. Whereas many retail manufacturers stated that this case may negatively have an effect on gross sales, Nike didn’t dwell on this unfavourable scenario in its statements after the earnings report.

One other scenario that might hinder Nike’s abroad gross sales is the slowdown in China. China, the corporate’s largest abroad market, has the potential to be a unfavourable for Nike’s financials in an surroundings of declining shopper demand and rising competitors. Nike executives, however, suppose they will overcome this strain by expressing their confidence within the improve in exercise in China after the pandemic.

Greatest-In-breed?

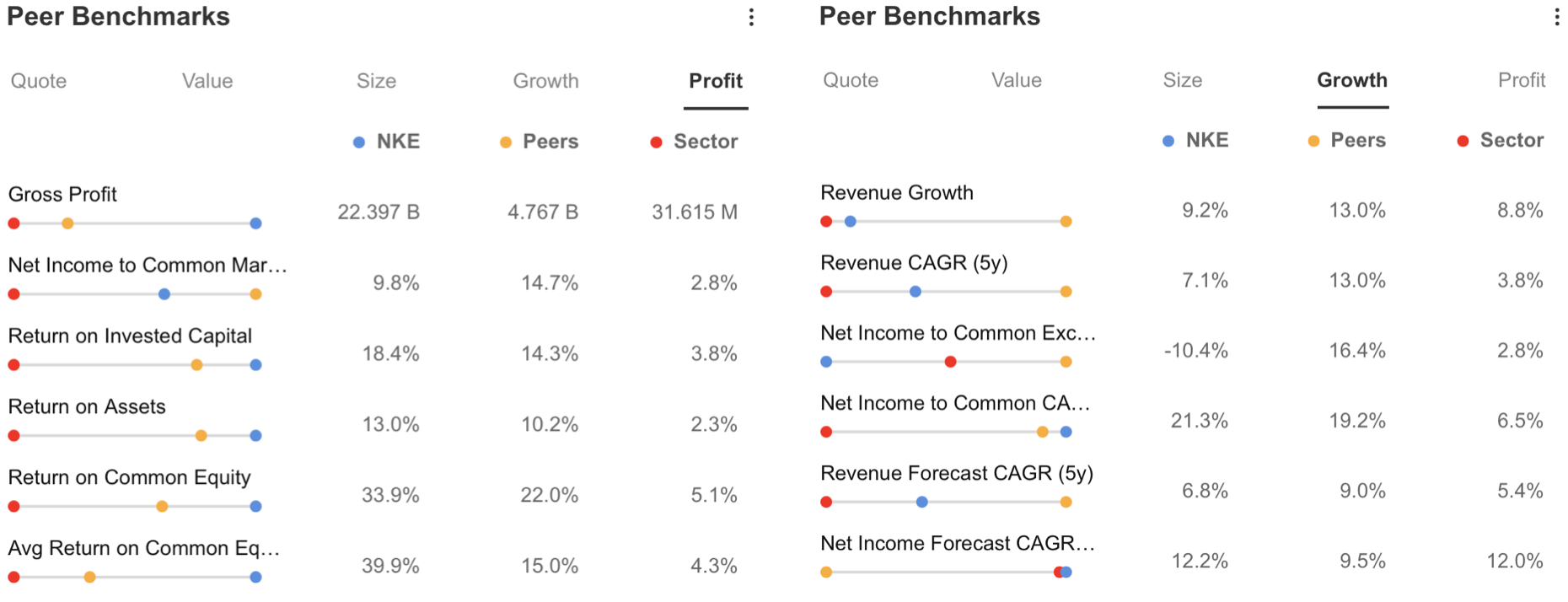

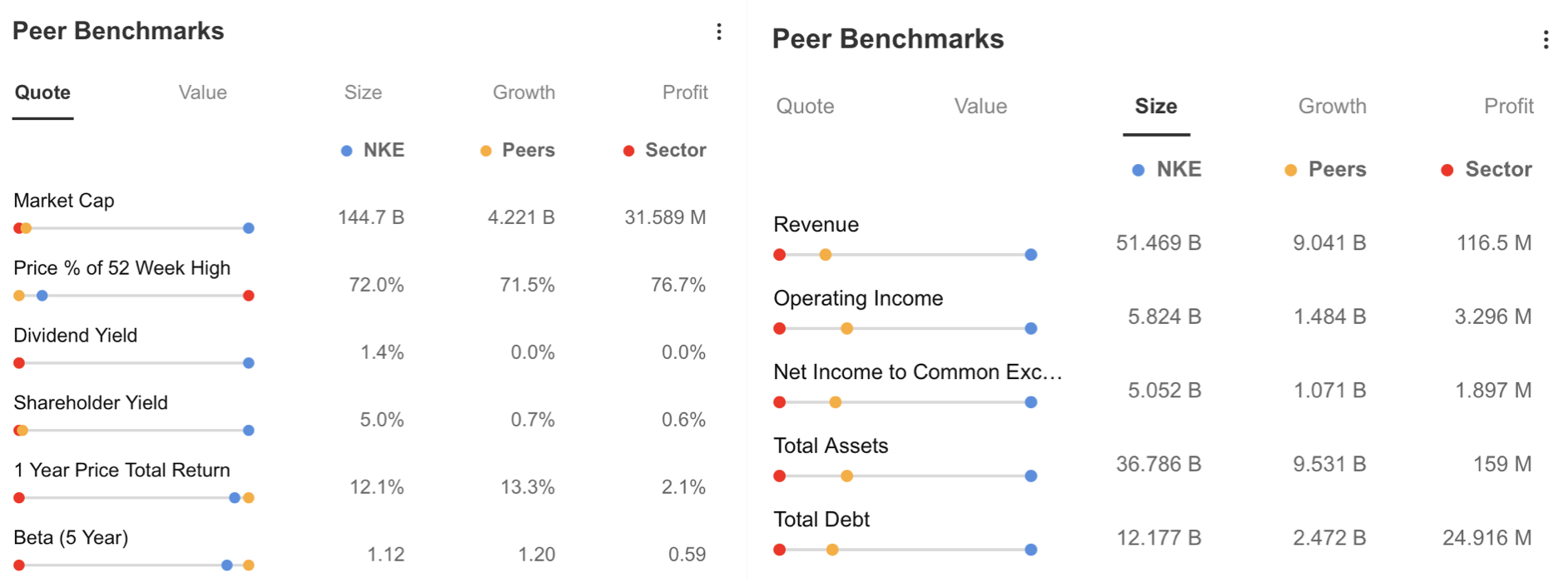

After we evaluate Nike with friends and the trade via InvestingPro, we will see that the corporate is forward of the trade and friends when it comes to profitability, whereas it lags behind friends when it comes to progress objects.

Supply: InvestingPro

Contemplating the scale of the corporate in comparison with its friends and the trade common, it’s explainable that it stays extra sluggish when it comes to progress. Amongst different noteworthy objects, the corporate’s common dividend funds, in contrast to its friends, might be seen as a distinguished issue. Nevertheless, shareholder return averages 5% every year, which is sort of good in comparison with the 0.7% common of friends.

However, NKE’s 5-year beta of 1.12 is under the peer common of 1.2. This will enable the inventory to maneuver extra according to market situations and be included within the portfolio as a defensive investor software.

Supply: InvestingPro

Valuation

After we summarize the corporate valuation by way of InvestingPro, we will see that the optimistic options of the sportswear big proceed to outweigh. Accordingly;

- Providing a excessive return on funding

- Elevating the dividend for 21 consecutive years

- Continuation of the inventory with low volatility

- Having a major market share in its sector

- Money move is at a degree to cowl curiosity expense

Conversely, the declining pattern in EPS, analysts’ downward revisions of earnings expectations for the upcoming interval, and the elevated EBITDA valuation ratio are considered as potential drawbacks for the corporate.

Nike is scheduled to launch its subsequent earnings report on December 21. A complete of 15 analysts have adjusted their earnings expectations downward, projecting an EPS of $0.84 for the upcoming interval, reflecting an anticipated 5% decline. Moreover, the income forecast at the moment sits at $13.41 billion, exhibiting a marginal 0.12% lower.

Supply: InvestingPro

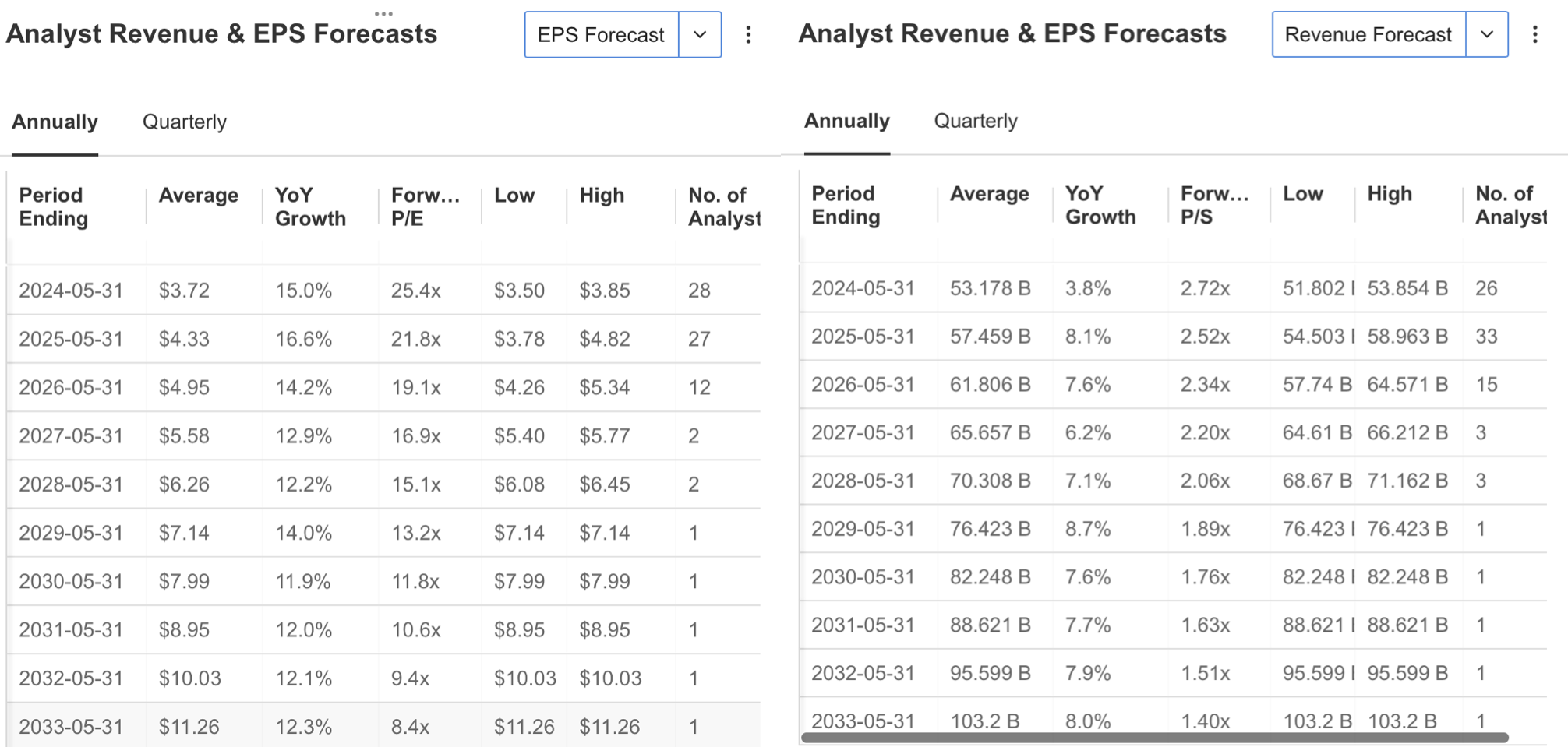

Regardless of bearish forecasts for the final quarter of the 12 months, longer-term forecasts stay optimistic for EPS and earnings.

Supply: InvestingPro

Worth Goal

The truthful worth evaluation of NKE inventory suggests a possible improve to $104, reflecting a ten% progress projection throughout the coming 12 months. Furthermore, contemplating information from 15 monetary fashions, the annual goal from 32 analyses yields a better common valuation of $123. These forecasts collectively point out that NKE is at the moment buying and selling at a reduction in comparison with its current value of $94.5.

On the technical chart, NKE concluded its restoration section at $128 within the remaining quarter of the earlier 12 months. All through the primary half of 2023, it maintained a comparatively steady vary, fluctuating between $118 and $127 till Could.

Subsequently, a downward pattern emerged, main the inventory to drop to $88, leading to an annual lack of 28%. Following the correction that adopted the prior 12 months’s restoration, patrons efficiently upheld this assist degree, largely influenced by the most recent earnings report.

To proceed its restoration within the upcoming interval, the inventory wants to determine itself above the $100 threshold. Past that, there exists a resistance zone spanning from $105 to $111. Nonetheless, so long as the $92 assist zone holds, NKE is poised for potential upward strikes, with additional features presumably reaching as much as the $120 vary.

Constructive indicators for a technical ascent might be gleaned from the Stochastic RSI, which has reversed upwards on the weekly chart, together with the notable response of the inventory value on the Fib 0.786 assist degree.

Nevertheless, if weekly closures dip under $92, it may set off a brand new backside forming under final 12 months’s low of $82.

***

InvestingPro has all of the instruments that can assist you revenue out of your investments, together with inventory market information, truthful worth, well being standing {and professional} charts. Click on right here to affix now!

Signal Up for a Free Week Now!

Disclaimer: The creator doesn’t personal any shares talked about on this report. This content material is solely for instructional functions and can’t be thought-about as funding recommendation.

[ad_2]

Source link