bjdlzx

Southwestern Vitality (NYSE:SWN) reported a comparatively lackluster quarter for q3’23 on account of the difficult pure fuel pricing backdrop. As mentioned in earlier earnings calls, administration is proactively curbing manufacturing by the gentle pure fuel market in anticipation of an upswing in fuel costs. I consider by their capital self-discipline, administration of their manufacturing volumes, and useful resource growth within the Haynesville/Bossier Basin in anticipation of rising export capability within the US Gulf of Mexico, Southwestern could have the bandwidth to react to the extra export capability with the opening of Golden Move on the finish of 2024. Given the present state of the fuel market, I present SWN a HOLD advice with a near-term value goal of $6.32/share.

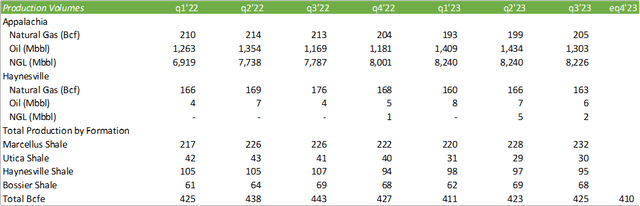

Operations

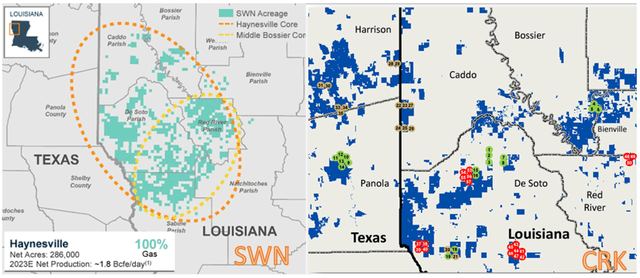

I’m long-term bullish on Southwestern Vitality given their asset publicity within the Haynesville/Bossier Basin. Regardless of the upper D&C prices related to the basin when in comparison with the Appalachia area, I consider Southwestern ought to be capable of seize value financial savings in midstream and transportation charges because the basin is additional developed to be utilized to fill export capability within the Gulf of Mexico as LNG demand stays strong. Administration additionally anticipates their drilling efficiencies to chop prices by 5% within the Appalachia area and 15% within the Haynesville Basin. Accordingly, the whole rig depend within the Haynesville/Bossier basin has fallen by 40% YTD on account of the difficult pure fuel market.

Past diminished exercise and the slowdown in provide progress that means LNG exports are up over 2 Bcf per day year-over-year, not too long ago exceeding 14 Bcf per day, whereas weather-adjusted energy demand is up 2 Bcf a day, and exports to Mexico are up virtually 1 Bcf a day. These components have helped to considerably dampen the end-of-season storage surplus with new LNG in service dates starting subsequent yr. By the tip of ’24, we anticipate LNG exports to develop to 16 Bcf per day, over 90% of which is situated alongside the Texas and Louisiana Gulf Coast.

Invoice Approach

Based on the EIA, there are at present 5 LNG export tasks which are at present below development with a mixed export capability of 9.7Bcf/d of LNG. These amenities embrace Golden Move, Plaquemines, Corpus Christi Stage III, Rio Grande, and Port Arthur. Each Golden Move LNG and Plaquemines LNG are anticipated to start operations in 2024.

On account of the softer fuel market, administration has shifted operations to extra liquids-rich property to derisk money flows. Looking forward to 2024, administration discerned that they are going to be reducing again on manufacturing within the first half of the yr with an upswing in manufacturing within the latter half.

Company Reviews

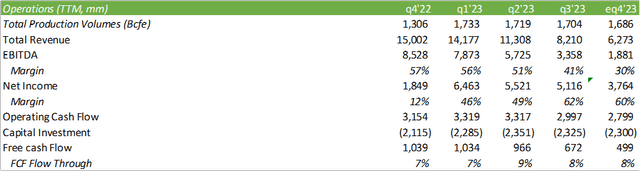

This goes together with the macro narrative for brand spanking new LNG capability coming on-line within the again half of 2024. Administration expects to make $2-2.3b in capital investments all through 2024 with the primary half of the yr being extra closely weighted in anticipation of the upswing.

Company Reviews

Total, I anticipate a gentle this fall’23 because the fuel market continues to stay suppressed. Regardless of Southwestern’s strong 40-60% fuel hedging outlay, the inventory tends to maneuver directionally with pure fuel costs.

TradingView

Debt Discount

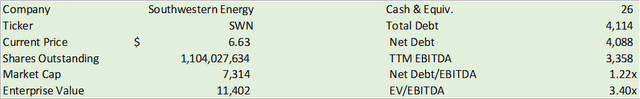

Given the difficult fuel market, administration made the choice to extend their debt load and draw from their revolver, ending the quarter with a complete debt load of $4.1b for a leverage ratio of 1.6x TTM EBITDA. Because the agency curtails manufacturing given the gentle strip pricing, administration stays targeted on producing free money circulation and lowering debt in direction of the highest finish of their vary to $3.5b, lowering leverage to their goal vary of 1-1.5x trailing EBITDA.

Shareholder Worth

Company Reviews

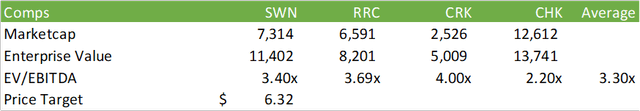

Southwestern is at present buying and selling at 3.40x trailing EV/EBITDA, barely increased than its peer cohort of fuel producers. I present SWN shares a HOLD advice based mostly on the peer common 3.30x EV/EBITDA for a value goal of $6.32/share.

Company Reviews

It’s value noting that administration hasn’t but articulated any M&A exercise however has hinted that strategic consolidation is within the playing cards. I had beforehand discerned my ideas in an article masking the Reuters report hinting at a Chesapeake Vitality (CHK) and Southwestern merger. Although names are usually not but named, there nonetheless stays the potential of a merger between the 2 corporations or different corporations within the sector. My expectation for a merger or acquisition could be with a agency that can bolster Southwestern’s Haynesville/Bossier property, like Comstock (CRK) or a personal producer.

Company Reviews

Administration discerned some further shareholder advantages to bolster their fairness worth, whether or not within the type of reinstating the buyback program or initiating a base dividend.

I feel as we stated all alongside, we would most likely proceed, reinitiate, if you’ll, share buyback, given what we consider our worth is relative to our intrinsic worth or no less than our share costs to that… If we are able to sustainably generate free money circulation and we consider we’ll be capable of, notably with decrease debt, the way in which you sort of show that, put in some kind of base dividend. So that may be one thing that we actually would take into account.

Carl Giesler