[ad_1]

Printed on March seventeenth, 2023 by Aristofanis Papadatos

SmartCentres Actual Property Funding Belief (CWYUF) has three interesting funding traits:

#1: It’s a REIT so it has a good tax construction and pays out the vast majority of its earnings as dividends.

Associated: Record of publicly traded REITs

#2: It’s a high-yield inventory based mostly on its 7.3% dividend yield.

Associated: Record of 5%+ yielding shares

#3: It pays dividends month-to-month as a substitute of quarterly.

Associated: Record of month-to-month dividend shares

There are at the moment simply 86 month-to-month dividend shares. You possibly can obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter, like dividend yield and payout ratio) by clicking on the hyperlink beneath:

SmartCentres Actual Property Funding Belief’s trifecta of favorable tax standing as a REIT, a excessive dividend yield, and a month-to-month dividend make it interesting to particular person buyers.

However there’s extra to the corporate than simply these components. Maintain studying this text to study extra about SmartCentres Actual Property Funding Belief.

Enterprise Overview

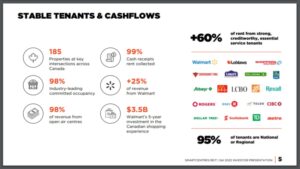

SmartCentres Actual Property Funding Belief is without doubt one of the largest totally built-in REITs in Canada, with a best-in-class portfolio that consists of 185 strategically positioned properties in each province throughout the nation. SmartCentres REIT has $7.5 billion in property and owns 34 million sq. ft of revenue producing value-oriented retail house with 98% occupancy, on 3500 acres of owned land throughout Canada.

Supply: Investor Presentation

SmartCentres REIT faces a secular headwind, specifically the shift of customers from conventional buying to on-line purchases. This development has remarkably accelerated because the onset of the coronavirus disaster. Many retail REITs have been damage by this secular shift.

Nonetheless, SmartCentres REIT enjoys a key aggressive benefit, specifically the robust monetary place of its tenants. The REIT generates greater than 25% of its revenues from Walmart and greater than 60% of its revenues from financially robust tenants, which supply important providers. This can be a main aggressive benefit, because it renders the money flows of the REIT dependable and renders the REIT resilient to financial downturns.

Due to its robust enterprise mannequin, SmartCentres REIT has proved markedly resilient all through the coronavirus disaster, in sharp distinction to many different REITs. The belief posted basically flat adjusted funds from operations (FFO) per unit in 2020 and grew its backside line by 4% in 2021 whereas it additionally stored elevating its dividend, albeit at a gradual tempo.

Furthermore, SmartCentres REIT at the moment enjoys constructive enterprise momentum. Within the fourth quarter of 2022, the belief grew its internet rental revenue by 2% and its FFO per unit by 7% over the prior yr’s quarter. Elevated rental revenue was greater than offset by elevated curiosity expense however the REIT grew its backside line because of a lower in its working bills.

Development Prospects

SmartCentres REIT can boast of getting a defensive enterprise mannequin because of the excessive credit score profile of its tenants. However, the REIT has did not develop its FFO per unit during the last decade, as its backside line has remained basically flat over this era.

You will need to notice that the lackluster efficiency document has resulted primarily from the strengthening of the USD vs. CAD. Because the Canadian greenback has depreciated by about 30% during the last decade, it’s apparent that SmartCentres REIT has grown its FFO per unit by about 2.7% per yr on common in its native foreign money during the last decade.

Furthermore, SmartCentres REIT at the moment has 274 particular person development initiatives in place.

Supply: Investor Presentation

Extra exactly, SmartCentres REIT has 179 initiatives which are associated to recurring revenue and 95 initiatives which are associated to intensification of present properties. Due to this fact, the long run seems to be brighter than the previous decade for the REIT.

However, central banks are elevating rates of interest aggressively so as to cool the financial system and thus restore inflation to its regular vary. Greater rates of interest are prone to considerably enhance the curiosity expense of SmartCentres REIT. This is a crucial headwind to think about going ahead.

Given the promising development prospects of SmartCentres REIT but additionally its lackluster efficiency document, its foreign money danger and the headwind from rising rates of interest, we count on the REIT to develop its FFO per unit by about 2.0% per yr on common over the following 5 years.

Dividend & Valuation Evaluation

SmartCentres REIT is at the moment providing an above-average dividend yield of seven.3%. It’s thus an attention-grabbing candidate for income-oriented buyers however the latter must be conscious that the dividend could fluctuate considerably over time as a result of gyrations of the trade charges between the Canadian greenback and the USD.

Furthermore, the REIT has an elevated payout ratio of 90%, which drastically reduces the margin of security of the dividend. On the intense aspect, because of its defensive enterprise mannequin and its robust curiosity protection ratio of 4.7, the belief is just not prone to reduce its dividend within the absence of a extreme recession. Nonetheless, buyers shouldn’t count on significant dividend development going ahead and must be conscious that the dividend could also be reduce within the occasion of an unexpected downturn, reminiscent of a deep recession.

We additionally notice that SmartCentres REIT has a fabric debt load on its steadiness sheet. Its internet debt is at the moment standing at $4.0 billion, which is 121% of the inventory’s market capitalization. The excessive payout ratio and the fabric debt load of the REIT considerably cut back its resilience to a possible future recession.

In reference to the valuation, SmartCentres REIT is at the moment buying and selling for 12.4 instances its FFO per unit within the final 12 months. Given the fabric debt load of the REIT, we assume a good price-to-FFO ratio of 12.0 for the inventory. Due to this fact, the present FFO a number of is barely increased than our assumed honest price-to-FFO ratio. If the inventory trades at its honest valuation stage in 5 years, it should incur a -0.7% annualized drag in its returns.

Bearing in mind the two% annual FFO-per-unit development, the 7.3% dividend, and a -0.7% annualized contraction of valuation stage, SmartCentres REIT might provide a 7.8% common annual complete return over the following 5 years. This can be a respectable anticipated return, although we advocate ready for a greater entry level so as to improve the margin of security in addition to the anticipated return. Furthermore, the inventory is appropriate just for buyers who’re comfy with the chance that comes from the excessive payout ratio and the fabric debt load of the belief.

Ultimate Ideas

SmartCentres REIT can generate most of its revenues from firms with rock-solid steadiness sheets. It thus enjoys way more dependable revenues than most REITs. This is a crucial aggressive benefit, particularly throughout financial downturns.

Regardless of its excessive payout ratio of 90%, the inventory provides an exceptionally excessive dividend yield of seven.3% and therefore it’s a sexy candidate for the portfolios of income-oriented buyers.

However, buyers ought to pay attention to the chance that outcomes from the considerably weak steadiness sheet of the REIT. If excessive inflation persists for for much longer than at the moment anticipated, high-interest charges will drastically burden the REIT. Due to this fact, solely the buyers who’re assured that inflation will quickly revert to regular ranges ought to think about buying this inventory.

Furthermore, SmartCentres REIT is characterised by extraordinarily low buying and selling quantity. Because of this it’s exhausting to determine or promote a big place on this inventory.

If you’re occupied with discovering extra high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases will likely be helpful:

The most important home inventory market indices are one other stable useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link