[ad_1]

Revealed on March seventeenth, 2023 by Aristofanis Papadatos

Canadian Condominium Properties Actual Property Funding Belief (CDPYF) has three interesting funding traits:

#1: It’s a REIT so it has a good tax construction and pays out the vast majority of its earnings as dividends.

Associated: Record of publicly traded REITs

#2: It’s providing a 3.2% dividend yield, which is double the 1.6% yield of the S&P 500.

#3: It pays dividends month-to-month as a substitute of quarterly.

Associated: Record of month-to-month dividend shares

There are at present simply 86 month-to-month dividend shares. You may obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter, like dividend yield and payout ratio) by clicking on the hyperlink under:

Canadian Condominium Properties Actual Property Funding Belief’s trifecta of favorable tax standing as a REIT, an above-average dividend yield, and a month-to-month dividend make it interesting to particular person traders.

However there’s extra to the corporate than simply these elements. Hold studying this text to be taught extra about Canadian Condominium Properties Actual Property Funding Belief.

Enterprise Overview

Canadian Condominium Properties Actual Property Funding Belief is a growth-oriented funding belief that owns freehold pursuits in multi-unit residential properties, together with condominium buildings, townhouses, and land lease communities situated in or close to main city facilities throughout Canada.

The goals of the REIT are to offer shareholders with long-term, steady, and predictable month-to-month money distributions whereas rising distributable earnings and shareholder worth via energetic administration of its properties, accretive acquisitions, and robust monetary administration.

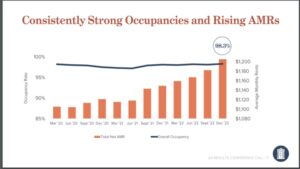

Canadian Condominium Properties REIT has exhibited persistently excessive occupancy charges and rising common month-to-month rents over the past three years.

Supply: Investor Presentation

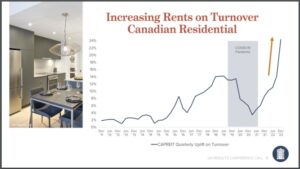

Lease progress decelerated sharply through the core of the coronavirus disaster, however it’s recovering strongly now because the pandemic has subsided.

Supply: Investor Presentation

Canadian Condominium Properties REIT enjoys respectable enterprise momentum proper now. Due to its restoration from the pandemic within the fourth quarter, the REIT grew its same-property web working earnings by 5.0% over the prior yr’s quarter and its funds from operations (FFO) per unit by 1.4%. Within the full yr, adjusted FFO per unit dipped 6%, from $1.79 to $1.69, however principally as a result of a non-recurring goodwill impairment.

Development Prospects

Canadian Condominium Properties REIT goals to develop by buying enticing new-built properties. The REIT invested $1.05 billion in 3,744 suites/websites in 2021 and one other $646 million in 1,537 suites/websites in 2022.

Furthermore, Canadian Condominium Properties REIT is operating a capital recycling program. It sells previous properties that not match to the core enterprise of the REIT and makes use of the proceeds to spend money on high-return properties and repay debt.

The REIT has grown its common FFO per unit by 2.0% per yr over the past decade. It has promising progress prospects forward, however we word that there’s restricted progress potential from the facet of occupancy, which at present exceeds 98%. As well as, the belief might be damage by fast-rising rates of interest, that are more likely to enhance curiosity bills considerably within the upcoming quarters. General, we anticipate Canadian Condominium Properties REIT to develop its FFO per unit by about 2.0% per yr on common over the subsequent 5 years, consistent with its historic progress fee.

Dividend & Valuation Evaluation

Canadian Condominium Properties REIT is at present providing a 3.2% dividend yield, which is double the 1.6% yield of the S&P 500. The REIT is thus an fascinating candidate for income-oriented traders however the latter must be conscious that the dividend might fluctuate considerably over time because of the gyrations of the trade fee between the Canadian greenback and the USD. Due to its strong enterprise mannequin, an honest payout ratio of 65%, and a wholesome curiosity protection ratio of three.7, the belief just isn’t more likely to lower its dividend within the absence of a extreme recession.

Notably, Canadian Condominium Properties REIT has maintained a stronger steadiness sheet than most REITs with a purpose to have the adequate monetary energy to endure a possible recession. We reward administration for sustaining an honest steadiness sheet, with web debt of $5.7 billion, which is marginally lower than the present market capitalization of the inventory.

Then again, because of the aggressive rate of interest hikes carried out by central banks in response to excessive inflation, curiosity expense is more likely to rise considerably within the upcoming years. This can be a headwind for the overwhelming majority of REITs, together with Canadian Condominium Properties REIT. If excessive inflation persists for for much longer than at present anticipated, high-interest charges will most likely take their toll on the underside line of Canadian Condominium Properties REIT.

In reference to the valuation, Canadian Condominium Properties REIT is at present buying and selling for 20.1 instances its FFO per unit within the final 12 months. This can be a markedly excessive FFO a number of, particularly within the present investing surroundings, through which the valuation of most shares has been compressed as a result of excessive inflation. Excessive inflation reduces the current worth of future money flows and thus compresses REITs’ price-to-FFO ratios.

We assume a good price-to-FFO ratio of 15.0 for the inventory. Due to this fact, the present FFO a number of is increased than our assumed honest price-to-FFO ratio. If the inventory trades at its honest valuation degree in 5 years, it’ll incur a -5.7% annualized drag in its returns.

Making an allowance for the two% annual FFO-per-unit progress, the three.2% dividend, and a -5.7% annualized contraction of valuation degree, Canadian Condominium Properties REIT might provide only a -0.2% common annual whole return over the subsequent 5 years. Thus, the REIT is richly valued proper now, and therefore traders ought to look ahead to a significant correction of the inventory.

Ultimate Ideas

Canadian Condominium Properties REIT at present enjoys a robust restoration from the coronavirus disaster. Because the inventory is providing a 3.2% dividend yield and has respectable progress prospects forward, it’s a gorgeous candidate for the portfolios of income-oriented traders.

Nevertheless, the market appears to have already appreciated the virtues of this REIT. Consequently, the inventory appears absolutely valued proper now.

Furthermore, Canadian Condominium Properties REIT is characterised by exceptionally low buying and selling quantity. Which means that it’s exhausting to determine or promote a big place on this inventory.

In case you are inquisitive about discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases might be helpful:

The main home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link