[ad_1]

- Meta Platforms reported excellent earnings

- The inventory has continued its cost upward ever since

- That raises the query, can the social media large proceed to report nice numbers that maintain the inventory’s rally?

Meta Platforms (NASDAQ:) has not too long ago unveiled spectacular for the second quarter of 2023. The longer term appears to be like vivid as operations and product choices show super progress potential, additional solidifying the optimistic outlook.

Throughout Q2, Meta achieved a outstanding web revenue of $7.8 billion, showcasing a considerable 16.4% improve in comparison with the earlier 12 months. However that is not all – its earnings per share additionally surpassed InvestingPro’s expectations by 3.2%, coming in at $2.98.

And that is only the start, as Meta’s income skilled important progress, hovering to $32 billion, a powerful 11% year-on-year improve, surpassing InvestingPro’s projections by 3%.

Let’s delve deep into the small print of the social media large’s excellent Q2 2023 efficiency and uncover the elements propelling it on an upward trajectory.

Supply: InvestingPro

Following the discharge of its spectacular monetary outcomes, Meta’s inventory skilled a rally, closing the day at $311 with a considerable acquire of practically 6%. At its peak, the inventory reached $325 after the report.

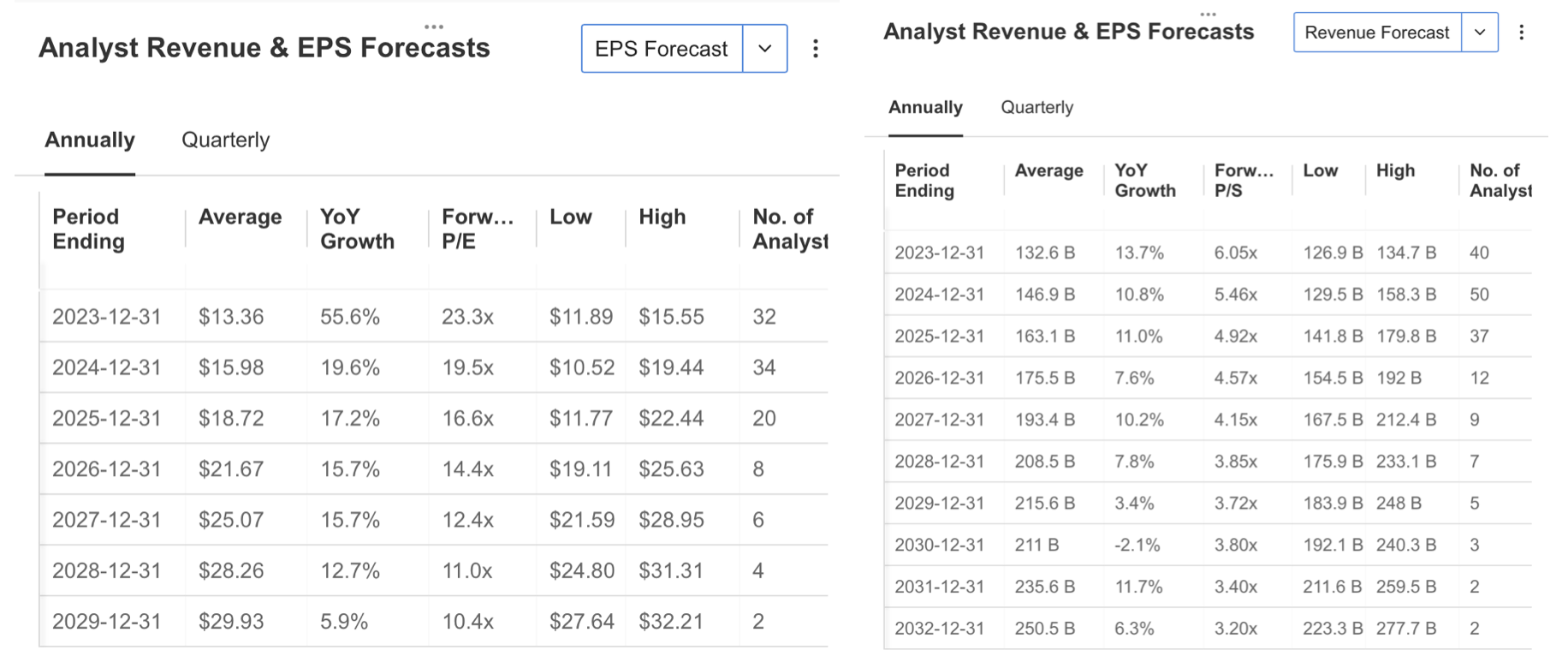

Wanting forward, analysts are optimistic about Meta’s prospects, as forecasts counsel that the corporate will proceed to attain progress in earnings per share and income all through the rest of the 12 months.

Supply: InvestingPro

By the top of the 12 months, the corporate is forecasted to attain earnings per share of $13.36, a 55.6% improve, and income of $132.5 billion, a 13.7% improve, as per analyst estimates.

Supply: InvestingPro

Within the Q3 evaluation, 22 analysts revised their views upwards, indicating optimistic expectations for the corporate’s efficiency. In consequence, Meta’s earnings per share (EPS) for the following quarter is estimated to be $3.56, and its quarterly income is projected to achieve $33.3 billion.

Meta Earnings Highlights

Over the past quarter, Meta demonstrated robust financials, with an 11% year-on-year improve in income, primarily pushed by a outstanding 12% progress in promoting gross sales. Notably, advertising and marketing expenditures, which had dipped throughout the pandemic, surged once more this quarter, with advert impressions rising by greater than 30%.

Meta’s strategic restructuring efforts, which concerned shedding round 21,000 staff and implementing effectivity and cost-cutting insurance policies, have begun to yield optimistic outcomes. The corporate achieved a noteworthy 16.4% improve in annual web earnings. Such encouraging outcomes have additional bolstered investor confidence in Meta’s prospects.

Wanting forward, Meta’s income projection for Q3 falls within the vary of $32 to $34.5 billion. Nevertheless, CEO Mark Zuckerberg issued a cautionary word, mentioning a rise in spending for 2024 as a part of their formidable plans for profitable initiatives.

To assist its future progress, Meta is investing in its social media platforms, Reels and Threads, and prioritizing synthetic intelligence merchandise and initiatives such because the Quest 3 digital actuality headset and Llama 2. Buyers are optimistic that these initiatives will proceed to drive the corporate’s growth within the coming durations.

Regardless of the optimistic strides, Meta’s Actuality Labs continues to incur losses. Within the 2nd quarter, Actuality Labs reported a lack of $3.74 billion, surpassing expectations. Alternatively, the revenues remained favorable, reaching $276 million.

Though the corporate invests closely within the Metaverse, it has not but generated earnings on this space. In consequence, the expectation is that Actuality Labs’ annual loss might improve as Meta continues to scale the ecosystem.

Within the Q3 evaluation for META, 22 analysts revised their views upwards. Accordingly, META’s HBK within the subsequent quarter is estimated at $ 3.56, and quarterly income is estimated at $ 33.3 billion.

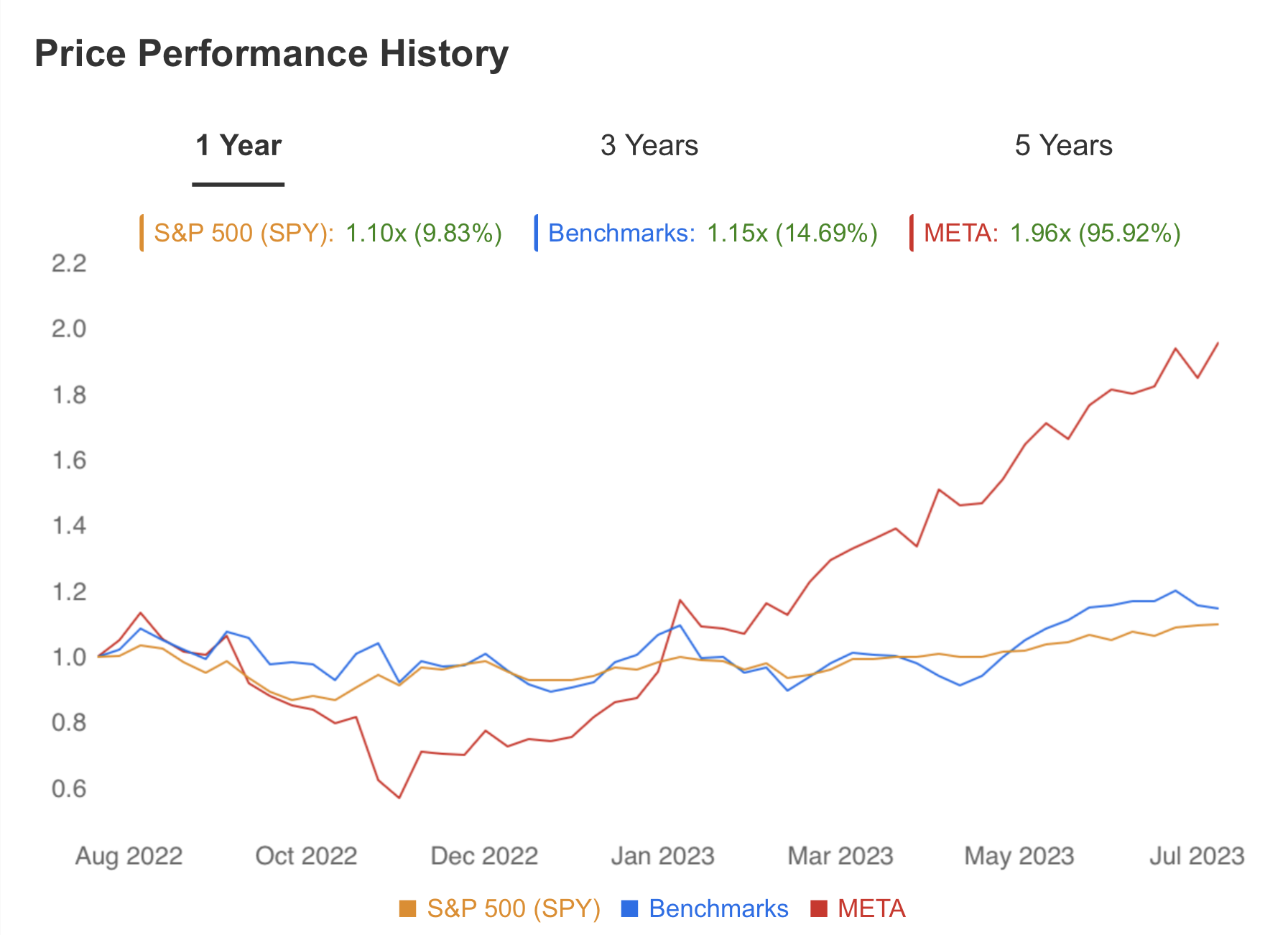

Supply: InvestingPro

In November 2022, META broke free from its downtrend and launched into a steep uptrend, setting the stage for a promising begin in 2023. Over the previous 12 months, the inventory has considerably outperformed its friends, decoupling from the sector common, which rose by 15%, and the , which recorded a progress of near 10%. In distinction, Meta’s inventory surged a powerful 96%.

Supply: InvestingPro

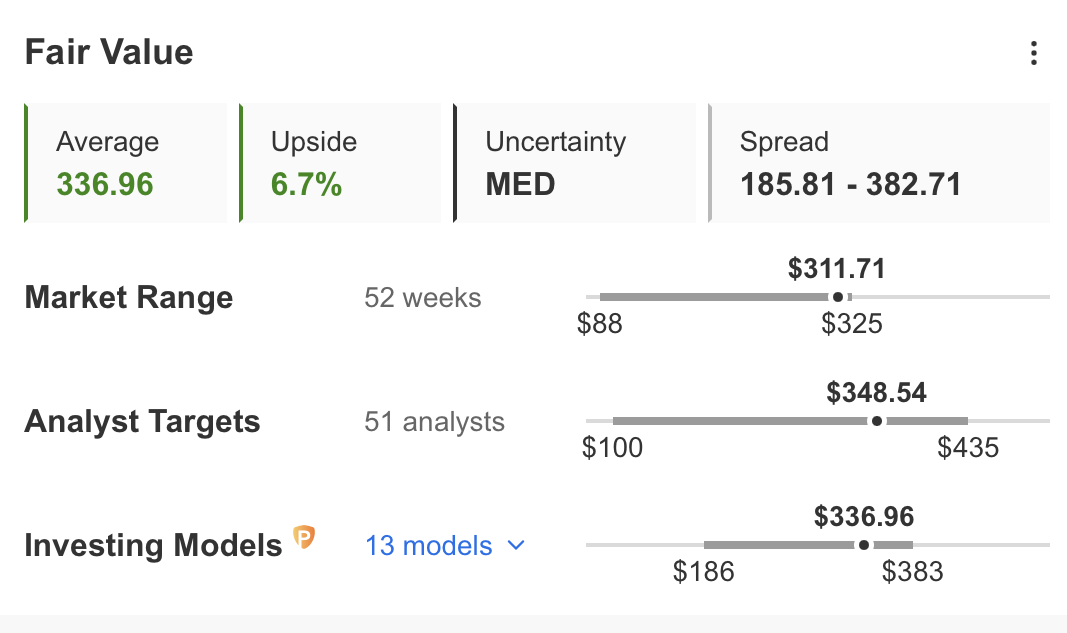

Based on InvestingPro, META’s truthful worth, as calculated by 13 monetary fashions, is estimated at $337, indicating that the present share worth is buying and selling at a reduction of roughly 7% in comparison with this worth. Nevertheless, the truthful worth common projected by 51 analysts is even increased at $350, suggesting additional upside potential for the inventory.

The present knowledge painting a optimistic outlook, as the corporate continues to ship excessive returns, and its stability sheet exhibits a wholesome money place above its liabilities, instilling confidence amongst traders. Furthermore, analysts’ upward revision of earnings expectations additional provides to the optimistic sentiment surrounding Meta’s prospects.

Alternatively, it is important to be aware of sure warning indicators. Regardless of the optimistic features, Meta’s excessive price-earnings ratio and the truth that its earnings per share are nonetheless under the height noticed in 2021 must be thought of.

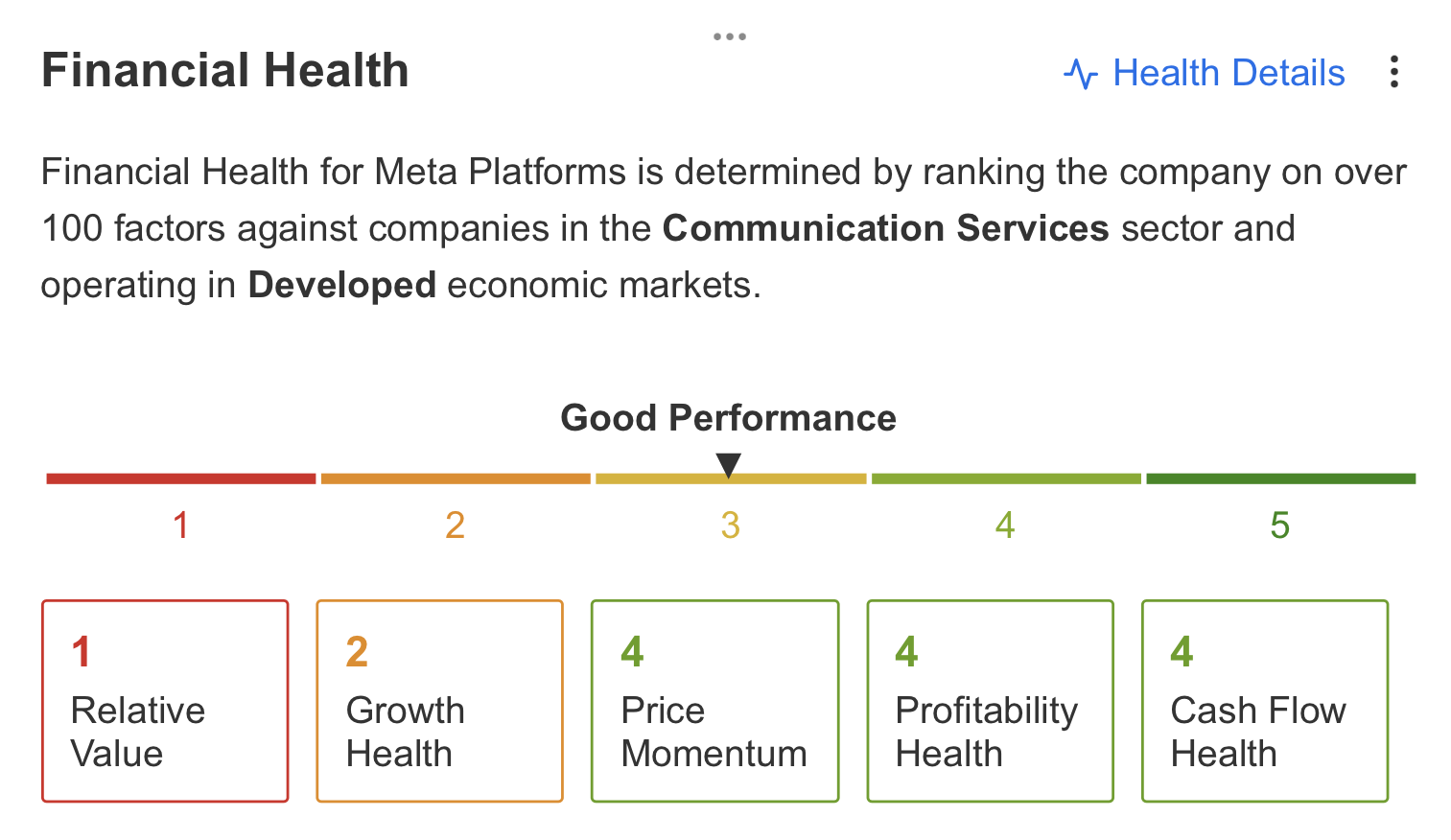

Supply: InvestingPro

The corporate’s money movement, profitability standing, and worth momentum are outstanding strengths, reflecting Meta’s robust efficiency in these areas. Alternatively, relative worth with progress well being seems to be a possible handicap, indicating room for enchancment on this side.

Meta continues to fare nicely in its monetary standing, with favorable indicators in money movement, profitability, and worth momentum. Whereas there are areas for potential progress, the corporate’s present efficiency is powerful and highlights its general optimistic trajectory.

Meta Inventory: Technical View

META’s surge in 2023 boosted the broader market. With the rally beginning in November, the inventory surged by nearly 235%, practically compensating for its 2022 losses.

On a weekly view, META has reached a important resistance stage at Fib 0.786 ($320), which is important relative to final 12 months’s downtrend. The previous three weeks of worth motion have confirmed this resistance level.

As soon as there is a clear weekly shut above $320, the following goal might be the latest peak at $381. Breaking this peak might doubtlessly drive the share worth to the $460 – $560 vary in the long run. Conversely, the assist space between $270 and $290 is essential for sustaining the present development.

Conclusion

Wanting forward, the competitors within the discipline of synthetic intelligence will play a significant function in shaping META’s future. Market commentators anticipate a rise within the firm’s AI-driven earnings, which might gas its progress. Nevertheless, the truth that AI merchandise are largely provided at no cost poses challenges in producing important income whereas prices proceed to rise.

Moreover, monetizing the Metaverse imaginative and prescient, for which META has invested billions of {dollars}, stays difficult. The social media platform-weighted promoting revenues want to stay regular to make sure secure progress.

Disclaimer: This text is written for informational functions solely; it’s not meant to encourage the acquisition of belongings in any approach, nor does it represent a solicitation, supply, suggestion, recommendation, counseling or suggestion to speculate. We remind you that each one belongings are evaluated from completely different views and are extraordinarily dangerous, so the funding determination and the related threat are the investor’s personal.

[ad_2]

Source link