[ad_1]

Treasury yields completed at/close to the day’s richest ranges whilst Fed Chair Powell and his G3 colleagues warned of additional tightening forward. Nonetheless, there have been no new insights there to permit dip patrons to offer assist. There was additionally some front-running of month- and quarter-end demand, in addition to rebalancing flows given the outperformance of equities (thanks AI) over Treasuries this quarter. Inventory markets traded combined in a single day and whereas European futures are down, US futures have discovered patrons. Markets are nonetheless weighing central financial institution feedback from yesterday. Governor Ueda appeared to sign the opportunity of a coverage shift subsequent 12 months. Reuters reporting that China’s main state-owned banks have been seen promoting {dollars} once more in the present day in change for the yuan within the onshore market.

- FX – The USDIndex cleared the 103 mark after hawkish feedback from Powell yesterday. USDJPY continues to be at 144.56. GBP and EUR slumped on considerations over their economies with extra price hikes forward.

- Shares – The US100 pulled again barely in the present day however holds above $4400. Financial institution of America Corp. and Wells Fargo & Co. have been larger as the largest lenders handed the Fed’s stress take a look at, clearing the best way for payouts. All 23 examined banks handed regardless of projected losses of $541 billion.

- Commodities – USOil is barely decrease from yesterday’s highs at $69.75 because the 2nd weekly draw from US crude stockpiles was greater than anticipated, offsetting worries that additional rate of interest hikes might gradual financial progress and scale back international oil demand.

- Gold – prolonged decrease to $1902 space.

As we speak – Eurozone Financial Confidence, Client Confidence, US GDP, Preliminary Jobless Claims.

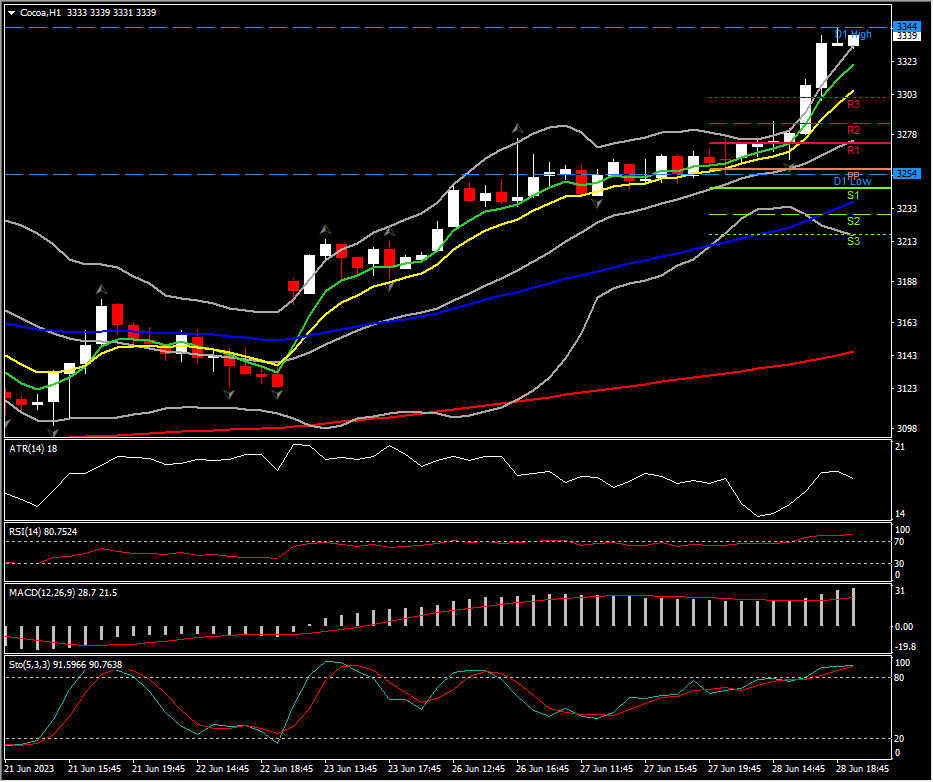

Largest Mover @ (06:30 GMT) Cocoa (+2.46%) rallied to 3344. Quick MAs flattened, however MACD strains are nonetheless positively configured with RSI at 80.75 and Stochastic at 91 and rising.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is supplied as a normal advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or ought to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link