[ad_1]

It is vitally tough to outline a exact route for the EURUSD in 2023. Actually, there may be nothing extra correct than to say that the pair is caught in a sideways vary between 1.05 and 1.105 and continues to check first one facet after which the opposite. Solely just lately, on the finish of Could, has the Euro began to strengthen within the 1.0660 space, marking rising lows in comparison with March. Truly, on this laterality a very slight tendency to mark each rising lows and rising highs might be seen (yellow channel in Fig.4), however to start with it must be confirmed by the present leg up.

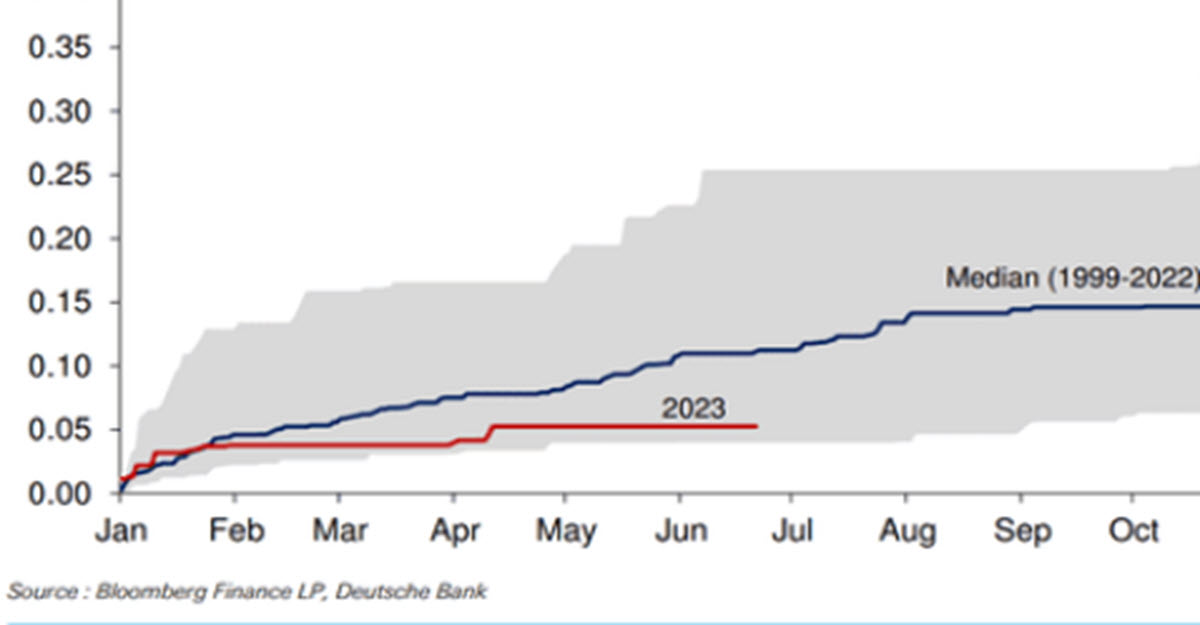

Fig 1. EURUSD max-min vary achieved throughout the yr, 1990 – at the moment

1.0780–1.09 is the world from the place in early 2020 the EURUSD discovered the energy to rise to 1.23 throughout a 1-year lengthy bull market. Since these highs the downward run has began once more: what pursuits us is that any trendline traceable to outline that motion has been damaged. The bear market that lasted about 16 months from the highs to the lows (0.955) on the finish of September 2022 is certainly over, by no means thoughts that the appreciation to present ranges has been about 14% (we’re speaking about currencies right here).

Fig 2. EURUSD Each day, 2018 – now

Therefore now we have a market that after the sturdy rebound that began in Q3 2022 has slowed down and gone sideways for six full months now. On the identical time, the motion that supported the USD from 2021 onwards is certainly lifeless. This has created a tough state of affairs to decipher over the long run (in any other case we might not be speaking about laterality).

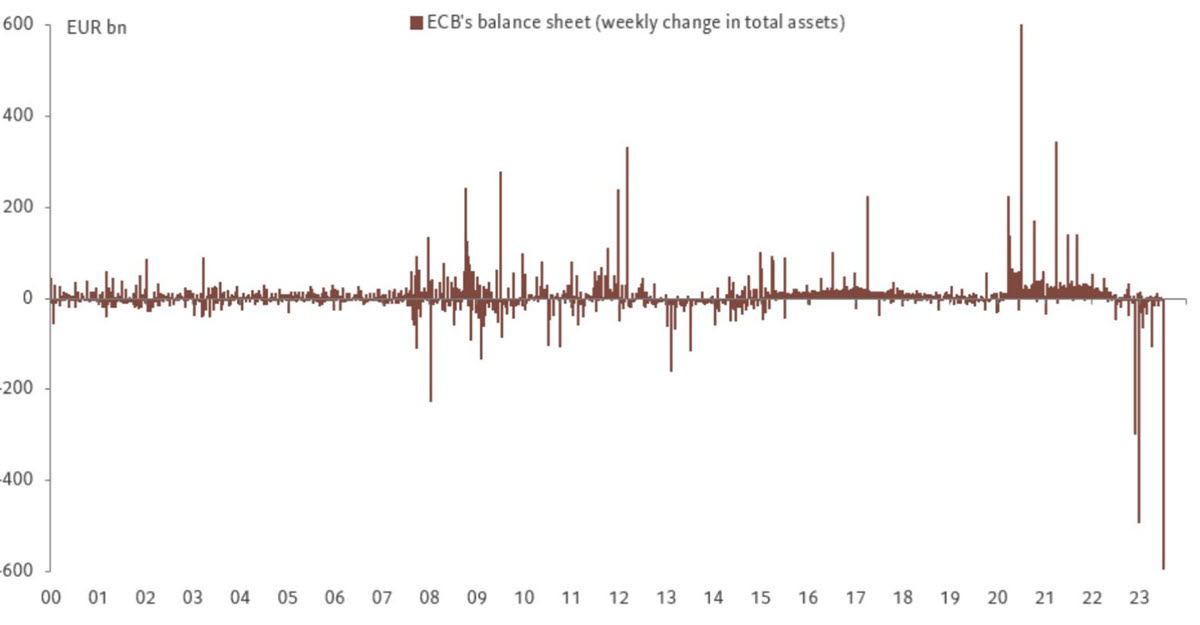

There may be possible a long-term bullish trendline coming and it’s passing at the moment round 1.0780 which – as a degree – might be thought-about a assist; the worth is simply now above its 50 MA. However one thing just isn’t fairly clear proper now: the European financial system is displaying extra indicators of weak spot than the US one and this isn’t supportive of a Euro appreciation. What would possibly ultimately be seen is the simply begun massive discount within the central financial institution steadiness sheet (this can be a theme of latest days), or a drastic deterioration within the situation of the US financial system.

Fig 3. ECB’s steadiness sheet weekly adjustments

Having stated that, in the long run the pair stays devoted to the construction at present in place: a sideways zig zag between 1.105 and 1.05, not forgetting, nonetheless, that final time the downward motion stopped at 1.0630 – we are going to monitor it – and if this have been the beginning of a rising lows construction inside the vary, this time even 1.0780 might be an necessary assist. To the upside, solely a break above 1.11 would unleash the potential for a brand new long-term upward transfer.

Fig.4 EURUSD day by day, ST

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a basic advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or must be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link