gopixa

By Jeremy Schwartz, CFA and Matt Wagner, CFA

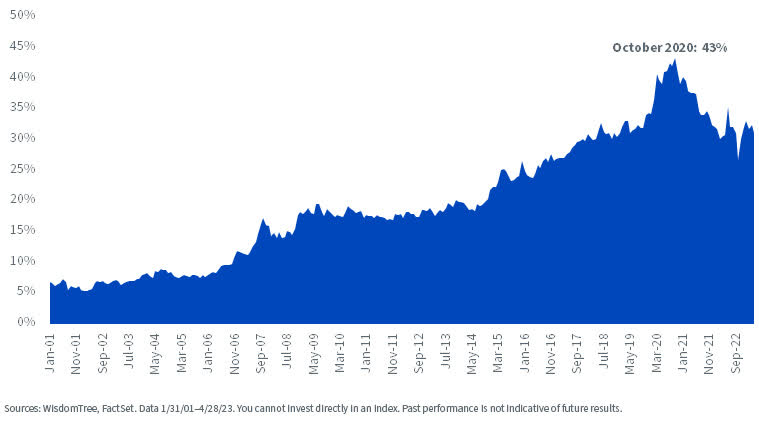

When the MSCI Rising Markets Index launched in January 2001, the market-cap weight of the Chinese language fairness market was round 7%.

Quick-forward twenty years and its weight has ballooned to roughly one-third of all rising markets equities in most benchmarks. At its peak in October 2020, China made up 43% of the MSCI EM index.

% China Weight within the MSCI Rising Markets Index

Chinese language equities have not too long ago been pushed by idiosyncratic dangers: China’s self-inflicted tech rules, U.S.-China commerce tensions, overbuilding and issues with actual property builders, and COVID-19 lockdowns and questions over the pandemic’s origins to call a couple of.

There’s now growing geopolitical rigidity with the U.S. over each China’s long-run intentions for Taiwan and its help of Russia. Seemingly, the one challenge to unite Washington politicians is posturing over who may very well be ‘harder on China.’

Given the numerous weight of China in broad rising market allocations, elevated however difficult-to-forecast dangers have repeatedly annoyed some asset allocators.

The refrain is asking, “Is China investable?” Usually an ‘un-investable’ narrative is what creates a number of the finest alternatives – assume again to when oil costs went unfavorable throughout the pandemic as a current asset class that was additionally thought of un-investable.

However actions of the U.S. regulators to penalize U.S. buyers when Russia invaded Ukraine name into query whether or not the identical might occur to U.S. investments in China. This threat is actually not zero and we imagine more and more buyers will need to isolate and mitigate China-specific dangers and alternatives that emanate from them.

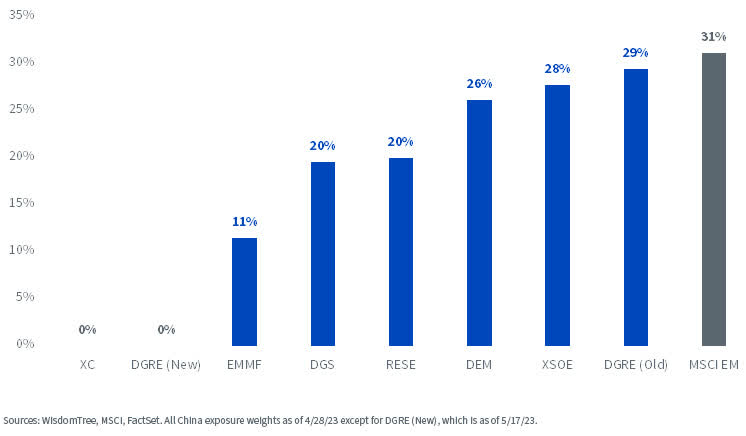

WisdomTree provides buyers rising markets publicity throughout seven totally different ETFs. In an try to present buyers the optionality to unpack the share of China publicity of their EM portfolios and management how a lot China they actually need, we launched the broad-based WisdomTree Rising Markets ex-China Fund (XC) final fall.

In two actively run portfolios, WisdomTree took additional steps to decrease our China dangers and provides extra instruments to buyers who need diversified rising markets publicity.

The WisdomTree Rising Markets High quality Dividend Development Fund (DGRE) rebalanced and re-allocated fully away from China, whereas our Rising Market Multifactor ETF (EMMF) lowered the load in China to lower than half that of the broad MSCI EM Index. We’ll comply with up with extra info on EMMF in one other weblog publish whereas focusing the dialogue on this publish on the refreshed portfolio traits for DGRE.

% China Publicity

Methodology

DGRE is a rules-based energetic ETF. The mannequin selects roughly 250–300 dividend-paying constituents, chosen based mostly on traits of upper working profitability (high quality) and trailing dividend development.

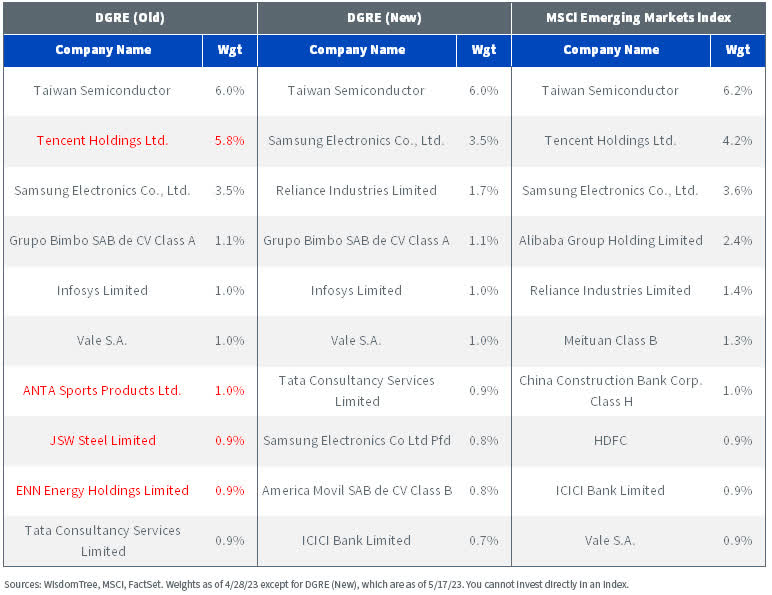

A number of Chinese language firms among the many prime 10 Fund holdings had been eliminated for threat concerns, together with Tencent Holdings (OTCPK:TCEHY, OTCPK:TCTZF), ENN Power (OTCPK:XNGSY, OTCPK:XNGSF), and ANTA Sports activities (OTCPK:ANPDY, OTCPK:ANPDF). JSW Metal Restricted – an Indian Supplies firm – was the one non-China holding faraway from the highest 10 holdings based mostly on the quantitative dividend-growth mannequin.

High 10 Holdings

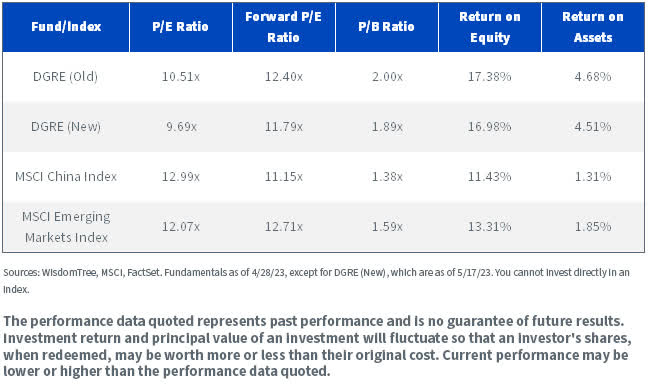

The weighting course of is modified market-cap to present higher weight to firms with increased scores on high quality and dividend development. After this week’s reconstitution, DGRE maintained a trailing P/E ratio low cost and 2X P/E factors beneath the MSCI EM Index. Additional, as the method favors high-quality firms incomes a excessive return on fairness and property, these benefits over the broad MSCI EM Index had been additionally effectively maintained.

Briefly, WisdomTree believes all of the engaging portfolio traits of DGRE had been maintained, however with the advantage of a major lower in China-specific dangers.

Fundamentals Comparability

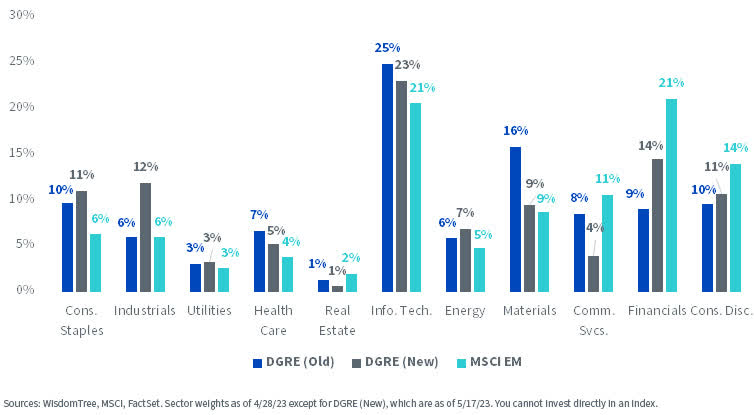

From a sector perspective, the rebalance elevated weight to Financials and Industrials and decreased weight to Communication Providers and Supplies.

Sector Exposures

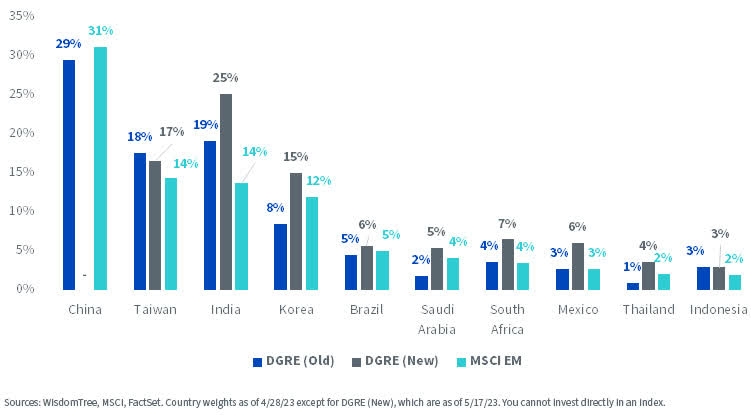

By way of nation exposures, eradicating the 31% weight to China leads to notable will increase to India (+7%) and Korea (+6%).

Nation Exposures

Conclusion

After the rebalance, the ex-ante beta of DGRE to the MSCI EM Index was materially lowered from 0.97 to 0.87.

We imagine the current rebalance of DGRE permits buyers to entry high quality dividend development rising markets firms whereas mitigating publicity to a number of the idiosyncratic dangers related to Chinese language equities lately.

Essential Dangers Associated to this Article

DGRE: There are dangers related to investing, together with the potential lack of principal. Overseas investing includes particular dangers, resembling threat of loss from foreign money fluctuation or political or financial uncertainty. Funds specializing in a single sector usually expertise higher value volatility. Investments in rising, offshore, or frontier markets are usually much less liquid and fewer environment friendly than developed markets and are topic to extra dangers, resembling of hostile governmental regulation, intervention, and political developments. As a result of funding technique of this Fund, it might make increased capital achieve distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

XC: There are dangers related to investing, together with potential lack of principal. Overseas investing includes particular dangers, resembling threat of loss from foreign money fluctuation or political or financial uncertainty. Investments in rising markets are usually much less liquid and fewer environment friendly than investments in developed markets and are topic to extra dangers. The Fund’s funding technique limits the kinds and variety of funding alternatives out there and, in consequence, the Fund could underperform different funds. The Fund’s publicity to sure sectors, nations, or areas could enhance its vulnerability to any single financial or regulatory improvement associated to such sector, nation, or area. The Fund is non-diversified, in consequence, modifications available in the market worth of a single safety might trigger higher fluctuations within the worth of Fund shares than would happen in a diversified fund. Investments in foreign money contain extra particular dangers, resembling credit score threat and rate of interest fluctuations. The Fund invests within the securities included in, or consultant of, its Index no matter their funding benefit, and the Fund doesn’t try and outperform its Index or take defensive positions in declining markets. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

EMMF: Investing includes threat together with potential lack of principal. Investments in non-U.S. securities contain political, regulatory, and financial dangers that is probably not current in U.S. securities. For instance, overseas securities could also be topic to threat of loss as a consequence of overseas foreign money fluctuations, political or financial instability, or geographic occasions that adversely affect issuers of overseas securities. Derivatives utilized by the Fund to offset publicity to foreign currency could not carry out as supposed. There will be no assurance that the Fund’s hedging transactions shall be efficient. The worth of an funding within the Fund may very well be considerably and negatively impacted if foreign currency admire on the similar time that the worth of the Fund’s fairness holdings falls. Whereas the Fund is actively managed, the Fund’s funding course of is predicted to be closely depending on quantitative fashions and the fashions could not carry out as supposed.

Extra dangers particular to EMMF embrace however should not restricted to Rising Markets Danger. Investments in securities and devices traded in growing or rising markets, or that present publicity to such securities or markets, can contain extra dangers regarding political, financial, or regulatory circumstances not related to investments in U.S. securities and devices or investments in additional developed worldwide markets. Please learn the Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

Jeremy Schwartz, CFA, International Chief Funding Officer

Jeremy Schwartz has served as our International Chief Funding Officer since November 2021 and leads WisdomTree’s funding technique group within the development of WisdomTree’s fairness Indexes, quantitative energetic methods and multi-asset Mannequin Portfolios. Jeremy joined WisdomTree in Could 2005 as a Senior Analyst, including Deputy Director of Analysis to his obligations in February 2007. He served as Director of Analysis from October 2008 to October 2018 and as International Head of Analysis from November 2018 to November 2021. Earlier than becoming a member of WisdomTree, he was a head analysis assistant for Professor Jeremy Siegel and, in 2022, grew to become his co-author on the sixth version of the e-book Shares for the Lengthy Run. Jeremy can also be co-author of the Monetary Analysts Journal paper “What Occurred to the Authentic Shares within the S&P 500?” He acquired his B.S. in economics from The Wharton College of the College of Pennsylvania and hosts the Wharton Enterprise Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.

Matt Wagner, CFA, Affiliate Director, Analysis

Matt Wagner joined WisdomTree in Could 2017 as an Analyst on the Analysis group. In his present position as an Affiliate Director, he helps the creation, upkeep, and reconstitution of our indexes and actively managed ETFs. Matt began his profession at Morgan Stanley, working as an analyst in Treasury Capital Markets from 2015 to 2017 the place he centered on unsecured funding planning, execution and threat administration. Matt graduated from Boston School in 2015 with a B.A. in Worldwide Research with a focus in Economics. In 2020, he earned a Certificates in Superior Valuation from NYU Stern. Matt is a holder of the Chartered Monetary Analyst designation.

Authentic Publish

Editor’s Notice: The abstract bullets for this text had been chosen by Looking for Alpha editors.