Dow, Dow Jones Industrial Common, S&P 500, SPX, NASDAQ 100, NDX – Outlook:

Advisable by Manish Jaradi

The Fundamentals of Pattern Buying and selling

US fairness indices jumped on Monday after reassurance from US lawmakers that the nation gained’t default on its debt obligations, boosting hopes of a deal to lift the debt ceiling. The percentages of additional good points within the indices are excessive, technical charts counsel.

“The leaders (of Congress) have all agreed: We is not going to default. Each chief has stated that,” US President Joe Biden stated on Wednesday. Market expectations have been low going into the debt ceiling talks, however the consensus to keep away from a debt default is a constructive signal.

Additionally, the constructive quarterly earnings season, the stabilization in US regional shares, and hopes that the US Federal Reserve has concluded its fee mountain climbing cycle are aiding sentiment. With market positioning nonetheless mild (bearish sentiment amongst world funding managers has reached excessive ranges whereas retail traders’ internet purchases of single shares are round multi-month lows), a constructive end result on the debt talks may push equities greater. For extra dialogue see “S&P 500, Nasdaq Week Forward: Resilience or a Lull Earlier than the Storm?”, revealed Might 15.

Dow Jones Industrial Common Each day Chart

Chart Created by Manish Jaradi Utilizing Tradingview

Dow Jones Industrial Common: Rebounds from key assist

On technical charts, the Dow Jones Industrial Common has rebounded from a reasonably robust converged cushion: the decrease fringe of a pitchfork channel from mid-2022 and the 200-day transferring common. The maintain above the assist raises the prospect of an additional advance. Whereas nonetheless unfolding, an increase towards the horizontal trendline from August at about 34280 and a subsequent break above may set off a reverse head & shoulders sample (the left shoulder on the December low, the pinnacle on the March low, the proper shoulder may very well be the Might low). If the bullish sample does get fashioned and triggered, a transfer towards 37000 may very well be on the playing cards.

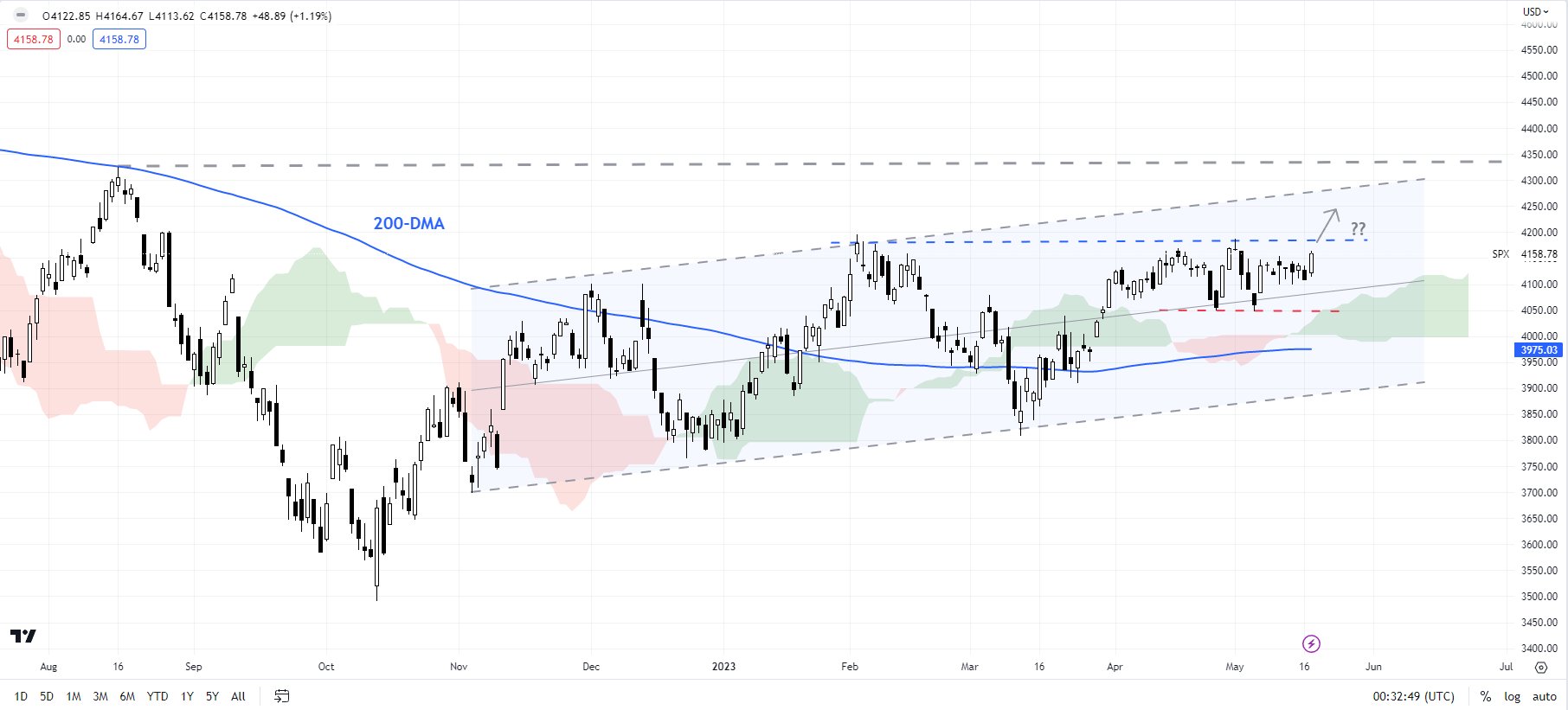

S&P 500 Each day Chart

Chart Created by Manish Jaradi Utilizing Tradingview

S&P 500: Gears up for an advance

The S&P 500 index’s rebound from the end-April low of 4050 has raised the potential for a minor double backside (the end-April and early-Might lows). Any break above the February excessive of 4195 would solidify the seven-month-long uptrend and will pave the way in which towards the August excessive of 4325. As first highlighted in January, the S&P 500 index’s broader development stays bullish – see “S&P 500 and Nasdaq 100 Index Technical Outlook: Turning Bullish”, revealed January 28.

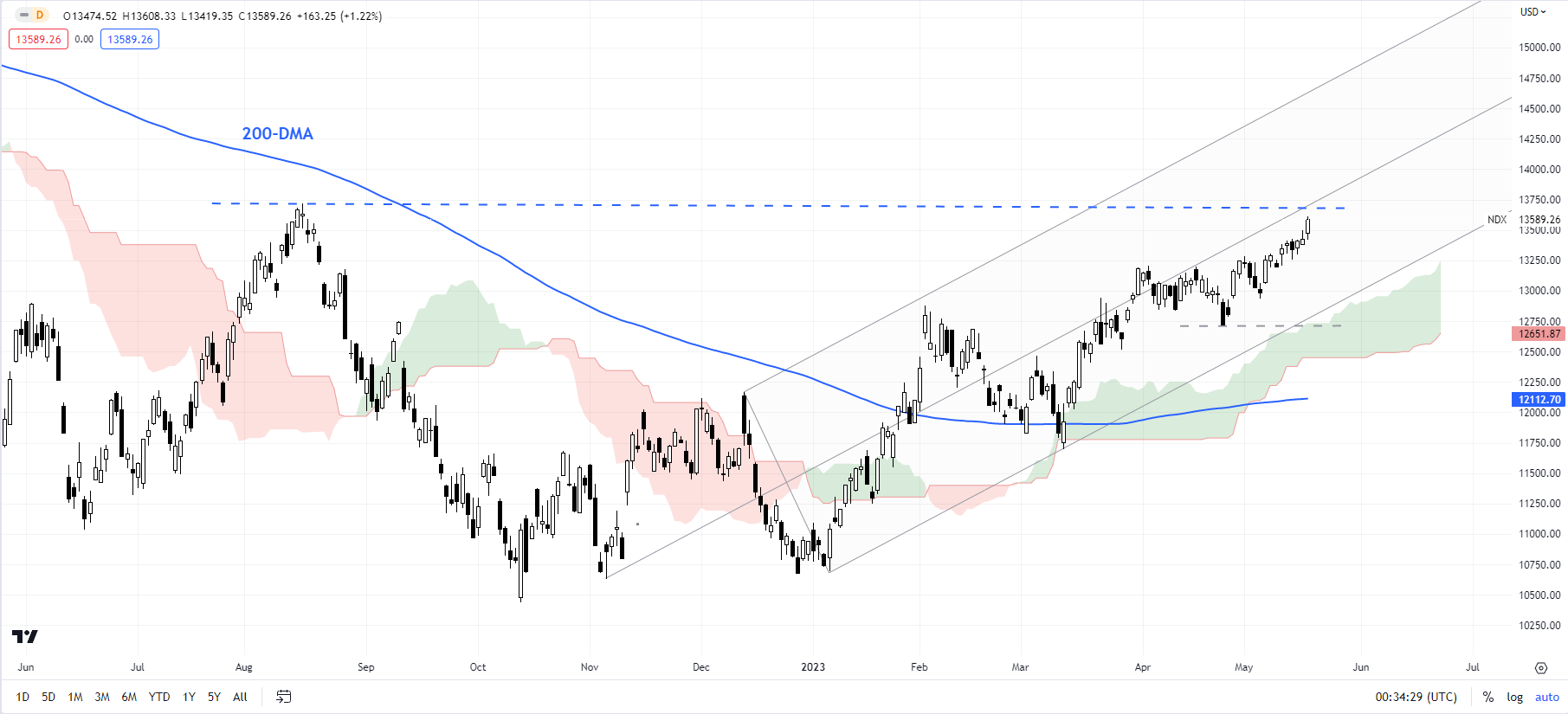

Nasdaq 100 Each day Chart

Chart Created by Manish Jaradi Utilizing Tradingview

On the draw back, the end-April low of 4050 stays a key flooring. Any break beneath the assist would affirm that the fast upward stress had pale considerably, pointing to an prolonged sideway vary.

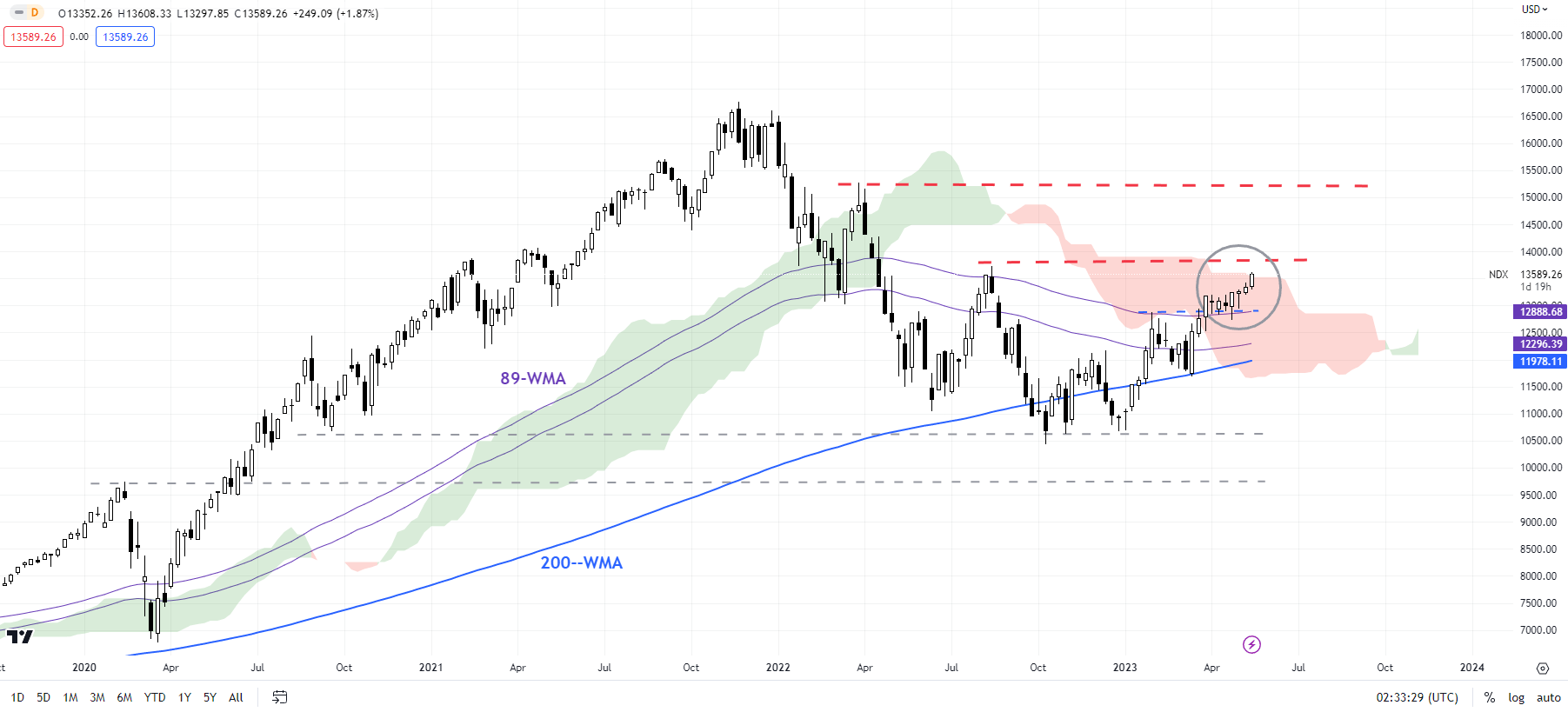

Nasdaq 100: Surges towards the August excessive

The Nasdaq 100 index is now a whisker away from the August excessive of 13720 – a chance highlighted in mid-April. See “Nasdaq 100 and S&P 500 to Retest August Highs – A Query of When Not If?”, revealed April 14.

Nasdaq 100 Weekly Chart

Chart Created by Manish Jaradi Utilizing Tradingview

This follows a break final week above the early-April excessive of 13205, which has now changed into preliminary assist. The short-term upward stress is unlikely to fade whereas the index holds above 13205.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to E-newsletter