Annually skilled analysts and forecasters shine up their crystal balls to submit their treasured metallic worth forecasts to the LBMA. The competition is to be probably the most correct predictor for the gold worth common for the yr; the analyst with the closest common worth for the yr wins a 1oz. gold bar. The 2023 forecasts, which analysts submitted in mid-January, had been printed on February 27.

The forecasts all the time draw a variety of doable outcomes and 2023 is not any totally different with the bottom annual common forecast for the gold worth at US$1,594 and the very best at US$2,025; the common of all analysts coming in at $1,859.90, which is 3.3% above the common set in 2022 of US$1,800.09.

The outlook for silver is considerably extra optimistic. The low common worth forecast submitted was US$17.50, the excessive was US$27 and the common of all analysts got here in at US$23.65, which is 8.8% greater than the precise common for 2022 of US$21.73.

Together with the forecasts, every analyst should additionally present the highest causes behind their forecasts. The general prime three drivers for gold had been: the US greenback and the associated Fed Financial Coverage, adopted by inflation, and at last geopolitical Components.

The analyst that submitted the bottom gold worth common for the yr cited rising actual rates of interest for the decline of the gold worth in 2023. Nonetheless, he does notice that gold will begin rallying as soon as the subsequent rate of interest easing cycle will be priced in.

The analyst with the very best gold worth thinks that the US economic system will flip weaker quickly and the US greenback will begin to decline turning the funding surroundings in direction of gold’s favour.

These two forecasts bracket your entire spectrum of typical knowledge. Neither of them is a groundbreaking concept.

Concerning silver, analysts cite lots of the identical causes as gold for his or her forecasts, however the lowest worth forecast comes from an analyst anticipating ‘lackluster industrial demand development” as a headwind for silver.

However he then provides that this can even flip extra optimistic within the medium-term. On the excessive finish of the worth forecasts analysts search for help for the ‘clear know-how motion’ in the way in which of elevated demand for photo voltaic panels and electrical autos to spice up silver demand.

A glance again at earlier forecasts

Analysts’ forecasts summited at first of 2022 calculated a mean worth that was US$1,801.90 and the precise worth got here in at $1,800.09 – solely US$1 off – which is an incredible outcome. Analysts had been too optimistic on silver nonetheless, with a mean analyst expectation of US$23.54 in 2022, and the precise common coming in at $21.73.

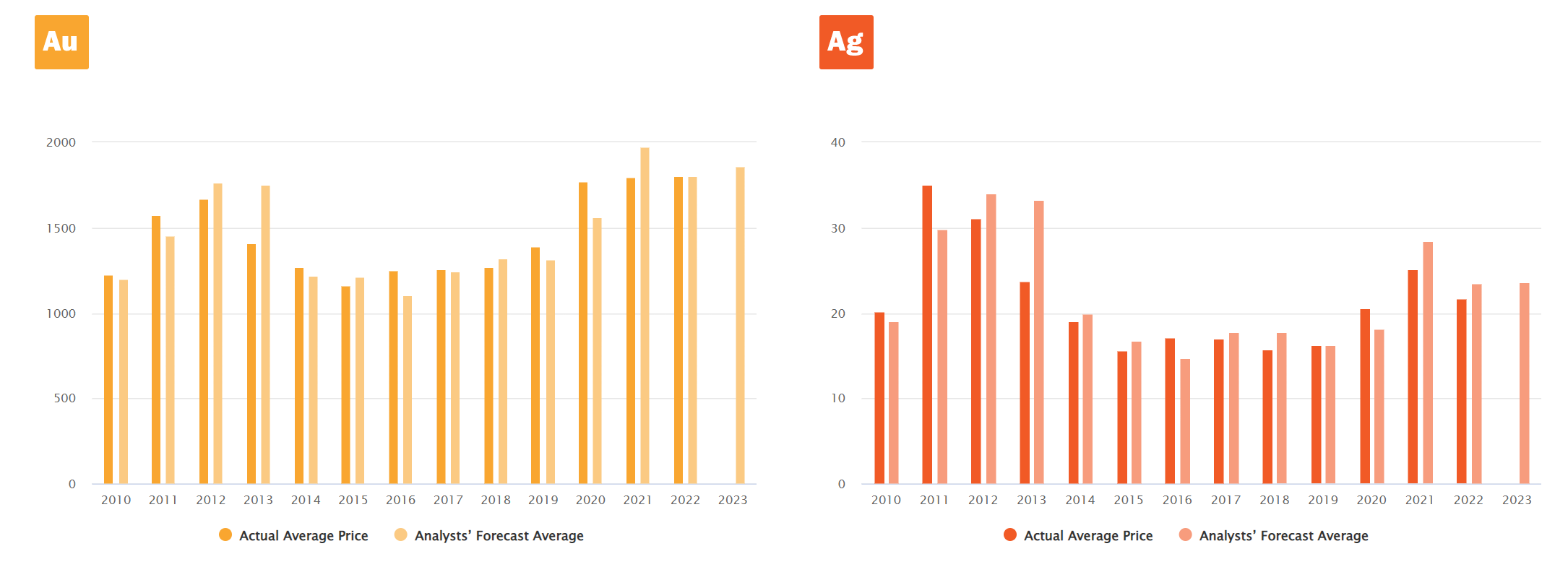

The chart beneath, from the LBMA’s web site, reveals the precise common and analysts’ common during the last 12 years.

The precise common and analysts’ common during the last 12 years chart

The precise common and analysts’ common during the last 12 years chart

Two necessary issues must be identified from these charts. First, is that when averaged collectively, professional analysts’ predictions are typically not ‘too far’ off from the precise common. This is smart as a result of bodily metals costs do transfer round over time however usually are not fully unpredictable nor notably risky.

Second, is that skilled forecasters, even when utilizing the common of a bunch of forecasts, are inclined to lag the worth by one to 2 years – which means that they’re gradual to see the turns available in the market. Stated one other manner, the professional opinion and traditional knowledge unconsciously assume that no matter occurred over the previous 24 months is more likely to proceed for the subsequent 12 months.

Do gold and silver worth predictions matter?

Value predictions are simply predictions. The analysts who make them do not likely have a crystal ball, however they do have expertise of treasured metals markets and the elements that have an effect on them. They’re attention-grabbing from an investor’s viewpoint as they offer perception into what main gamers within the gold and silver market are searching for, what they’re anxious about and the way assured they’re feeling in regards to the subsequent 12 months.

However, actually how a lot predictions matter simply comes down as to whether or not costs matter. We are sometimes requested ‘is now an excellent time to purchase gold?’ and the query comes from a priority about lacking out on a ‘good worth’. In fact, in case your resolution is to purchase now or subsequent month, then there’s unlikely to be a lot in it and also you is likely to be taking a look at gold from the mistaken perspective.

Why Gareth Soloway is “unbelievably bullish” on gold and silver

Folks spend money on gold not primarily to make a revenue from yr to yr however as a result of they see it as a manner of holding insurance coverage for his or her portfolio. The gold (and silver) is there to guard the worth of your portfolio, somewhat than make a fast buck month to month.

Buying gold is much like buying insurance coverage. We don’t take into account if it’s an excellent time to buy residence insurance coverage once we make the acquisition, as a result of we’re conscious that we want to shield our houses with insurance coverage within the occasion of any unforeseeable circumstances.

We additionally by no means query ourselves when going with out insurance coverage could be a wise concept. The identical is true with gold. When is an effective time to be with out gold is a greater query to ask than when gold is an effective worth.

Learn extra about if it’s an excellent time to purchase gold.

Purchase Gold Cash

GOLD PRICES (USD, GBP & EUR – AM/ PM LBMA Repair)

01-03-2023 1833.50 1841.25 1521.81 1532.84 1720.19 1725.80

28-02-2023 1810.20 1824.60 1498.66 1502.92 1705.93 1714.94

27-02-2023 1809.05 1818.65 1512.00 1512.75 1714.26 1717.35

24-02-2023 1824.10 1810.95 1517.29 1516.13 1722.13 1717.87

23-02-2023 1826.95 1826.05 1518.01 1515.07 1724.64 1721.97

22-02-2023 1833.45 1835.75 1518.46 1516.33 1723.63 1723.03

21-02-2023 1833.20 1836.85 1516.42 1519.26 1719.91 1723.70

20-02-2023 1844.20 1845.80 1533.27 1532.94 1725.99 1726.19

17-02-2023 1824.50 1833.95 1527.65 1527.50 1714.85 1719.69

16-02-2023 1837.30 1828.95 1522.94 1526.62 1715.67 1715.37

Purchase gold cash and bars and retailer them within the most secure vaults in Switzerland, London or Singapore with GoldCore.

Be taught why Switzerland stays a safe-haven jurisdiction for proudly owning treasured metals. Entry Our Most Widespread Information, the Important Information to Storing Gold in Switzerland right here