Fokusiert/iStock via Getty Images

Is it worth playing this wild natural gas game?

Maybe not, unless you use options to capture market volatility. This is where we come in, helping Weather Wealth clients develop longer-term trading strategies based on weather. If May and early summer are normal to cool in the United States, natural gas will not rally above $8.50-$9.00

Tight U.S. stocks and strong LNG exports to Europe plus possible European import restrictions from Russia have sent natural gas prices on a tear. Natural Gas (NYSEARCA:UNG) prices had close to a $2 range just this week alone; incredible.

The tight stock situation is well known by the trade, and though next week’s EIA number may be bullish due to recent cold weather, much of this has already been built into the natural gas market.

The ways natural gas prices could rebound again and become a major bull market for late spring and summer are: 1) LNG exports continue to soar and Europe has a hot summer; 2) The western U.S. drought continues to increase natural gas demand at the expense of little hydro-power (this happened last summer); and 3) The U.S. has a hot summer and/or an active hurricane season in the Gulf.

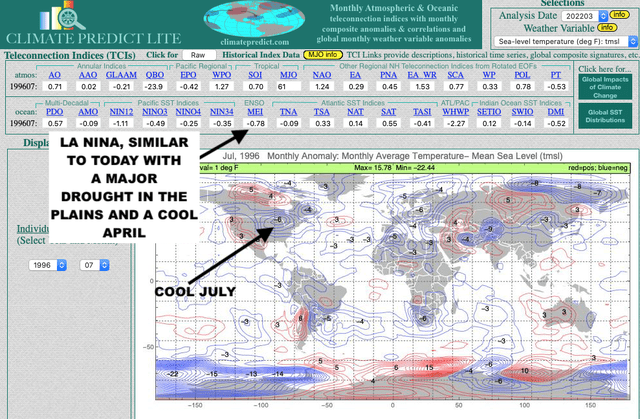

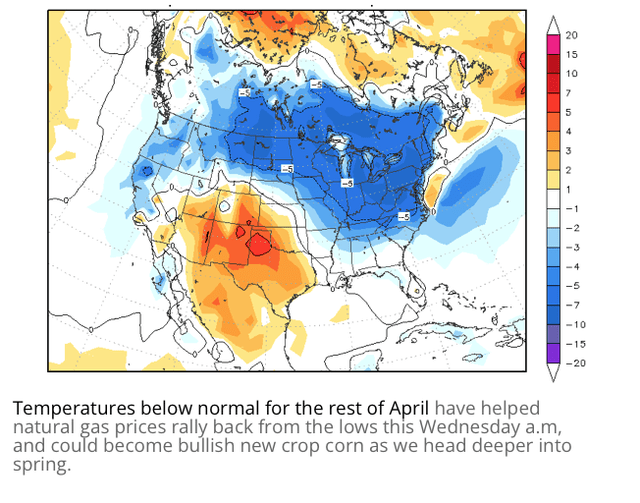

However, normal to cool weather heading into May and possibly June means less U.S. natural gas usage than normal. Previously, the cool April weather the U.S. has experienced was due to a negative Arctic Oscillation Index and La Nina. This video explains a lot more about how global teleconnections and a strengthening La Nina are impacting commodities, including natural gas.

So what to do with natural gas right now?

As we get deeper into spring and demand slackens off, prices could come down. This is what the natural gas market is looking at right now. While many weather forecasters are going for a hot U.S. summer, much of my early research suggests that the U.S. summer could be normal to cool. If this were to happen, then whatever high we see in prices this spring would result in a big sell-off in prices during the May-July time frame.

Not all La Niñas result in a hot summer. While this is still possible, there have only been a couple of summers when the Arctic Oscillation was negative in April and we also had a La Niña Two of those years were 1996 and 2008. The year 1996 had a major U.S. drought for Plains wheat, while 2008 had a cool spring and planting delays for U.S. corn.

Not All La Ninas Are Hot Summers (Weather Wealth Newsletter)

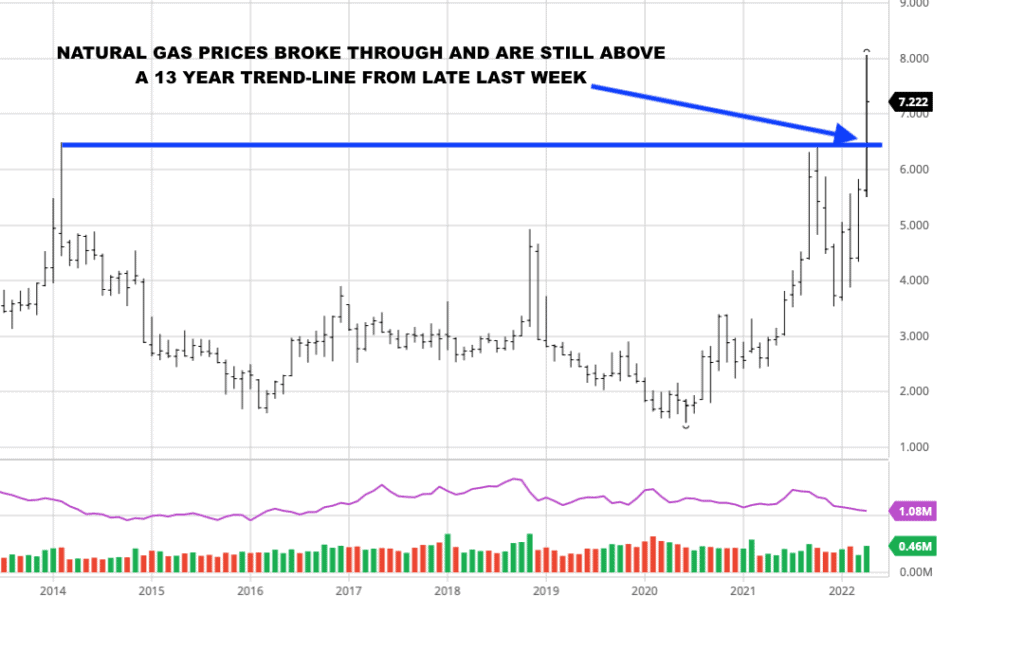

Natural gas prices broke resistance earlier this week only to come crashing down through support again. Often when you see a spike rally like this in a market, it is time to take profits and run for cover.

Natural Gas prices had a fake-out rally above long term resistance (Weather Wealth Newsletter by Jim Roemer)

A cool mid-late April could still help natural gas prices rally, but if May and June are normal to cool, prices will top out at some point.

Cool the rest of April (Weather Wealth Newsletter)

Conclusion

Buying natural gas (UNG) on the tight stocks, cool spring weather, and great LNG exports normally would make sense on this huge break. However, the way to trade natural gas (BOIL) volatility is by using options. Any easing of the Russian-Ukraine tensions and a potential normal to cool spring and early summer would, however, send prices back to $5.00 (KOLD). Nevertheless, next week’s EIA should be bullish and I expect short covering sometime next week in the natural gas market.

Given the 1996 or 2008 analog, some potential bullish plays still exist in wheat (WEAT) and possibly corn (CORN) on breaks. Given the high prices of grains, however, here, too, the way to play this is with conservative option strategies and spreads.

One final note. La Niña could set up a very active hurricane season again. This is going to set up more huge trading volatility in natural gas, all summer and fall long. At Weather Wealth, we help clients from natural gas producers to ETF investors and traders learn how to use option strangles and get better long-range weather forecasts.