When stocks show weakness, we can learn a lot by watching the credit markets. Today, we look at the Junk Bonds ETF, the SPDR Bloomberg High Yield Bond ETF (NYSE:).

Below, we share two charts that help better illustrate what is happening in the broader markets.

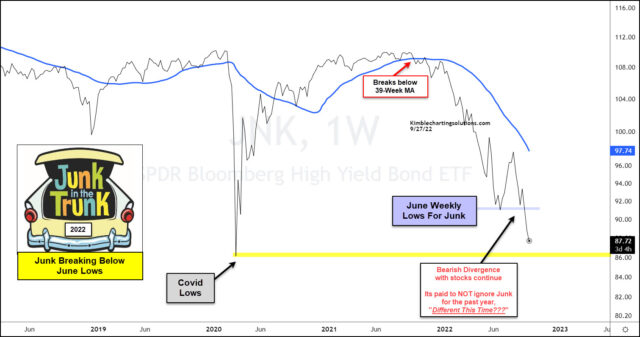

The first is the JNK on a weekly timeframe. As you can see, the ETF is nearing its COVID lows and has fallen much lower than its June low. This has formed a bearish divergence with stocks, as several indices have yet to puncture the June low, or, if they did, it was very marginal.

JNK Weekly Chart

The second chart looks at $JNK versus the SPDR S&P 500 (NYSE:).

This illustrates just how much further $JNK has fallen compared to stocks.

In summary, stock bulls do not want to play a game of catch-up with junk bonds.