[ad_1]

Brent and WTI Crude Oil Information and Evaluation

- Somber world outlook seems to limit oil costs regardless of cumulative output cuts

- WTI approaches prior important degree of $67 which has acted as a pivot level earlier than

- Brent crude oil eyes $71.50 as the following degree of assist

- IG consumer sentiment points a blended sign however excessive lengthy positioning eyes extra draw back

- The evaluation on this article makes use of chart patterns and key assist and resistance ranges. For extra data go to our complete training library

Really useful by Richard Snow

The best way to Commerce Oil

Oil Markets Fail to Shake Unfavourable Sentiment as a Effectively-Established Degree of Assist Stands within the Manner of Prolonged Promote-off

Oil markets anticipate financial headwinds forward as bullish momentum fails to look regardless of cumulative OPEC manufacturing cuts. Actually, oil continues to commerce decrease forward of Saudi Arabia’s manufacturing cuts (1 million barrels per day) coming into play from subsequent week as central financial institution heads are anticipated to warn of additional fee hikes to come back.

Elevated rates of interest have the meant consequence of dampening world demand with the intention to decrease wide-spread worth pressures which have taken maintain within the aftermath of Russia’s struggle in opposition to Ukraine and former provide constraints resulting from Covid lockdowns.

WTI Heads In the direction of Acquainted Pivot Level

WTI (US crude) costs have dropped sharply since tagging the $72.50 deal with that supplied turning factors in January and February of this yr. Buying and selling via the psychological degree of $70 with relative ease, costs now eye $67 – which was the decrease sure of the vary recognized by the Biden administration as the specified degree to replenish decreased SPR ranges. That is now not the case, however the degree has continued to behave as a pseudo-support for oil costs regardless. A convincing shut beneath this degree opens up the marketplace for a possible prolonged sell-off in direction of $62. Resistance lies at $70 however the MACD indicator suggests momentum stays to the draw back.

WTI Crude Oil Each day Chart

Supply: TradingView, ready by Richard Snow

| Change in | Longs | Shorts | OI |

| Each day | 10% | -11% | 7% |

| Weekly | 29% | -34% | 17% |

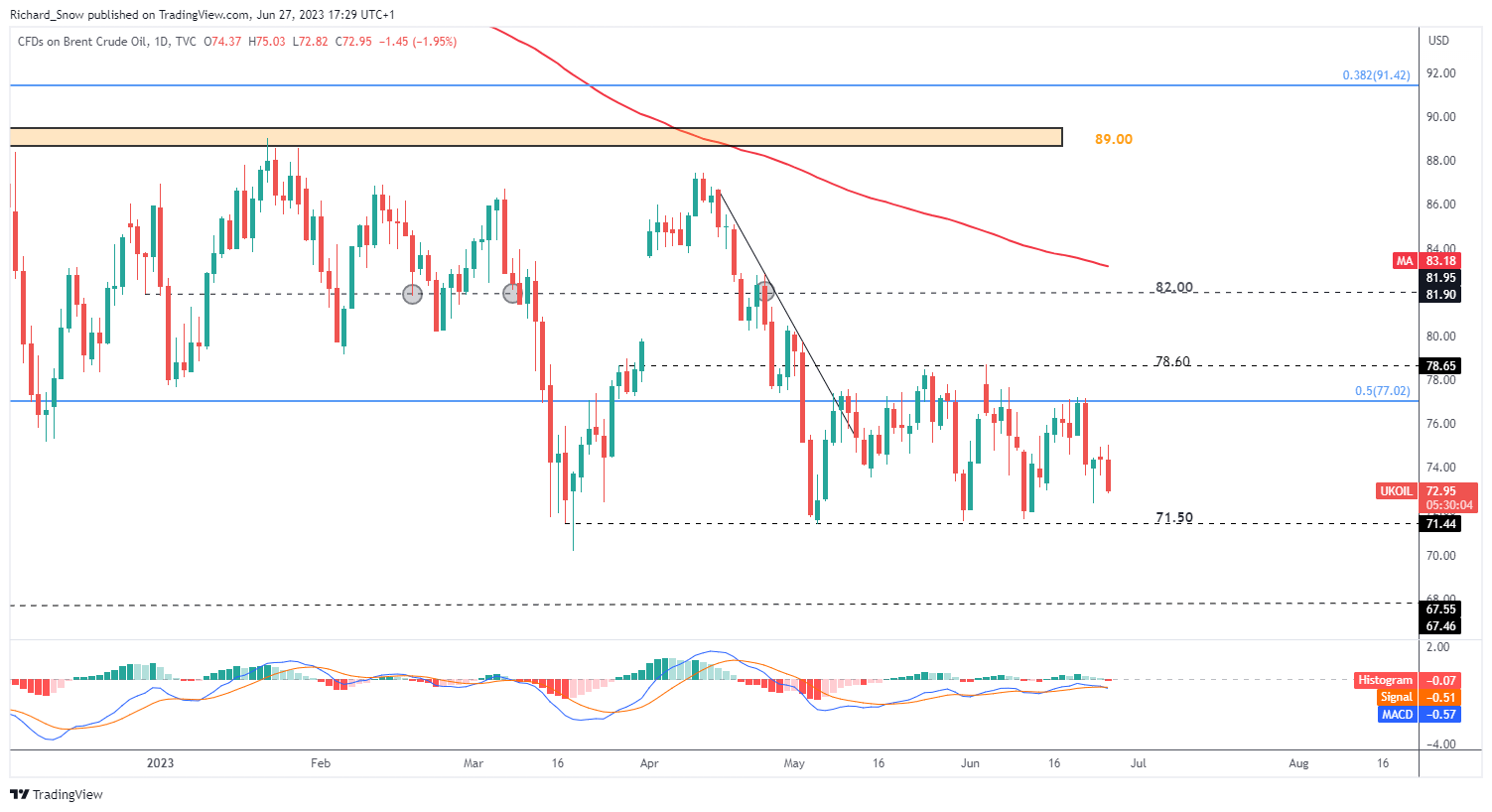

Brent Crude Oil Approaches Check of Prolonged Promote-off

Brent crude oil day by day chart, the same marker posture has developed in latest buying and selling periods, with a really key degree of assist in focus. Like WTI, Brent costs have approached a degree of assist that has so far halted additional promoting on a lot of events and could also be examined but once more. $71.50 is the extent in focus, with a drop to $67.50 a risk on additional draw back momentum. Resistance lies on the 50% retracement of the foremost 2020 to 2022 advance ($77).

Brent Crude Oil Each day Chart

Supply: TradingView, ready by Richard Snow

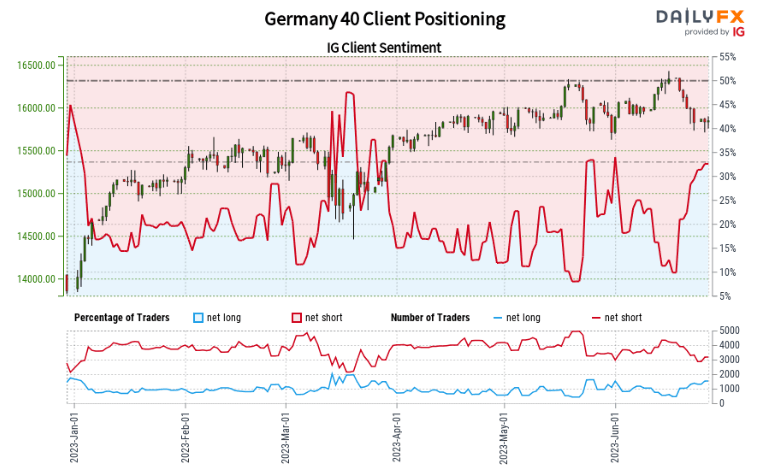

Excessive Web-Brief Positioning Poses Potential Problem for Bearish Continuation

Oil- US Crude:Retail dealer knowledge exhibits 86.96% of merchants are net-long with the ratio of merchants lengthy to quick at 6.67 to 1.

We sometimes take a contrarian view to crowd sentiment, and the actual fact merchants are net-long suggests Oil– US Crude costs might proceed to fall.

The variety of merchants net-long is 4.78% increased than yesterday and 30.42% increased from final week, whereas the variety of merchants net-short is 8.17% increased than yesterday and 25.00% decrease from final week.

Positioning is much less net-long than yesterday however extra net-long from final week. The mixture of present sentiment and up to date modifications offers us a additional blended Oil – US Crude buying and selling outlook.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to E-newsletter

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX

[ad_2]

Source link