[ad_1]

Up to date on June twenty seventh, 2023 by Bob Ciura

Spreadsheet knowledge up to date day by day

Mega-cap shares are corporations with market capitalizations in extra of $200 billion. The full variety of mega cap shares varies relying upon market circumstances. Proper now there are over 50 mega-cap shares, so there are loads to select from for traders.

These are the most important shares out there right now and have a tendency to have recognizable manufacturers, along with pretty regular income, earnings, and in lots of circumstances dividends. Thus, mega cap shares would are likely to enchantment to all kinds of traders as they’d sometimes see much less volatility than smaller shares and have extra predictable ahead returns.

You possibly can obtain a free spreadsheet of all 50+ mega cap shares (together with necessary monetary metrics equivalent to price-to-earnings ratios and dividend yields) by clicking on the hyperlink under:

This text features a spreadsheet and desk of all mega cap shares, in addition to detailed evaluation on our High 10 mega cap shares right now.

Preserve studying to see the ten finest mega cap shares analyzed intimately.

The ten Finest Mega Cap Shares Right now

Now that we’ve outlined what a mega cap inventory is, let’s check out the ten finest mega cap shares, as outlined by our Positive Evaluation Analysis Database.

The database ranks whole anticipated annual returns, combining present yield, forecast earnings progress and any change in worth from the valuation.

Be aware: The Positive Evaluation Analysis Database is targeted on revenue producing securities. In consequence, we don’t observe or rank securities that don’t pay dividends. Mega caps that don’t pay dividends had been excluded from the High 10 rankings under. As well as, solely U.S. primarily based mega cap shares had been thought of for the highest 10 record.

We’ve screened the mega cap shares with the most effective potential returns and have offered them under, ranked in reverse order of forecast whole returns. You possibly can immediately bounce to any particular person inventory evaluation through the use of the hyperlinks under:

Mega Cap Inventory #10: Coca-Cola Co. (KO)

- 5-year anticipated annual returns: 8.2%

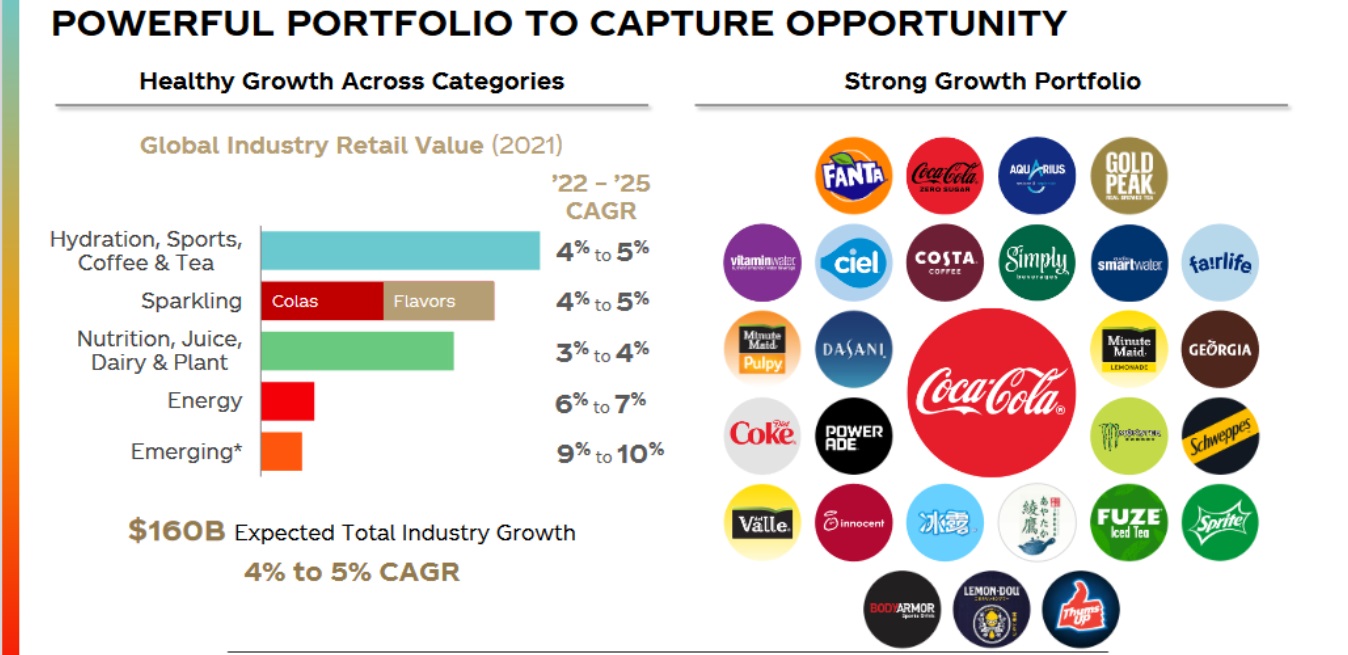

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers. Because the firm’s founding in 1886, it has unfold to greater than 200 international locations worldwide.

Supply: Investor Presentation

The corporate additionally has an distinctive 59-year dividend enhance streak.

Coca-Cola’s aggressive benefits embrace its unparalleled suite of beverage manufacturers, in addition to its environment friendly world

distribution community. Coca-Cola can be extraordinarily proof against recessionary environments, having elevated its earningsper-share throughout and after the monetary disaster.

Click on right here to obtain our most up-to-date Positive Evaluation report on KO (preview of web page 1 of three proven under):

Mega Cap Inventory #9: Visa Inc. (V)

- 5-year anticipated annual returns: 8.6%

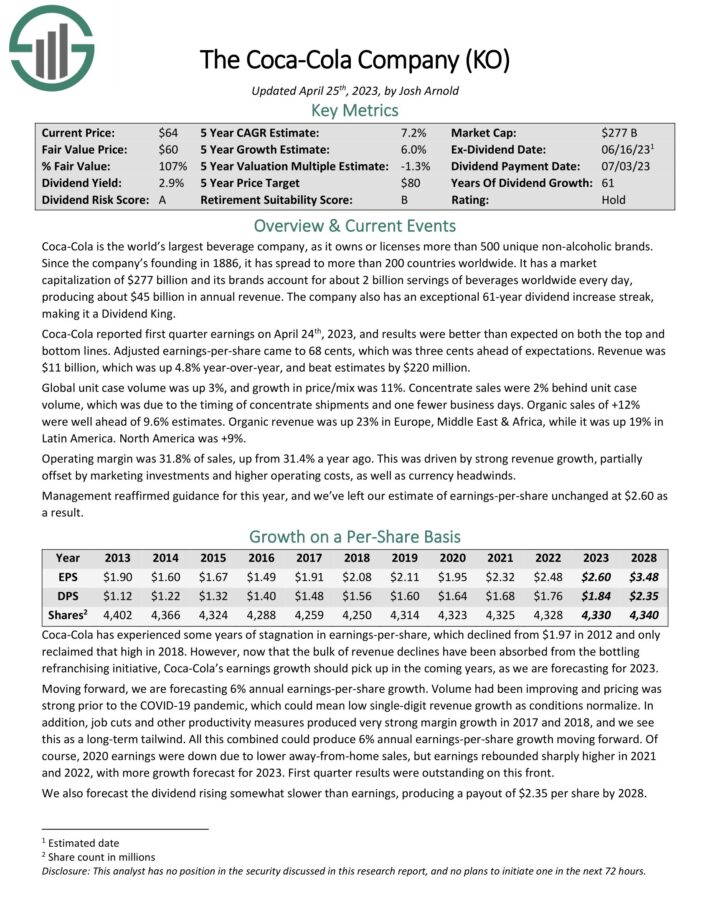

Visa is the world’s chief in digital funds, with exercise in additional than 200 international locations. The corporate’s world processing community offers safe and dependable funds world wide and is able to dealing with greater than 65,000 transactions a second. In fiscal yr 2022 the corporate generated $16 billion in revenue.

On April twenty fifth, 2023, Visa reported second quarter 2023 outcomes for the interval ending March thirty first, 2023. (Visa’s fiscal yr ends September thirtieth.) For the quarter, Visa generated income of $8.0 billion, adjusted internet revenue of $4.4 billion and adjusted earnings-per-share of $2.09, marking will increase of 11%, 14% and 17%, respectively.

Click on right here to obtain our most up-to-date Positive Evaluation report on Visa (preview of web page 1 of three proven under):

Mega Cap Inventory #8: Pfizer Inc. (PFE)

- 5-year anticipated annual returns: 8.6%

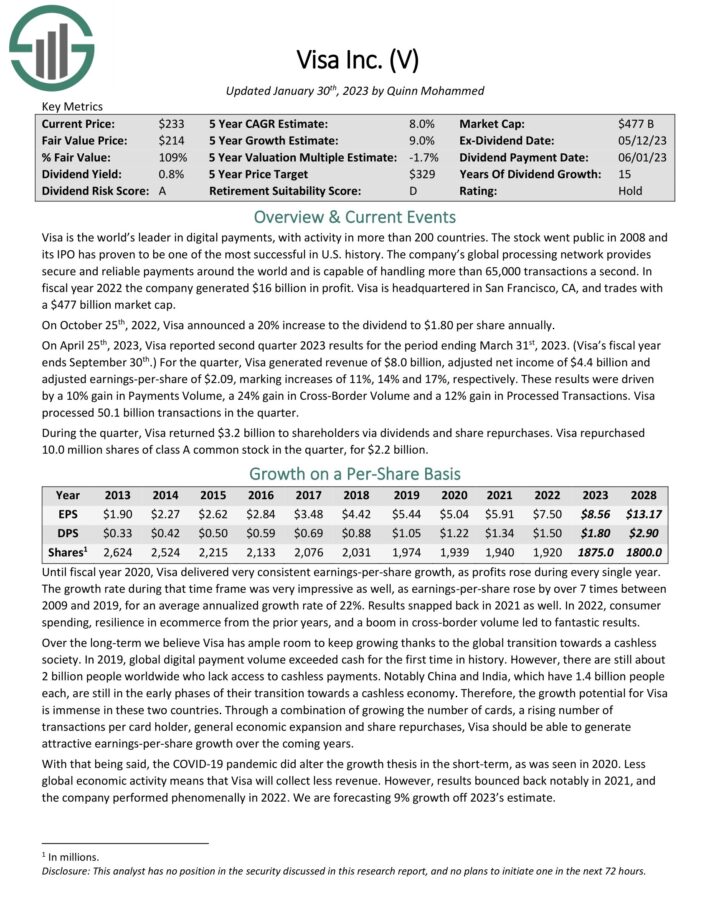

Pfizer Inc. is a world pharmaceutical firm that focuses on prescribed drugs and vaccines.

Pfizer’s new CEO accomplished a collection of transactions considerably altering the corporate construction and technique. Pfizer fashioned the GSK Shopper Healthcare Joint Enterprise in 2019 with GlaxoSmithKline plc (GSK), which incorporates Pfizer’s over-the-counter enterprise. Pfizer owns 32% of the JV. Pfizer spun off its Upjohn section and merged it with Mylan forming Viatris for its off patent, branded and generic medicines in 2020.

Pfizer’s high merchandise are Eliquis, Ibrance, Prevnar, Enebrel (worldwide), Sutent, Xtandi, Vyndaqel/ Vyndamax, Inlyta, Xeljanz, Plaxlovid, and Comiranty.

Pfizer reported Q1 2023 outcomes on Could 2nd, 2023. Firm-wide income fell (-29%) to $18,282M from $25,661M and adjusted diluted earnings per share dropped (-24%) to $1.23 versus $1.62 on a year-over-year foundation due to declining COVID-19 vaccine and anti-viral drug gross sales. Diluted GAAP earnings per share fell (-29%) to $0.97 from $1.37 in comparable quarters.

Click on right here to obtain our most up-to-date Positive Evaluation report on Pfizer (preview of web page 1 of three proven under):

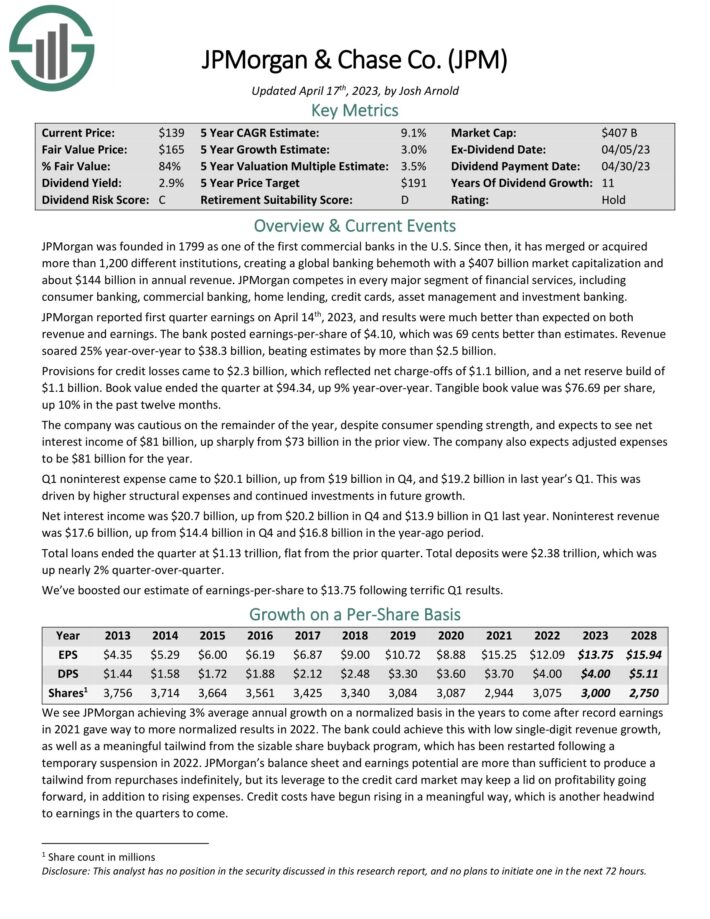

Mega Cap Inventory #7: JP Morgan Chase (JPM)

- 5-year anticipated annual returns: 9.0%

JPMorgan was based in 1799 as one of many first business banks within the U.S. Since then, it has merged or acquired greater than 1,200 totally different establishments, creating a world banking behemoth with about $124 billion in annual income. JPMorgan competes in each main section of economic providers, together with client banking, business banking, house lending, bank cards, asset administration and funding banking.

JPMorgan reported first quarter earnings on April 14th, 2023, and outcomes had been significantly better than anticipated on each income and earnings. The financial institution posted earnings-per-share of $4.10, which was 69 cents higher than estimates. Income soared 25% year-over-year to $38.3 billion, beating estimates by greater than $2.5 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on JPM (preview of web page 1 of three proven under):

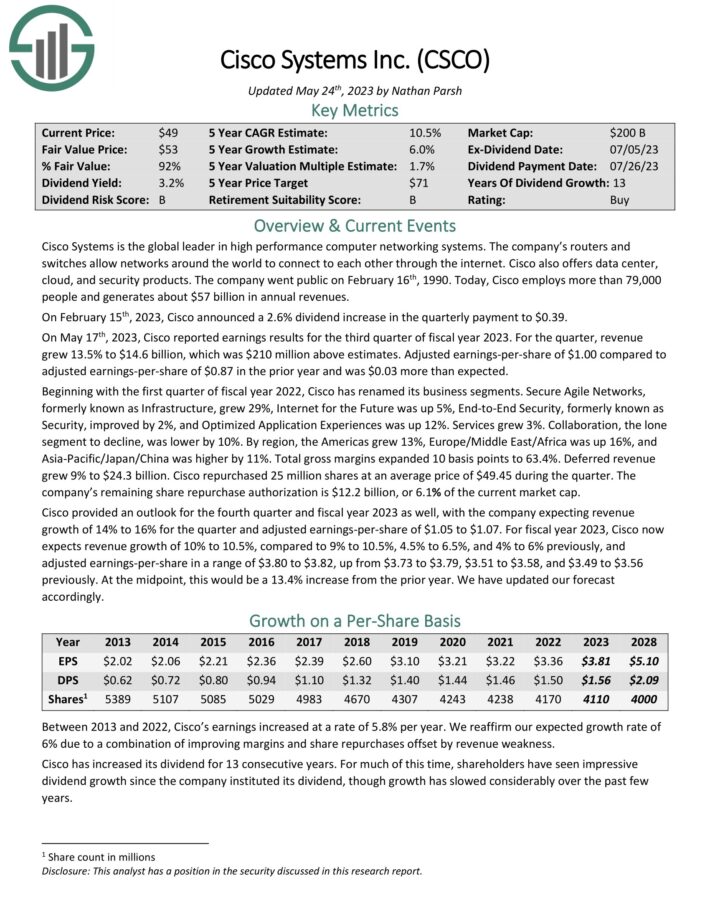

Mega Cap Inventory #6: Cisco Methods (CSCO)

- 5-year anticipated annual returns: 9.8%

Cisco Methods is the worldwide chief in high-performance laptop networking programs. The corporate’s routers and switches permit networks worldwide to attach to one another by means of the web. Cisco additionally gives knowledge heart, cloud, and safety merchandise. Cisco generates about $51 billion in annual revenues.

On Could seventeenth, 2023, Cisco reported earnings outcomes for the third quarter of fiscal yr 2023. For the quarter, income grew 13.5% to $14.6 billion, which was $210 million above estimates. Adjusted earnings-per-share of $1.00 in comparison with adjusted earnings-per-share of $0.87 within the prior yr and was $0.03 greater than anticipated.

Click on right here to obtain our most up-to-date Positive Evaluation report on Cisco Methods (CSCO) (preview of web page 1 of three proven under):

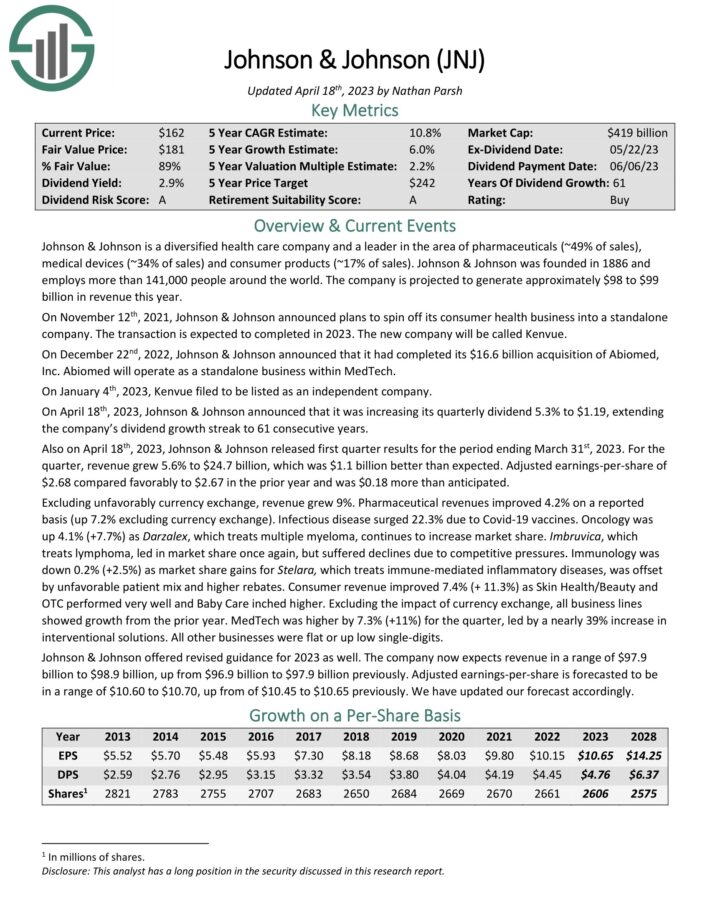

Mega Cap Inventory #5: Johnson & Johnson (JNJ)

- 5-year anticipated annual returns: 10.6%

Johnson & Johnson is a world healthcare big. The corporate presently operates three segments: Shopper, Pharmaceutical, and Medical Gadgets & Diagnostics. The company contains roughly 250 subsidiary corporations with operations in 60 international locations and merchandise offered in over 175 international locations.

Johnson & Johnson’s key aggressive benefit is the scale and scale of its enterprise. The corporate is a worldwide chief in a number of healthcare classes. Johnson & Johnson’s diversification permits it to proceed to develop even when one of many segments is underperforming.

The corporate has elevated its dividend for 60 consecutive years, making it a Dividend King. The inventory is owned by many well-known cash managers. For instance, J&J is a Kevin O’Leary dividend inventory.

Click on right here to obtain our most up-to-date Positive Evaluation report on JNJ (preview of web page 1 of three proven under):

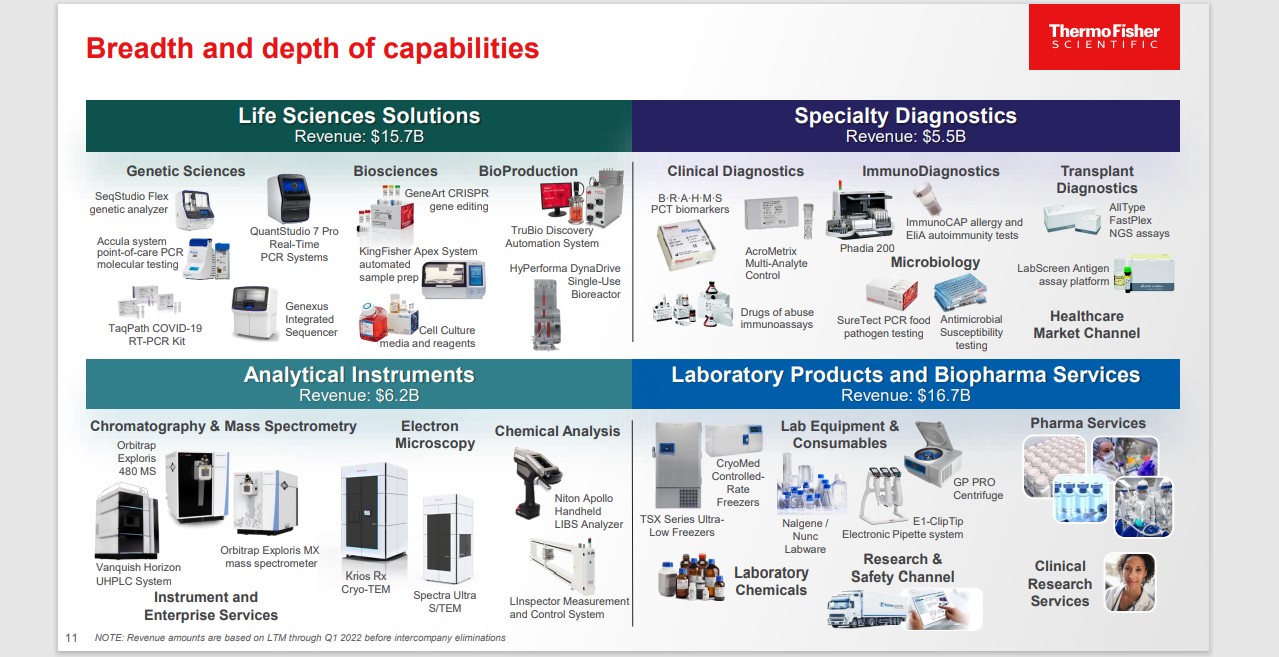

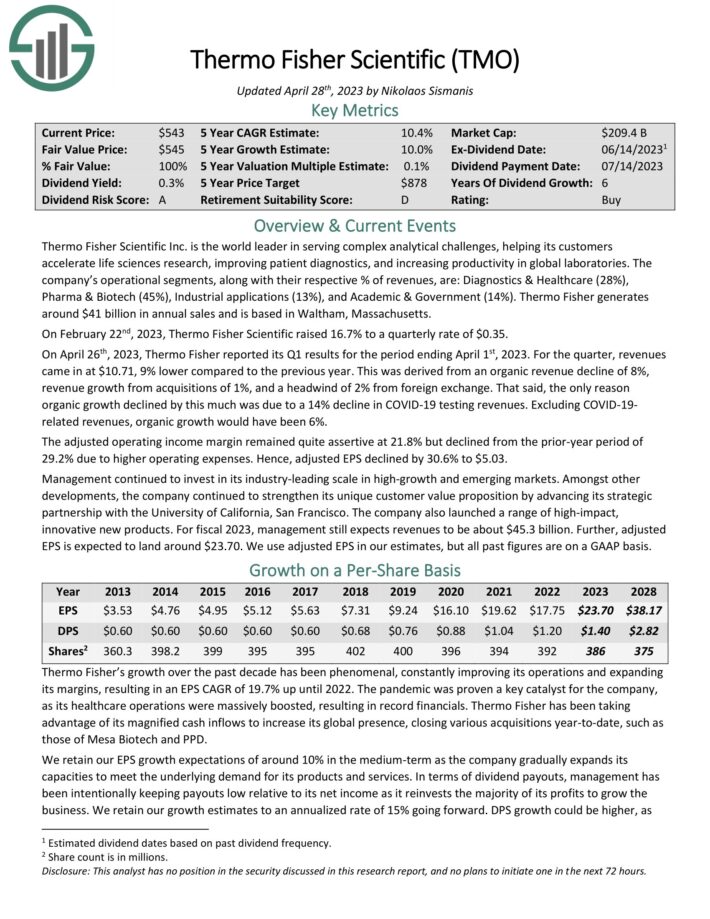

Mega Cap Inventory #4: Thermo Fisher (TMO)

- 5-year anticipated annual returns: 11.2%

Thermo Fisher Scientific Inc. is the world chief in serving complicated analytical challenges, serving to its prospects speed up life sciences analysis, enhancing affected person diagnostics, and growing productiveness in world laboratories.

The corporate’s operational segments, together with their respective % of revenues, are: Diagnostics & Healthcare (28%), Pharma & Biotech (45%), Industrial purposes (13%), and Tutorial & Authorities (14%). Thermo Fisher generates round $41 billion in annual gross sales.

Supply: Investor Presentation

Click on right here to obtain our most up-to-date Positive Evaluation report on TMO (preview of web page 1 of three proven under):

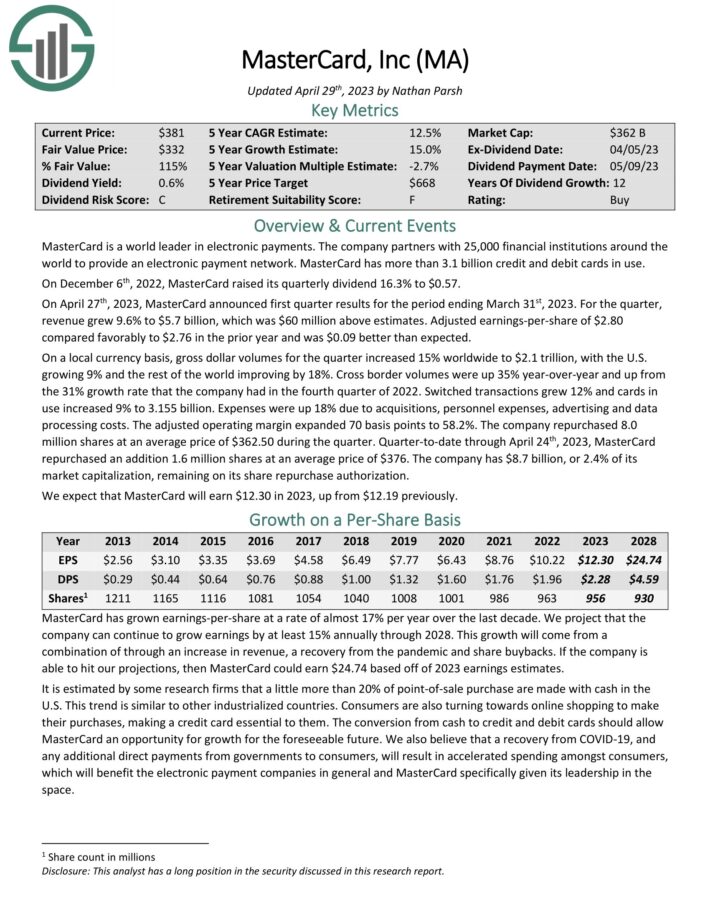

Mega Cap Inventory #3: Mastercard Inc. (MA)

- 5-year anticipated annual returns: 12.7%

Mastercard is a world chief in digital funds. The corporate companions with 25,000 monetary establishments world wide to offer an digital cost community. Mastercard has practically 3 billion credit score and debit playing cards in use.

On April twenty seventh, 2023, MasterCard introduced first quarter outcomes for the interval ending March thirty first, 2023. For the quarter, income grew 9.6% to $5.7 billion, which was $60 million above estimates. Adjusted earnings-per-share of $2.80 in contrast favorably to $2.76 within the prior yr and was $0.09 higher than anticipated.

Click on right here to obtain our most up-to-date Positive Evaluation report on Mastercard (preview of web page 1 of three proven under):

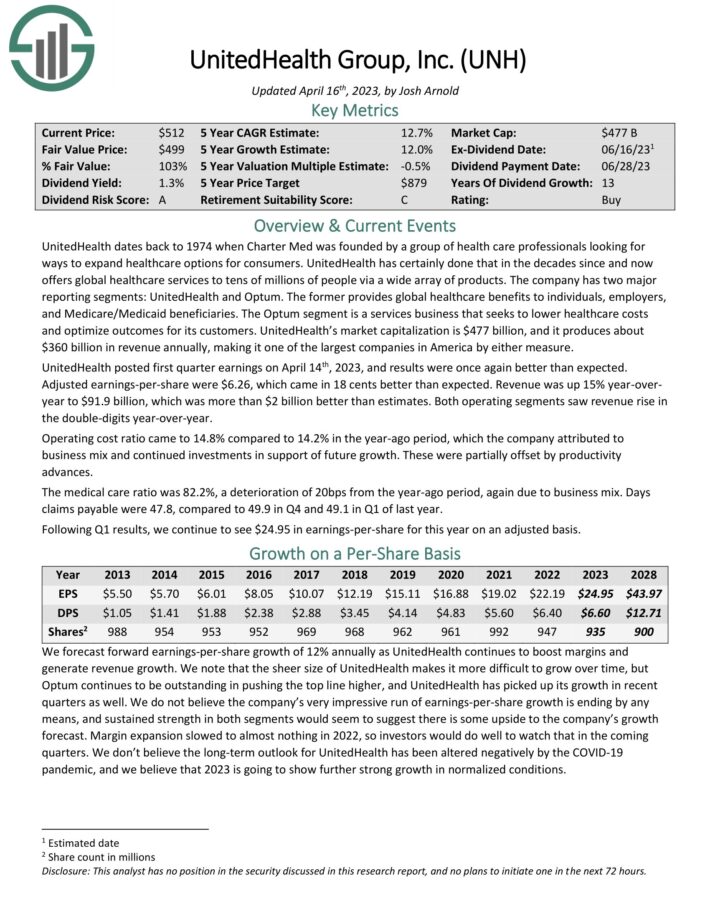

Mega Cap Inventory #2: UnitedHealth Group (UNH)

- 5-year anticipated annual returns: 14.2%

UnitedHealth dates again to 1974 when Constitution Med was based by a gaggle of well being care professionals searching for methods to increase healthcare choices for shoppers. UnitedHealth has definitely achieved that within the many years since and now gives world healthcare providers to tens of tens of millions of individuals by way of a wide selection of merchandise.

The corporate has two main reporting segments: UnitedHealth and Optum. The previous offers world healthcare advantages to people, employers, and Medicare/Medicaid beneficiaries. The Optum section is a providers enterprise that seeks to decrease healthcare prices and optimize outcomes for its prospects. UnitedHealth produces about $321 billion in income yearly, making it one of many largest corporations in America by both measure.

Click on right here to obtain our most up-to-date Positive Evaluation report on UnitedHealth (preview of web page 1 of three proven under):

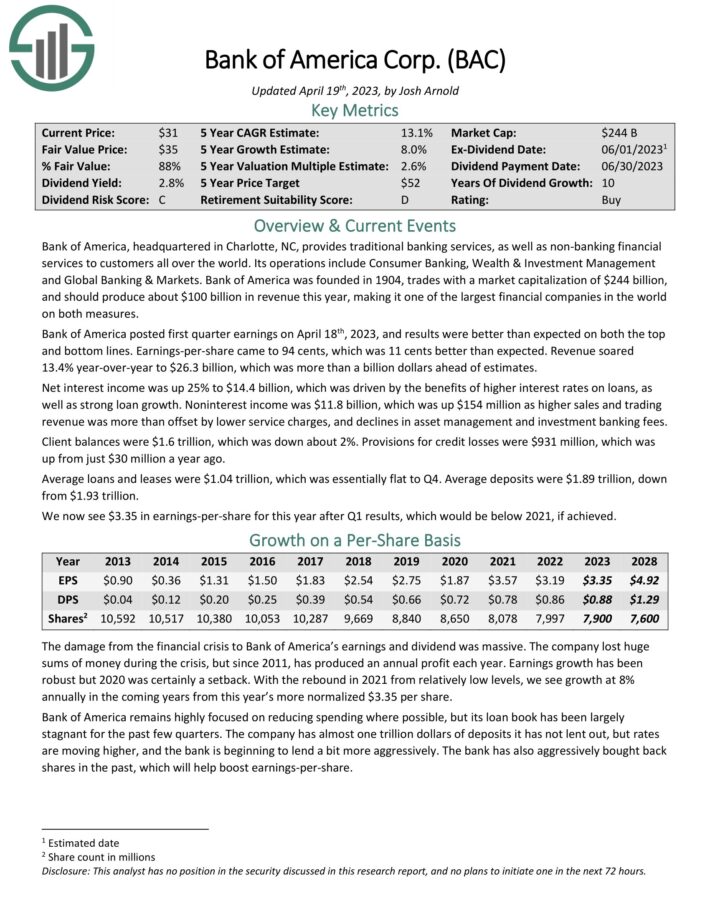

Mega Cap Inventory #1: Financial institution of America (BAC)

- 5-year anticipated annual returns: 15.2%

Financial institution of America, headquartered in Charlotte, NC, offers conventional banking providers, in addition to non–banking monetary providers to prospects throughout the world. Its operations embrace Shopper Banking, Wealth & Funding Administration and World Banking & Markets.

Financial institution of America was based in 1904, and may produce about $89 billion in income this year. Financial institution of America is one of many largest monetary shares on the planet.

Click on right here to obtain our most up-to-date Positive Evaluation report on Financial institution of America (preview of web page 1 of three proven under):

Last Ideas

Mega cap shares provide traders entry to the most important and customarily most worthwhile corporations on the planet. The group tends to carry up higher throughout downturns and provide traders regular streams of income and earnings.

Most of the shares on this record provide traders beneficiant dividend yields as effectively, however all of them have excessive potential whole returns. These 10 shares, we consider, collectively provide traders a beautiful mix of progress, worth and yield.

Additional Studying: The 7 Finest Dividend Healthcare Shares Now

Different Dividend Lists

The next lists comprise many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link