When commodity costs take off within the quick time period individuals are inclined to worry long-term adjustments to their on a regular basis lives, particularly on the subject of one with such giant implications downstream as crude oil does. Positive, extra drivers are going electrical with each passing day, however the overwhelming majority of the inhabitants remains to be reliant on crude oil’s byproducts for not solely automotive journey utilizing gasoline but additionally air journey that’s depending on jet gas.

So how out of hand can the value tag on the pump or in your subsequent journey get? And what are you able to do about excessive crude oil costs?

Historic Crude Oil Costs

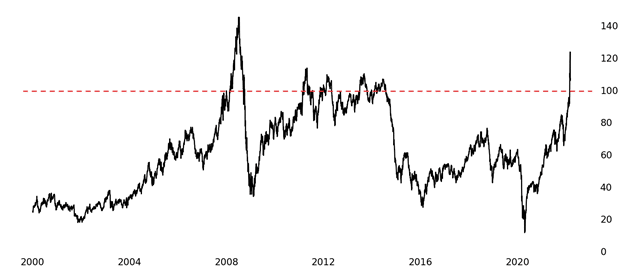

Going again to 2000, the very best crude oil value was $145 per barrel, which suggests final week’s value motion and its results are usually not far off from historic highs. In the identical time-frame, crude closed above $100 simply 8% of the time and spent simply 20 days above the watermark earlier than reversing under it, on common.

Crude Oil Above $100

That is all to say that crude oil above $100 is a uncommon sight, traditionally talking, and making brash, long-term choices based mostly on such an outlier may not be essentially the most prudent.

Find out how to Brief Crude Oil

Except for buying and selling in your gas-powered automotive for an electrical one or just attempting to not use the commodity’s byproducts for the subsequent few weeks, you should use futures to promote excessive crude oil costs.

SMO Small Crude Oil Futures

You should utilize Small Crude Oil futures to take a position on the place costs for the vitality could be headed at 1/tenth the scale of the normal CL futures. Assume crude costs will fall from their latest highs? You may promote SMO and revenue $100 with each $1 decline within the commodity. Assume crude costs will proceed to rise? You should buy SMO and revenue $100 with each $1 rise within the commodity.

There’s usually discuss of a brand new regular being set when markets hit extremes, however, as a rule, the previous regular stays dominant. Solely time will inform with crude oil costs, and you may entry them in a direct, comparatively small vogue.

*All instance knowledge taken on 3/4/22

—

To be taught extra about how the Small Alternate is merging the effectivity of futures with the readability of shares, be certain that to subscribe to their YouTube channel and comply with them on Twitter so that you by no means miss an replace.

© 2022 Small Alternate, Inc. All rights reserved. Small Alternate, Inc. is a Designated Contract Market registered with the U.S. Commodity Futures Buying and selling Fee. The data on this commercial is present as of the date famous, is for informational functions solely, and doesn’t contend to handle the monetary goals, state of affairs, or particular wants of any particular person investor. Buying and selling futures entails the danger of loss, together with the opportunity of loss larger than your preliminary funding.