Revealed on April 3, 2022, by Felix Martinez

There are many excessive dividend yield shares available in the market. However only a few excessive yield shares with a protected and rising dividend. Franklin Sources Inc. (BEN) is a kind of few excessive yield shares with a protected, excessive yield dividend that’s rising yearly.

We additionally cowl numerous different totally different high-yield shares in our database.

Now we have created a spreadsheet of shares (and intently associated REITs and MLPs, and so forth.) with dividend yields of 5% or extra…

You may obtain your free full listing of all securities with 5%+ yields (together with essential monetary metrics comparable to dividend yield and payout ratio) by clicking on the hyperlink under:

This text analyzes high-yield inventory Franklin Sources intimately. Whereas it doesn’t have a 5.0%+ yield at the moment, its dividend yield of 4.2% remains to be excessive, particularly in at present’s low-interest-rate setting.

Enterprise Overview

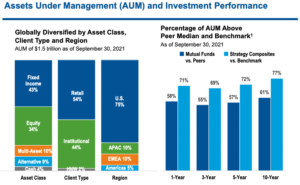

Franklin Sources, based in 1947 and headquartered in San Mateo, CA, is a world asset supervisor with an extended and profitable historical past. The corporate gives funding administration and associated providers to its prospects, together with gross sales, distribution, and shareholder servicing. As of December 31, 2021, property below administration (AUM) totaled $1.578 trillion. The corporate has a present market capitalization of 14.02 billion.

Supply: FranklinResources

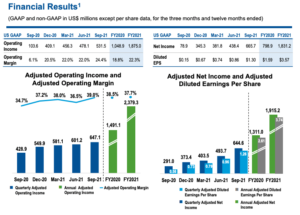

On February 1, 2022, the corporate reported first-quarter outcomes for Fiscal Yr (FY)2022. The corporate fiscal 12 months ends in September. Complete income for the quarter was $2,224 million in comparison with $1,995.1 million in whole income the corporate made in 1Q2021, or an 11% improve. The funding administration charges section, which is the corporate’s main income, grew by 14% for the quarter year-over-year. The gross sales and distribution charges section was flat, whereas the shareholder servicing charges section noticed a detrimental development of three% 12 months over 12 months.

Working earnings grew 36% in comparison with the primary quarter of 2021. The reported working earnings was $557.7 million in comparison with $409.1 million a 12 months in the past for a similar interval. This was achieved even with the rise in whole working bills of 5%.

Thus, adjusted internet income3 was $553.6 million, and adjusted diluted earnings per share was $1.08 for the quarter, in comparison with $644.6 million and $1.26 for the earlier quarter, and $373.4 million and $0.73 for the quarter ended December 31, 2020. This represents a big improve of 47.9% in comparison with the primary quarter interval.

The corporate CEO Jenny Johnson was delighted with the consequence for the primary quarter. The corporate diversifies its enterprise throughout merchandise, geographies, automobiles, and asset courses. It will, in flip, assist create broader sources of income and development potential. Total, all asset courses noticed improved long-term internet flows for the quarter, and options posted a tenth consecutive quarter of long-term internet inflows.

Total, on an Incomes per-share foundation, the corporate made $3.74 for FY2021, which is a rise of 43% in comparison with the $2.61 per share the corporate made in 2020. We count on the corporate will earn $3.50 per share for FY2022. It will characterize a lower of 1% versus FY2021. That is anticipated as a result of the market is predicted to have a modest to flat development 12 months.

Supply: Investor Presentation

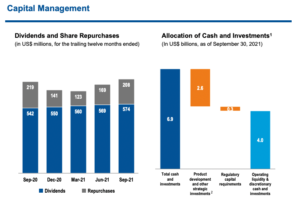

On November 1, 2021, the corporate introduced the acquisition of Lexington Companions, a World Chief in Secondary Non-public Fairness and Co-Investments. Franklin Templeton is buying 100% of Lexington from its present house owners for a money fee of $1.75 billion, made up of $1 billion at shut and extra funds totaling $750 million over the subsequent three years. The transaction will likely be funded from Franklin Templeton’s current steadiness sheet assets and is predicted to be instantly added and improve its adjusted earnings per share.

Progress Prospects

The primary development driver for the corporate will come from acquisitions in addition to an inflow of inflows from present shoppers/prospects. For instance, the corporate generated $24.1 billion in inflows, which helped raise the whole AUM. Nevertheless, charge compression is predicted to be an ongoing subject for U.S.-based lively asset managers. Thus. we expect that Franklin Sources will battle to generate greater than low-single-digit optimistic annual top-line development throughout the subsequent 5 years. Consequently, earnings margin may also see stress as firms like Franklin Sources spend extra closely to enhance funding efficiency and improve distribution capabilities.

Supply: Investor Presentation

Aggressive Benefits & Recession Efficiency

Franklin Sources has a slim financial moat round its operations. It is because the corporate has well-known manufacturers like Franklin, Templeton, Western Asset Administration, ClearBridge Investments, Brandywine World, Clarion Companions, Martin Currie, and Royce & Associates. The corporate additionally has about $1.578 trillion in AUM. This helps the corporate by offering it with the dimensions and scale essential to be aggressive.

The corporate carried out terribly throughout the Nice Recession of 2008-2010. The inventory worth noticed a lower of over 59% from the excessive of 2007 to the low in 2009, and earnings decreased in that very same interval.

BEN’s earnings-per-share all through the Nice Recession:

- 2007 earnings-per-share of $2.34

- 2008 earnings-per-share of $2.23 (5% lower)

- 2009 earnings-per-share of $1.30 (42% lower)

- 2010 earnings-per-share of $2.11 (63% improve)

As you see, the corporate didn’t do nicely throughout the 2008-2009 Nice Recession. Earnings and the inventory worth decreased in these years. Thankfully, the corporate didn’t have to chop its dividend. Earnings in these years lined the dividend very nicely. As a matter of reality, the corporate elevated its dividend yearly throughout the Nice Recession.

Dividend Evaluation

The corporate has a really spectacular dividend historical past. The corporate has been growing its dividend for forty-two consecutive years. Over the previous ten years, the dividend has had a Compound Annual Progress Charge (CAGR) of 12.9%. Nevertheless, the corporate has been slowing down its dividend development charge in recent times. Over the previous 5 years, the dividend CAGR has been 9.2%, and over the previous three years, it has been 6.8%.

The latest dividend improve was introduced on February 23, 2022. The corporate reported a 4.0% improve in its dividend. Thus, the dividend improve charge has been slowing down noticeably.

The corporate additionally sports activities a really wholesome dividend payout ratio. Final 12 months, the corporate earned $3.47 per share and paid out a dividend of $1.12 per share. This offers us a dividend payout ratio of 29.9%. For FY2022, we count on the corporate to make $3.50 per share and payout $1.16 in dividends per share. Thus, giving us a dividend payout ratio of 33%.

Throughout the Nice recession, the dividend payout ratio was not below stress. For instance, from 2007 to 2010 the dividend payout ratio was 8.5%, 12%, 21.6%, and 13.9%, respectively

Supply: Investor Presentation

The corporate additionally has a stable steadiness sheet. The corporate has a 0.7 debt-to-equity ratio, which is first rate, and an curiosity protection ratio of 35.7. Moreover, Franklin Sources has an S&P Credit score Score of “A.” This credit standing is an investment-grade ranking from S&P.

Thus, the steadiness sheet is in glorious situation and will assist the corporate face up to a recession with out a dividend lower. Subsequently, we expect the dividend could be very protected.

Ultimate Ideas

Franklin Sources is an asset supervisor that should battle the rise of low-cost investing, which has been accountable for prospects transferring cash from actively managed funds to ETFs. The corporate is in an fascinating state of affairs the place the core enterprise is declining, however the monetary basis has been steady. The dividend could be very nicely lined with earnings. Additionally, the corporate steadiness sheet could be very wholesome. Total, the corporate is an excellent inventory to contemplate as a excessive dividend yield inventory. It will make each dividend development and earnings buyers very joyful for years to return.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].