Key Takeaways

- Decentraland continues to commerce round its resistance stage.

- The Sandbox seems to have damaged out with out bullish continuation.

- Each MANA and SAND are awaiting a spike in purchase orders to advance additional.

Share this text

Decentraland and The Sandbox seem like getting ready to a bullish breakout. Nonetheless, each Metaverse tokens will want a spike in shopping for stress to realize their upside potential.

Decentraland Exams Resistance

Decentraland continues to consolidate inside a good vary whereas trying to slice by means of resistance.

The Metaverse sport’s MANA token has seen its worth motion getting narrower over time. Up to now week, MANA has largely traded between $2.60 and $2.76 with out offering a transparent course.

From a technical perspective, it seems to be caught inside a symmetrical triangle that has been forming since late January. A descending trendline has developed together with the swing highs, whereas an ascending trendline fashioned together with the swing lows. This continuation sample estimates {that a} decisive each day shut above $2.70 might propel MANA to $3.80.

Nonetheless, Decentraland should proceed to commerce above $2.27 to validate the bullish outlook. Failing to take action might encourage market members to exit their lengthy positions, including stress on the token. Below such circumstances, MANA might retrace to $2 and even $1.72.

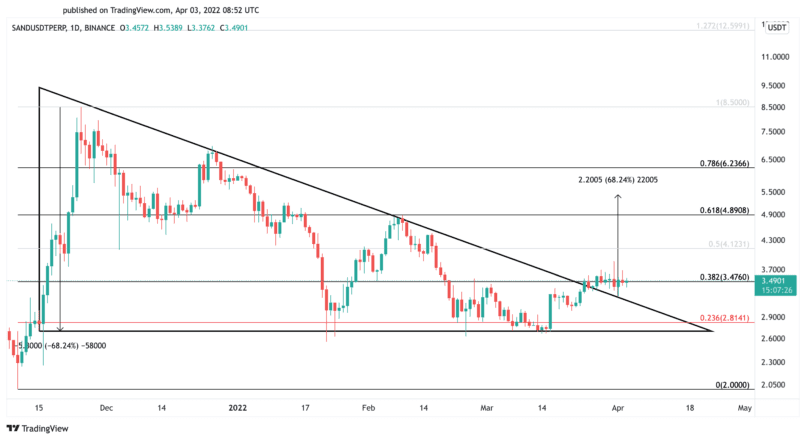

The Sandbox Prepares to Surge

The Sandbox may very well be positioning itself for a bullish impulse, nevertheless it’s missing the upward stress it must rise.

The Sandbox’s SAND token has remained stagnant over the previous week after slicing by means of a vital resistance space. It’s been consolidating between $3.30 and $3.70 whereas sustaining a bullish bias.

SAND seems to have damaged out of a descending triangle that developed on its each day chart since mid-November 2021. The technical formation anticipates {that a} spike in shopping for stress across the present worth ranges might propel SAND towards $5.50, representing a 68% enhance.

Given the low buying and selling quantity SAND has seen over the previous week, the Metaverse token might see an invalidation of the bullish thesis. A downswing that pushes SAND under $2.81 may very well be an indication that costs will dip decrease. SAND might then crumble underneath stress and take a look at the $2 assist stage.

Disclosure: On the time of writing, the creator of this piece owned BTC and ETH.

Share this text

OVR – the most important decentralized AR Metaverse

OVR is the decentralized infrastructure for the metaverse, merging bodily and digital world by means of Augmented Actuality, creating a brand new dimension the place the whole lot is feasible. It’s composed of 1.6 trillion distinctive hexagons…

Decentraland Eyes Rally Forward of Metaverse Vogue Week

Decentraland’s MANA token seems to be constructing bullish momentum for a possible breakout within the lead-up to its Metaverse Vogue Week occasion. Decentraland Hosts Metaverse Vogue Week MANA may very well be…

HSBC Buys Digital Land in The Sandbox’s Metaverse

HSBC, one of many world’s largest banks and monetary providers organizations, has purchased a plot of digital actual property in The Sandbox’s Metaverse to interact and join with sports activities, esports,…

ShoeFy Bringing DeFi Utility for NFTs & Metaverse

Main Metaverse vogue & DeFi platform, ShoeFy has launched its Genesis NFT Minting to supply DeFi stage utility for NFTs. Since its inception final 12 months, ShoeFy has proven outstanding innovation…