[ad_1]

Up to date on January nineteenth, 2023, by Quinn Mohammed

After a powerful 36-year streak of dividend will increase, AT&T paid the identical dividend in 2021 because it did in 2020. This marked the tip of its dividend improve streak, and the corporate then slashed its dividend 47% following the spinoff of its media enterprise in mid-2022.

Regardless of the dividend minimize in 2022, the corporate right now has a excessive yield of 5.7% at its current share value. This excessive yield may assist soften the challenges inflation is posing to present funding portfolios.

Now we have created a spreadsheet of excessive dividend shares with dividend yields of 5% or extra…

You’ll be able to obtain your free full record of all securities with 5%+ yields (together with vital monetary metrics similar to dividend yield and payout ratio) by clicking on the hyperlink beneath:

On this article, we are going to analyze the telecom behemoth AT&T Inc. (T).

Enterprise Overview

AT&T is a number one telecommunications firm, offering a variety of companies, together with wi-fi, broadband, and tv. The corporate is made up of two working segments.

First, AT&T Communications offers communications and leisure companies by cell and broadband. The section serves greater than 100 million U.S. prospects and almost 3 million enterprise prospects. In 2021, this section generated $114.7 billion in income.

Second is the AT&T Latin America section, which offers cell service to shoppers and companies in Mexico. The Latin America section generated $5.4 billion in income in 2021. Nonetheless, to notice, is that the corporate offered off the Vrio video operations in mid-November 2021, which was accountable for $2.7 billion of the $5.4 billion in that point interval.

AT&T is a large-cap inventory with a market capitalization of $140 billion. The corporate generated regular income and robust money circulation for a few years.

On April eighth, 2022, AT&T accomplished the spin-off of WarnerMedia to type the brand new firm Warner Bros. Discovery (WBD). AT&T shareholders acquired 0.241917 shares of WBD for each 1 share of AT&T they held.

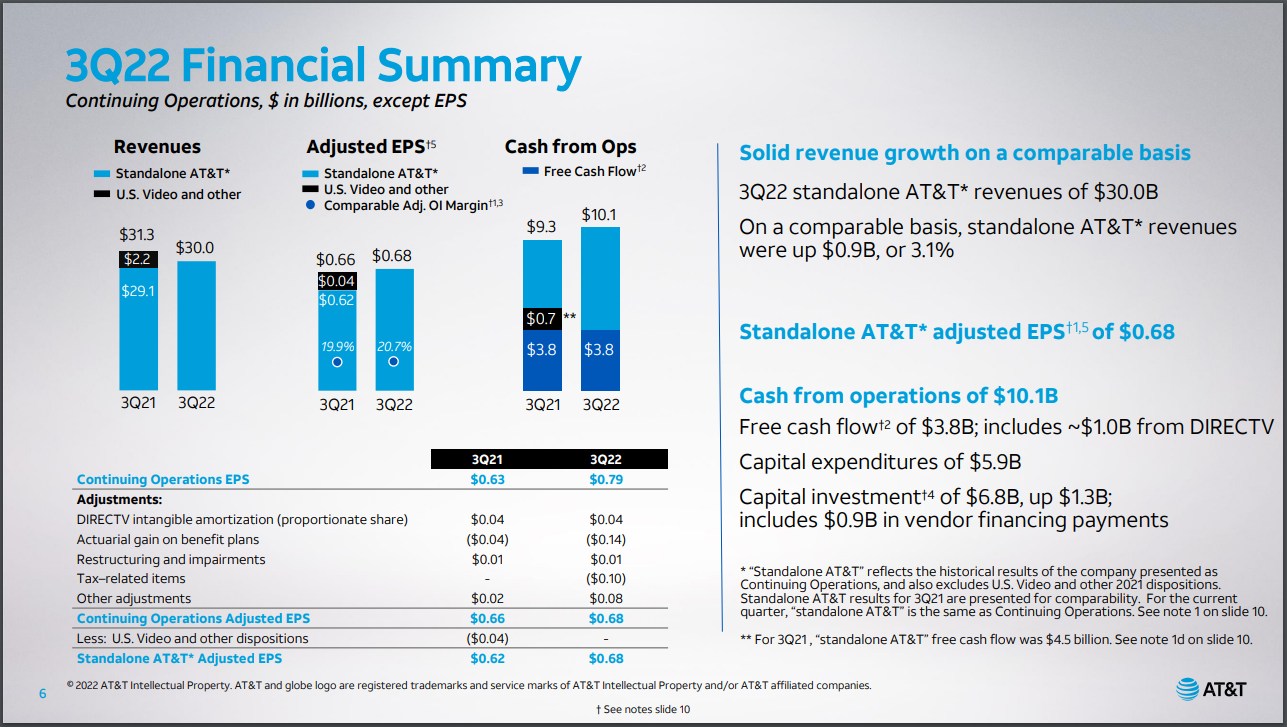

On October twentieth, 2022, AT&T reported Q3 2022 outcomes. For the quarter, the corporate generated $30.0 billion in income from persevering with operations, down -4.1% from $31.3 billion in Q3 2021, on account of the U.S. Video separation in July 2021. On an adjusted foundation, earnings-per-share equaled $0.68 in comparison with $0.66 within the 12 months in the past quarter.

Supply: Investor Presentation

AT&T’s web debt equaled $131.1 billion, and the corporate’s web debt-to-EBITDA ratio was 3.22x on the finish of the third quarter.

AT&T additionally offered a 2022 outlook. The corporate expects adjusted earnings-per-share of at the least $2.50 within the full 12 months.

Progress Prospects

AT&T is an enormous enterprise, and because the legislation of enormous numbers dictates, the corporate grows very slowly.

The corporate took on a great deal of debt to fund acquisitions, similar to DirecTV in 2015 and Time Warner in 2018, along with different bolt-on acquisitions. Paying down this vital amassed debt took its toll on the corporate and prevented it from investing as a lot because it in any other case would have been in a position to into its principal enterprise, telecommunications.

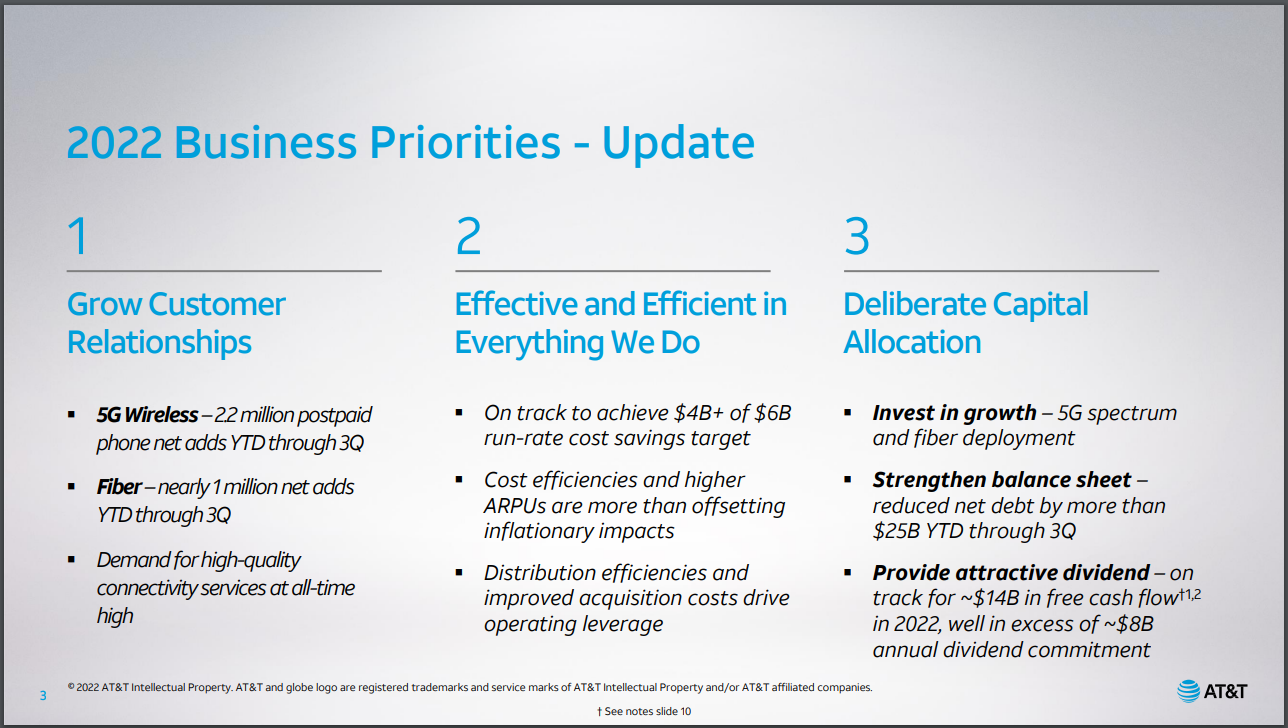

Supply: Investor Presentation

AT&T expects to spend tremendously on capital investments within the subsequent couple of years on its telecom enterprise. In 2022 and 2023 every, the corporate anticipates capital investments in extra of $20 billion. Beginning in 2024, nevertheless, these investments ought to diminish as the corporate strikes previous its peak years for capital funding in 5G and fiber.

AT&T, following the spinoff, is now an easier and extra centered firm, with the objective of turning into America’s greatest broadband supplier. This title could be appointed based mostly on its community with fiber at its basis. Via its fiber growth plans the corporate expects to assist greater than 30 million fiber areas by the tip of 2025.

The corporate will strengthen the stability sheet by decreasing its web debt with its free money circulation after dividends. AT&T continues to consider it may well cut back the web debt to adjusted EBITDA ratio to 2.5x by the tip of 2023. After having separated its media enterprise, AT&T’s renewed give attention to telecom will profit from the truth that it now not must put money into wi-fi community infrastructure and media belongings on the identical time.

For 2022 and 2023, the corporate is anticipating low-to-mid single-digit income progress, because it adjusts to the brand new make-up of the corporate. Progress will come from a rise in wi-fi service revenues and broadband income. Moreover, the corporate is on observe to realize greater than $4 billion out of the $6 billion run-rate value financial savings goal by the tip of 2022, which in impact will gas progress in adjusted EBITDA within the coming years.

Aggressive Benefits & Recession Efficiency

AT&T has a aggressive benefit with its entrenched place in varied vital industries. The corporate additionally operates a recession-resistant enterprise. AT&T enjoys regular demand, as most shoppers require their broadband and wi-fi service, even throughout recessions.

AT&T’s earnings-per-share throughout the Nice Recession are beneath:

- 2007 earnings-per-share: $2.76

- 2008 earnings-per-share: $2.16

- 2009 earnings-per-share: $2.12

- 2010 earnings-per-share: $2.29

AT&T skilled some earnings decline throughout the Nice Recession, however the firm remained extremely worthwhile. This allowed it to proceed rising its dividend all through the time interval and past. AT&T eclipsed its pre-recession earnings degree, however it took till 2016. Nonetheless, the corporate paid a dividend that was properly coated all through the final decade.

Within the COVID-19 pandemic 12 months of 2020, the enterprise held up fairly properly. Whereas many companies confronted great challenges because of the pandemic, AT&T generated robust money circulation and had a payout ratio beneath 70%. Within the present financial downturn on account of excessive inflation and rising rates of interest, AT&T’s dividend seems to be rock strong.

Dividend Evaluation

Following the Time Warner acquisition, AT&T confronted difficulties in rising its dividend meaningfully. After 36 years of consecutive dividend will increase, AT&T saved its dividend regular and misplaced its Dividend Aristocrat standing in 2021. Then in 2022, AT&T utilized the spinoff as a method to cut back its dividend cost to shareholders. In flip, this afforded the corporate the funds for its large capital funding plans.

Following the spinoff, AT&T’s new annual dividend is $1.11. On the present share value, AT&T is yielding about 5.7%. Primarily based on the corporate’s forecasted adjusted EPS of $2.55, the corporate could be paying out solely 44% of 2022 earnings as dividends.

With the decrease payout, AT&T could return to rising the dividends as soon as its new construction has been digested.

Closing Ideas

AT&T ought to profit from its renewed give attention to its principal telecom enterprise following the spin off its media belongings and its diminished dividend. Its slimmed down enterprise and improved effectivity ought to enable it to enhance the stability sheet and proceed to make large capital investments in its growth.

Regardless of the dividend discount, AT&T sports activities a excessive dividend yield of 5.7% right now. Moreover, this dividend seems to be extremely protected with a dividend payout ratio of solely 44% forecast for 2022.

Sadly, the spin-off value the corporate its Dividend Aristocrat standing. Following the digestion of the brand new enterprise construction, although, AT&T could reinstate its annual dividend will increase.

If you’re involved in discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases might be helpful:

The foremost home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them usually:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link