[ad_1]

Gold, XAU/USD, US Greenback, FOMC, Fed, Treasury Yields, GVZ Index – Speaking Factors

- The gold value seems poised for motion this week after a stint of vary buying and selling

- Treasury and actual yields are tinkering on the edges for path forward of FOMC

- If the Fed surprises markets, will actual yields and USD get away to drive gold’s path?

Beneficial by Daniel McCarthy

Get Your Free Gold Forecast

Gold continues to tread water forward of an important week of US knowledge factors and a Federal Open Market Committee (FOMC) assembly.

Whereas ISM and non-farm payrolls knowledge will likely be intently watched, the FOMC gathering would be the focus for markets. The rate of interest market has just about baked in a 25 foundation level raise within the Fed funds goal price on Wednesday.

The financial knowledge releases beneath are marked US native time however might be seen reside and adjusted to your time zone through the DailyFX financial calendar.

The post-FOMC press convention would possibly maintain sway as forecasts for additional hikes have been all however discounted by the market and potential cuts towards the tip of the yr are anticipated by charges merchants.

The response to Wednesday’s choice additional out on the yield curve would possibly see extra impression for gold. After dipping decrease final week, each nominal and actual yields have recovered going into this week.

The actual yield is the nominal yield much less the market-priced inflation price derived from Treasury inflation protected securities (TIPS) for a similar tenor.

Beneficial by Daniel McCarthy

Learn how to Commerce Gold

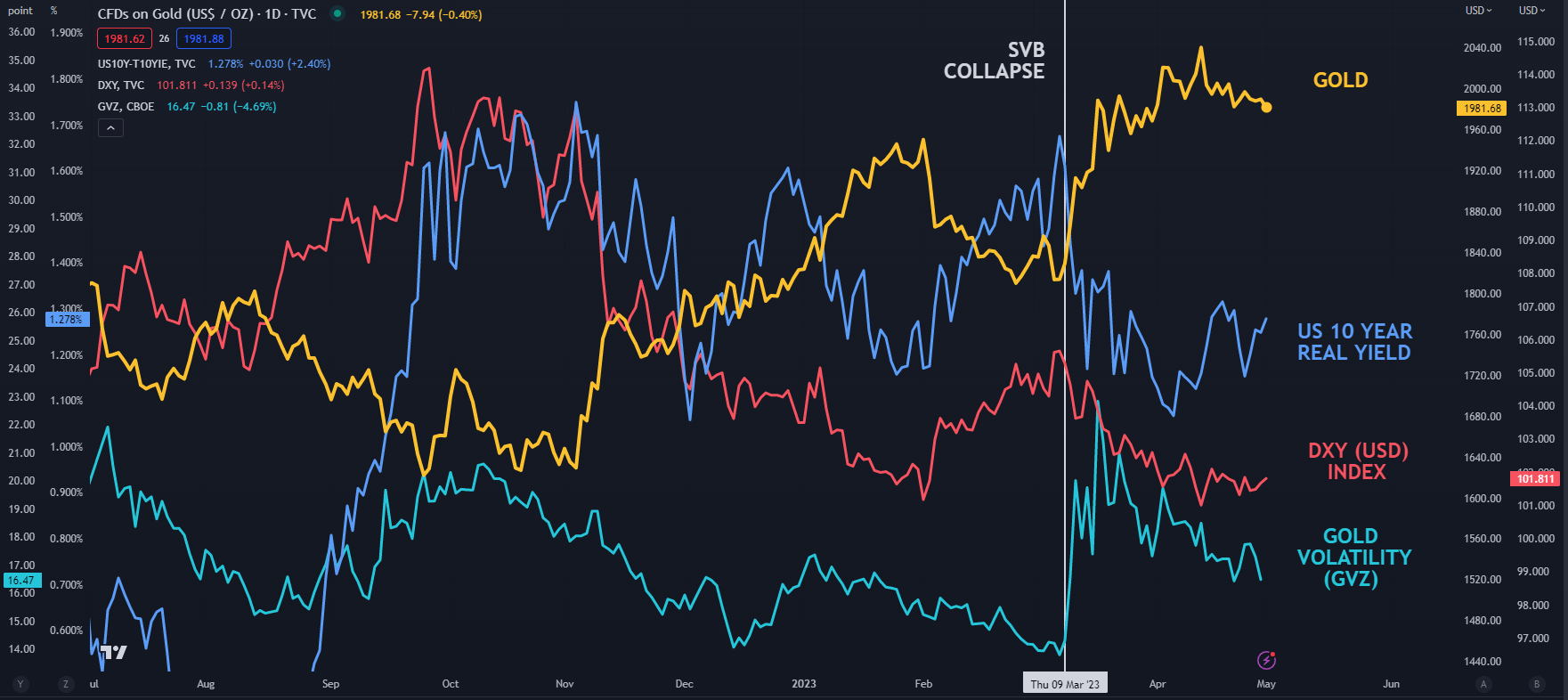

The ten-year actual yield touched 1.13% early final week however then climbed to 1.36% on Friday and is buying and selling slightly below 1.30% on the time of going to print as we speak.

That peak was a seven-week excessive for the instrument however there was little correlation to gold with the worth remaining within the US$ 1,969 – 2,049 vary of the final month.

Vital strikes in the actual yield of Treasuries might affect the worth of the yellow steel attributable to it being a non-interest-bearing asset.

With a scarcity of path in actual yields, the broad DXY (USD) index has additionally been caught in a spread of late.

The shortage of path in XAU/USD and the US Greenback index extra typically has seen gold volatility proceed to slip decrease.

Whereas it jacked increased on the SVB collapse and issues for the USA banking sector, the transfer decrease is perhaps an acceptance by the marketplace for the general increased ranges of gold.

The GVZ index is a measure of volatility within the gold value just like the VIX index’s measure of volatility within the S&P 500.

This week’s Fed assembly would possibly present the catalyst for the following transfer within the ‘large greenback’ and XAU/USD.

GOLD AGAINST US DOLLAR (DXY), US 10-YEAR REAL YIELDS AND VOLATILITY (GVZ)

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel through @DanMcCathyFX on Twitter

[ad_2]

Source link