[ad_1]

Article by IG Senior Market Analyst Axel Rudolph

FTSE 100, DAX 40, Russell 2000 Evaluation and Charts

FTSE 100 stays beneath stress

The FTSE 100 tries to stay above this week’s low at 7,323 however continues to be beneath rapid stress while buying and selling under Wednesday’s 7,430 excessive. Failure at 7,323 would put the 7,228 to 7,204 March-to-August lows again on the plate.

Whereas 7,323 underpins, the early September and early October lows at 7,369 to 7,384 are to be revisited. An increase above the following greater 7,430 excessive might result in the Could and early August lows at 7,433 to 7,438 being again in sight. Additional resistance might be seen alongside the 55-day easy transferring common (SMA) at 7,493 and on the 7,524 early September excessive.

FTSE 100 Each day Chart

Obtain the Free FTSE 100 Sentiment Information

| Change in | Longs | Shorts | OI |

| Each day | 5% | -13% | 1% |

| Weekly | 17% | -26% | 4% |

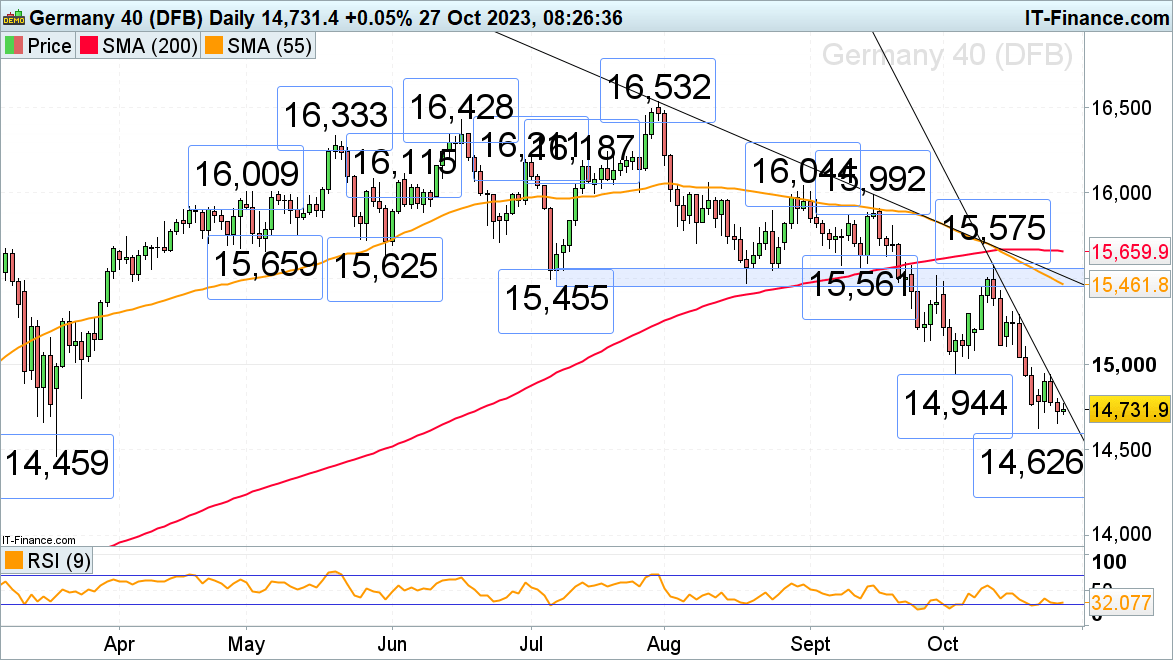

DAX 40 nonetheless trades in seven-month lows

The DAX 40’s rejection by its early October 14,944 low, which acted as resistance on Tuesday, and the truth that the index stays under its accelerated downtrend line at 14,788, continues to place stress on it with this week’s seven month low at 14,626 remaining within reach. If slipped by way of, the March trough at 14,459 could be again in focus.

Minor resistance above the accelerated downtrend line at 14,788 sits at Monday’s 14,853 excessive.

DAX 40 Each day Chart

Really useful by IG

Get Your Free Equities Forecast

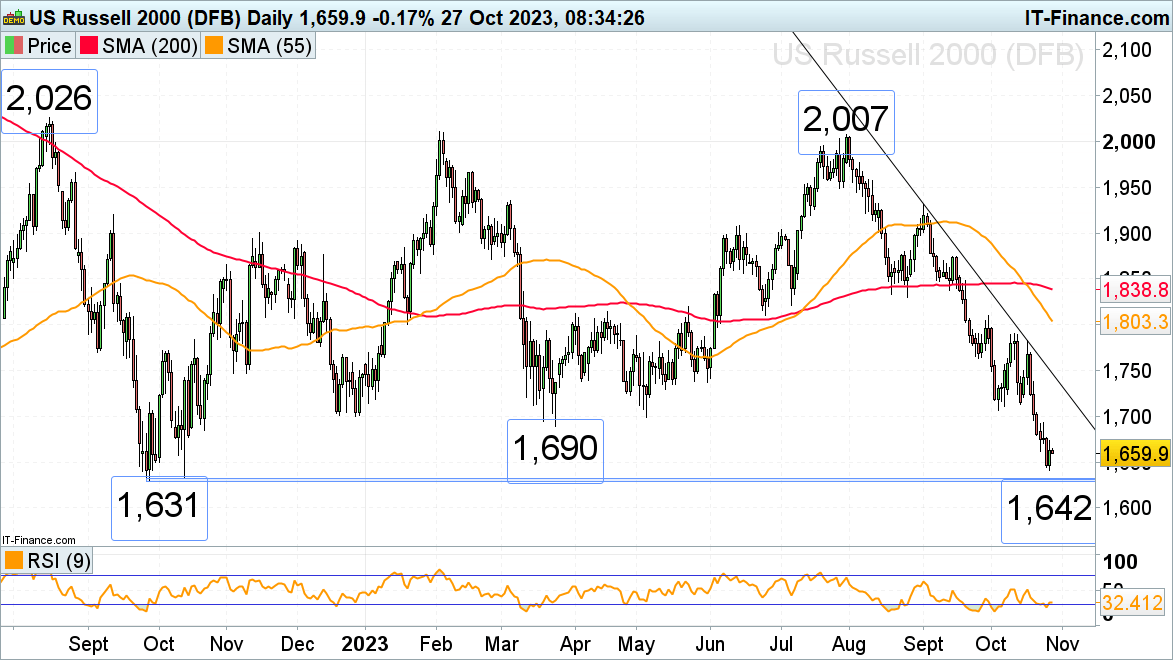

Russell 2000 trades at a one-year low above key assist

The Russell 2000, the nice underperformer of US inventory indices with a 5% detrimental efficiency year-to-date, is buying and selling in one-year lows. The index has come near its main 1,633 to 1,631 September and October 2022 lows as risk-off sentiment and worse-than-expected earnings drag the index decrease.

Whereas Thursday’s low at 1,642 holds, although, a minor bounce on short-covering trades into the weekend might ensue. The earlier December 2022 to Could main assist zone at 1,690 to 1,700, now due to inverse polarity a resistance space, could also be examined however is prone to cap. If not, minor resistance might be noticed on the 1,707 early October low and likewise on the 1,713 mid-October low.

Russell 2000 Each day Chart

High Buying and selling Alternatives for This autumn

Really useful by IG

Get Your Free High Buying and selling Alternatives Forecast

[ad_2]

Source link