[ad_1]

Economists not anticipate a recession. Such was in line with a current WSJ survey of Wall Road economists. To wit:

“Within the newest quarterly survey by The Wall Road Journal, enterprise and educational economists lowered the likelihood of a recession inside the subsequent 12 months, from 54% on common in July to a extra optimistic 48%. That’s the first time they’ve put the likelihood beneath 50% for the reason that center of final 12 months.”

The Federal Reserve additionally suggests the identical. Following the September FOMC assembly, the Federal Reserve reiterated its “increased for longer” mantra and upgraded its financial forecast to incorporate a “no recession” state of affairs.

“Fueling the optimism are three key components: inflation persevering with to say no, a Federal Reserve that’s completed elevating rates of interest, and a strong labor market and financial development which have outperformed expectations.” – WSJ

The issue with that optimism is that it’s solely primarily based on lagging financial knowledge.

Extra importantly, that lagging knowledge is topic to comparatively giant destructive revisions sooner or later.

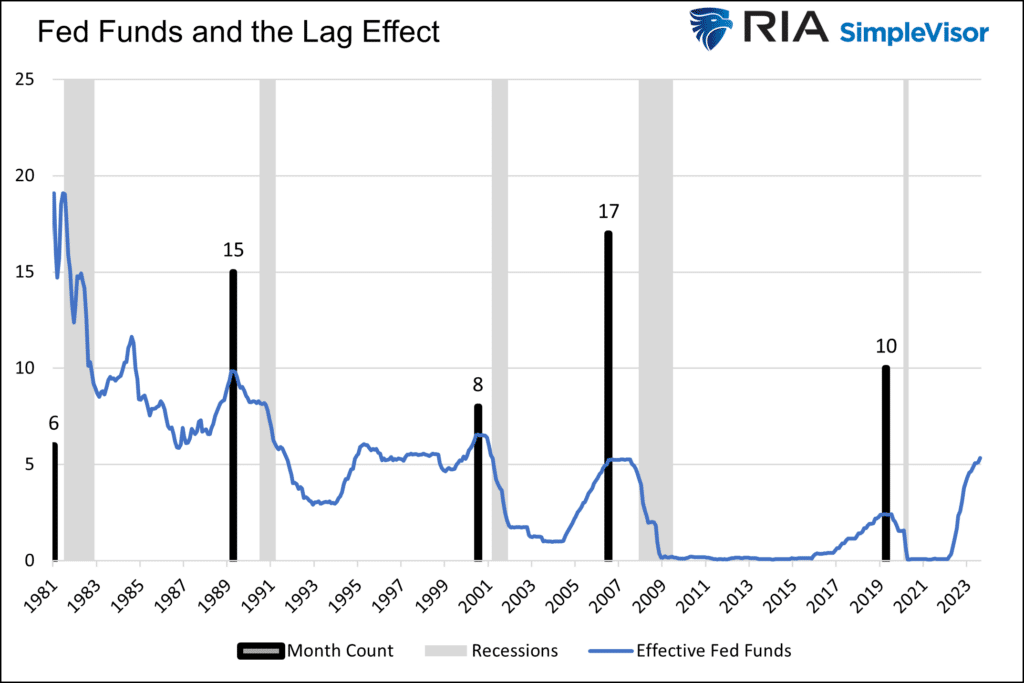

Moreover, as mentioned beforehand, tighter financial coverage’s “lag impact” remains to be working by the system. As Michael Lebowitz famous:

“Adjustments in rates of interest solely influence new debtors, together with these with maturing debt who should reissue debt to pay again traders of the maturing bonds. Accordingly, increased charges don’t influence these with fixed-rate debt that isn’t maturing. The lag impact happens because of the time it takes for the brand new debt issuance to bear sufficient weight on the economic system to sluggish it down.“

Fed Funds and The Lag Impact

Fed Funds and The Lag Impact

In different phrases, if the typical delay between the ultimate fee enhance and recession is 11 months, and the final hike was in July 2023, the chance to ahead expectations is sort of elevated.

Such is why the Fed and economists are at all times a day late and a quick.

A Day Late And A Greenback Brief

Given the dependence on financial knowledge topic to important revisions, it’s unsurprising that the Fed and economists are sometimes incorrect of their prognostications. As we famous earlier:

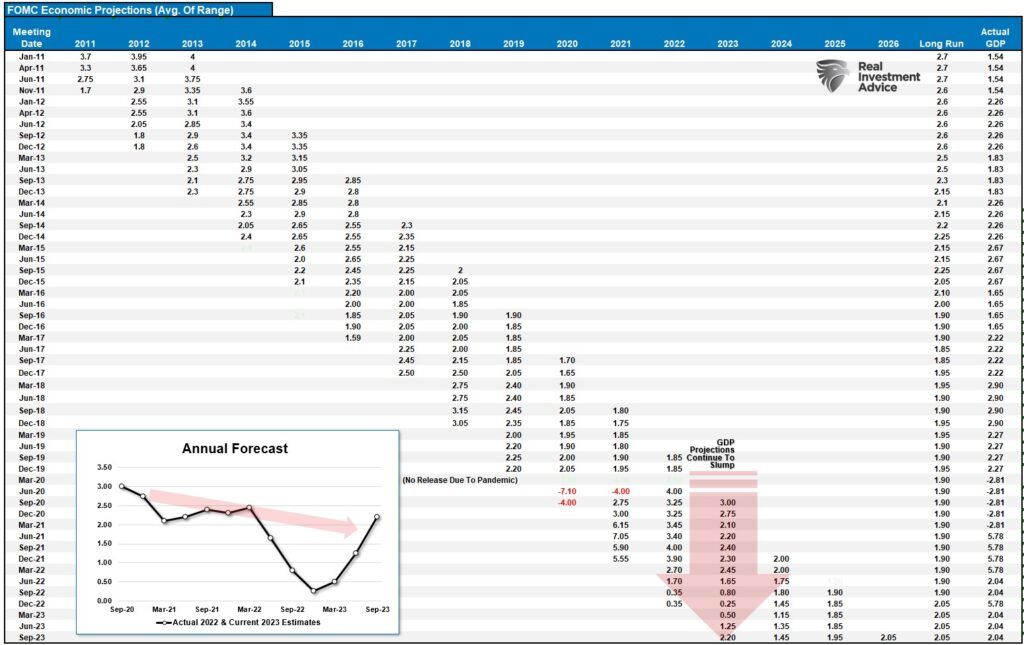

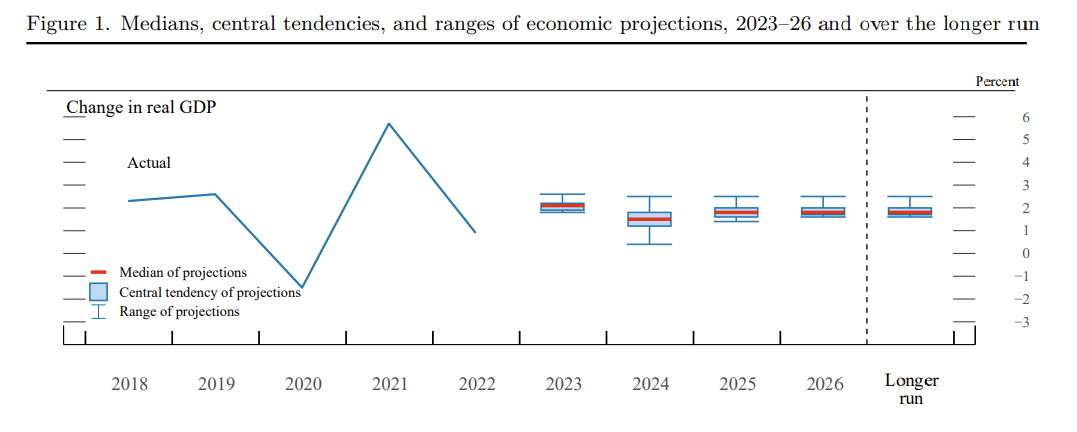

“Nevertheless, there’s a drawback with the Fed projections. They’re traditionally the worst financial forecasters ever. We now have tracked the median level of the Fed projections since 2011, they usually have but to be correct. The desk and chart present that Fed projections are at all times inherently overly optimistic.

As proven, in 2022, the Fed thought 2022 development could be close to 3%. That has been revised down to simply 2.2% at present and can seemingly be decrease by year-end. Like Wall Road analysts with earnings estimates, the Fed’s projections are at all times initially overly optimistic and guided decrease to actuality.”

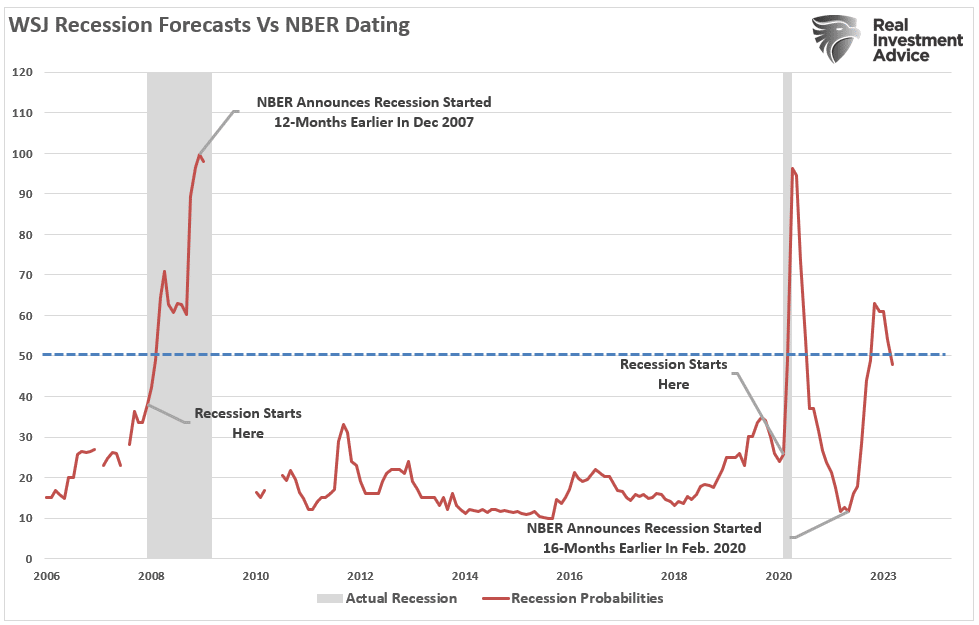

In fact, economists should not significantly better. Let’s revisit the WSJ survey of Wall Road economists from above.

Nevertheless, this time, we’ll word the dates that the Nationwide Bureau Of Financial Analysis (NBER) dated the start and finish of the final two recessions. (The WSJ survey solely dates again to 2006.)

Whereas this pattern dimension is comparatively small, it does reinforce the purpose that economists are typically incorrect a few “gentle touchdown” state of affairs.

The issue with assessing the state of the economic system immediately primarily based on present knowledge factors is that these numbers are solely “finest guesses.”

Financial knowledge is topic to substantive destructive revisions as knowledge will get collected and adjusted over the forthcoming 12- and 36-months.

Contemplate for a minute that in January 2008, Chairman Bernanke said:

“The Federal Reserve will not be at present forecasting a recession.”

In hindsight, in December 2008, the NBER dated the beginning of the official recession in December 2007.

If Ben Bernanke didn’t know a recession was underway, how would we?

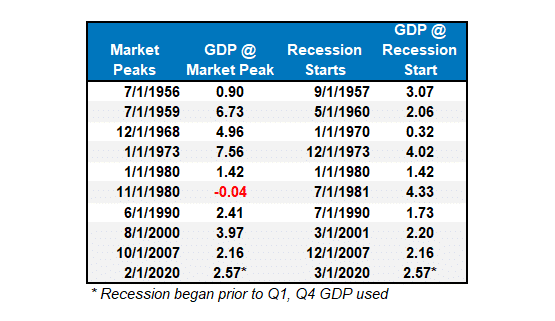

Let’s check out the information beneath of actual (inflation-adjusted) financial development charges:

NBER GDP Peak vs Recession

Every of the dates above exhibits the economic system’s development fee instantly earlier than the onset of a recession.

You’ll word within the desk above that in 7 of the final ten recessions, actual development was operating at 2% or above. In different phrases, in line with the media, there was NO indication of a recession.

However the subsequent month, one started.

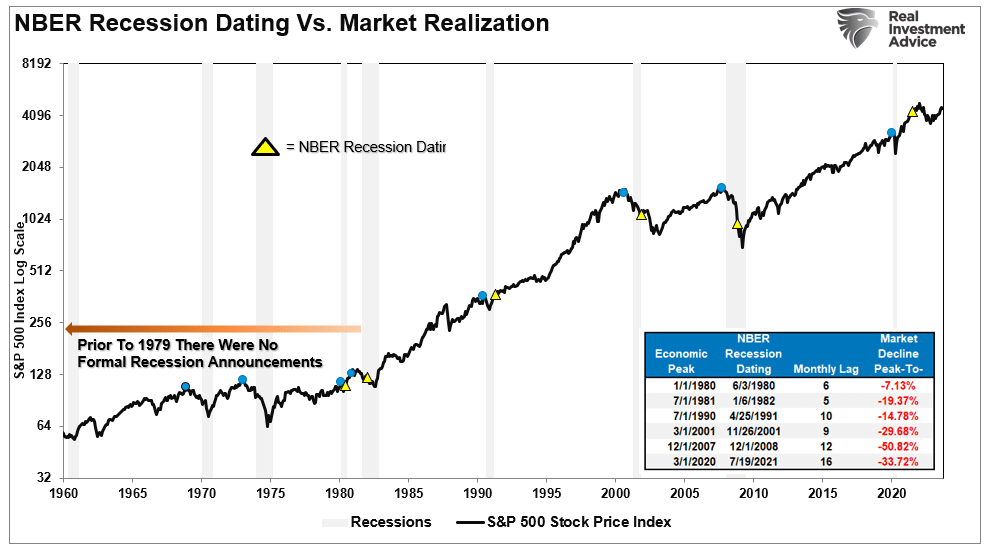

The chart beneath exhibits the with two dots. The blue dots are when the recession began.

The yellow triangle is when the NBER dated the beginning of the recession. In 9 of 10 situations, the S&P 500 peaked and turned decrease earlier than the popularity of a recession.

Do you see the issue of the “no recession” name by economists?

Ready On The Information

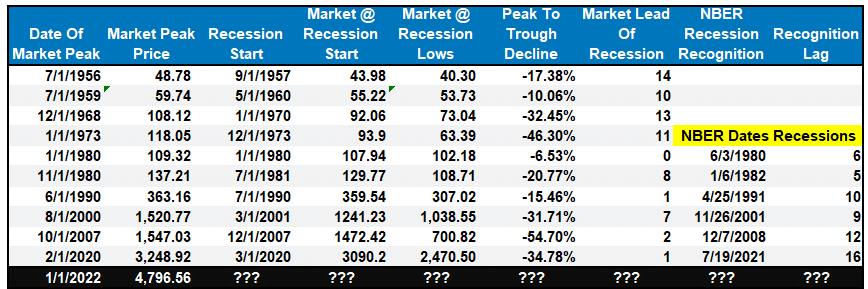

Whereas the WSJ economists are seemingly assured of their expectation of “no recession,” the financial knowledge hasn’t caught up with financial realities. The desk beneath exhibits the date of the market peak and actual GDP versus the beginning of the recession and GDP development at the moment.

Earlier than 1980, the NBER didn’t formally date recession beginning and ending factors.

For instance:

- In July 1956, the market peaked at 48.78 and began to say no.

- Financial development was growing from 0.9% and heading to three.07% in 1957. (No signal of recession)

- In September 1957, the economic system fell into recession, and the market had already fallen by virtually 10%.

- From peak to trough, the market fell 17.38%

- Notably, the market had warned of a recession 14 months upfront.

As famous above, throughout 2007, most media, analysts, and the financial neighborhood proclaimed there was “no signal of recession.”

They had been incorrect.

At present, we’re as soon as once more seeing lots of the identical . Main financial indicators, inverted yield curves, and the change in financial velocity counsel the chance of a recession is elevated.

There are three classes to be discovered from this evaluation:

- The financial “quantity” reported immediately won’t be the identical when revised sooner or later.

- The development and deviation of the information are much more essential than the quantity itself.

- “Document” highs and lows are data for a motive, as they denote historic turning factors within the knowledge.

We suspect the bevy of WSJ economists will once more be incorrect of their assumptions.

Sadly, we received’t have that proof till it’s too late.

[ad_2]

Source link