[ad_1]

Up to date on February 4th, 2023 by Nikolaos Sismanis

The Dividend Aristocrats are a bunch of shares within the S&P 500 Index with 25+ years of consecutive dividend will increase. These corporations have high-quality enterprise fashions which have stood the take a look at of time and proven a exceptional capability to boost dividends yearly whatever the financial system.

We have now compiled a listing of all 68 Dividend Aristocrats, together with related monetary metrics like dividend yield and P/E ratios. You may obtain the total Dividend Aristocrats checklist by clicking on the hyperlink beneath:

The checklist of Dividend Aristocrats is diversified throughout a number of sectors, together with shopper items, financials, industrials, and healthcare. One group that’s surprisingly under-represented is the utility sector.

There are solely three utility shares on the checklist of Dividend Aristocrats: Consolidated Edison (ED), NextEra Power (NEE), and Atmos Power (ATO).

The truth that there are solely three utilities on the checklist could come as a shock, particularly since utilities are extensively thought to be being regular dividend shares. This text will focus on Atmos Power’s path to turning into a Dividend Aristocrat.

Enterprise Overview

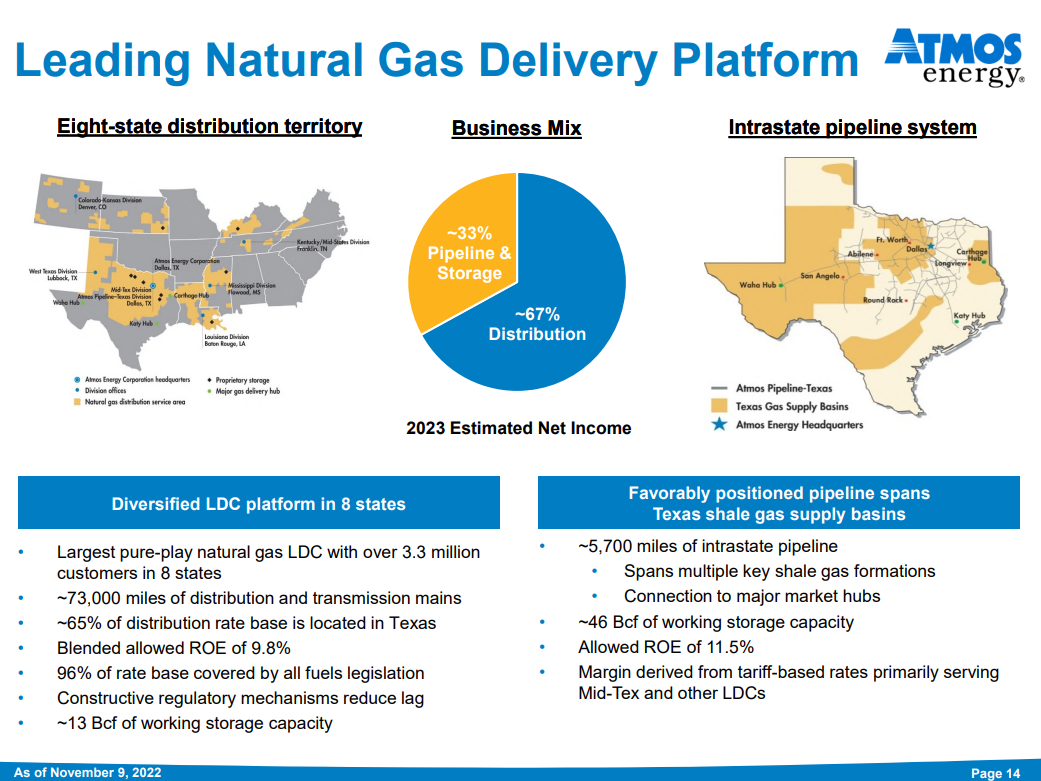

Atmos Power can hint its beginnings all the best way again to 1906, when it was shaped in Texas. Since that point, it has grown each organically and thru mergers. In the present day, Atmos Power distributes and shops pure gasoline in eight states, serving over 3 million prospects. As well as, Atmos owns about 5,700 miles of pure gasoline transmission traces. The utility ought to generate about $4.6 billion in income this 12 months.

Atmos Power is a large-cap inventory with a market capitalization above $16.5 billion.

The corporate serves over 3 million pure gasoline prospects unfold throughout eight totally different states.

Supply: Investor Presentation

Atmos reported fourth-quarter and full-year earnings on November ninth, 2022, and outcomes have been higher than anticipated on each the highest and backside traces. Earnings-per-share got here to 51 cents, seven cents higher than estimates. Income soared 27% year-over-year to $723 million, which was $63 million higher than anticipated.

For the total 12 months, consolidated working earnings was up $16 million to $921 million. Refunds of extra deferred earnings taxes decreased working earnings by $112 million, which was considerably offset by a lower in earnings tax expense. Excluding these things, working earnings was up $128 million resulting from charge outcomes in each of its segments, in addition to buyer progress in distribution. These have been partially offset by gentle climate and decrease consumption within the distribution section, in addition to elevated operations and upkeep bills.

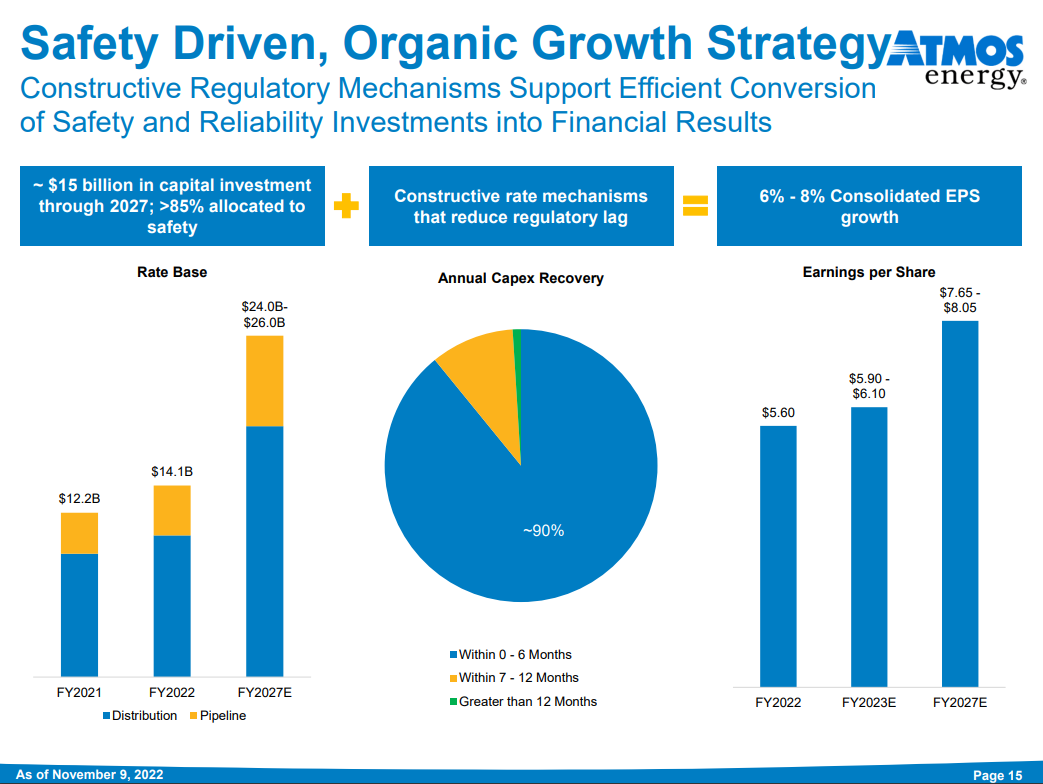

The corporate guided for earnings-per-share of $5.90 to $6.10 to begin the fiscal 12 months, indicating one other 12 months of sturdy progress. Accordingly, we’ve set our forecast on the midpoint,.

Progress Prospects

Earnings progress throughout the utility trade sometimes mimics GDP progress. Nonetheless, we anticipate Atmos Power to proceed outperforming this pattern resulting from its concentrate on capital funding in its regulated operations, a constructive regulatory atmosphere in Texas, and inhabitants progress.

In consequence, the corporate ought to profit from sturdy charge base progress, which in flip will generate annual earnings per share progress in accordance with administration’s 6% – 8% steering.

The expansion drivers for Atmos Power are new prospects, charge will increase, and aggressive capital expenditures. One advantage of working in a regulated trade is that utilities are permitted to boost charges frequently, which nearly assures a gentle stage of progress.

Supply: Investor Presentation

The first danger going through the corporate is its capability to realize well timed and optimistic regulatory charge changes. If the corporate achieved decrease than anticipated allowed returns, it may trigger important hurt to earnings.

Nonetheless, we imagine Atmos can obtain at the least 6% annual EPS progress through continued enhancements in gross margin, reductions in working prices as a proportion of income, and top-line progress through acquisitions in addition to natural buyer progress.

The corporate continues to file favorable charge circumstances with its varied localities that present for small income will increase over time as effectively, as we noticed once more in fiscal 2022 full–12 months outcomes. The core distribution enterprise carried out very effectively within the fourth quarter, which we expect is a optimistic indicator for 2023 results.

Aggressive Benefits & Recession Efficiency

Atmos Power’s major aggressive benefit is the excessive regulatory hurdles of the utility trade. Gasoline service is critical and very important to society. In consequence, the trade is extremely regulated, making it nearly not possible for a brand new competitor to enter the market. This offers quite a lot of certainty to Atmos Power and its annual earnings.

One other aggressive benefit is the corporate’s steady enterprise mannequin and sound stability sheet, giving it a sexy value of capital. This permits it to fund accretive acquisitions and progress capital expenditures, driving outsized earnings per share progress.

As well as, the utility enterprise mannequin is extremely recession-resistant. Whereas many corporations skilled massive earnings declines in 2008 and 2009, Atmos Power’s earnings per share stored rising. Earnings-per-share in the course of the Nice Recession are proven beneath:

- 2007 earnings-per-share of $1.91

- 2008 earnings-per-share of $1.99 (4% progress)

- 2009 earnings-per-share of $2.07 (4% progress)

- 2010 earnings-per-share of $2.20 (6% progress)

The corporate nonetheless generated wholesome progress even in the course of the worst of the financial downturn. Outcomes remained resilient and continued to develop in the course of the pandemic as effectively, demonstrating the mission-critical nature of Atmos’ property.

- 2019 earnings-per-share of $4.35

- 2020 earnings-per-share of $4.69 (7.8% progress)

- 2021 earnings-per-share of $5.12 (9.1% progress)

This resilience has allowed Atmos Power to proceed rising its dividend every year throughout these unfavorable market environments.

Valuation & Anticipated Returns

Atmos Power is predicted to earn $6.00 this 12 months. Primarily based on this, the inventory trades with a price-to-earnings ratio of 19.5. That is barely above our honest worth estimate of 19x tearnings, which is barely beneath the 10-year common price-to-earnings ratio for the inventory.

In consequence, Atmos Power shares look like barely overvalued. If the inventory valuation retraces to the honest worth estimate over the following 5 years, the corresponding a number of contraction would scale back annual returns by 0.6%. This could possibly be a small headwind for future returns.

Fortuitously, the inventory may nonetheless present optimistic returns to shareholders, by way of earnings progress and dividends. We anticipate the corporate to develop earnings by 6% per 12 months over the following 5 years.

As well as, the inventory has a present dividend yield of two.5%. Atmos Power final raised its dividend by 8.8% in November 2022. This marked the thirty ninth 12 months of dividend progress for Atmos Power.

Supply: Investor Presentation

Placing all of it collectively, Atmos Power’s complete anticipated returns may appear like the next:

- 6% earnings progress

- -0.6% a number of reversion

- 2.5% dividend yield

Added up, Atmos Power is predicted to generate 7.0% annualized complete returns over the following 5 years, making the inventory enticing for traders all in favour of dividend progress and complete returns.

The dividend yield is just not substantial however stays enticing, whereas the dividend seems fairly protected. The corporate has a projected 2023 payout ratio of ~49%, which signifies a sustainable dividend. In consequence, we view Atmos Power as a blue-chip inventory.

Last Ideas

Atmos Power inventory is enticing for traders on the lookout for an above-average yield and common dividend progress. Due to this, Atmos Power can serve a helpful function in an earnings investor’s portfolio because the inventory presents a really safe and rising dividend earnings stream, and its dividend yield is effectively above the common dividend yield of the S&P 500 Index.

Word: Atmos Power additionally ranks effectively utilizing The Chowder Rule.

Atmos Power can also be a Dividend Aristocrat and will elevate its dividend every year. Subsequently, risk-averse traders wanting primarily for earnings proper now–akin to retirees–may see better worth in shopping for utility shares like Atmos Power.

Moreover, the next Certain Dividend databases comprise essentially the most dependable dividend growers in our funding universe:

If you happen to’re on the lookout for shares with distinctive dividend traits, contemplate the next Certain Dividend databases:

The foremost home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link