[ad_1]

- Delta Air Traces is ready to report Q3 earnings on Thursday

- The corporate has not too long ago made strikes to diversify income streams and spark long-term development

- Regardless of that, geopolitical and financial uncertainties pose headwinds for the inventory going forward

- Can the Q3 earnings report ignite a development reversal for the inventory?

The journey trade began the week on the flawed foot as Hamas’ terrorist assault on Israel raised considerations concerning the affect of hovering on the profitability of travel-related companies. As a consequence, Delta Air Traces (NYSE:) dropped by as a lot as 4% on Monday.

However whereas the short-term outlook seems dangerous amid the battle’s escalation, the longer-term perspective is actually extra promising, because of Delta’s strategic measures geared toward enhancing profitability and diversifying income sources.

The airline has partnered with tourism-focused traders Certares and Knighthead, in addition to non-public aviation providers supplier Wheels Up Expertise, with the goal of strengthening its trade place and facilitating long-term development.

Nonetheless, Delta faces a number of challenges, together with rising gas costs, expectations of lowered passenger site visitors post-summer, and growing plane upkeep prices.

What to Count on From the corporate’s Q3 Earnings

Delta Air Traces is ready to unveil its third-quarter earnings on Thursday, October 12. In its from July, the corporate surpassed expectations, boasting earnings per share (EPS) of $2.68, an 11.6% beat.

Quarterly income additionally outperformed, surpassing forecasts by 1.5%, coming in at $15.57 billion.

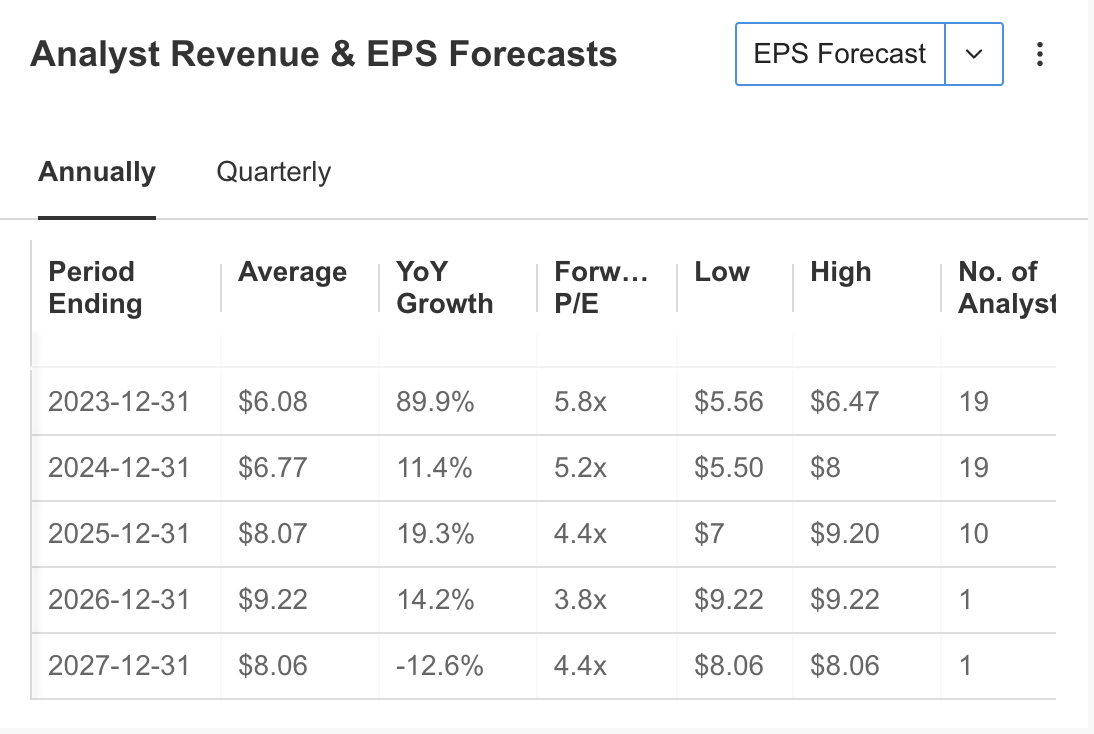

Supply: InvestingPro

Within the earnings report back to be introduced this week, InvestingPro estimates that EPS will likely be introduced at $1.96, up 25% in comparison with final 12 months.

Nonetheless, the corporate’s income is anticipated to be round $15.13 billion, up 13% in comparison with the identical interval of the earlier 12 months.

Supply: InvestingPro

Regardless of the downward revision for Q3, Delta is anticipated to achieve an annual EPS of $6 by the top of the 12 months, up 90% year-on-year. Lengthy-term steering displays reasonable development in the meanwhile.

As we method the discharge of Delta Air Traces’ Q3 monetary outcomes this week, it is vital to evaluate the corporate’s key monetary metrics main up so far.

Delta Air Traces: Basic View

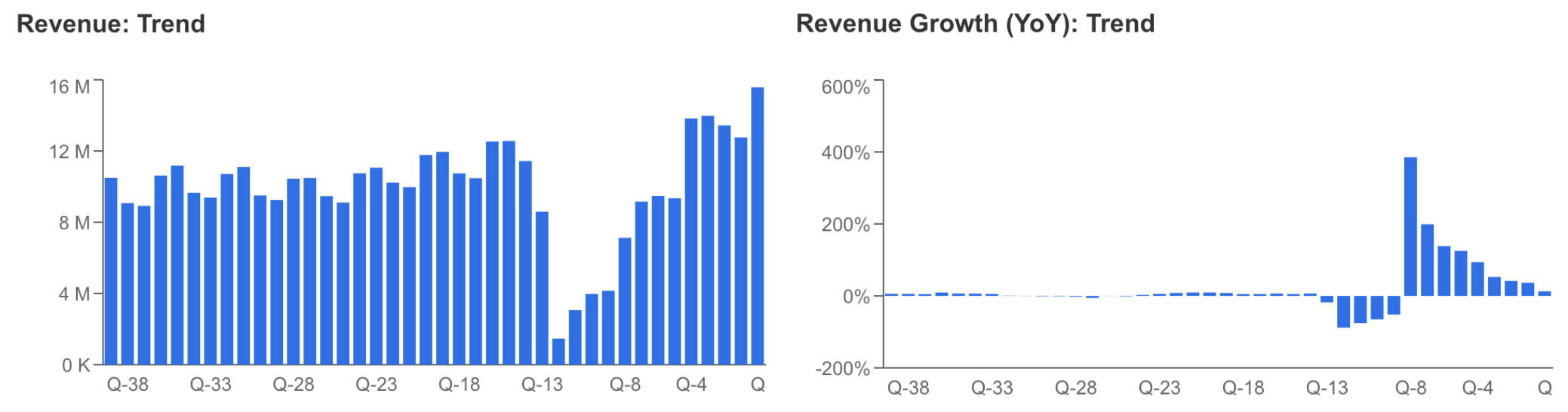

The corporate’s income development through the summer time interval in comparison with the earlier 12 months stays a optimistic spotlight. The anticipation is that the third quarter income will hover across the $15 billion mark.

It is value noting that whereas quarterly income development stays constant, a pure deceleration in development may happen as a result of base impact.

Supply: InvestingPro

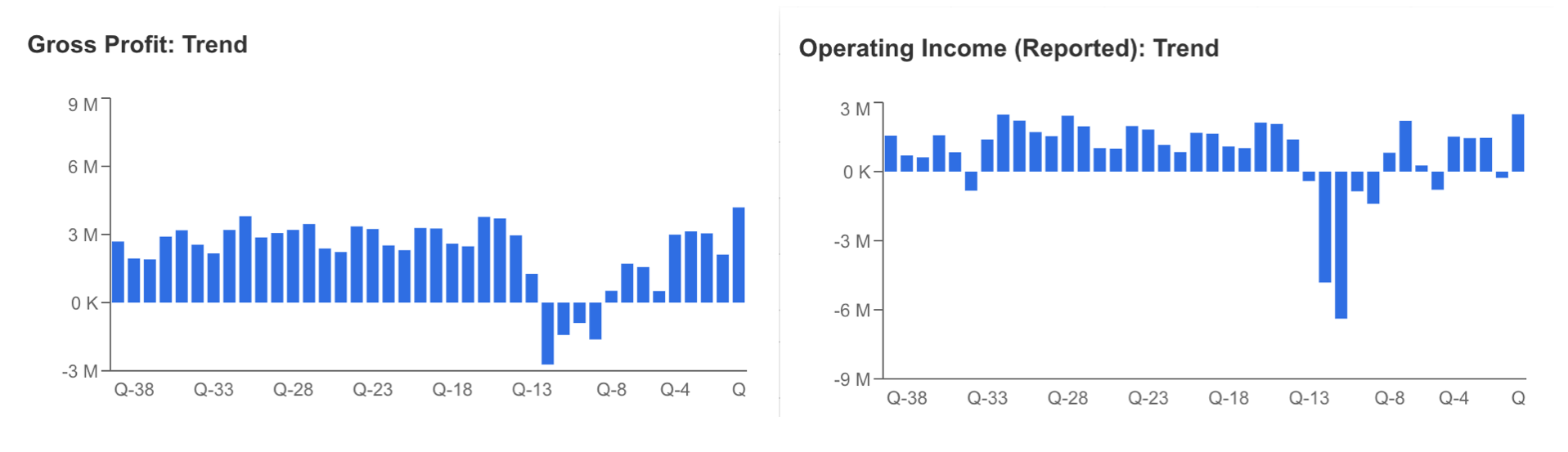

As well as, though the price improve continued to negatively have an effect on gross profitability, the income development within the final quarter enabled gross revenue to double in comparison with the earlier quarter.

At this level, the truth that the working revenue recovered within the second quarter and got here in at $2.5 billion after coming in unfavourable within the first quarter had an excellent affect.

Supply: InvestingPro

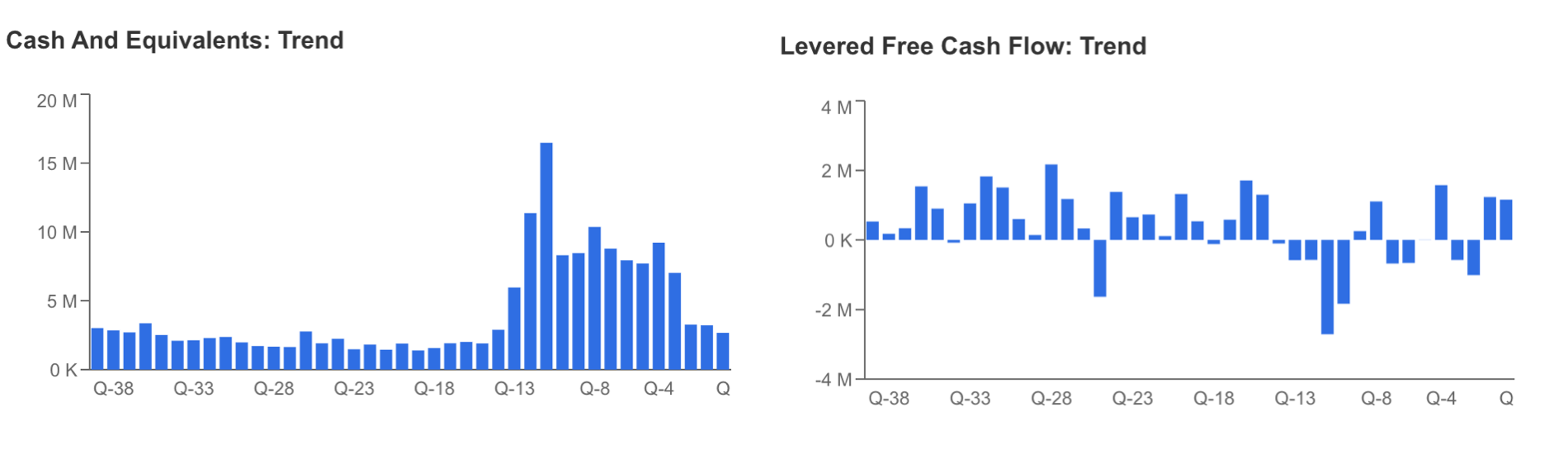

Though Delta Air Traces has seen an enhancing development within the final 2 quarters, the 30% decline in free money circulation in comparison with final 12 months could be seen as an issue.

As well as, the downward development in money and comparable belongings continued within the 2nd quarter outcomes.

Subsequently, within the earnings report back to be introduced this week, the event in money and money equivalents, which was $2.7 billion within the final quarter, will likely be intently monitored.

Supply: InvestingPro

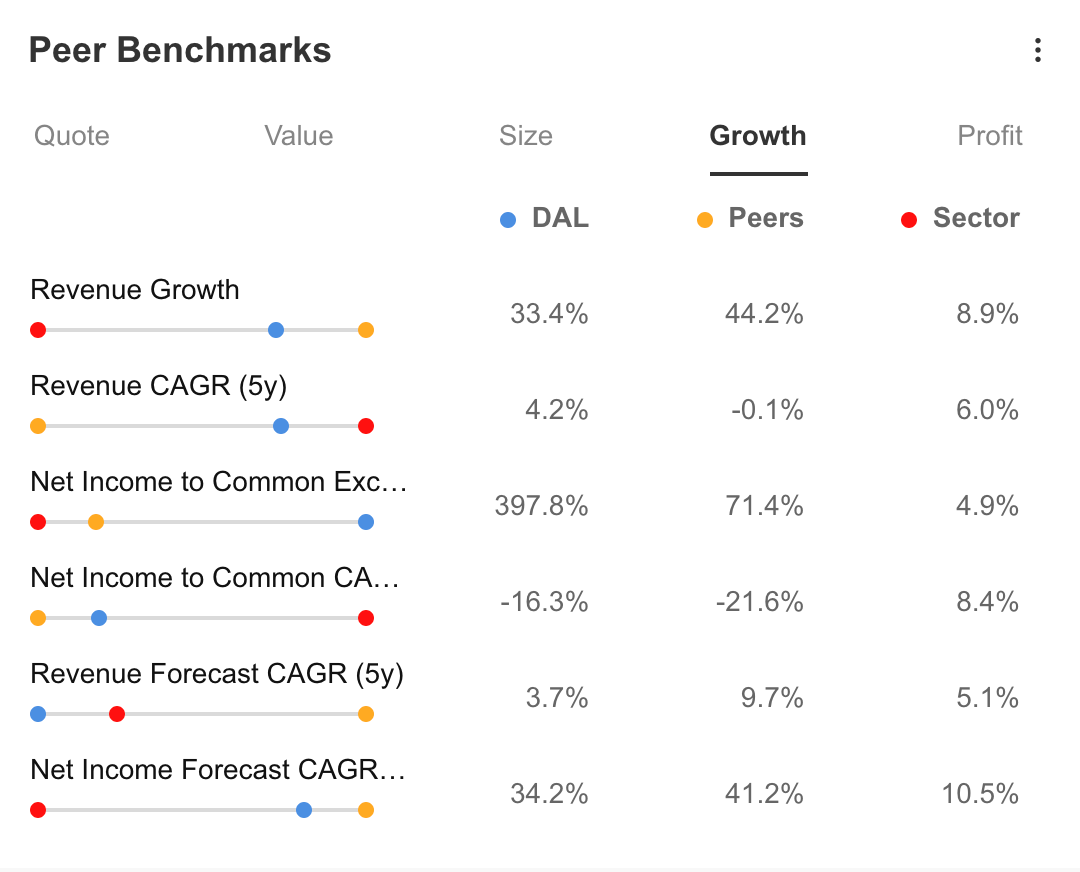

Once we evaluate Delta Air Traces’ development efficiency over the previous 12 months to its friends and the trade, we will set up a basic framework.

Primarily based on the evaluation carried out utilizing the InvestingPro platform, Delta has exhibited a income development charge surpassing that of the trade however falling brief compared to its friends, with a 33% income development.

The corporate maintains a optimistic compounded annual development charge, averaging at 4%, whereas friends are experiencing unfavourable development.

However, the 5-year development forecasts for each income and internet revenue are decrease than these of its friends, indicating areas for potential enchancment.

Supply: InvestingPro

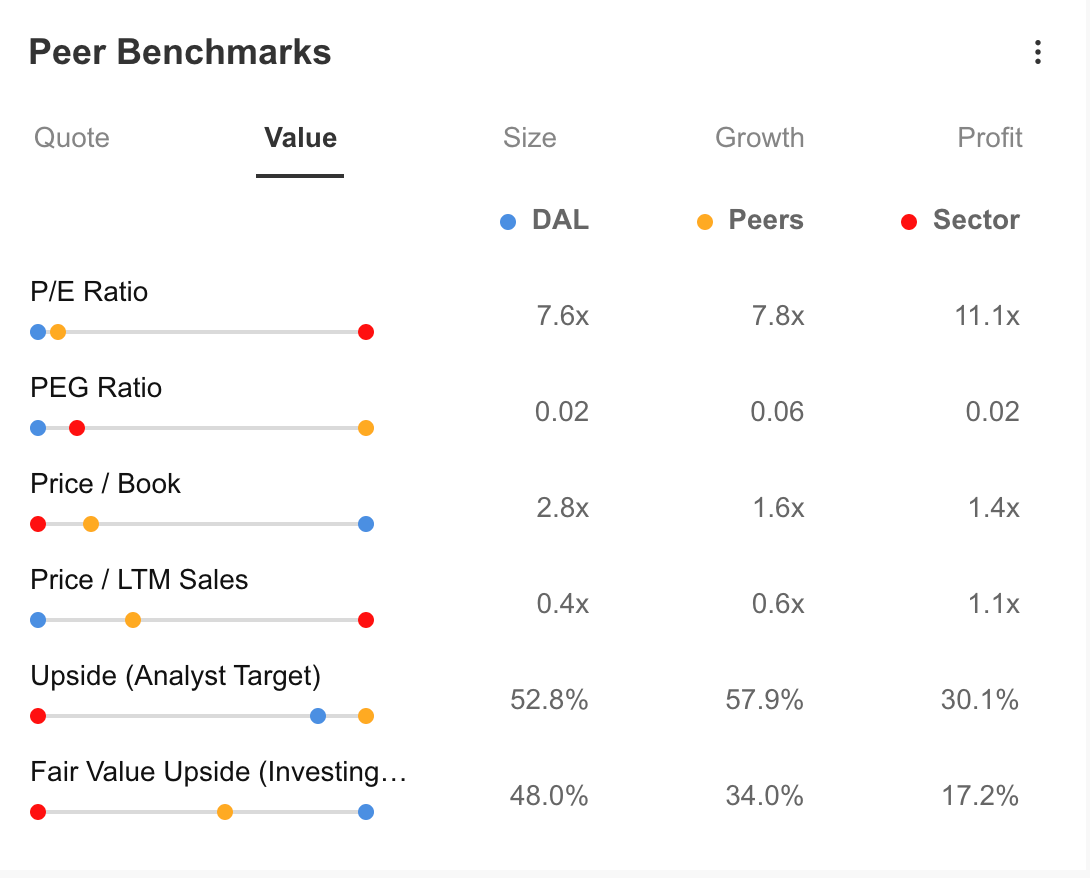

Analyzing the corporate’s ratios, Delta presently boasts a Value-to-Earnings ratio of seven.6x, which is beneath the trade common of 11x however aligns with its peer corporations.

Moreover, the PEG (Value/Earnings-to-Development) ratio of 0.02 locations it in keeping with the sector and beneath its peer corporations.

Regardless of the considerably blended monetary outlook, DAL inventory is anticipated to have a good worth with a 48% upside forecast, hinting at its potential to outperform its peer corporations.

Supply: InvestingPro

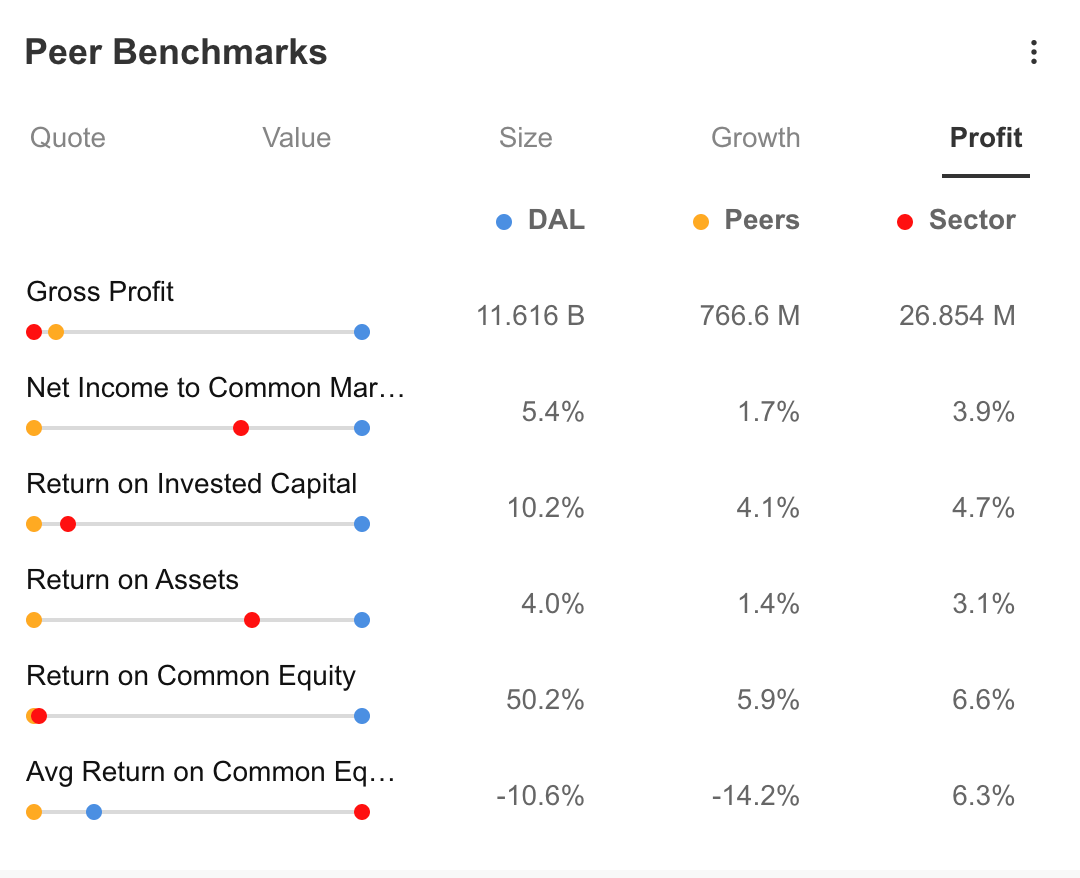

When analyzed by way of profitability, Delta Air Traces continues to do fairly properly in comparison with friends and the trade generally.

Supply: InvestingPro

In abstract, InvestingPro highlights the optimistic features of Delta Air Traces as follows:

- Steadily growing earnings per share.

- Excessive shareholder returns.

- Expectations for development in internet revenue.

- Being one of many main gamers within the airline trade.

Nonetheless, there are particular standards that will pose disadvantages within the coming intervals:

- Poor efficiency within the final month.

- Quick-term liabilities hovering above liquid belongings, which could be thought of a warning signal.

Delta Air Traces’ general monetary efficiency is presently rated as common. Whereas the corporate’s development outlook seems wholesome, there may be room for enchancment by way of money circulation and profitability. Moreover, the inventory has underperformed over the previous 12 months.

Primarily based on this info and the truthful worth evaluation of Delta Air Traces (DAL), it’s estimated that the inventory may attain as much as $52 with an upward potential of near 50% over a one-year interval.

The consensus amongst 19 analysts additionally factors to a median worth goal of $55, aligning with the truthful worth evaluation.

Delta Air Traces: Technical View

Within the first quarter of the 12 months, Delta Air Traces’ inventory exhibited a horizontal motion inside a large worth vary, adopted by an upward development within the second quarter.

Nonetheless, in the identical 12 months, the inventory, which reached its peak within the $49 area, initiated a big correction beginning in July.

From a technical perspective, based mostly on the 12 months’s lows and highs, it seems that the present worth of DAL at $35 corresponds to a possible help degree (Fib 0.786).

If the current dangers have a restricted affect and the Q3 monetary outcomes end up positively, there may be potential for the DAL inventory to rebound in the direction of the $40 vary within the final quarter.

The worth zone of $38 to $40 is a vital resistance space that have to be surpassed for the upward development to proceed. Conversely, if the $35 help is breached, it might result in a check beneath $30.

Conclusion

In conclusion, Delta Air Traces has taken important steps towards long-term development and profitability by means of current collaborations, which is a optimistic improvement. Nonetheless, challenges to profitability embrace blended monetary efficiency, money circulation weaknesses, and debt administration considerations.

Moreover, geopolitical dangers and financial uncertainties within the sector are elements that would pose challenges for the airline.

***

Discover All of the Data You Want on InvestingPro!

Disclaimer: The creator doesn’t personal any of those shares. This content material, which is ready for purely instructional functions, can’t be thought of funding recommendation.

[ad_2]

Source link