Whereas most crypto novices deal with worth fluctuations and attempt to time trades, superior buyers perceive there are dozens of metrics and knowledge which might be indispensable for gauging the well being and long-term potential of DeFi initiatives. Because the blockchain trade has matured, extra instruments have been developed for folks to research on-chain knowledge.

Under are the highest 5 forms of helpful instruments grouped by the class of knowledge they might help you perceive.

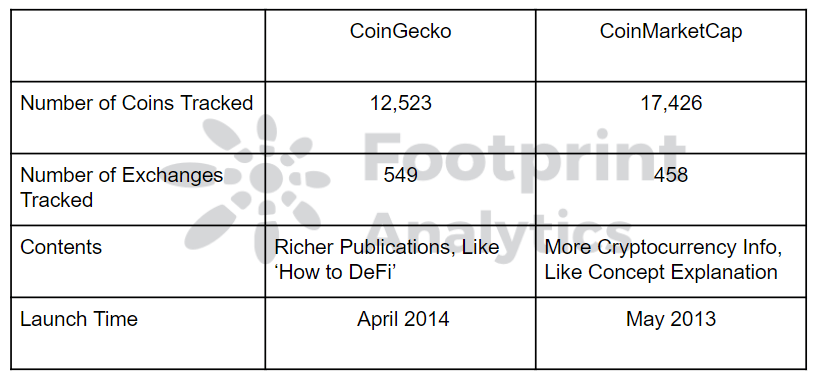

Instruments for Analyzing Tokens: CoinGecko & CoinMarketCap

CoinGecko was launched in 2014 and is a robust knowledge evaluation software targeted on blockchain knowledge.

(1) Monitor DeFi tokens. Tokens are listed by market cap by default, however customers can select different filters. Tokens might be in contrast by worth, buying and selling quantity, market cap, and different metrics.

(2) Newbie’s information. CoinGecko supplies a newbie’s information, a glossary, and information that will help you perceive the dynamics of crypto.

(3) Visualization of token historic knowledge. Coingecko historic knowledge contains worth, market cap, and buying and selling quantity, which can be utilized to find out the information efficiency of tokens.

- Prime Options

(1) Highly effective metric filtering choices

(2) Information for over 12,500 tokens

(3) Quite a few further options, e.g. NFT board, Newbie’s Information, information, and many others.

Instruments to Analyze DeFi Income: Token Terminal

Instruments to Analyze DeFi Income: Token Terminal

Token Terminal measures DeFi with conventional monetary metrics, which makes it extra accessible for these getting into crypto from a standard finance background.

(1) Gives standardized metrics to match the strengths and weaknesses of DeFi initiatives.

(2) Customers can use metrics to find out the worth they’ll get from investing in a challenge. Similar to P/S Ratio, P/E Ratio, and protocol income.

- Causes for Suggestion

(1) Excellent for customers with a standard monetary background to guage initiatives as investments.

(2) Over 100 DeFi protocols included. There are extra metrics and extra choices for knowledge quantification.

(3) Information is up to date rapidly, with an replace frequency of high protocols at 4 hours.

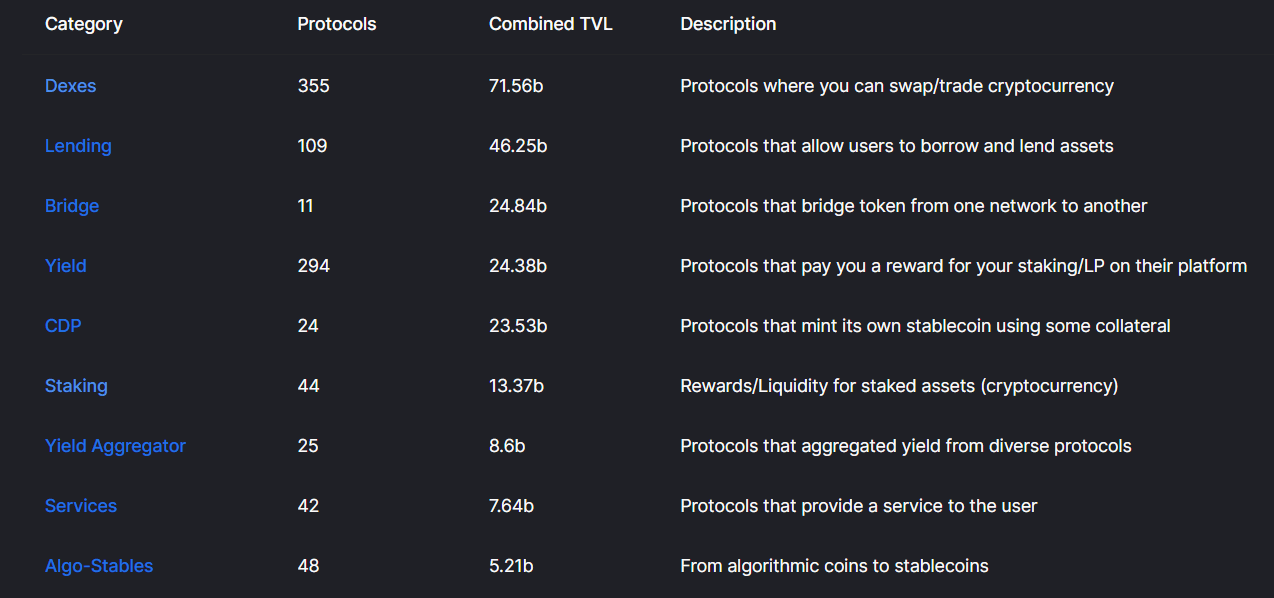

Instruments Used to Analyze DeFi TVL: DeFiLlama

DeFiLlama tracks the TVL of over 800 DeFi protocols. It may be seen by DEX, Lending, Yield, and different classes. The particular rating labels are 1d Change, 7d Change, 1m Change, TVL, and MarketCap/TVL.

- Causes for Suggestion

(1) Monitor extra protocols and categorize them, which is the present first selection for viewing DeFi TVL.

(2) Open the DeFiLlama NFT part to fulfill the twin wants of DeFi and NFT with one software.

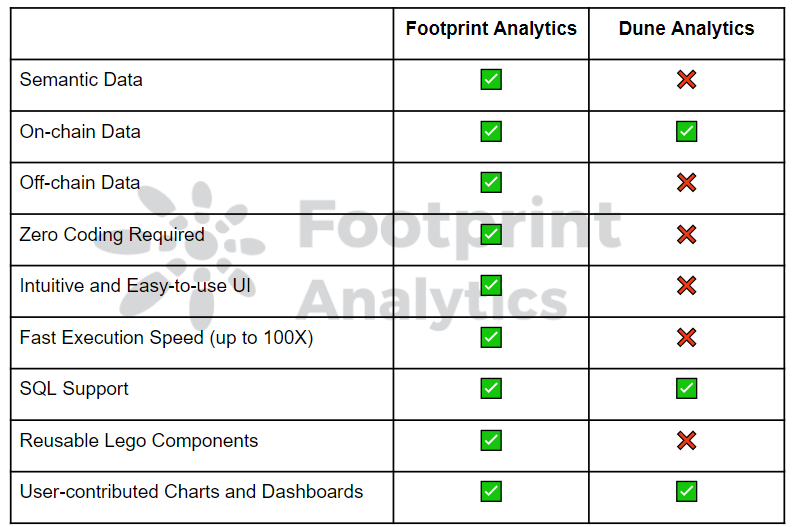

All-in-one Evaluation Instruments: Dune Analytics & Footprint Analytics

Dune Analytics and Footprint Analytics are comparable in perform, each offering all-in-one evaluation to visualise knowledge.

- For learners, Footprint is really helpful, because it requires zero coding nor SQL abilities.

- For somebody with a coding background, Dune is really helpful. Dune makes use of SQL to research real-time uncooked knowledge.

Dune Analytics has been round for 4 years and has knowledge queries for five chains. It closed a $69.42 million Collection B spherical in February 2022.

- Causes for Suggestion

(1) Customization. Question a number of databases with SQL, visualize the outcomes and discover extra knowledge evaluation for DeFi protocols.

(2) Group sharing. By default, all queries and datasets are public, and customers can instantly copy others’ Dashboard and use it as a reference. dune additionally encourages the contribution of queries.

Though Dune is highly effective, it’s not simple to grasp due to the SQL.

Footprint Analytics supplies an easy-to-use knowledge analytics service. It closed a $1.5 million seed spherical led by IOSG Ventures in January 2022.

- Causes for Suggestion

(1) Zero coding is required. Footprint offers customers a easy drag-and-drop interface.

(2) One-click bifurcation question. At the moment helps 18 knowledge chains for question and 4 chains for drill-down depth evaluation.

(3) Easy and simple to research knowledge, defend underlying cumbersome and difficult-to-understand uncooked knowledge.

Instruments for Monitor and Goal Whales: Nansen & Glassnode

Nansen was created in 2019 to supply knowledge evaluation of on-chain pockets transactions. Whilst an all-pay service, it stays very fashionable. The cumulative funding of over $80 million in lower than six months between the Collection A and B rounds is proof of this.

(1)Nansen’s most outstanding characteristic is “sensible cash”, which tags over 50 million Ethereum pockets addresses. Customers also can monitor Whale accounts.

(2)The Token God Mode characteristic can parse ERC-20 tokens in all points.

- Causes for Suggestion

The pockets handle evaluation could be very highly effective. It may monitor whales quick, which is right for buyers who observe whales

Glassnode is an alternative choice for monitoring whales. In contrast to Nasen, which focuses solely on pockets handle evaluation, Glassnode gives quite a lot of knowledge evaluation companies.

(1)Monitor whales. Assist customers monitor and observe whales for funding.

(2)Glassnode alerts. Tracks the dynamics of ERC20s on-chain metrics.

(3)Weekly studies. Assist to know the cryptocurrency market.

By way of versatility, Glassnode focuses extra on general market analysis and supplies a richer supply of knowledge.

Abstract

In comparison with conventional finance, the cryptocurrency market is comparatively open when it comes to the quantity of knowledge that may be accessed by anyone. Solely by analyzing the underlying knowledge are you able to assess a DeFi challenge and, for that, you want the fitting instruments.

Date & Writer: Feb twenty ninth, 2022, by Grace at Footprint analytics.

What’s Footprint Analytics?

Footprint Analytics is an all-in-one evaluation platform to visualise blockchain knowledge and uncover insights. It cleans and integrates on-chain knowledge so customers of any expertise degree can rapidly begin researching tokens, initiatives, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anybody can construct their very own custom-made charts in minutes. Uncover blockchain knowledge and make investments smarter with Footprint.

CryptoSlate Publication

That includes a abstract of crucial day by day tales on this planet of crypto, DeFi, NFTs and extra.

Get an edge on the cryptoasset market

Entry extra crypto insights and context in each article as a paid member of CryptoSlate Edge.

On-chain evaluation

Value snapshots

Extra context

Be part of now for $19/month Discover all advantages