[ad_1]

Journey Faery/iStock Editorial through Getty Photos

ZIM Built-in Delivery (NYSE:ZIM) reported its third-quarter monetary outcomes earlier this week, unveiling a welcome shock to buyers by beating estimates. There is a debacle about whether or not ZIM will falter amid rising systemic danger. As well as, many buyers are cautious of the inventory’s illustrious dividend profile and query its sustainability. In at the moment’s article, we uncover key speaking factors about ZIM Built-in Delivery and focus on buyers’ horizons as a key decision-making variable.

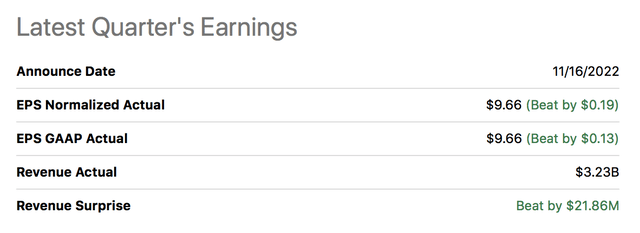

Looking for Alpha

Earnings Assessment

Working Outcomes

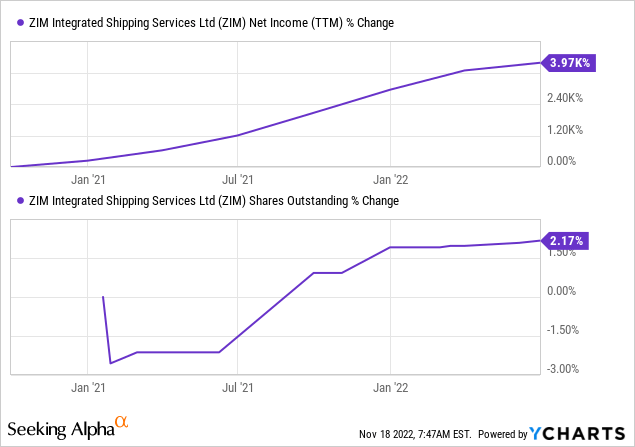

Not like Golden Ocean (GOGL), ZIM Built-in Delivery skilled year-over-year development with a 3.2% enhance in top-line income. The corporate’s embedded development stays on monitor, with its common TEU price rising 4% year-over-year, with cumulative price will increase because the flip of the yr reaching 43%. Regardless of ex-post price will increase, ZIM’s provider quantity dipped by 5% in comparison with Q3 2021 resulting from port congestion and receding client demand.

ZIM’s fleet measurement has stayed the identical since its final report, with its vessel depend at present at 149. The corporate’s common remaining length of present capability is at 27.4 months, and 37 of its vessels are up for renewal in 2024.

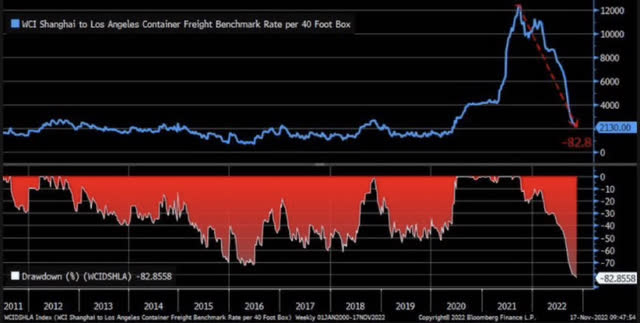

Broadly talking, transport charges are declining. We consider charges are declining resulting from demand destruction brought on by the uncertain economic system. For instance, the port of Los Angeles has skilled a 25% drop in container exercise since October final yr. As well as, the Worldwide Financial Fund just lately reported slowing financial development, which may very well be a key cause behind tapered transport charges.

Regardless of producing year-over-year development, we consider it is solely a matter of time earlier than ZIM begins feeling systemic warmth.

Bloomberg Terminal; Market Radar

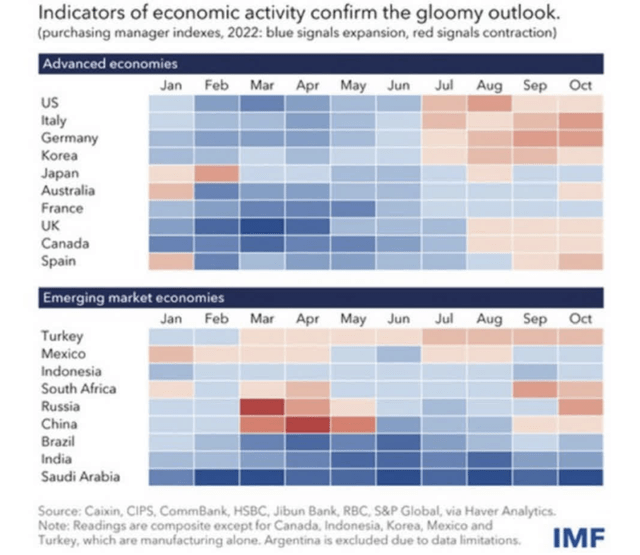

The diagram beneath reiterates the state of at the moment’s economic system. Slowing buying energy will possible affect world commerce, damaging demand for ship operators. The economic system is a cyclical automobile, and it will not shock us if the transport business experiences a pointy drop within the coming quarters.

World Financial Exercise Heatmap (IMF)

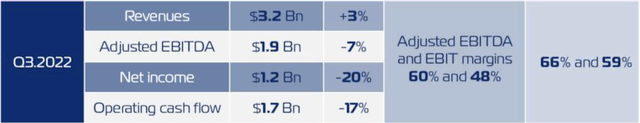

Accounting Metrics

Earlier than delving into ZIM’s accounting metrics, let’s take into account a couple of line objects. The corporate’s adjusted EBITDA fell 7% year-over-year, and its internet earnings was compressed by 20%. We consider inflation will stay resilient, leaving ZIM’s earnings assertion beneath strain.

Moreover, the corporate’s working money movement slumped by 17% year-over-year, reflecting an obvious slowdown within the firm’s core operations. Many consider income represents a agency’s development; nonetheless, money movement presents a greater viewpoint because it is not recorded on an accrual foundation. As well as, observing working money movement is essentially the most crucial because it phases out any non-organic money inflows.

Primarily based on our statement, ZIM’s core money inflows are in decline.

Looking for Alpha; ZIM Built-in Delivery

A degree of concern for us is ZIM’s Beneish M-score, which sits at -0.93. As a rule of thumb, the Beneish M-score needs to be beneath -1.78 to conclude that an organization is an unlikely earnings manipulator. ZIM’s elevated M-score implies that it may very well be recognizing sure earnings assertion objects prematurely, leaving buyers in peril of going through a backdrop in following earnings reviews.

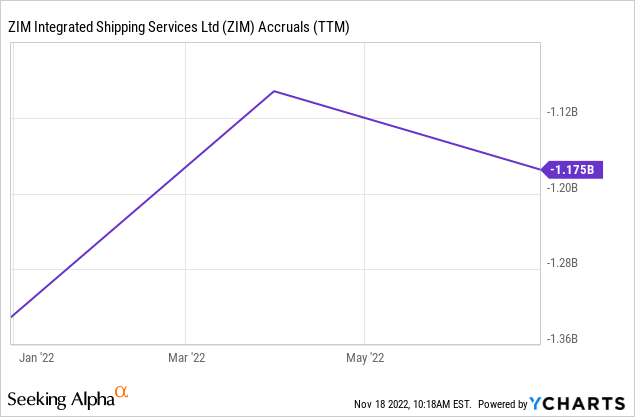

Regardless of its unfavorable M-score, ZIM does not have optimistic accruals, which means its money from operations and investing stays above its internet earnings, indicating that its natural money actions are increased than its accrual-based earnings (which is an efficient factor).

Funding Horizon

Assessing ZIM’s prospects requires an investor to find out his/her funding horizon. Some buyers favor shopping for and holding, some shift portfolio weights, and a few execute short-term trades. Thus, a cyclical inventory similar to ZIM will yield totally different outcomes for varied classes of buyers.

Let’s focus on the elephant within the room: ZIM’s illustrious dividend yield. The agency’s humongous dividend yield displayed at 105.98% is a policy-driven payout. The corporate re-distributed 10% in particular dividends after its second quarter resulting from superior efficiency. Nevertheless, ZIM’s common coverage is to distribute 30% of its internet earnings to buyers.

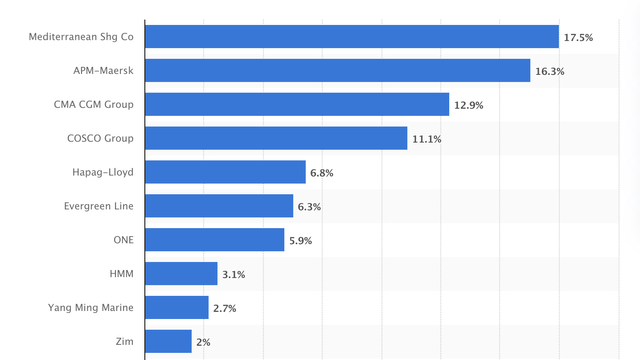

Though ZIM is a mature firm, its inventory hasn’t been publicly listed for a very long time; thus, it is obscure the corporate’s dividend sample. Nevertheless, reverting to our beforehand mentioned top-down method, it is evident that this agency and different transport corporations are severely uncovered to financial cycles. As well as, it is price mentioning that transport charges have been possible unrealistic throughout the pandemic, and ZIM’s presence in a “excessive obstacles to entry” business allowed it to take full benefit. Thus, primary economics 101 tells us that ZIM’s present degree of internet earnings is probably going unsustainable, and earnings assertion compression may drive the agency to faucet into investor assets to maintain the corporate.

Ship Operator Market Share October 2022 (Statista)

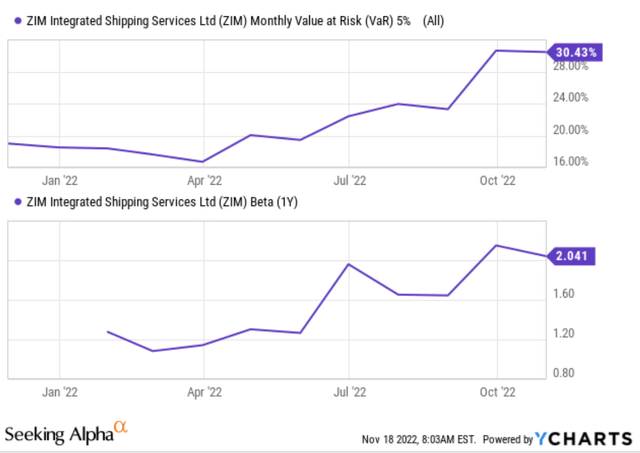

Now, again to the central argument, which is your funding horizon. ZIM is ready to pay a quarterly dividend price $2.95 per share on December 7, with a shareholder of file date set at November 29. In case you’re investing now, assuming the inventory value stays static, you possibly can lock in an earnings return of above 11% (from dividends). Contemplating the inventory’s 5% Month-to-month VAR of 30.43% and its beta sensitivity (sensitivity to the broader inventory market) of two.041, I would say it is a believable tactical play.

Looking for Alpha

Assuming a longer-term vantage level, you’d possible be extra uncovered to dividend destruction and value danger than short-term buyers. Once more, this attracts again to the macroeconomic argument I tabled earlier on.

To ZIM’s protection, the inventory possesses spectacular value multiples with its price-to-earnings and price-to-book ratios at 0.52x and 0.59x, respectively. Buyers may see the asset as a cut price purchase; nonetheless, we argue that cyclicality will upend the inventory’s valuation metrics, inflicting a attainable worth lure.

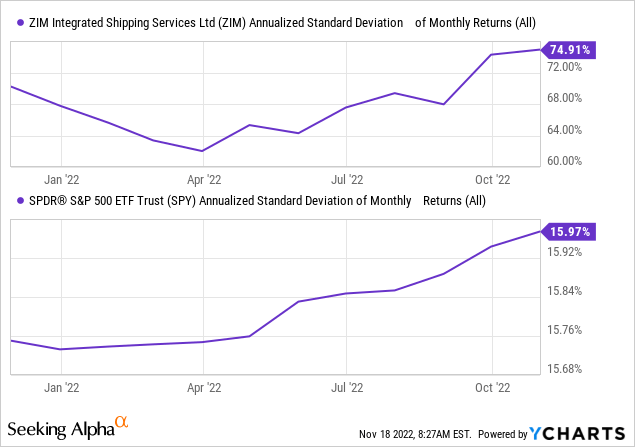

Moreover, ZIM’s annualized commonplace deviation is exceptionally excessive. Due to this fact, buyers should ask themselves whether or not the inventory’s dividend advantages are ample to section out value danger.

ZIM’s prospects rely upon an investor’s horizon. The inventory’s dividend yield makes up for short-term value danger. Nevertheless, longer-term value dangers and dividend cyclicality may very well be unfavorable.

Concluding Ideas

Regardless of experiencing strong year-over-year income development, ZIM built-in assets may very well be confronted with demand destruction, in flip inflicting its current progress to stagnate. Furthermore, the corporate’s top-line earnings and money movement statements are polarized, presenting considerations.

From an funding vantage level, holding a place in ZIM is determined by your horizon. Lengthy-term prospects appear uncertain, however short-term allocation may yield important advantages. The inventory is undervalued; nonetheless, preserve cyclicality in thoughts.

Contemplating a quarterly horizon, we assign a maintain score to ZIM and can revisit our stance thereafter.

[ad_2]

Source link