[ad_1]

Khanchit Khirisutchalual

Thesis highlight

I recommend going long on Ziff Davis (NASDAQ:ZD) ($71.32 as of this writing). It has a decent digital portfolio that allows it to capture a piece of the digital advertising space, which generates cash to fund management’s acquisition strategy. The strong track record of acquisitions set by management over the years gives comfort that this business is led by a sensible team. I expect it to generate $900 million in adj. EBITDA in FY26, which, based on a 7.2x forward EBITDA multiple, would give it an equity value of $126 per share, which is 78% more than it is worth now.

Company overview

ZD is divided into two business units: Digital Media, and Cybersecurity and Martech.

Its Digital Media division focuses on the technology, shopping, entertainment (TSE), and health and wellness markets, offering content, tools, and services to consumers and businesses through a portfolio of web properties and apps. Trusted reviews of TSE products and services; news and commentary about their vertical markets; and interactive tools and mobile applications that help consumers manage a wide range of health and wellness needs on a daily basis are just a few examples of the content available. This part of the business makes most of its money from click-throughs, commissions on sales linked to clicks, and business leads.

Its Cybersecurity and Martech businesses offer cloud-based subscription services like cybersecurity, privacy, and marketing technology to both consumers and businesses. This segment’s revenues are primarily derived from customer subscriptions and usage fees.

As of 2Q22, Digital Media represents 78% of operating profits and Cybersecurity and Martech represent 22%. In terms of geographic exposure, ZD has 85% of its revenue from the U.S. and 15% from international countries.

Investments merits

Portfolio of digital assets targets audience in a large and growing TAM

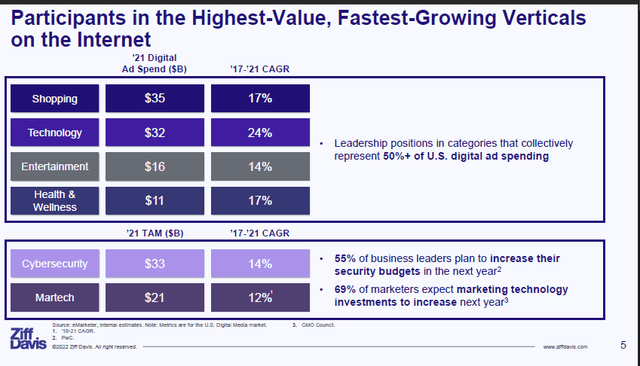

ZD primarily provides what are known as “performance marketing solutions,” which tap into corporate ad budgets and generate revenue as long as the leads are converted into sales. ZD’s verticals are high-value markets with a total of $94 billion in dollar TAM that have been growing at very good rates, ranging from the mid-teens to 20% CAGR from 2017 to 2021. There is no doubt that digital advertising will continue to grow at a rapid pace, eclipsing traditional mediums such as newspapers and magazines. However, the competitive landscape is much more difficult because we have the walled gardens of Google (GOOGL), Facebook (META), and Amazon (AMZN), which collectively control more than 60% of total US advertising spend. As a result, it is critical for advertising firms to differentiate themselves in order to capture a piece of the pie, and ZD has the assets to do so.

ZD Core Investor Presentation Aug 2022

ZD’s portfolio of digital assets has some very decent and recognizable brands in their respective verticals. Here are some examples:

- TSE includes PCMag, Mashable, IGN Entertainment (IGN), and RetailMeNot.

- Health and Wellness includes Everyday Health Group (EHG), What to Expect, and BabyCenter

ZD distinguishes itself from other advertising companies by providing content that informs decisions to a specific audience with a high intent to purchase something via ZD digital properties. People who visit PCMag.com, for example, are likely to be already interested in purchasing a PC, as is BabyCenter.com for women that are already pregnant. The holy grail of marketing is being able to specifically target the group of customers you want to reach.

The advantage of providing something that your customer desperately wants is that you can charge a higher fee, and the customer will pay because he really needs it. High-intent content attracts large advertisers because it generates high-quality leads that result in sales, allowing the high customer acquisition cost (CAC) to be justified. As of 4Q21, ZD’s average quarterly revenue per advertiser was $130k, or $43k per month, which is significantly higher than the average advertising spend on Facebook. We know this is not a one-time occurrence for ZD as the advertisement segment has grown at a 20% CAGR between 2018 and 2021 (source: ZD Core Investor Presentation Aug 2022), largely in line with the industry, indicating that they are maintaining market share. Also, ZD’s customers tend to spend more each year, as shown by the fact that they keep more than 100% of their net advertising.

What makes all of this even more amazing is that, unlike Google, ZD does not need to pay (or pay very little) for traffic acquisition costs because it delivers content on owned and operated properties. In an offline business context, this is analogous to running a food store but without the need to pay rent. This means that profit margins are significantly higher because costs are significantly lower (for example, Google’s TAC is 16% of revenue as of FY21).

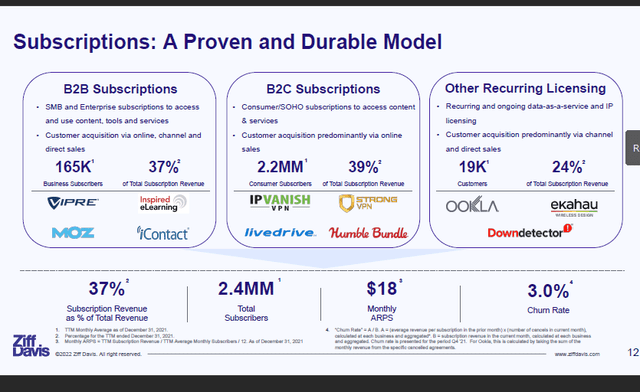

ZD’s Martech and Cybersecurity divisions (which account for a smaller portion of ZD’s profits) are mostly subscription models for services such as SEO optimization, cybersecurity, and VPN services. I won’t go into detail because my views on this topic are fairly consistent with consensus. Aside from the fact that the end markets are growing by double digits, I also like this division because of the recurring subscription-based revenue it brings in for the company.

ZD Core Investor Presentation Aug 2022

Strong track record of conducting value accretive acquisition to expand into strategic adjacencies

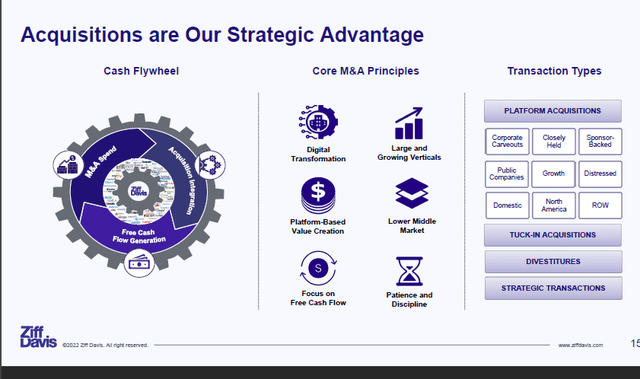

ZD’s strategy for growth is to acquire, own, and operate digital properties with established audiences in order to sell or lease advertising space to businesses (as described above), and then to repeat this process in adjacent markets.

ZD Core Investor Presentation Aug 22

ZD’s acquisition strategy is to acquire, own, and operate digital properties with engaged audiences with the intention of selling or leasing advertising space to businesses (as described above). ZD CEO Vivek Shah stated during the September 2021 analyst day that ZD is primarily a buyer and operator of Digital Media and Internet Businesses. The core tenet is to acquire assets in developing markets at the lower-middle market level with a focus on maximizing free cash flow. The emphasis on FCF is understandable, but it does not imply that ZD should only acquire companies that generate cash flow. In some cases, the target asset may have a very profitable core business unit that is obscured by other loss-making segments. In this case, ZD could buy the asset to grow the profitable segment while cutting the cash-burning segments.

ZD is often the buyer of choice for many sellers because its deal sponsors have a lot of experience (they have worked in the same vertical and with the target for years) and expertise, their decision-making process is quick, and they have a reputation for being decisive. Based on ZD’s acquisition history, management has a proven track record of acquiring companies, reducing unprofitable parts, and reinvesting in profitable segments. ZD typically finds assets for 8 to 10 times pre-synergies EBITDA and has increased EBITDA margins by 60% to 100% (source: DA Davidson FinTech and Vertical Solutions Conference). The number seems high, but it is possible that since these businesses are small (lower middle market with $10–$15 million in revenue), there isn’t much investment needed to get synergies and grow the business that was bought.

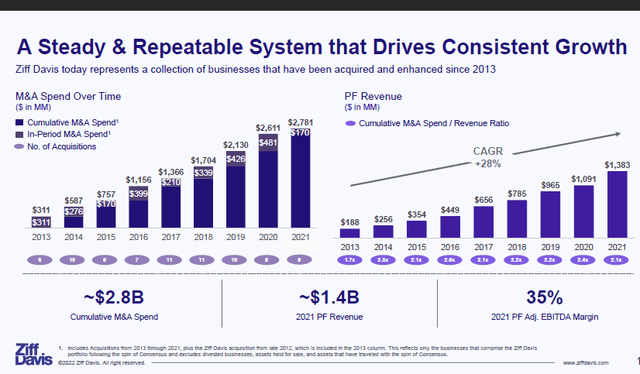

ZD Core Investor Presentation

ZD’s strong acquisition strategy also allows them to expand into adjacent verticals if opportunities arise. This is especially true for its subscription business, where it buys other companies to reach more consumers and businesses.

IGN’s acquisition of Humble Bundle is an example of this. Humble Bundle is a B&M store that sells video games at bundle prices for indie games, at a price determined by the customer, with a portion of the price paid going to charities, but it has content discovery issues, which IGN solves. This acquisition effectively expands IGN’s reach into the $14 billion indie gaming market (September ’21 Analyst Day). Aside from this synergy, IGN has also launched subscription services in order to increase monetization.

ZD Core Investor Presentation Aug 22

Valuation

Price target

My model suggests a price target of ~$127 or ~78% upside in FY25 from today’s share price of $71.32. This is based on the assumption that revenue growth will return to the historical rate of 17% in FY24e and that the forward EV/EBITDA multiple will be 7.2x in FY25e.

Image created by author using data from ZD’s filings and own estimates

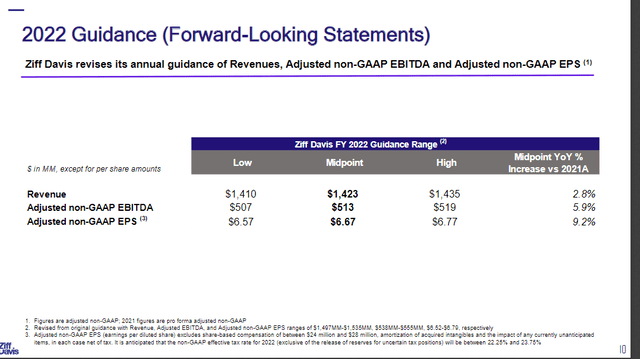

For FY22e, I used the mid-point of management guidance during 2Q22, which was $1.42 billion for revenue and $513 million for adjusted EBITDA. Moving forward from FY22e to FY26e, I assumed revenue could continue to grow at industry levels just like it did in the past, but with a gradual recovery from FY22e to 17% in FY24e.

ZD 2Q22 Earnings presentation

As for valuation, ZD currently trades at 7.2x forward EBITDA, about 20% lower than its 10-year average of 8.9x. I believe this 20% is warranted given the macro environment. Hence, I assumed ZD would continue trading at this valuation in FY25e.

Risks

Advertising revenue competition

Despite having a few reputable brands under its belt and carving out a niche for itself in the vast world of digital advertising, ZD is not a huge player that has created a substantial moat around the verticals it operates in. FB, GOOGL, and AMZN will enter the market and take market share regardless of the size of their balance sheets.

Mis-execution of acquisition

This is a problem shared by all serial acquirers; it is common for management to overestimate cost synergies and overpay as a result. Even if the deal is well thought out and will add value in the long run, the market perception of it may be “management overpaid,” sending the stock down. We saw this happen just a few days ago when Adobe (ADBE) acquired Figma, causing the stock to plummet upon the announcement.

Conclusion

To conclude, I believe ZD is worth ~78% more than its value today ($71.32 as of writing). Even though there will be a slight slowdown in growth in FY22e (based on what management says), I think ZD can continue to grow at the same rate as the industry once the macro environment improves. This is because ZD has done this in the past.

[ad_2]

Source link