USD/JPY Information and Evaluation

- Japanese Yen dips after inflation knowledge reveals optimistic indicators (PPI heads decrease)

- USD/JPY ranges to look at: current greenback energy entices bears forward of key stage of resistance

- Main danger occasions: US debt ceiling, regional banks, Q1 Japanese GDP and CPI and Fed audio system

- The evaluation on this article makes use of chart patterns and key help and resistance ranges. For extra data go to our complete schooling library

Really helpful by Richard Snow

See what out analysts consider the yen in Q2

Japanese Yen Dips after Inflation Knowledge Reveals Optimistic Indicators

Japanese PPI cooled in April in comparison with the identical time final yr and continues to rend decrease. As well as, Japan’s CPI and core CPI figures have seen successive decrease prints after reaching highs in January. Decrease inflation reduces stress on new Financial institution of Japan (BoJ) head Mr Kazuo Ueda to vary ultra-dovish financial coverage.

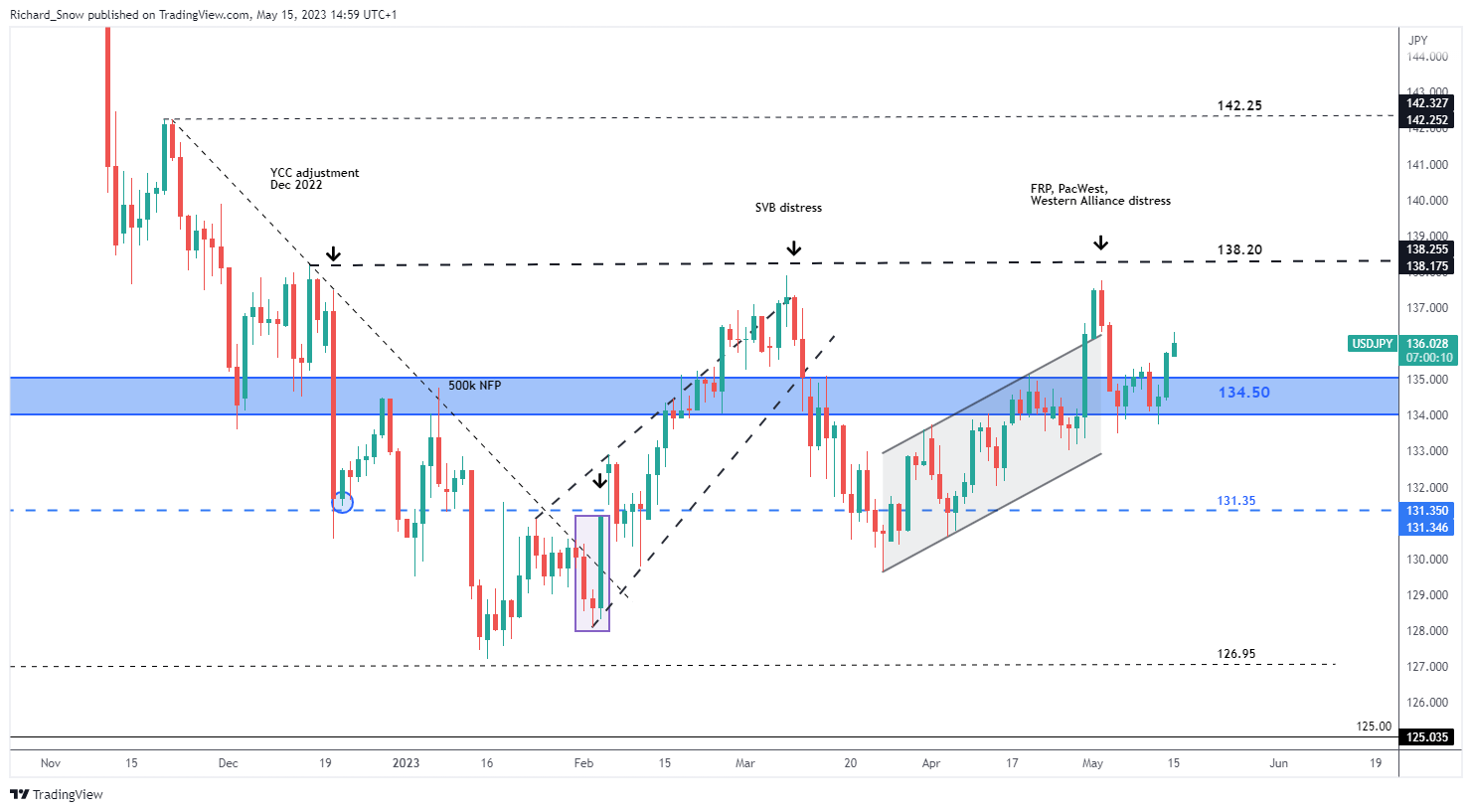

USD/JPY Ranges to Watch

USD/JPY continues so as to add to final week’s good points after discovering help on the decrease finish of the zone at 134.00. Nonetheless, upside potential is massively restricted at 138.20 – a stage that has evaded USD/JPY bulls twice earlier than. In actual fact, each makes an attempt failed to succeed in the extent and turned a long way beneath.

A brief historical past of financial institution misery in 2023 reveals the safe-haven traits of the yen stays robust. In March when the SVB saga unfolded, USD/JPY plummeted and once more, earlier this month, there was one other spate of concern as JP Morgan absorbed First Republic Financial institution with PacWest and Western Alliance the following distressed lenders on the chopping block it could seem. With the US regional banking sector experiencing a continued lack of confidence, coupled with the looming debt ceiling deadline, danger aversion might come again into play over the following three weeks. In that occasion, ranges to the draw back embrace 134 and 131.35.

USD/JPY Every day Chart

Supply: TradingView, ready by Richard Snow

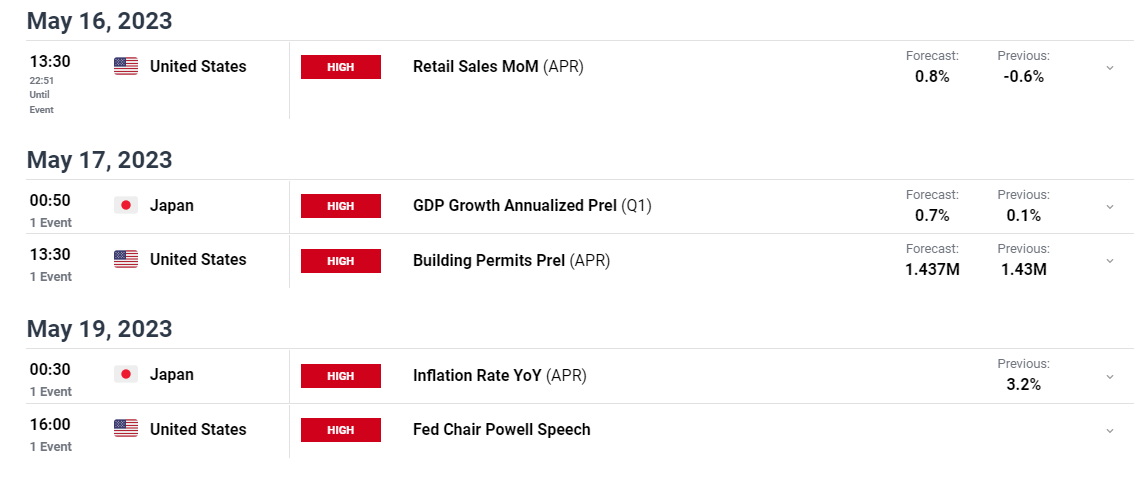

Scheduled Danger Occasions this Week

Dominating danger occasions this week is more likely to be the present deadlock between Republicans and Democrats over the US debt ceiling. 1 June has been recognized because the day the US authorities must prioritise its spending to keep away from a default. Beforehand, collaboration has tended to choose up throughout the two weeks previous to the deadline and so markets can be eagerly awaiting tomorrow’s discussions.

Other than that, Japanese GDP for Q1 is due on Wednesday, with inflation knowledge to comply with on the Friday – the identical day Jerome Powell is because of communicate at a Fed hosted occasion titled ‘Views on Financial Coverage’

Customise and filter dwell financial knowledge through our DailyFX financial calendar

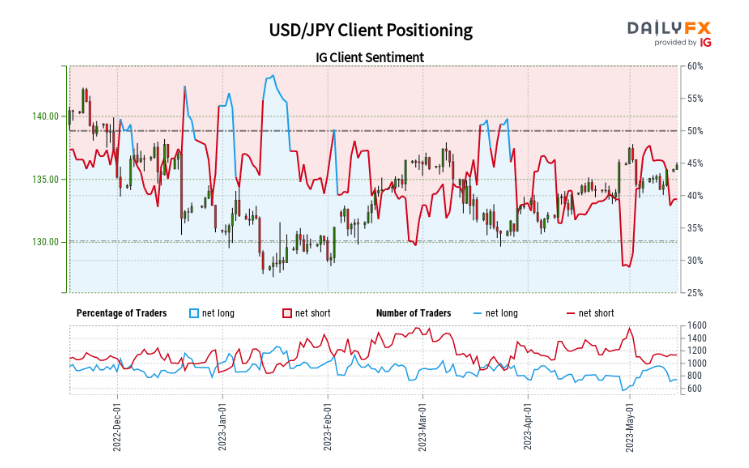

IG Consumer Sentiment Hints at Continued Bullish Transfer

USD/JPY:Retail dealer knowledge reveals 38.69% of merchants are net-long with the ratio of merchants quick to lengthy at 1.58 to 1.

We sometimes take a contrarian view to crowd sentiment, and the very fact merchants are net-short suggests USD/JPY costs could proceed to rise.

The variety of merchants net-long is 4.59% larger than yesterday and 21.63% decrease from final week, whereas the variety of merchants net-short is 10.31% larger than yesterday and 17.82% larger from final week.

Merchants are additional net-short than yesterday and final week, and the mix of present sentiment and up to date modifications provides us a stronger USD/JPY-bullish contrarian buying and selling bias.

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX