Key Takeaways

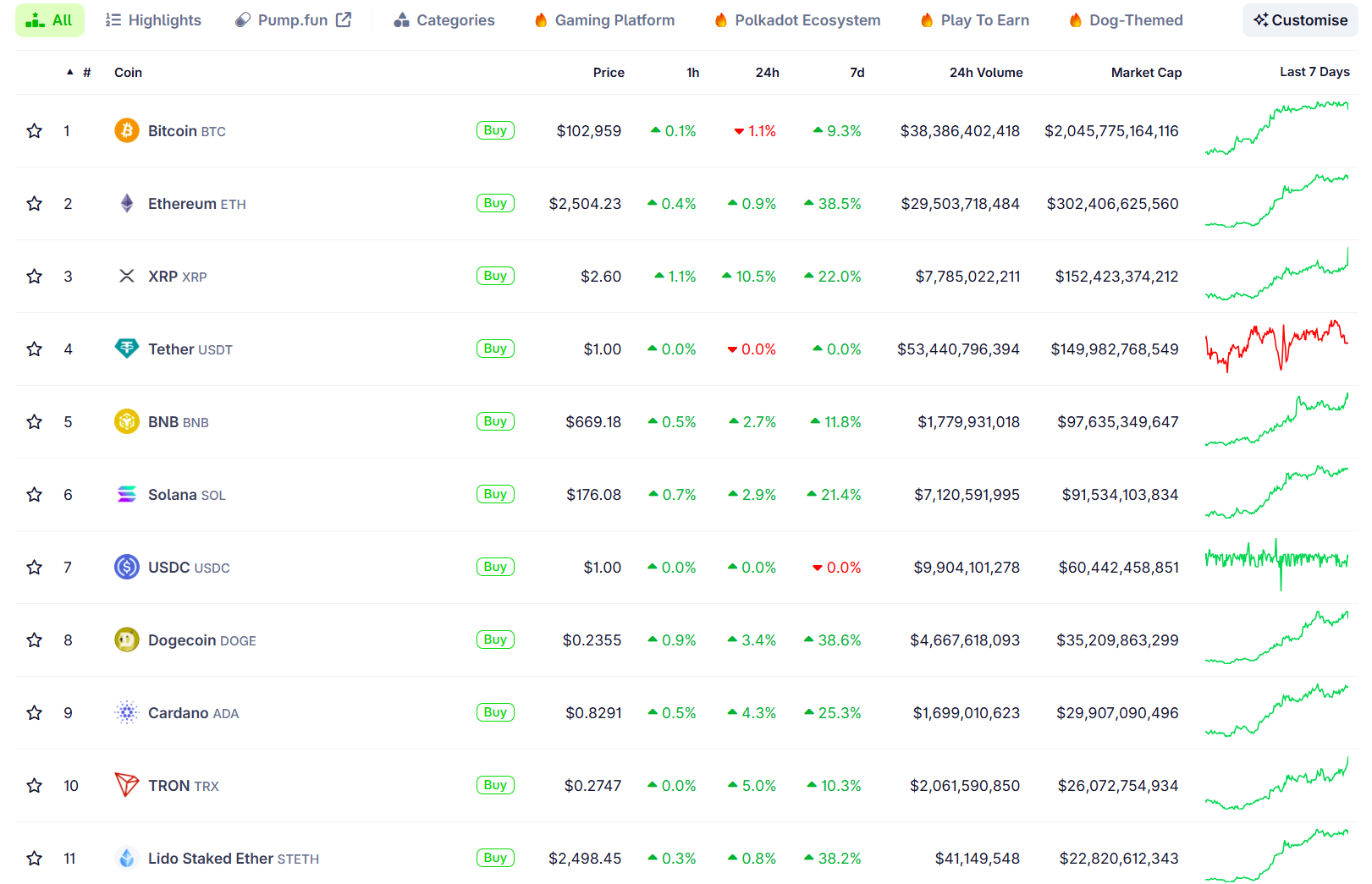

- XRP’s worth surged by 10% to $2.6, overtaking USDT because the third-largest crypto asset.

- Ripple is increasing its institutional presence via acquisitions and strategic partnerships.

Share this text

XRP has surged 10% over the previous 24 hours to succeed in $2.6, lifting its market capitalization to roughly $152 billion and reclaiming its place because the third-largest crypto asset, CoinGecko information reveals.

The surge narrowly pushed Ripple’s flagship foreign money forward of Tether’s USDT, which additionally achieved a serious milestone. USDT’s market cap hit $150 billion for the primary time on Monday, cementing its function because the main and most generally used stablecoin within the crypto ecosystem.

XRP is now buying and selling at its highest degree since early March, although the digital asset stays about 24% beneath its all-time excessive of $3.4, set in January 2018.

This isn’t the primary time XRP has climbed to the third spot in market rankings. Final December, the crypto asset reached a market capitalization of over $140 billion, surpassing Tether and Solana to change into the third-largest cryptocurrency by market worth.

On the time, the rally was pushed by optimism over a US election final result seen as favorable to native crypto initiatives, together with speculative curiosity within the potential approval of spot XRP ETFs.

Those self same catalysts have as soon as once more reignited bullish momentum. Final Friday, Ripple and the SEC introduced a joint movement to settle their years-long authorized dispute for $50 million.

The settlement, pending court docket approval, would permit Ripple to get well $125 million at present held in escrow, whereas upholding the court docket’s prior ruling on XRP gross sales.

Aside from its ongoing makes an attempt to resolve the case, Ripple has additionally made headlines for its latest push to broaden its footprint in institutional finance and the stablecoin market.

In April, the corporate reached an settlement to amass Hidden Street, a multi-asset prime dealer, for $1.25 billion. The acquisition goals to strengthen Ripple’s monetary providers choices, with Hidden Street planning to switch its post-trade actions to the XRP Ledger.

Additionally final month, Ripple reportedly made a bid between $4 billion and $5 billion to amass Circle, the USDC stablecoin issuer. Nonetheless, the supply was finally rejected by Circle, which deemed the valuation undervalued in mild of its upcoming IPO.

Share this text