LordHenriVoton

Now’s an opportune time to evaluation the place key sectors stand as we place ourselves for 2023. The Client Staples Choose Sector SPDR Fund (NYSEARCA:XLP) is an efficient approach to get publicity to the normally regular and generally secure space of family, blue-chip U.S. massive caps.

Many pundits, although, have considerations in regards to the group’s excessive valuation given a typically risk-off setting in 2022.

XLP: Sharply Beating SPX In 2022

Stockcharts.com

For background, XLP gives buyers publicity to corporations from the meals and staples retailing, beverage, meals product, tobacco, family product, and private product industries within the U.S., in accordance with SSGA.

I’m taking an uncommon strategy with this text – operating by way of key charts from Goldman Sachs and Financial institution of America International Analysis utilizing their 2023 fairness market outlooks. With the info, maintaining an open thoughts to each the bullish and bearish views, I’ll come to a conclusion about how I see Client Staples wanting as we strategy year-end and thru subsequent 12 months. My readers shall be acquainted with how I conclude the article – with “The Technical Take.”

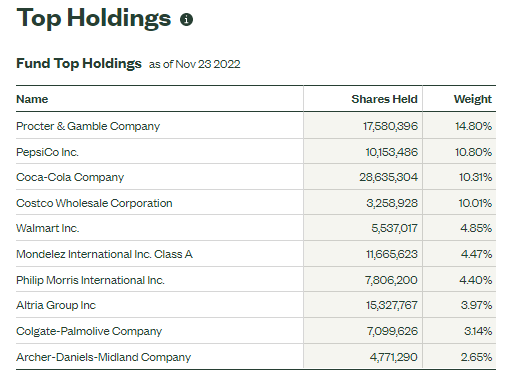

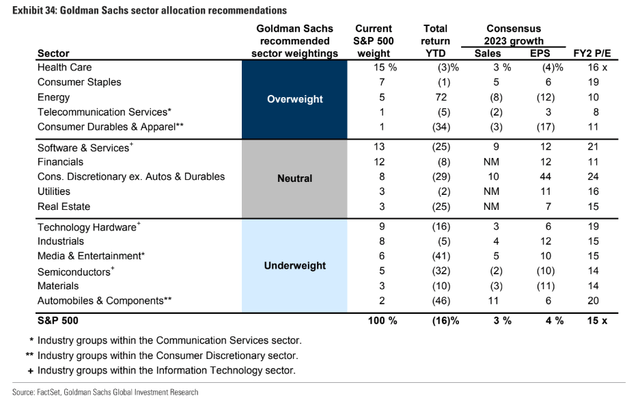

Kicking issues off, Goldman Sachs has Client Staples as considered one of their 5 sector allocation overweights. At simply 7% of the S&P 500, it’s not an enormous piece of the market regardless of being so recognizable with names like Procter & Gamble (PG), Pepsi (PEP), Coca-Cola (KO), Costco (COST), and Walmart (WMT) being the highest holdings in XLP.

XLP High Holdings

SSGA Funds

The sector is poised to see gross sales progress subsequent 12 months, but in addition strong earnings progress whereas a number of different spots see per-share revenue declines. The priority is {that a} 19-times ahead P/E is considerably above the S&P 500’s 16-time forecast earnings a number of. I stay skeptical that the group can sustain that lofty valuation, however let’s dive deeper.

Goldman’s 2023 Sector Suggestions

Goldman Sachs Funding Analysis

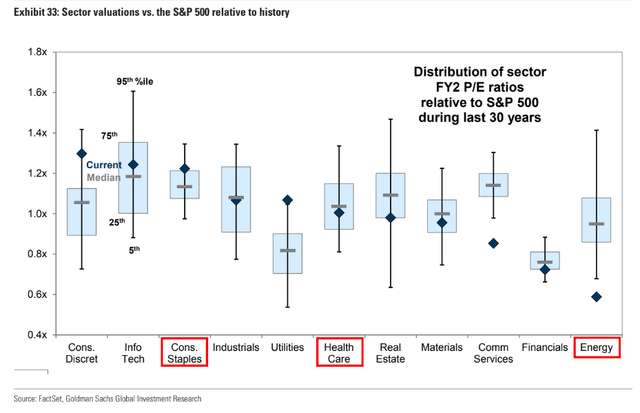

Staples certainly trades on the higher half of its historic valuation relative to the broad market, although the premium will not be as stretched as, say, fellow safety-play Utilities or the other shopper spectrum sector – Discretionary. So, the chart beneath from Goldman eases a few of my valuation considerations.

Goldman: Staples Barely Dear

Goldman Sachs Funding Analysis

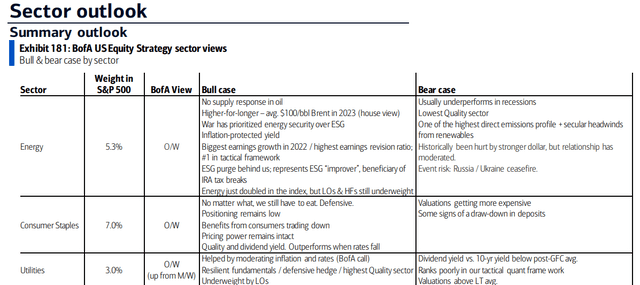

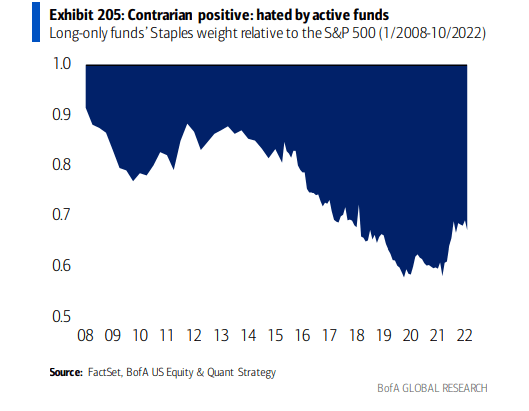

Let’s flip now to what BofA sees. Like Goldman, there’s an chubby advice in place for 2023. The BofA staff is among the many most bearish on the road for subsequent 12 months, and that’s proven of their sector suggestions. Apparently, investor positioning stays low to XLP corporations, and the sector has sturdy buying energy (as evidenced by Goldman’s take that mentioned companies can seize favorable working leverage (larger earnings progress than gross sales progress)). Lastly, information present that staples outperform when rates of interest fall – and I see that as a excessive chance subsequent 12 months as fears shift from inflation to recession.

BofA’s Sector Outlook Heading Into 2023: Obese Client Staples

BofA International Analysis

Funds Shunning Staples

BofA International Analysis

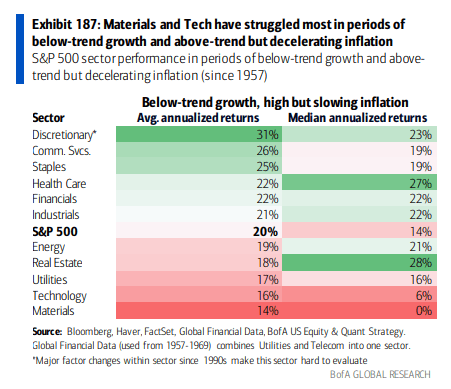

2023 also needs to be a 12 months of low actual GDP progress around the globe and disinflation. BofA analysis means that such durations favor the Client Staples sector.

Staples Advantages From Tepid Progress And Excessive & Falling Inflation

BofA International Analysis

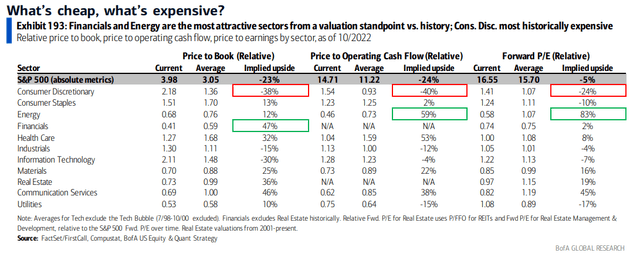

BofA’s valuation evaluation illustrates that the sector trades at a excessive ahead P/E in comparison with its historical past. Different metrics, nevertheless, recommend upside potential to the sector’s worth. Discover within the desk beneath that the group’s worth to e book (relative) and worth to working money move (relative) are literally at a reduction to the S&P 500, although not impressively so.

Staples: A Combined Valuation Image Relative To The S&P 500

BofA International Analysis

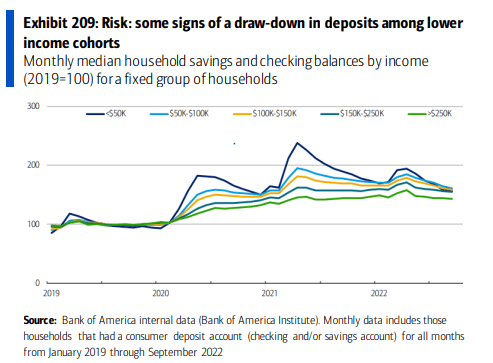

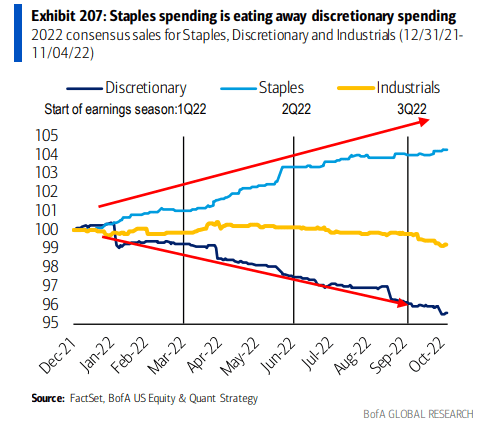

Maybe the kicker for 2023 is {that a} shopper trade-down impact must be in full pressure. We’re already seeing that amongst retailers which have reported Q3 outcomes. There was a very notable slowdown in discretionary spending beginning in mid-October. A continued development away from luxuries and the niceties of life towards requirements ought to profit staples – and with Discretionary nonetheless being probably the most richly-valued sector, in accordance with FactSet’s ahead P/E numbers, it seems a brand new cost-conscious regular will not be totally priced in.

BofA notes: “Even increased earnings customers are buying and selling down (see high-income (greatest spender) shopper decelerating). Walmart: ‘We’ve continued to achieve grocery market share from households throughout earnings demographics, with almost three-quarters of the share achieve coming from these exceeding $100,000 in annual earnings.’”

Buying and selling Down Bought Ya Down? Staples Successful As Extra Financial savings Falls

BofA International Analysis

Staples Spending On The Rise

BofA International Analysis

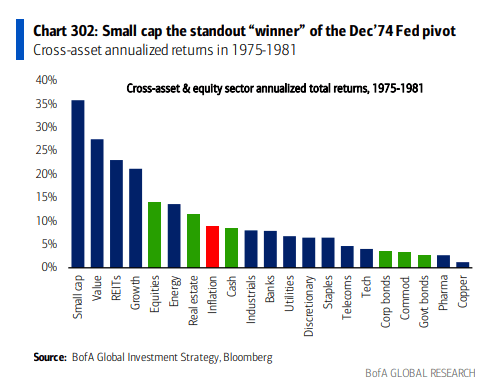

Merchants have priced in Fed charge cuts through the again half of 2023. If that performs out – name it a pivot – then we are able to look again to the nice Fed pivot of 1974 to see what areas carried out finest within the years that adopted. In that occasion, Staples weren’t a serious standout, so this would possibly recommend wanting extra towards small-cap worth names with Staples particularly.

An Outdated Pivot Playbook: Favor Small-Cap Worth Staples?

BofA International Analysis

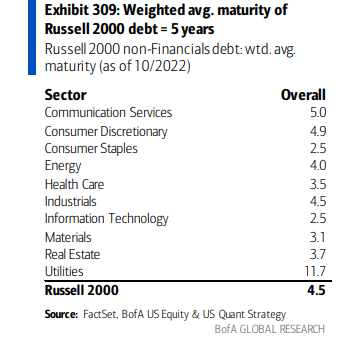

Lastly, a threat to small-cap staples is that they’ve a really quick weighted common maturity by way of the group’s debt burden. Meaning quite a lot of fixed-rate borrowings will come due and must be refinanced at increased rates of interest quickly. For a typically low-margin a part of the enterprise world, that’s a priority.

Small-Cap Staples: Refinancing Danger

BofA International Analysis

The Technical Take

XLP has a constructive look when analyzing the 3-year zoom. Discover within the chart beneath that shares have a key help worth of $68. Skeptics would possibly see the dip beneath that worth two months in the past as a bearish signal, however I see the temporary dip beneath $68 as a bullish false breakdown. Technicians say that “from false strikes come quick strikes in the other way.” That quip performed out because the ETF surged to recent multi-month highs earlier than the vacation. I see near-term resistance at $78 whereas the all-time excessive notched again in Q2 at $81 may very well be in play quickly. Furthermore, discover that the RSI momentum indicator has confirmed the latest rally that broke above a downtrend resistance line off the height earlier in 2022.

Total, I like the worth motion within the sector.

XLP: Bullish False Breakdown, Shares Climb Above Resistance With RSI Affirmation

Stockcharts.com

The Backside Line

My intestine feeling going into this evaluation was the staples have been costly and a dangerous spot to be chubby given some bullish consensus on Wall Avenue. After a evaluation, I see extra bullish potential than draw back dangers proper now. I like to recommend an chubby going into 2023.