[ad_1]

GOLD PRICE OUTLOOK

- Gold costs have trended decrease in 2024 after a powerful efficiency late final 12 months

- Merchants appear reluctant to tackle new bullish positions earlier than having extra readability on the Fed’s financial coverage outlook

- The December U.S. inflation report will steal the highlight later this week

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to Publication

Most Learn: US Greenback Reverses Decrease Earlier than US CPI, Setups on EUR/USD, GBP/USD, USD/JPY

Gold costs rallied strongly by way of late December, however have trended decrease in early January, with merchants reluctant to tackle new bullish positions for fears of a bigger bearish reversal ought to deep rate of interest cuts projected for 2024 fail to materialize.

Though the FOMC has signaled that it might lower borrowing prices later this 12 months, easing expectations appears excessive for an financial system that’s nowhere close to a recession and nonetheless scuffling with sticky inflation. If markets began to unwind dovish financial coverage bets, bullion may endure.

For an intensive overview of gold’s medium-term outlook, which includes insights from basic and technical evaluation, obtain our Q1 buying and selling forecast now!

Really helpful by Diego Colman

Get Your Free Gold Forecast

FOMC MEETING PROBABILITIES

Supply: FedWatch Software

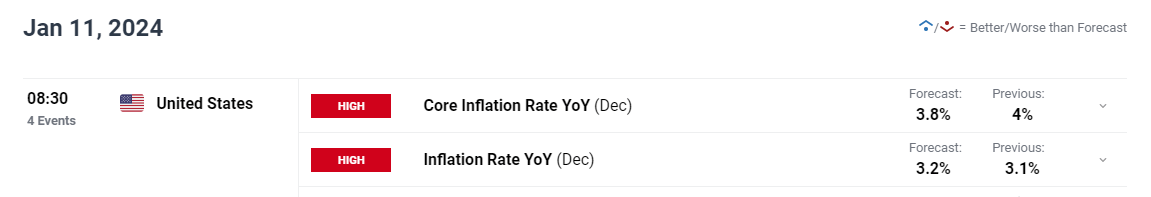

For insights into the Fed’s path, which is significant for valuable metals, you will need to maintain a detailed eye on a high-impact occasion later this week: the discharge of the December U.S. inflation report. Whereas the yearly studying for the core CPI indicator is seen moderating barely, the headline gauge is forecast to reaccelerate, making a headache for policymakers.

Upcoming US Inflation Knowledge

Supply: DailyFX Financial Calendar

By way of attainable outcomes, gold wants weak inflation numbers to have a greater likelihood of resuming its upward journey. An in-line or above forecast CPI report may set off a hawkish repricing of the central financial institution’s coverage trajectory, reinforcing the metallic’s latest downward correction.

In search of actionable buying and selling concepts? Obtain our prime buying and selling alternatives information full of insightful methods for the primary quarter!

Really helpful by Diego Colman

Get Your Free Prime Buying and selling Alternatives Forecast

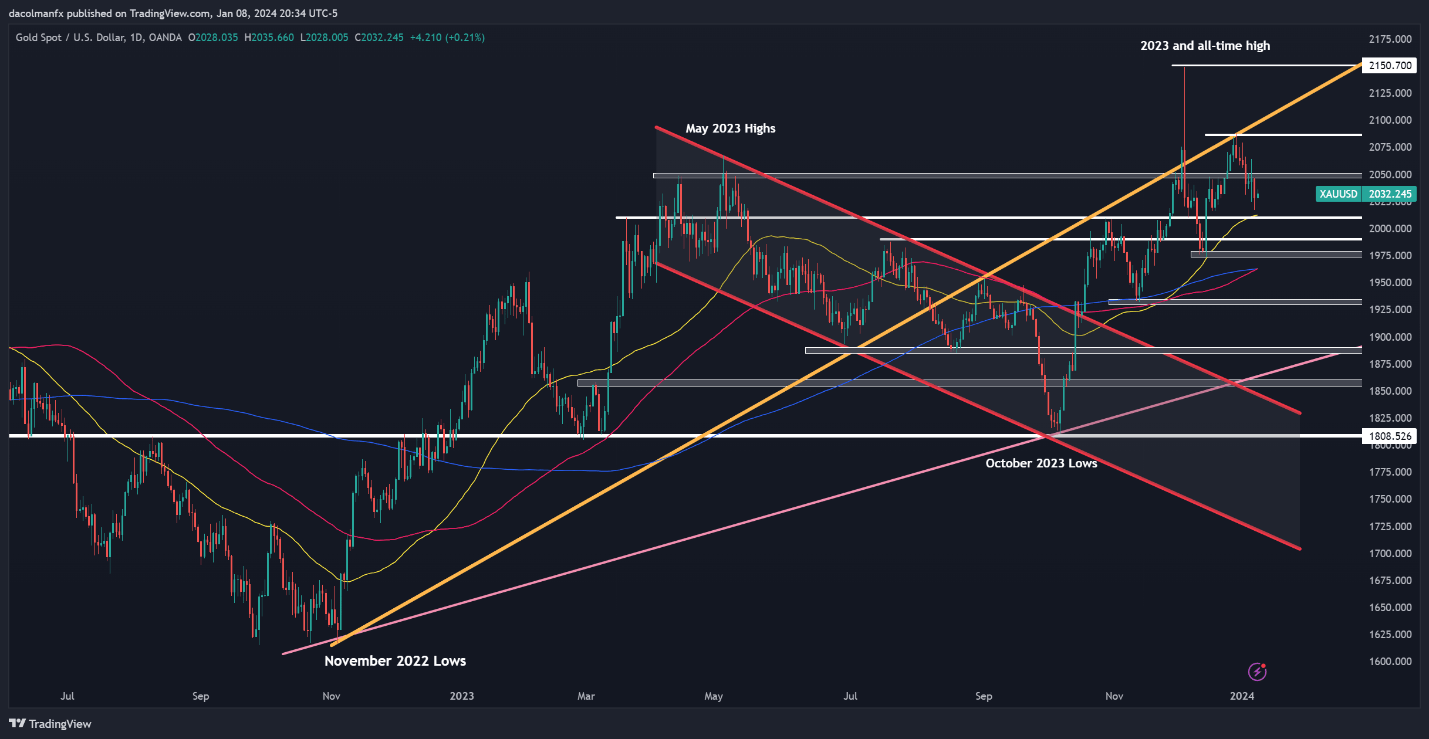

GOLD PRICE TECHNICAL ANALYSIS

Gold costs (XAU/USD) fell on Monday, extending losses after breaching a key help band at $2,050/ $2,045 final week. Extended buying and selling beneath this space may empower sellers to push costs in the direction of the 50-day easy transferring common situated close to $2,010, with additional weak spot shifting consideration to $1,990.

Conversely, if patrons regain management and spark a rebound, resistance looms at $2,045-$2,050. Whereas reclaiming this space could also be difficult for the bulls, a breakout may pave the way in which for a transfer towards the late December peak close to $2,085. Continued energy may ship gold towards its file close to $2,150.

GOLD PRICE TECHNICAL CHART

Gold Value Chart Created Utilizing TradingView

[ad_2]

Source link