Gold (XAU/USD) Information and Evaluation

Advisable by Richard Snow

Get Your Free Gold Forecast

Gold Costs Coil right into a Vary Throughout a Week that Lacks Excessive Influence Knowledge

Gold costs dropped reasonably sharply on Friday as a a lot hotter than anticipated NFP report despatched the sign that regardless of more and more tight monetary circumstances, the labour market refuses to roll over. Higher than anticipated labour information normally results in a carry in charge hike odds however the Fed’s communication of a “skip” at this month’s FOMC assembly implies that markets nonetheless anticipate charges to stay the place they’re.

Provided that this week brings with it little in the way in which of excessive affect financial information, gold costs have been seen drifting inside the broader vary of 1937 and 1985 and really a lot searching for its subsequent directional transfer. A bipartisan settlement to droop the debt ceiling has lowered the enchantment of the secure haven steel in latest buying and selling periods however the treasured steel is but to point out indicators of a chronic sell-off. Subsequent week’s US CPI and FOMC choice are all however set to inject volatility again into the market. If core inflation breaks under the cussed 5.5%, that might support the narrative of a extra dovish Fed within the coming conferences, decrease greenback – which might proceed to offer help for gold costs.

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to Publication

Gold each day chart

Supply: TradingView, ready by Richard Snow

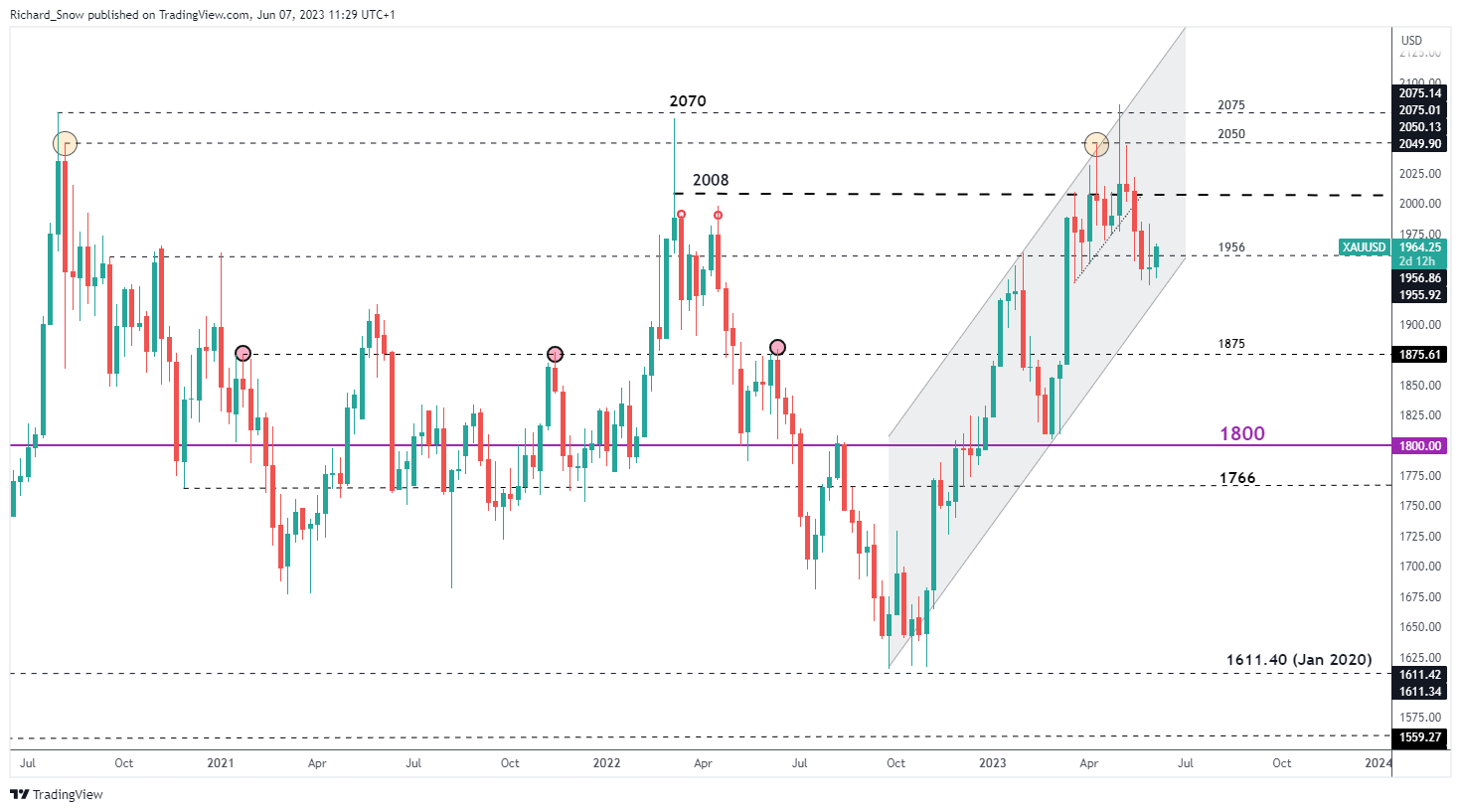

Broader Uptrend Stays Regardless of Softer Gold Costs

On the weekly chart gold costs stay inside the ascending channel, which means even when costs ease additional bears might discover resistance close by. A bullish continuation stays constructive upon a weekly shut above 1956.

Gold Weekly Chart

Supply: TradingView, ready by Richard Snow

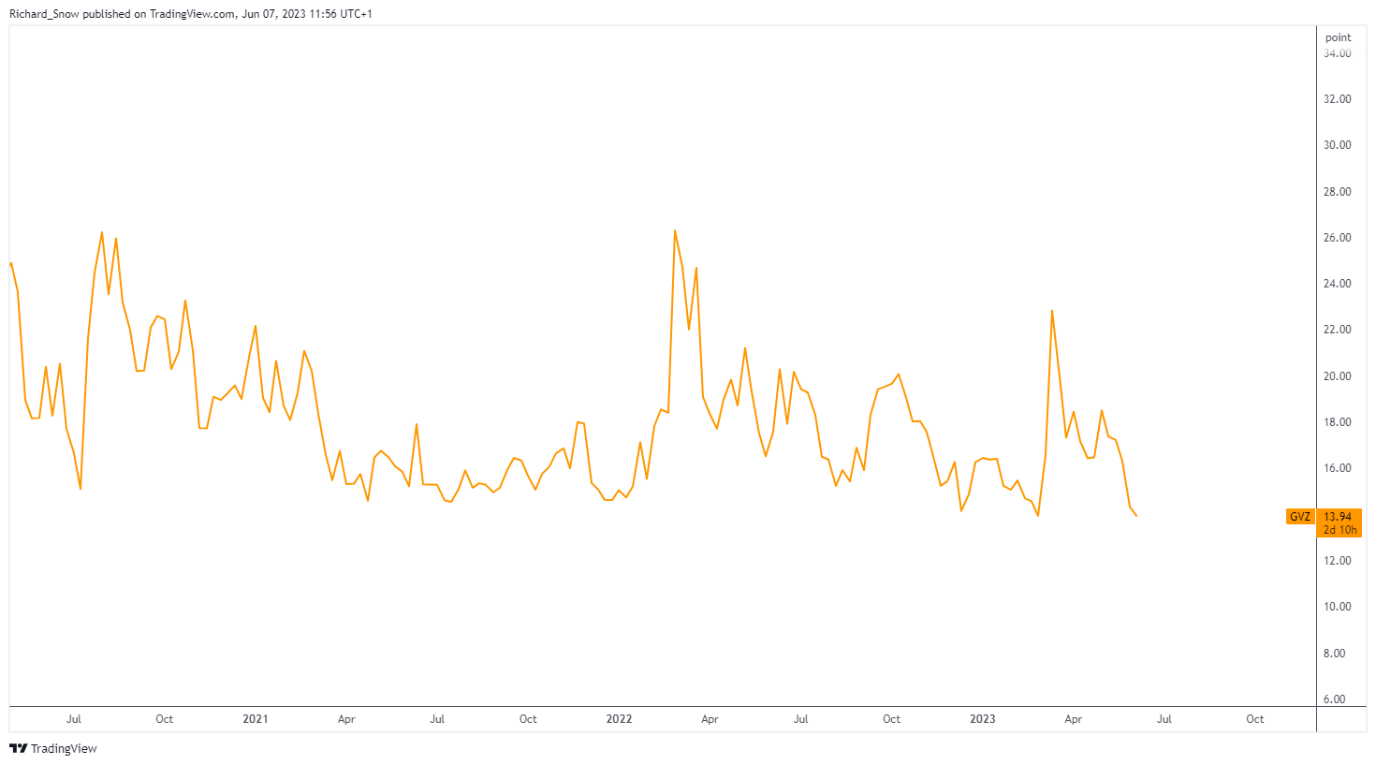

Ranging markets are typically characterised by a low volatility atmosphere and certainly gold volatility has been seen declining. The chart under reveals gold volatility over time which now approaches multi-month lows.

GVZ – gold volatility index

Supply: TradingView, ready by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX