[ad_1]

OIL PRICE FORECAST:

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to E-newsletter

Most Learn: What’s OPEC and What’s Their Function in International Markets?

Oil costs completed final week sturdy as a weaker US Greenback on Friday helped maintain costs supported. Oil gave the impression to be destined for a retracement final week earlier than feedback of a Saudi extension on its manufacturing cuts saved market individuals on edge.

SAUDI ARAMCO PRODUCTION CUTS, US EXPORTS SURGE

This morning we heard feedback CEO Amin Nasser who said that they nonetheless have vital provide for purchasers whereas including that the voluntary cuts could possibly be prolonged or deepened. Mr Nasser went additional and stated that Chinese language flights are solely at 85% of pre-pandemic ranges, which might paint to additional progress forward. The Kingdom and the OPEC+ alliance have been fast to arrest any significant slide in Oil costs (thus far, they’ve intervened between the $66-$70 a barrel vary) and this appears set to proceed.

The income of Saudi Aramco did drop some 38% with notable positives being the way during which they’ve navigated the unsure geopolitical and market climates. Capital spending is about to to proceed because the Kingdom appears to broaden capability and use of rising and ever-changing developments within the know-how sphere.

US Crude oil exports have surged in 2023 pushing costs down in Europe and Asia and is probably going a key motive behind steady manufacturing cuts by OPEC + because the cities main gamers appear to engaged in a tug of battle over costs. There seems to be concern of an oversupply and will clarify the announcement of the Saudi Kingdom to increase manufacturing cuts. Nonetheless, regardless of this Oil costs nonetheless seem extra delicate to choices taken by OPEC + member international locations. In a optimistic the OPEC+ Ministerial Panel met on Friday conserving coverage unchanged because of the Saudi cuts and the current rally in Oil costs which noticed WTI rise +-16% through the month of July.

US DATA WEIGHS ON SENTIMENT AT THE START OF THE WEEK

Final Fridays NFP simply added a wee little bit of uncertainty to markets as the roles information launched on Friday got here in relatively blended. Whereas the Non-Farm print got here in beneath estimates, the unemployment fee dropped again to three.5% with common hourly earnings rising as soon as extra. The robustness of the labor market noticed a slight uptick in fee hike expectations heading into this week’s US CPI numbers which ought to present a clearer image.

Waiting for the remainder of the week and US CPI is the largest danger occasion which may have broader implications on total market sentiment relying on the print. An extra drop in inflation may assist danger belongings and oil costs transfer increased with market individuals more likely to pay shut consideration to the cussed Core CPI quantity as nicely.

For all market-moving financial releases and occasions, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

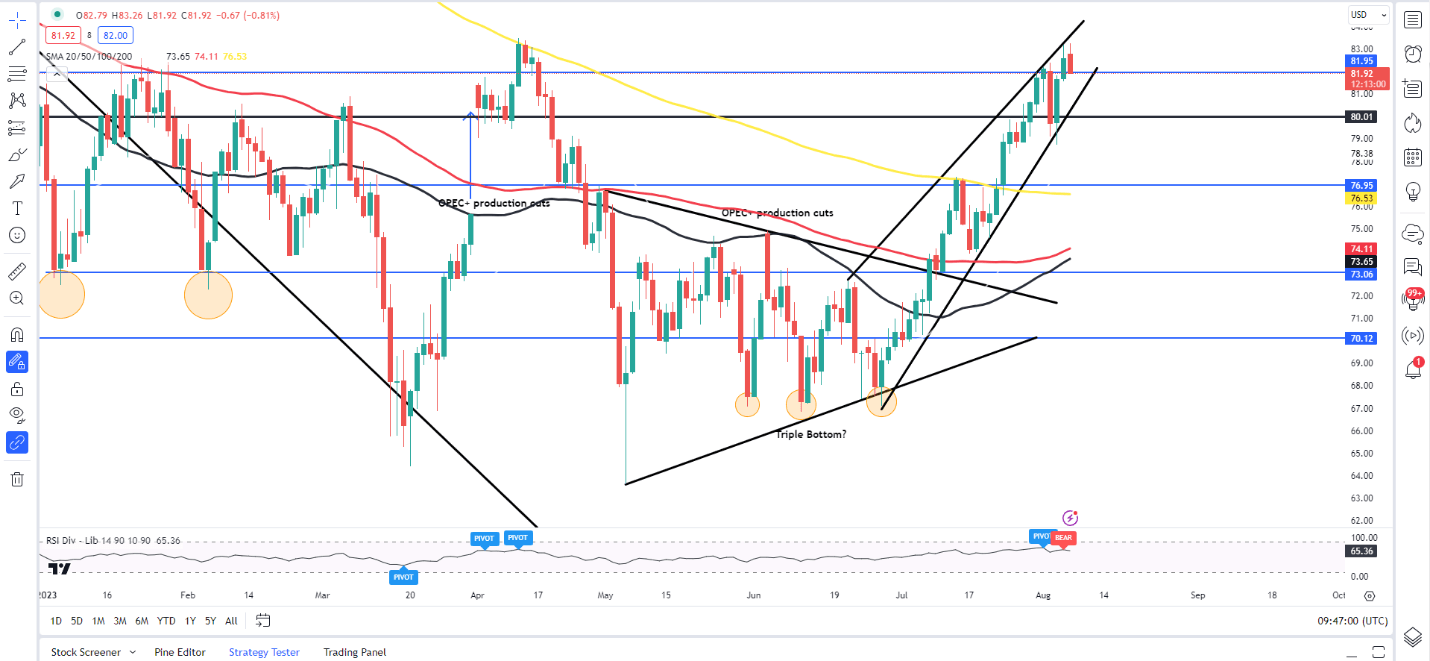

From a technical perspective each WTI and Brent completed final week sturdy earlier than a slight hole increased over the weekend which has already been stuffed. WTI for its half stays contained in the rising wedge sample tapping the highest on Friday earlier than a transfer decrease which has continued into the brand new week. There may be additionally a possible golden cross sample creating on the Day by day Chart as we’ve got the 50-MA eyeing a break above the 100-day MA which may see WTI rise increased following a quick retracement.

WTI is presently resting at help across the $82 a barrel mark with a break decrease bringing the $80 psychological degree into play earlier than the 50 and 100-Day MAs are reached resting at $73.65 and $74.11 respectively.

To study extra about buying and selling ranges and patterns obtain the Information beneath

Beneficial by Zain Vawda

The Fundamentals of Breakout Buying and selling

WTI Crude Oil Day by day Chart – August 7, 2023

Supply: TradingView

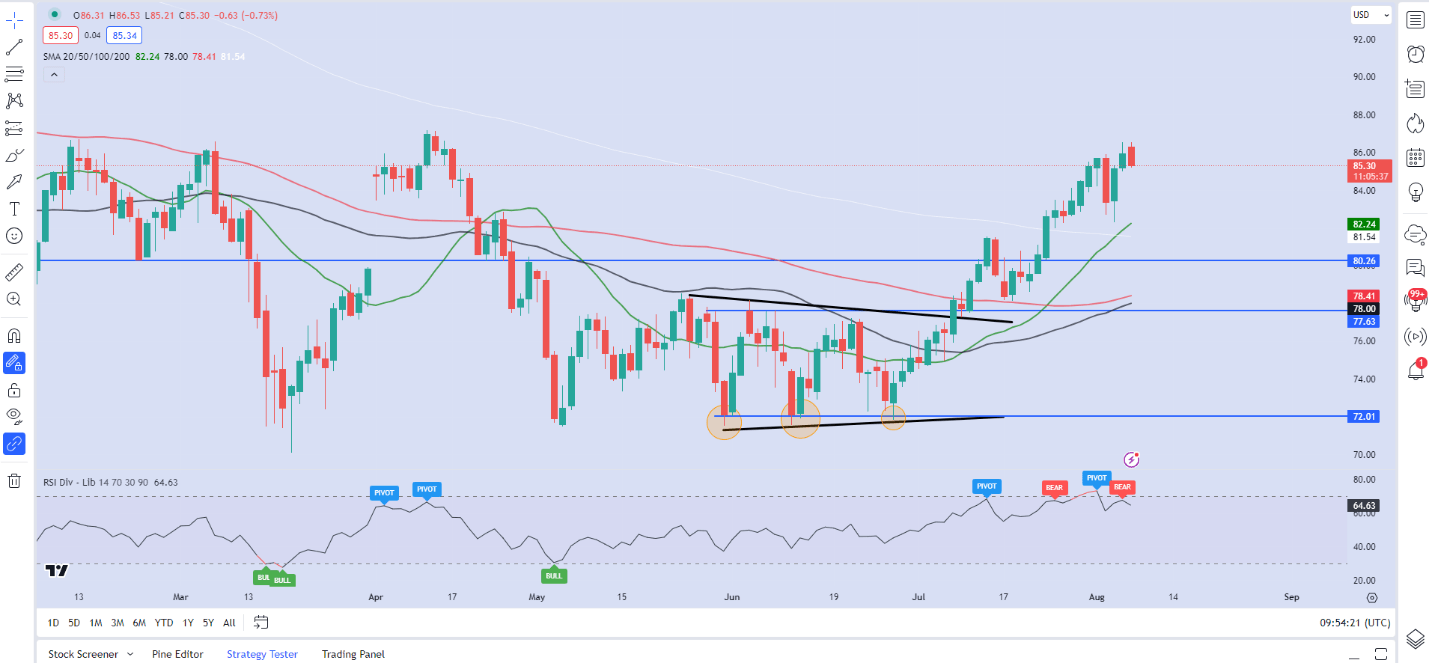

Brent Crude is starting to appear like a mirror picture of WTI with a golden cross going down final week because the 20-day MA has crossed above the 200 day MA In an indication of the upside momentum that is still.

A pullback in value from right here might run into a problem across the $82.20 a mark as we’ve got a bunch of confluences resting there with the swing excessive and the 20-da MA. Wanting decrease and the $80 a barrel psychological degree could also be examined as soon as extra.

Brent Oil Day by day Chart – August 7, 2023

Supply: TradingView

IG CLIENT SENTIMENT DATA- OIL US CRUDE

IGCS reveals retail merchants are presently SHORT on WTI Oil, with 62% of merchants presently holding SHORT positions. At DailyFX we sometimes take a contrarian view to crowd sentiment, and the truth that merchants are SHORT highlights means Oil costs may proceed to rise following a quick pullback.

| Change in | Longs | Shorts | OI |

| Day by day | 3% | 2% | 2% |

| Weekly | -9% | 28% | 11% |

Written by: Zain Vawda, Market Author for DailyFX.com

Contact and observe Zain on Twitter: @zvawda

[ad_2]

Source link