[ad_1]

Utilizing the Elliott Wave Precept, I discovered the :

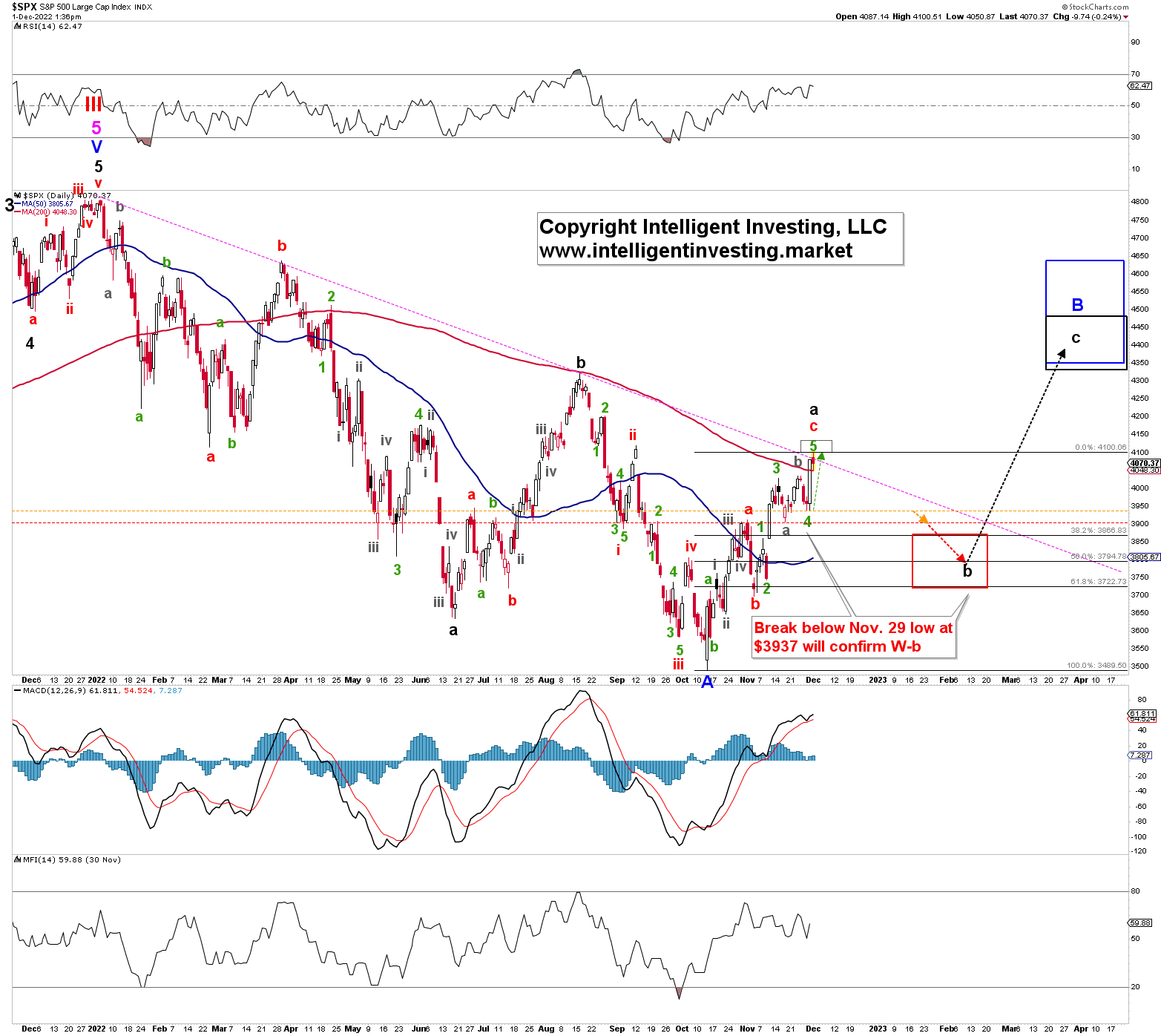

“The index ought to now be in a multi-day corrective sample into late November, ideally concentrating on the black W-b field at $3,735-3,875.”

Since then, the index dropped to as little as $3,906 and rallied as excessive as $4,034. Thus, it had been caught in a 130p vary till yesterday, when it broke greater. Thus, we certainly bought a multi-day corrective sample. However was that sideways vary for 2 weeks all we bought for the anticipated b-wave decrease? And now, is the “extra important black W-c again as much as ideally $4,350-4,500” below means?

Let’s assess the index’s each day chart, beginning with determine 1 beneath.

Determine 1:

The 2-week sideways worth motion fell 31p (0.8%), in need of the higher finish of the perfect goal zone for W-b: $3,906 vs. $3,735-3,875. Thus, technically, the Nov. 17 low at $3,906 may have been sufficient. Nonetheless, the worth motion during the last two weeks seems to be extra bullish than bearish, as a possible bull flag fashioned (dotted inexperienced sample), ideally concentrating on round $4,225. In addition to, this week’s greater low ($3,937 vs. $3,906) and yesterday’s rally counsel the index is in a subdividing inexperienced W-5 (gray W-i, ii, iii, iv, v) concentrating on the gray goal zone at $4,200+/-25 ideally. Thus, the perfect Fibonacci-based impulse sample’s fifth wave goal zone matches properly with the technical bull flag sample. That will then full black W-a. Black W-b can then nonetheless begin, concentrating on $3,830+/-80 ideally, earlier than W-c to $4,450-4,600 takes maintain.

Nonetheless, for this feature to remain alive, the index shouldn’t break beneath the Nov. 25 excessive at $4,034 from present ranges as that might imply overlap with the potential gray W-i. It ought to stay above this week’s low at $3,937 always. In any other case, the index may have already topped per the EWP depend proven in Determine 2 beneath.

Determine 2:

Sideways worth motion all the time leaves issues extra open to interpretation from an EWP perspective than a trending market, be it up or down. This week’s low, as a substitute of the Nov. 17 low, may have been inexperienced W-4. In that case, it was what’s referred to as within the EWP an irregular operating flat (see right here).

That, in flip, signifies that yesterday’s rally into at present’s open was inexperienced W-5: the entire black W-a is near completion. At this time’s excessive would make for an ideal inexperienced W-5 = W-1 relationship (dotted inexperienced up arrow). A break beneath the Nov. 29 low at $3,937, with a primary warning for the bulls beneath $4,034, will affirm this feature. I then count on a pullback to $3,795+/-75 for black W-b earlier than the subsequent rally (black W-c) takes place to $4,350-4,475.

In conclusion, the final two weeks’ sideways worth motion mixed with yesterday’s breakout permits for a remaining push greater, to probably as excessive as $4,200+/-25, earlier than the subsequent bigger pullback to $3,830+/-80 kicks in. However the bulls should maintain $4,034 and $3,937 for now as a result of the bears will take the ball and run it all the way down to $3,795+/-75.

[ad_2]

Source link