[ad_1]

The tip of the earnings season is at all times a great time to take a step again and see who shined (and who not a lot). Let’s take a look at how the information infrastructure shares have fared in Q2, beginning with Teradata (NYSE:).

This text was initially revealed on Inventory Story

Producing insights from system degree information is an rising precedence for many companies, however to take action requires connecting and analyzing piles of information saved and siloed in separate databases. That is the demand driver for cloud primarily based information infrastructure software program suppliers, who can extra readily combine, distribute and course of data vs. legacy on-premise software program suppliers.

The 4 information infrastructure shares we monitor reported a combined Q2; on common, revenues beat analyst consensus estimates by 2.98%, whereas on common subsequent quarter income steerage was 0.52% above consensus. Buyers deserted money burning corporations since excessive rates of interest will make it more durable to lift capital, however information infrastructure shares held their floor higher than others, with share costs down 3.78% because the earlier earnings outcomes, on common.

Teradata

A part of point-of-sale and ATM firm NCR (NYSE:) from 1991 to 2007, Teradata (NYSE:TDC) gives a software-as-service platform that helps organizations handle their information throughout a number of storages and analyze it.

Teradata reported revenues of $462 million, up 7.44% yr on yr, beating analyst expectations by 3.85%. It was a good quarter for the corporate, with income and ARR (annual recurring income) surpassing Wall Road’s expectations. Subsequent quarter’s non-GAAP EPS steerage was in line, and the corporate largely maintained its full yr steerage.

“Our broad-based momentum throughout the enterprise generated sturdy monetary outcomes, together with 77% Cloud ARR progress, 10% enhance in Complete ARR progress and EPS that exceeded our steerage,” mentioned Steve McMillan, President and CEO, Teradata.

Teradata pulled off the strongest analyst estimates beat however had the slowest income progress of the entire group. The inventory is down 16.7% because the outcomes and at present trades at $46.21.

Greatest Q2: Confluent

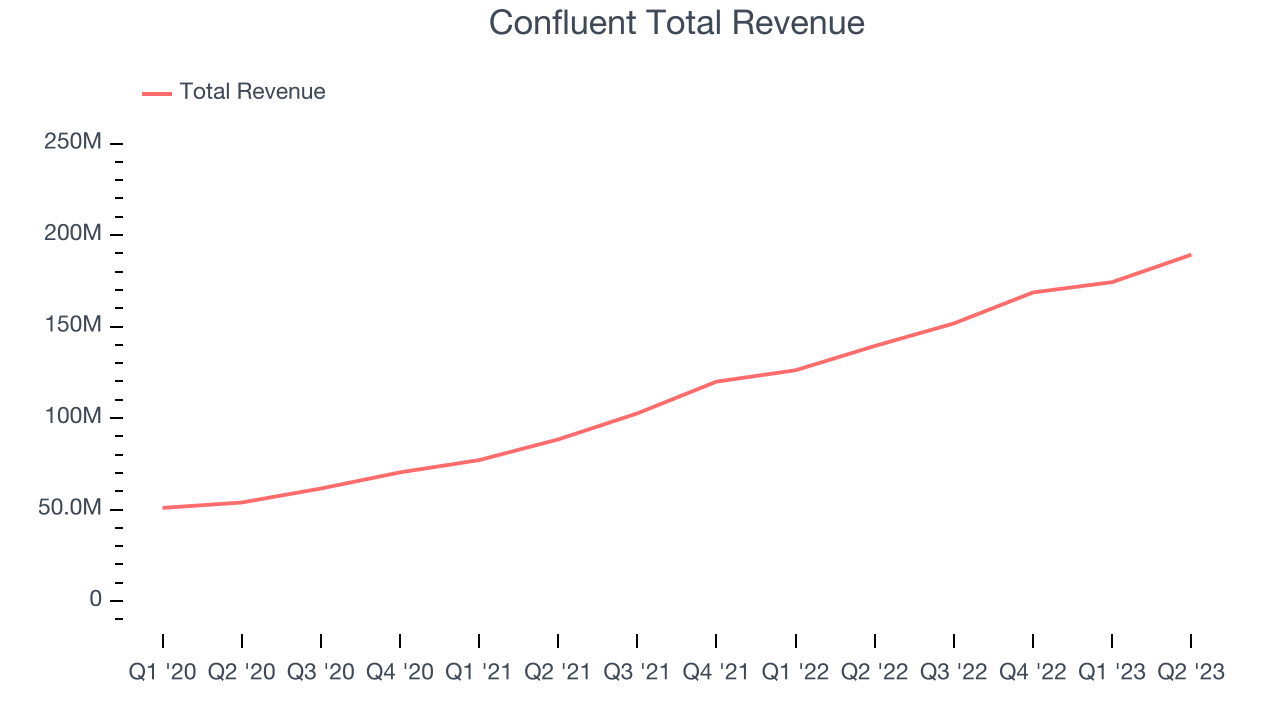

Began in 2014 by the workforce of engineers at LinkedIn who initially constructed it as an inner device, Confluent (NASDAQ:CFLT) offers infrastructure software program for organizations that makes it simple and quick to gather and transfer massive quantities of information between totally different techniques.

Confluent reported revenues of $189.3 million, up 35.8% yr on yr, beating analyst expectations by 3.75%. It was a good quarter for the corporate, with a beat on quarterly income in addition to RPO (remaining efficiency obligations, a number one indicator of income). Ahead steerage was additionally bullish, with subsequent quarter and the complete yr non-GAAP working revenue steerage notably spectacular vs. Wall Road expectations.

Confluent scored the quickest income progress and highest full yr steerage elevate amongst its friends. The corporate added 69 enterprise clients paying greater than $100,000 yearly to a complete of 1,144. The inventory is down 4.9% because the outcomes and at present trades at $29.5.

Weakest Q2: C3.ai (NYSE:)

Based in 2009 by enterprise software program veteran Tom Seibel, C3.ai (NYSE:AI) offers software program that makes it simple for organizations so as to add synthetic intelligence expertise to their functions.

C3.ai reported revenues of $72.4 million, up 10.8% yr on yr, beating analyst expectations by 1.07%. It was a combined quarter for the corporate, with its full-year income steerage coming in greater than Wall Road’s estimates. Nonetheless, the outlook for the complete yr working loss is bigger.

C3.ai had the weakest efficiency towards analyst estimates within the group. The inventory is down 22.8% because the outcomes and at present trades at $24.27.

Elastic (NYSE:)

Began by Shay Banon as a search engine for his spouse’s rising checklist of recipes at Le Cordon Bleu cooking college in Paris, Elastic (NYSE:ESTC) helps corporations combine search into their merchandise and monitor their cloud infrastructure.

Elastic reported revenues of $293.8 million, up 17.5% yr on yr, beating analyst expectations by 3.26%. It was a good quarter, with income and non-GAAP working revenue exceeding expectations. Subsequent quarter’s steerage was largely forward, and the complete yr outlook was raised as nicely. Alternatively, its web income retention fell.

Elastic had the weakest full yr steerage replace among the many friends. The corporate added 30 enterprise clients paying greater than $100,000 yearly to a complete of 1,190. The inventory is up 29.3% because the outcomes and at present trades at $80.05.

[ad_2]

Source link