[ad_1]

There’s been a variety of alarm in the actual property funding neighborhood recently over a newly enacted Federal Housing Finance Company rule for Fannie Mae and Freddie Mac loans relating to mortgage charges.

The gist of the grievance is that homebuyers with good credit score will now should subsidize these with very bad credit. Technically, that is true. Nonetheless, the best way it’s being framed is sort of deceptive. The overall argument goes one thing like this: These with a 620 FICO rating will get a 1.75% low cost, and people with a 740 FICO rating can pay 1%.

Or one other instance can be this particularly popular tweet:

?

Homebuyers with credit score scores of 680 or greater can pay ~$40 per thirty days extra on a house mortgage of $400,000.

Consumers with down funds of 15% to twenty% will get socked with the biggest charges.

Consumers with riskier credit score scores and decrease down funds will get decrease charges and costs. pic.twitter.com/yVEp3btNJg

— Wall Road Silver (@WallStreetSilv) April 19, 2023

Whereas what is alleged is technically right, it sounds a lot worse than it’s.

Initially, this may solely have an effect on Fannie Mae and Freddie Mac loans. This accounts for many loans made to owners however wouldn’t have an effect on FHA and VA loans nor the non-conforming loans that many buyers get.

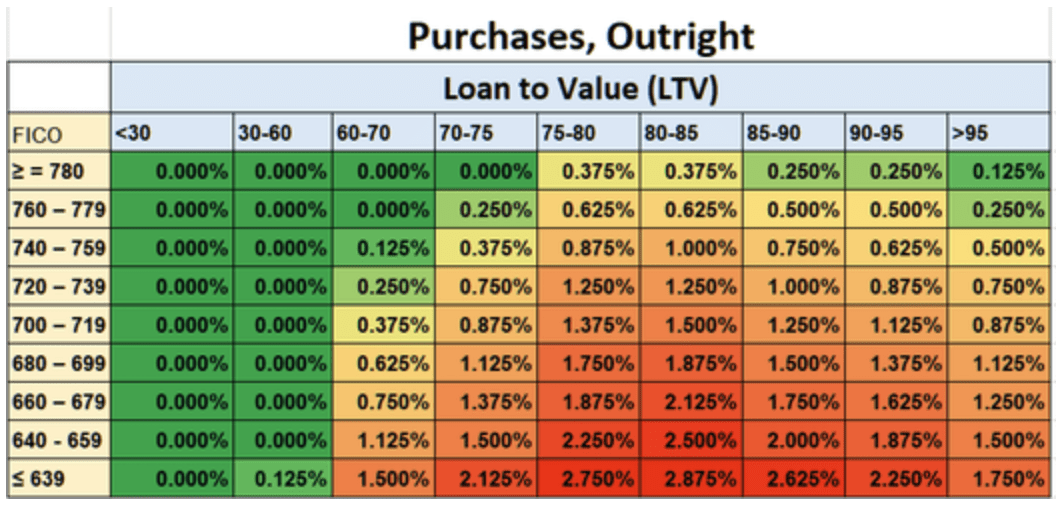

The price being mentioned right here is known as the Mortgage-Stage Value Adjustment or LLPA, which predominantly takes under consideration the borrower’s FICO rating and the LTV of the mortgage. To a lesser extent, it additionally takes under consideration whether or not the property is owner-occupied or not, if it’s a condominium or single-family residence, whether or not it’s a second or first mortgage, and if there may be any cash-out on a refinance.

The LLPA price is then successfully added to the mortgage. So, for instance, if the mortgage is $100,000 and has a 1% LLPA, the LLPA can be $1,000. This might be paid as a price however is extra typically absorbed by the lender in trade for the next rate of interest on the mortgage.

This added value on the mortgage is to cowl Fannie Mae and Freddie Mac from the added threat of lending to riskier debtors.

Riskier Debtors Are Nonetheless Paying Extra

The error being made by many right here is that the odds given are the adjustments, not the totals. Nicely, not fairly even that. The 1% price talked about is what somebody with a 740 FICO rating would pay if they’re taking out an 80-85% LTV mortgage. The 1.75% “low cost” will not be the price somebody with a 620 FICO rating would pay, however as a substitute the discount in that price from earlier than. And on this case, it’s for somebody taking out a 95% LTV mortgage or greater.

Earlier than this rule was handed, the LLPA price for somebody with a 620 FICO rating taking out a 95% mortgage was 3.5%. Now it’s 1.75% (a 1.75% discount). Here’s a chart from Mortgage Information Each day displaying the consequences the adjustments of this rule would have on loans for debtors relying on the LTV and FICO rating.

And listed below are the precise charges individuals would pay.

As Mortgage Information Each day sums up,

“As now you can plainly see, you probably have a rating of 640, you’ll be paying considerably greater than should you had a 740. Utilizing an 80% loan-to-value ratio for example, your LLPA at 640 is 2.25% versus 0.875% for a 740 rating. That’s a distinction of 1.375%, or simply over $4000 on a $300k mortgage. That is virtually half the earlier distinction, and that’s actually an enormous change.”

The truth is, this rule change was made again on January 1, 2023, and solely got here into impact now. Right here is the announcement from the Federal Housing Finance Company, and right here is the full loan-level value adjustment matrix from Fannie Mae itself.

The lengthy and quick story of it’s, nonetheless, that these with low credit score will nonetheless pay greater than these with excessive credit score. The actual property world has not been put utterly the other way up.

Is it Nonetheless a Subsidy for These with Low Credit score?

At first of this text, I mentioned this new rule nonetheless concerned these with good credit score subsidizing these with unhealthy. Given these with good credit score nonetheless pay much less, how is that so?

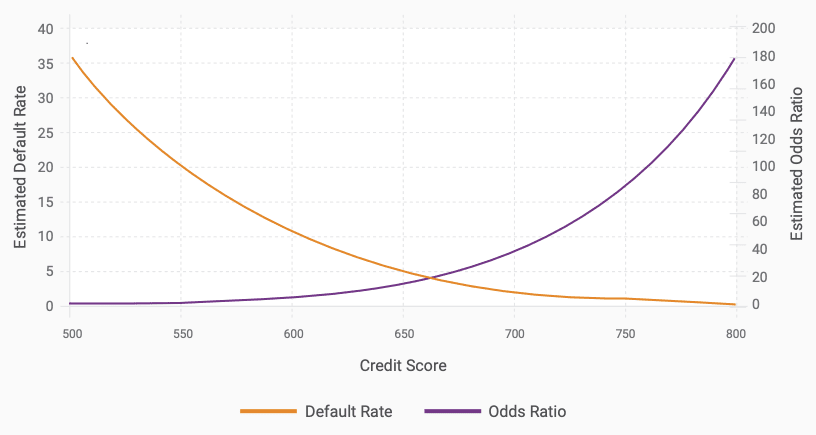

The reason being that these with low credit score scores are more likely to enter default than these with good credit score. And the distinction might be greater than most individuals understand.

For instance, a white paper from FICO concluded their mannequin confirmed that “at a rating of 800, we count on roughly 180 debtors to persistently pay their loans on time for each one borrower that defaults. This compares fairly favorably to customers with a rating of 600, the place one out of each 11 debtors is anticipated to have cost issues.”

General, this was the connection they discovered between FICO scores and mortgage default charges was as follows:

One other paper discovered that between 2000 and 2002, these with a FICO rating of 750 or extra had a chance of default of simply 1%, whereas these with a rating of 600-649 had a default price of 15.8%, and people underneath 500 had a default price of a whopping 41%. Comparable outcomes have been present in one other research by the SEC of mortgages taken out between 1997 and 2009.

The overall consequence shouldn’t be stunning, though the scale of the discrepancy is perhaps too many (Does the 2008 monetary disaster make a little bit extra sense now?).

The LLPA is supposed to cowl a few of this added threat. However from simply eyeballing the chart above, it will seem that even the outdated LLPAs have been a bit beneficiant (particularly given the typical loss a financial institution takes on a mortgage that will get foreclosed on is one thing like 40%). Lowering the LLPA for dangerous debtors is probably going going to extend the prices to Fannie and Freddie much more so. And as primary economics would point out, that loss would should be made up for by growing charges throughout the board, together with on debtors with excessive credit score scores.

Thus, it’s true this rule is more likely to imply that debtors with excessive credit score scores might be subsidizing these with low scores.

However no, the outrage clickbait headlines are false. Debtors with low credit score scores won’t be paying lower than debtors with excessive credit score scores. And it’s necessary to be exact about what precisely is going on.

Discover a Lender in Minutes

A terrific deal doesn’t sit round. Shortly discover a lender who focuses on investor-friendly loans which can be best for you and your funding technique.

Observe By BiggerPockets: These are opinions written by the writer and don’t essentially signify the opinions of BiggerPockets.

[ad_2]

Source link