USD/JPY Evaluation

- USD/JPY edges increased after uptick in US CPI reinforces ‘increased for longer’ narrative

- Fed forecasts in focus as markets search for affirmation on peak charges and CPI forecasts

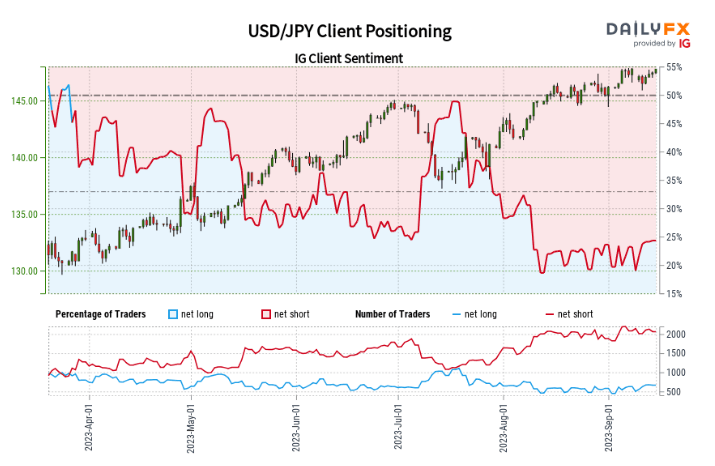

- IG consumer sentiment hints at bullish fatigue as latest positioning knowledge reveals a change in course

- The evaluation on this article makes use of chart patterns and key assist and resistance ranges. For extra info go to our complete schooling library

USD/JPY edges increased after US CPI reinforces ‘increased for longer’ narrative

Firstly of the week, Financial institution of Japan Governor Ueda said the financial institution might have sufficient knowledge to decide on ending unfavourable rates of interest by yr finish. This instantly resulted in a shift increased within the Japanese bond market as charges on the 10-year Japanese authorities bond yield trounced the prior excessive of 0.682 and nonetheless climbing.

10-Yr Japanese Authorities Bond Yields

Supply: TradingView, ready by Richard Snow

Naturally, Governor Ueda’s feedback resulted in yen appreciation and a chance appeared for the pair to pullback after an admittedly brief advance which broke new floor for the yr.

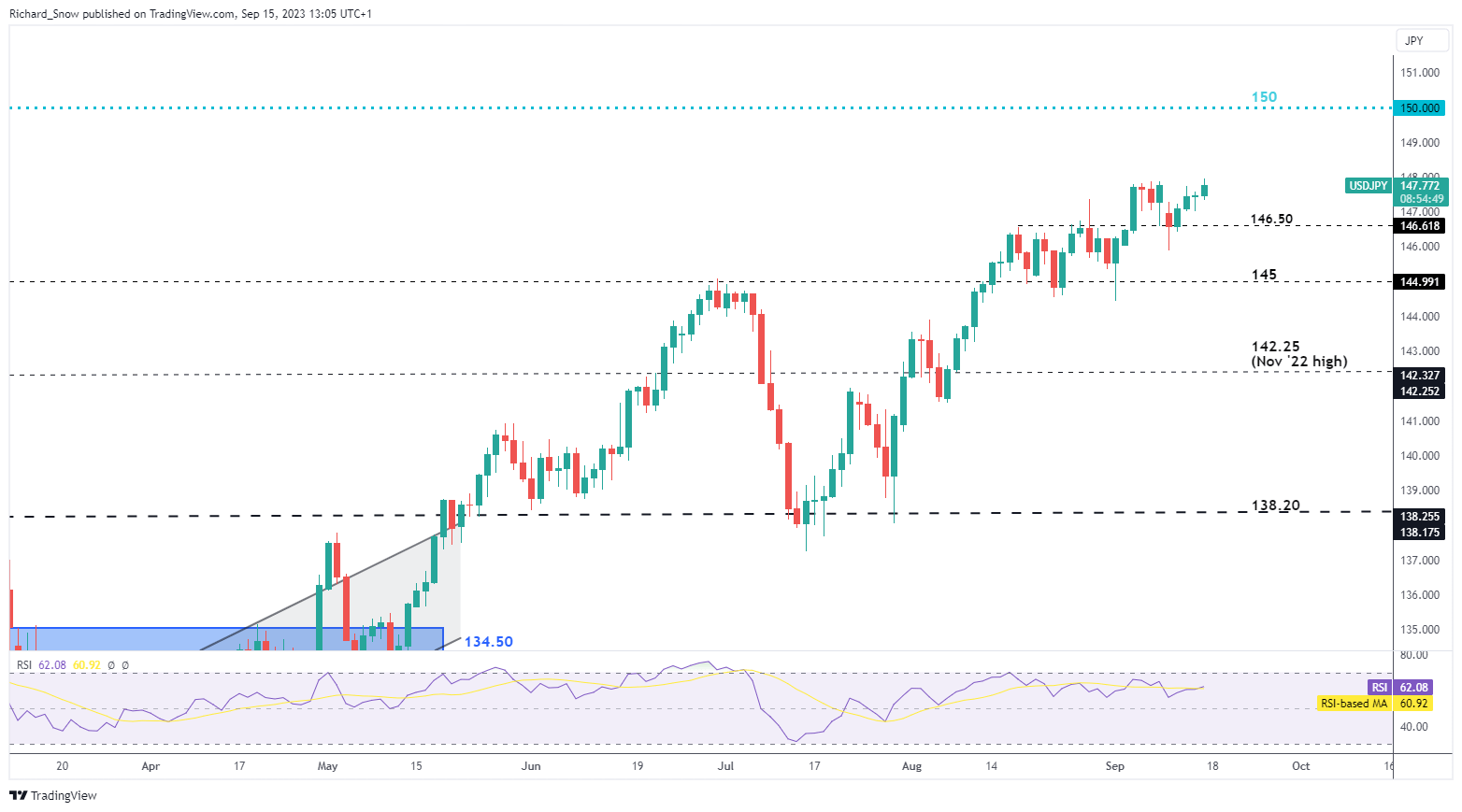

The pullback discovered assist at 146.50 and has headed increased the remainder of the week. Forward of the FOMC resolution on Wednesday, markets are prone to revisit issues about FX intervention by the Japanese Ministry of Finance, notably if we get a hawkish message from the Fed or see the abstract of financial projections level to increased inflation figures than beforehand forecasted. 150 is the extent of resistance with 146.50 remaining as assist.

There could also be a chorus from merchants to enter at such elevated ranges as this can be likened to selecting up pennies in entrance of a steam curler – the potential reward doesn’t outweigh the chance concerned.

Beneficial by Richard Snow

Find out how to Commerce USD/JPY

USD/JPY Day by day Chart

Supply: TradingView, ready by Richard Snow

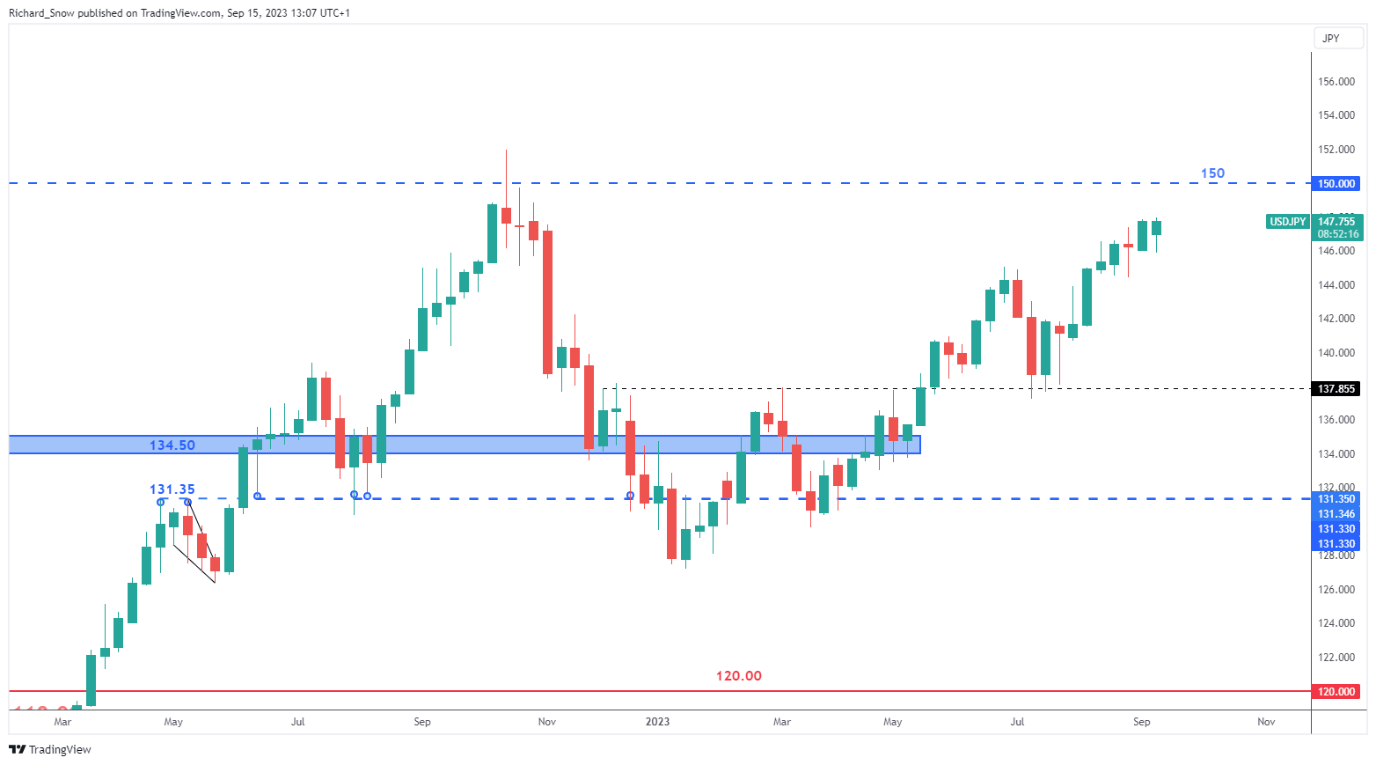

The weekly chart reveals the regular rise in USD/JPY, persevering with to make new yearly highs however nonetheless wanting the 2022 excessive simply shy of 152.00.

USD/JPY Weekly Chart Supply: TradingView, ready by Richard Snow

IG Shopper Sentiment Warns of Fading Bullish Momentum

Current modifications in positioning complicate the now bearish outlook offered by the contrarian indicator as merchants stay web brief.

Supply: TradingView, ready by Richard Snow

USD/JPY:Retail dealer knowledge reveals 24.49% of merchants are net-long with the ratio of merchants brief to lengthy at 3.08 to 1. We usually take a contrarian view to crowd sentiment, and the actual fact merchants are net-short suggests USD/JPY costs might proceed to rise.

Discover out why latest modifications in sentiment level to the potential for a draw back transfer in USD/JPY by studying our devoted information on IG consumer sentiment under:

| Change in | Longs | Shorts | OI |

| Day by day | -23% | 6% | -1% |

| Weekly | 0% | 1% | 1% |

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to Publication

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX