[ad_1]

- Walmart will launch its subsequent quarterly outcomes on Thursday

- Yesterday’s session noticed the corporate escape towards new historic highs

- Walmart inventory appears to be like like a promising funding for long-term traders, however await a correction earlier than shopping for

- Safe your Black Friday good points with InvestingPro’s as much as 55% low cost!

This week, Wall Avenue is abuzz with anticipation surrounding earnings experiences from the retail sector. Buyers are desperate to gauge whether or not customers have sustained strong buying patterns regardless of difficult financial situations.

Whereas a number of of the business’s giants are set to disclosure outcomes, together with Dwelling Depot (NYSE:) as we speak and Goal (NYSE:) tomorrow, the highlight is especially intense on Walmart (NYSE:), which experiences on Thursday after the bell. The retail big surged to new historic highs in yesterday’s session, signaling robust expectations from traders and the potential for a sustained upward pattern.

Trying on the greater image, the markets are driving on a wave of optimism. The has surged by a stable 8% over the previous 10 days, outperforming the extra modest achieve of lower than 5% within the .

Within the present financial panorama, for those who’re fascinated about long-term investments, Walmart may very well be a terrific selection.

It is received a steady, frequently paid dividend and publicity to the resilient meals sector, which tends to carry up nicely throughout financial slowdowns or recessions.

Walmart Dividend Payout Historical past

Supply: InvestingPro

Upcoming Vacation Season Is Essential for the Retail Sector

The upcoming vacation season holds paramount significance for the retail business, marked by elevated turnover and the necessity for strategic stockpiling, particularly within the lead-up to Christmas.

Nevertheless, there is a looming threat of overstocking, contemplating forecasts indicating a modest 3-4% improve in American client spending in comparison with the earlier yr.

Regardless of this problem, Walmart, positioned as a retail chief with a robust deal with meals, advantages from a positive macroeconomic state of affairs. This positivity is mirrored within the firm’s inventory worth dynamics.

Encouragingly, the e-commerce section brings very optimistic information, witnessing a powerful 24% year-on-year improve within the first two quarters.

This progress is especially notable within the post-pandemic interval, the place many corporations are experiencing pure declines on this sector.

The surge in e-commerce is probably going attributed to customers actively in search of engaging worth affords, particularly inside grocery and home items. This pattern good points significance amid elevated inflation, impacting family budgets.

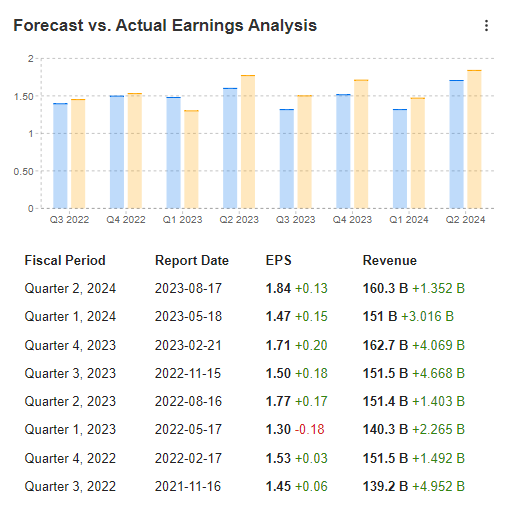

Walmart Earnings Have Frequently Overwhelmed Forecasts within the Previous

The market benchmark on Thursday will likely be earnings per share of $1.52 and revenues of $158.5 billion.

Upcoming Earnings Report

Supply: InvestingPro

Taking a look at precise outcomes versus forecasts for the previous eight quarters, solely as soon as have readings been under consensus, which is actually a powerful statistic.

Czy Walmart poprawi nowe historyczne maksima po publikacji wyników?

Supply: InvestingPro

It is vital to notice that the surge in e-commerce success hasn’t constantly translated into instant will increase in inventory costs throughout buying and selling periods.

Nevertheless, a number of different components, significantly forecasts for future quarters associated to web revenue and gross sales quantity, have come into play.

Walmart Inventory Technical View: Await a Correction to Hop on the Bandwagon

Whereas the breakout to new historic highs is undoubtedly a sturdy sign of the uptrend’s continuation, it is probably not essentially the most opportune time to enter a place from a technical standpoint, contemplating the chance of shopping for at elevated ranges.

Subsequently, a possible pullback may current a superb alternative to hitch the continuing pattern at a extra favorable worth.

Walmart Inventory Worth Chart

The instant help ranges are located within the worth vary of $166 and $164 per share, indicating that any potential correction could not lengthen too deeply.

This inclination in the direction of a shallow correction is additional substantiated by the honest worth index, which at the moment factors to a goal degree close to $165 per share.

It is important to notice that we’re discussing a localized low cost, and the outlook stays optimistic for additional will increase within the medium and long run.

***

Purchase or Promote? Get the reply with InvestingPro for Half of the Worth This Black Friday!

Well timed insights and knowledgeable choices are the keys to maximizing revenue potential. This Black Friday, make the neatest funding determination available in the market and save as much as 55% on InvestingPro subscription plans.

Whether or not you are a seasoned dealer or simply beginning your funding journey, this provide is designed to equip you with the knowledge wanted for extra clever and worthwhile buying and selling.

Black Friday Sale – Declare Your Low cost Now!

Disclosure: The writer holds no positions in any of the securities talked about on this report.

[ad_2]

Source link