[ad_1]

The recent 56% plunge in Uber Technologies (NYSE:) suggests that the world’s largest ride-hailing app isn’t immune to the current broad market downturn. Uber shares closed Tuesday at $21.09.

However, how the San Francisco-based company would perform in a global recessionary environment remains a big question mark.

Uber and many of its app-focused technology counterparts belong to an economic segment that came into existence after the Global Financial Crisis of 2008. As such, they’d not yet experienced such a hostile economy.

Although investors are usually reluctant to hold tech companies in their portfolios when the sailing is rough, Uber’s business transformation over the past two years has made this app much stronger. Indeed, it’s now a good buy-on-the-dip candidate.

The company mission has expanded beyond rides, broadening its revenue base. Unlike its US rival LYFT (NASDAQ:), Uber was able to rely on its food delivery unit to provide growth when rides dried up during the pandemic.

Recession Resistant

CEO Dara Khosrowshahi’s key post-pandemic strategy has been to capitalize on the boom in delivery by expanding into other categories like convenience-store items, alcohol, and groceries, turning the Uber rides app into much more than just ride-sharing.

Last month, Uber introduced Uber Charter, a service to book shuttles and coaches for large groups directly via the app. The company also debuted Uber Travel which compiles flight, hotel, and restaurant bookings and allows people in the US and Canada to reserve rides for each leg of their itinerary. In the UK, the company is piloting a service to enable customers to book long-distance travel in the app.

In a recent interview with Bloomberg, CEO Khosrowshahi said the company is “recession-resistant” and added that he doesn’t see a need for job cuts.

“The signal on the street is that things are really strong, and the spend on services continues to be quite robust.”

The company’s latest strongly signals that Khosrowshahi’s strategy to expand into other services is paying off. The company last month gave a positive outlook for the current period, with gross bookings exceeding analysts’ estimates. Uber’s guidance comes after revenue rose 136% to $6.9 billion in the first quarter, while adjusted EBITDA earnings were $168 million, surpassing the $135 million analysts expected.

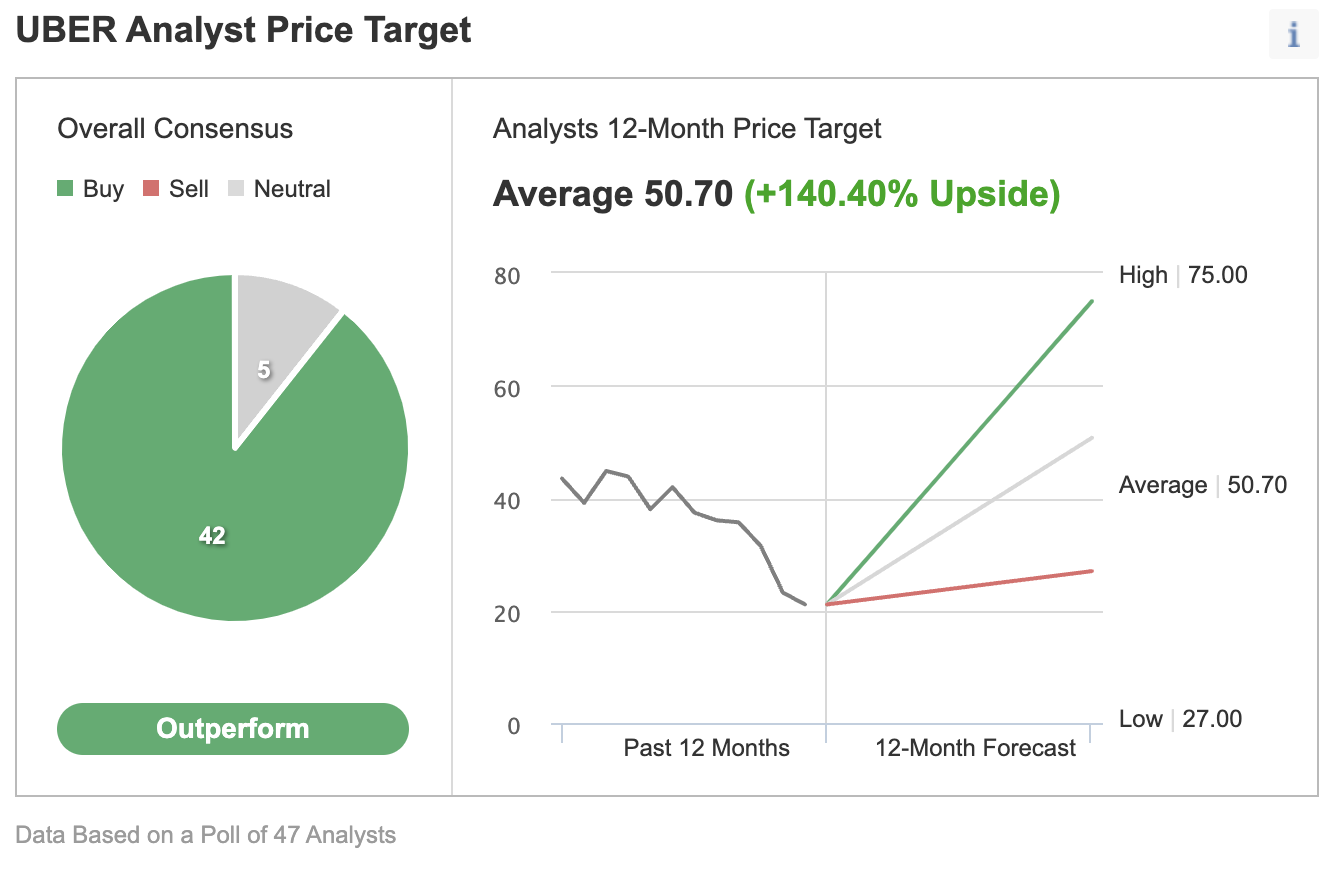

Analyst recommendations on Uber stock is also bullish. In an Investing.com survey of 47 analysts, 42 recommend buying the stock, with their 12-month consensus price target implying a 140% upside potential.

Source: Investing.com

Barclays last week reiterated Uber as overweight in a note to clients. It also raised its price target on the ride-sharing company to $53 per share from $48, saying the stock is a recession beneficiary.

The note added that a possible recession could ease drivers’ shortage and make it more challenging for the second-tier competitors to get funding.

Bottom Line

Uber’s expanded business model makes it much more resilient in dealing with a tough economic environment. That means its stock is a much better bet to consider after the current sell-off.

***

Looking to get up to speed on your next idea? With InvestingPro+ you can find

- Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

- A fair value calculated from dozens of financial models

- Quick comparison to the company’s peers

- Fundamental and performance charts

- And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »

[ad_2]

Source link